What Is Oasdi Tax

Oasdi tax, an acronym for Old-Age, Survivors, and Disability Insurance, is a crucial component of the social security system in the United States. This tax is an essential revenue source for the government, contributing to the financial stability of millions of Americans during their retirement years, in the event of disability, or upon the death of a family member. Understanding the intricacies of Oasdi tax is vital for individuals to plan their financial futures effectively.

The Role of Oasdi Tax in Social Security

Oasdi tax is a mandatory payroll tax levied on both employees and employers. It forms a significant part of the social security contributions, which are designed to provide a safety net for individuals and their families during times of financial need.

The tax is calculated as a percentage of an employee's gross wages, with the rate determined by the federal government. For the year 2023, the Oasdi tax rate is set at 6.2% for both employees and employers, applying to earnings up to a certain threshold. Any income exceeding this threshold is not subject to Oasdi tax, but may be subject to other taxes.

Who Pays Oasdi Tax?

Oasdi tax is applicable to most workers in the United States. This includes employees of companies, self-employed individuals, and even those who work for religious organizations. However, there are certain exceptions and specific cases where Oasdi tax may not be applicable.

For instance, certain government employees, including federal, state, and local government workers, might have different tax arrangements due to their specific employment conditions. Additionally, workers in certain industries, such as railroad workers, have their own specific tax systems.

It's crucial for individuals to understand their tax obligations based on their employment status to ensure they are compliant with the law and contributing adequately towards their future social security benefits.

How Oasdi Tax Funds Social Security Benefits

The Oasdi tax plays a pivotal role in funding the social security benefits that millions of Americans rely on. When an individual works and pays Oasdi tax, they essentially contribute to a collective fund that is used to provide benefits to those who are eligible.

These benefits include retirement income for older individuals, disability benefits for those who can no longer work due to a disability, and survivor benefits for the families of deceased workers. The amount of benefits an individual receives is directly linked to the amount of Oasdi tax they have paid throughout their working life.

| Social Security Benefit | Description |

|---|---|

| Retirement Benefits | Monthly payments to individuals upon reaching retirement age, typically 62 or older. |

| Disability Benefits | Monthly payments to individuals who become disabled and can no longer work. |

| Survivor Benefits | Monthly payments to the family of a deceased worker, providing financial support to the surviving spouse and children. |

Oasdi Tax and Your Financial Planning

Understanding Oasdi tax is essential for effective financial planning. While it is a mandatory tax, it is also an investment in your future social security benefits. By paying Oasdi tax, you are contributing to a system that will provide financial support during your retirement years or in the event of disability.

The Impact of Oasdi Tax on Your Take-Home Pay

Oasdi tax, along with other payroll taxes, can significantly impact your take-home pay. For example, an employee earning 50,000 annually would pay 3,100 in Oasdi tax, which is a substantial portion of their income. This tax deduction is an important consideration when budgeting and planning your finances.

Maximizing Your Social Security Benefits

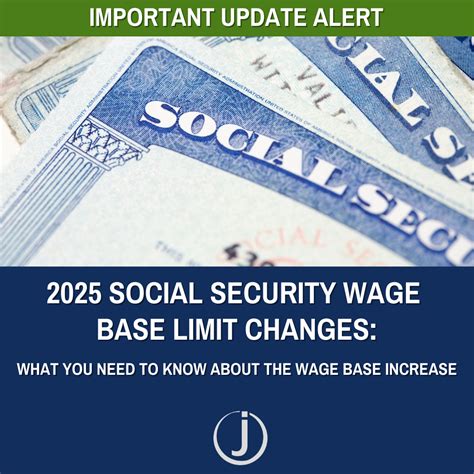

To maximize your social security benefits, it’s crucial to understand the rules and regulations surrounding Oasdi tax and social security contributions. This includes knowing the wage base limit, which is the maximum amount of earnings subject to the tax each year. In 2023, the wage base limit for Oasdi tax is $160,200.

By staying informed about these limits and contributing consistently throughout your working life, you can ensure you receive the maximum social security benefits when you need them.

The Future of Oasdi Tax and Social Security

The future of Oasdi tax and social security is a topic of much debate and discussion. As the population ages and life expectancies increase, the demand for social security benefits is expected to rise. This puts pressure on the system to ensure it remains sustainable and able to meet the needs of future generations.

While the Oasdi tax rate and wage base limits are adjusted periodically to maintain the financial health of the social security system, ongoing debates and discussions revolve around potential reforms and adjustments to ensure the system remains robust and effective in the long term.

FAQs

What happens if I don’t pay Oasdi tax?

+Failing to pay Oasdi tax can result in significant penalties and interest charges. It’s important to ensure you are compliant with your tax obligations to avoid these consequences.

Can I opt out of paying Oasdi tax?

+No, Oasdi tax is a mandatory payroll tax. While there are certain exceptions for specific types of employment, most workers are required to pay this tax.

How does Oasdi tax affect self-employed individuals?

+Self-employed individuals are responsible for paying both the employee and employer portions of the Oasdi tax. This means they pay a total of 12.4% on their net earnings, up to the wage base limit.

Can I get a refund on my Oasdi tax contributions?

+No, Oasdi tax contributions are not refundable. They are used to fund social security benefits, which you may receive in the future based on your contributions.