Tax Unrealized Gains

In the world of finance and investment, understanding the concept of taxing unrealized gains is crucial for both individual investors and financial professionals. This intricate topic delves into the realm of capital gains taxation, exploring the nuances of how gains are taxed even before they are realized through the sale of an asset. As we navigate this complex landscape, we uncover the strategies, implications, and legal frameworks that govern this process, providing a comprehensive guide to help investors optimize their financial strategies.

Understanding Unrealized Gains and Their Tax Implications

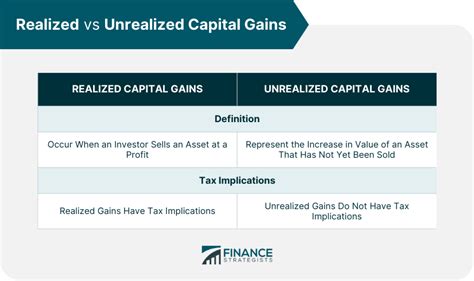

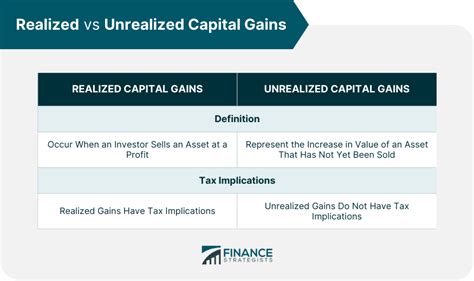

Unrealized gains, a cornerstone of investment strategy, represent the increase in value of an asset, such as stocks, bonds, or real estate, from the time of purchase until the present moment. These gains remain unrealized until the asset is sold, at which point they become realized gains, subject to capital gains tax. However, the taxation of unrealized gains is a nuanced concept that requires a deeper exploration of legal frameworks and financial strategies.

The taxation of unrealized gains is a unique feature of the U.S. tax code, known as the Mark-to-Market accounting method. This method, primarily applicable to certain financial professionals and high-net-worth individuals, allows the Internal Revenue Service (IRS) to tax gains on investments even when those gains are not yet realized through a sale. This approach is in contrast to the more common cash accounting method, where gains are taxed only when the asset is sold.

Legal Frameworks and Regulations

The Internal Revenue Code, particularly Section 475, outlines the rules for mark-to-market accounting. This section allows taxpayers to elect to treat securities held as inventory in a trade or business as if they were sold at the end of each tax year. This election triggers the recognition of any unrealized gains or losses, subjecting them to current taxation. The mark-to-market method is primarily used by traders and dealers in securities, commodities, or derivatives, and provides a more accurate representation of their financial position and tax liability.

| Taxpayer Type | Mark-to-Market Election |

|---|---|

| Traders | Mandatory |

| Dealers | Optional |

However, the mark-to-market method is not without its complexities. For instance, the election is generally irrevocable, meaning once a taxpayer chooses this method, they are typically locked into it for future years. Additionally, the calculation of gains and losses can be intricate, often requiring the assistance of tax professionals to ensure compliance and accuracy.

Financial Strategies and Tax Planning

For those subject to the taxation of unrealized gains, effective tax planning becomes a crucial aspect of financial management. Here are some strategies and considerations to navigate this complex landscape:

Capital Gains Tax Rates

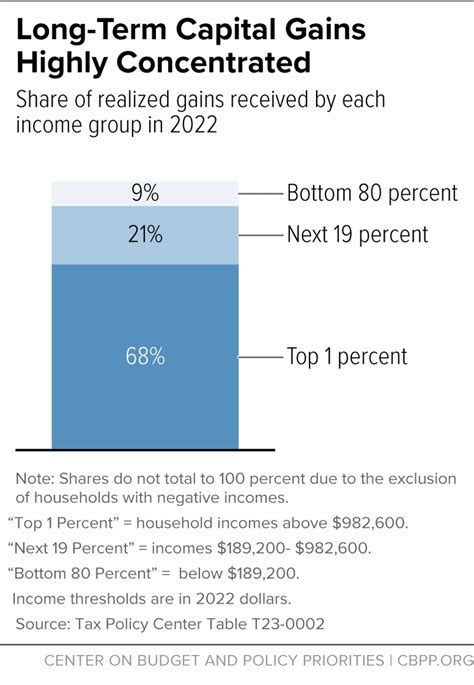

Capital gains are generally taxed at either long-term or short-term rates, depending on how long the asset was held before the sale. Long-term capital gains, from assets held for over a year, often enjoy more favorable tax rates compared to short-term gains. Understanding these rates and planning asset sales accordingly can significantly impact the overall tax liability.

