Ohio State Tax Refund

Ohio, like many other states, offers its residents the opportunity to claim tax refunds when they have overpaid their taxes. The Ohio tax refund process can be straightforward, but it's essential to understand the various aspects, from eligibility criteria to the actual refund timeline, to ensure a smooth and efficient experience.

Understanding the Ohio State Tax Refund

The Ohio Department of Taxation is responsible for administering state tax refunds. A tax refund occurs when an individual’s total tax liability is less than the tax payments and withholdings made during the tax year. This can happen due to various reasons, including overpayment of estimated taxes, excessive withholding on wages, or eligibility for certain tax credits and deductions.

Ohio residents who have overpaid their taxes can file for a refund by submitting the appropriate tax return for the year in question. The state offers both individual and business tax refund options, ensuring that all taxpayers can reclaim their overpaid taxes.

Eligibility and Requirements

To be eligible for an Ohio state tax refund, taxpayers must meet certain criteria:

- Residency: You must be a resident of Ohio for the entire tax year or at least have income sources within the state.

- Filing Status: Ensure you use the correct filing status on your tax return. Ohio offers different tax rates and brackets based on filing status, so this can impact your refund.

- Timely Filing: It’s crucial to file your tax return by the due date to avoid penalties and interest charges. Late filings may also delay your refund.

- Accurate Information: Provide all necessary information accurately on your tax return. This includes personal details, income sources, deductions, and credits.

It's worth noting that Ohio offers various tax credits, such as the Ohio Earned Income Tax Credit and the Homestead Exemption, which can significantly impact your refund amount. Ensure you understand these credits and their eligibility criteria to maximize your refund.

Calculating Your Refund

The calculation of your Ohio state tax refund depends on several factors, including your taxable income, tax credits, and deductions. Ohio uses a progressive tax system, meaning tax rates increase as income levels rise. The state has five tax brackets, ranging from 0.479% to 4.799% for the 2022 tax year.

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $5,700 | 0.479% |

| $5,700.01 - $11,400 | 1.529% |

| $11,400.01 - $100,000 | 2.529% |

| $100,000.01 - $250,000 | 3.799% |

| $250,000.01 and above | 4.799% |

When calculating your refund, you'll need to consider your taxable income, apply the appropriate tax rate, and then subtract any tax credits and deductions. It's a good idea to use tax software or consult a tax professional to ensure an accurate calculation.

Filing Your Tax Return

Ohio offers several methods for filing tax returns, including:

- Online Filing: The Ohio Department of Taxation provides an online filing system, OH TAX, which is secure, efficient, and free for most taxpayers. It allows you to file your return and track your refund status.

- Paper Filing: If you prefer a traditional approach, you can download and print tax forms from the Ohio Department of Taxation’s website. These forms must be mailed to the address specified on the website.

- Tax Professionals: You can also engage the services of a tax professional or accountant to prepare and file your tax return on your behalf.

Remember to keep accurate records of your income, expenses, and any other relevant tax documents to facilitate the filing process and ensure an error-free return.

Refund Timeline and Tracking

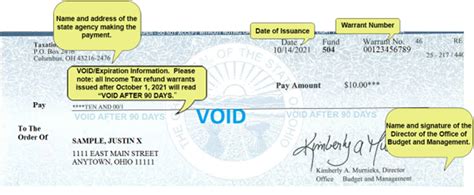

Once you’ve filed your tax return, the Ohio Department of Taxation processes refunds in the order they are received. The department aims to issue refunds within 30 days of receiving a complete and accurate return. However, various factors can influence the timeline, including the filing method, payment method, and any errors or issues with your return.

To track the status of your refund, you can use the Where's My Refund tool on the Ohio Department of Taxation's website. This tool provides real-time updates on the processing status of your refund. You'll need to enter your Social Security Number, filing status, and the exact amount of your expected refund to use this service.

Maximizing Your Ohio State Tax Refund

While the primary goal of filing a tax return is to ensure compliance with state tax laws, maximizing your refund can provide a welcome financial boost. Here are some strategies to consider:

Take Advantage of Tax Credits

Ohio offers a range of tax credits that can significantly reduce your tax liability and increase your refund. Some of the key credits to be aware of include:

- Ohio Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income workers and families. It’s designed to offset the burden of Social Security taxes and provide a financial boost. The amount of the credit depends on your income and the number of qualifying children you have.

- Child and Dependent Care Tax Credit: If you pay for childcare or dependent care services to enable you to work or attend school, you may be eligible for this credit. It can help offset the costs of childcare, providing a refund or reducing your tax liability.

- Property Tax Credits: Ohio offers property tax credits to certain homeowners, such as the Homestead Exemption and the Senior Citizen Credit. These credits can reduce the property taxes you pay, resulting in a higher refund.

Research and understand these credits to determine your eligibility and maximize your refund.

Deduct Eligible Expenses

Ohio allows taxpayers to deduct various expenses from their taxable income, reducing their overall tax liability. Common deductions include:

- Medical and dental expenses

- State and local taxes paid

- Charitable contributions

- Home mortgage interest

- Educational expenses

Keep detailed records of these expenses throughout the year to ensure you can claim all eligible deductions when filing your tax return.

Consider Tax Planning Strategies

Tax planning can be a powerful tool to optimize your tax situation and increase your refund. Here are some strategies to consider:

- Adjust Your Withholdings: If you consistently receive large refunds, you may be overwithholding on your taxes. Adjusting your withholdings can put more money in your pocket throughout the year instead of waiting for a refund. However, be cautious not to underwithhold, as this can lead to penalties and interest charges.

- Maximize Retirement Contributions: Contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can reduce your taxable income. This strategy not only lowers your tax bill but also helps you save for retirement.

- Explore Tax-Efficient Investment Strategies: Certain investments, such as municipal bonds, can provide tax-free income. Consider working with a financial advisor to develop a tax-efficient investment strategy.

Conclusion

Understanding the Ohio state tax refund process and employing effective strategies can help you reclaim overpaid taxes efficiently and maximize your refund. By staying informed, accurately filing your tax return, and utilizing tax credits and deductions, you can make the most of your tax situation. Remember to consult tax professionals or use reputable tax software for guidance and to ensure compliance with the latest tax laws.

Frequently Asked Questions

What is the average Ohio state tax refund amount?

+The average Ohio state tax refund amount can vary depending on factors such as income level, tax credits claimed, and deductions taken. However, according to the Ohio Department of Taxation, the average refund for the 2021 tax year was approximately $742.

How long does it typically take to receive an Ohio state tax refund?

+The Ohio Department of Taxation aims to issue refunds within 30 days of receiving a complete and accurate tax return. However, various factors, such as the filing method, payment method, and any issues with the return, can impact the timeline. It’s best to track your refund status using the Where’s My Refund tool.

Can I check the status of my Ohio state tax refund online?

+Yes, you can check the status of your Ohio state tax refund online using the Where’s My Refund tool on the Ohio Department of Taxation’s website. You’ll need to provide your Social Security Number, filing status, and the exact amount of your expected refund to access this tool.

What if I don’t receive my Ohio state tax refund within the expected timeframe?

+If you don’t receive your Ohio state tax refund within the expected timeframe, there could be several reasons. Common issues include errors on your tax return, missing or incomplete information, or delays due to identity verification processes. Contact the Ohio Department of Taxation’s refund inquiry line at 1-800-282-1780 for assistance.

Are there any penalties for filing an Ohio state tax return late?

+Yes, Ohio imposes penalties for filing tax returns late. The penalty for late filing is 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may be charged on the unpaid tax from the due date until the date the tax is paid.