| Tax Rate | Long-Term Capital Gains | Short-Term Capital Gains |

|---|---|---|

| 0% | Applies to taxpayers in the 10% and 12% tax brackets. | N/A |

| 15% | Most taxpayers fall into this bracket for long-term gains. | Taxed as ordinary income, potentially at higher rates. |

| 20% | Applies to taxpayers with taxable income above certain thresholds. | Taxed as ordinary income, potentially at higher rates. |

Loss Harvesting

Loss harvesting is a strategy where taxpayers sell underperforming assets to realize losses, which can then be used to offset gains and reduce overall tax liability. This strategy is particularly beneficial when combined with the mark-to-market method, as it allows taxpayers to recognize and utilize losses on a more frequent basis.

Tax-Efficient Investing

Certain types of investments, such as tax-exempt municipal bonds or retirement accounts like 401(k)s and IRAs, offer tax advantages. These investments can provide a way to grow wealth without immediate tax consequences, making them valuable tools in a tax-efficient portfolio.

Strategic Asset Allocation

Allocating assets across different types of investments and holding periods can help manage tax liability. For instance, holding long-term investments in tax-advantaged accounts while using short-term trading strategies in taxable accounts can optimize the tax treatment of gains and losses.

Case Study: The Impact of Taxing Unrealized Gains

Let’s consider a hypothetical case study to illustrate the practical implications of taxing unrealized gains. Imagine a trader, John, who has elected the mark-to-market method for his trading business. At the end of the year, John’s portfolio has unrealized gains of 50,000 and unrealized losses of 20,000. Due to the mark-to-market election, these gains and losses are recognized and subject to taxation.

In this scenario, John's unrealized gains of $50,000 would be taxed at the applicable capital gains rate, let's say 15%. This results in a tax liability of $7,500. However, John can also use his unrealized losses of $20,000 to offset his gains, reducing his tax liability. This case study highlights the complexity and potential benefits of the mark-to-market method, where gains and losses are recognized and taxed annually, impacting the trader's overall financial position.

Future Implications and Industry Trends

The taxation of unrealized gains is a dynamic aspect of the financial landscape, influenced by changing tax laws and evolving investment strategies. As the financial industry continues to innovate, we can expect to see new approaches to managing and optimizing the tax implications of unrealized gains.

Emerging Trends

-

Blockchain and Cryptocurrency: With the rise of blockchain technology and cryptocurrency, the taxation of unrealized gains takes on a new dimension. The unique nature of these assets, which can appreciate in value significantly over short periods, presents new challenges and opportunities for tax planning.

-

Tax Reform: Tax laws are subject to change, and future reforms could impact the taxation of unrealized gains. Keeping abreast of these changes is essential for financial professionals and investors to adapt their strategies accordingly.

-

Alternative Investments: The growing popularity of alternative investments, such as private equity and hedge funds, presents unique tax considerations. Understanding the tax implications of these investments is crucial for effective tax planning.

Expert Insights

According to leading financial experts, the taxation of unrealized gains remains a critical aspect of financial planning, particularly for high-net-worth individuals and professional traders. While it presents complexities, it also offers opportunities for strategic tax planning. The key lies in staying informed about the latest tax laws and working with experienced professionals to navigate this intricate landscape.

How does the mark-to-market method impact my tax liability compared to the cash accounting method?

+The mark-to-market method can result in higher tax liabilities in the short term, as it taxes unrealized gains. However, it also allows for the recognition of losses, which can offset gains and potentially reduce overall tax liability over time. The cash accounting method, on the other hand, defers tax liability until the asset is sold, providing a more straightforward approach for many investors.

Are there any exceptions or limitations to the mark-to-market election?

+Yes, there are specific rules and limitations. For instance, the election is generally irrevocable once made, and certain types of assets, like real estate, are not eligible for mark-to-market treatment. It’s crucial to consult with a tax professional to understand the full implications and potential benefits of this election.

What are the potential benefits of loss harvesting for investors subject to mark-to-market accounting?

+Loss harvesting allows investors to recognize and utilize losses to offset gains, which can reduce overall tax liability. This strategy is particularly beneficial for those using the mark-to-market method, as it provides an opportunity to manage tax obligations on an annual basis. It’s a way to proactively manage tax liability and optimize financial outcomes.