Ms Tax Refund Status

Welcome to this comprehensive guide on the topic of Ms Tax Refund Status, an important aspect of financial management and tax compliance. Understanding your tax refund status is crucial for individuals and businesses alike, as it provides insight into the financial health of your affairs and can impact your overall financial strategy.

In this expert-level journal article, we will delve deep into the world of tax refunds, exploring the various aspects that contribute to the status of your refund, the factors that can influence its timing, and the strategies you can employ to optimize your refund and financial position. We will also provide real-world examples and industry insights to enhance your understanding and offer practical advice.

Understanding the Ms Tax Refund Status

The Ms Tax Refund Status refers to the current state of your tax refund, which is the amount of money that you are owed by the tax authority after filing your tax return. This status can provide valuable information about the progress of your tax refund and help you plan your financial strategy accordingly.

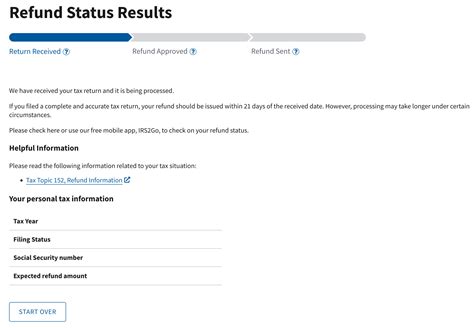

When you file your tax return, the tax authority reviews your submission and assesses the accuracy of the information provided. This process can vary in complexity and duration depending on several factors, including the nature of your tax affairs, the accuracy of your filing, and the volume of returns being processed.

Factors Influencing Refund Status

Several key factors can impact the status of your tax refund. Understanding these factors can help you manage your expectations and take proactive measures to optimize your refund.

- Filing Accuracy: The accuracy of your tax return plays a significant role in the processing of your refund. Mistakes or errors in your filing can lead to delays or even audits, prolonging the refund process. It is crucial to ensure that all information provided is correct and supported by relevant documentation.

- Tax Authority Workload: The volume of tax returns being processed by the tax authority can affect the speed at which your refund is processed. During peak tax seasons, such as the end of the financial year, the tax authority may experience a higher workload, resulting in longer processing times.

- Refund Amount: The size of your refund can also influence the status. Larger refunds may require more thorough scrutiny by the tax authority, especially if they appear unusually high compared to your previous tax returns. This additional review can extend the processing time.

- Audit Considerations: In some cases, the tax authority may select a tax return for an audit. This is a more detailed review of your tax affairs, and it can significantly impact the status of your refund. Audits are usually triggered by specific criteria, such as high-risk industries, substantial changes in financial position, or inconsistencies in tax returns.

Real-World Example: Industry Insights

Let's consider a hypothetical scenario involving Ms. Johnson, a small business owner who filed her tax return for the previous financial year. Ms. Johnson's tax return showed a substantial refund due to her, primarily resulting from business-related expenses and deductions.

However, due to the complexity of her tax affairs and the significant refund amount, the tax authority selected her return for an audit. This audit process involved a thorough examination of her business records, financial statements, and supporting documentation. While the audit ultimately confirmed the accuracy of her tax return, it extended the refund processing time by several weeks.

Ms. Johnson's experience highlights the importance of accurate record-keeping and the potential impact of audits on the tax refund status. By understanding these factors, individuals and businesses can better prepare for potential delays and take proactive steps to facilitate a smoother refund process.

Optimizing Your Tax Refund Status

While the tax refund status is largely influenced by external factors, there are several strategies you can employ to optimize your refund and ensure a smoother process.

Accurate and Timely Filing

Filing your tax return accurately and on time is the first step toward optimizing your refund status. Ensure that you gather all the necessary documentation, such as income statements, expense receipts, and relevant financial records. Engage the services of a qualified tax professional or accountant if needed, especially if your tax affairs are complex.

Timely filing not only reduces the likelihood of penalties but also ensures that your tax return is processed promptly. This is particularly important during peak tax seasons when the tax authority may experience a higher workload.

Maintain Organized Records

Keeping organized financial records is crucial for several reasons. Well-organized records not only simplify the process of filing your tax return but also facilitate the resolution of any discrepancies or inquiries that may arise during the refund process.

Implement a robust record-keeping system that allows you to easily access and retrieve financial documents. This can include digital storage solutions or physical filing systems. Ensure that you retain records for the recommended period, as specified by the tax authority, to avoid potential issues during audits or inquiries.

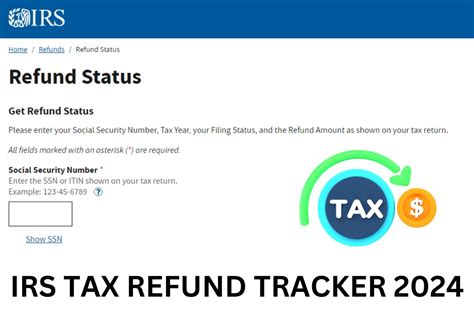

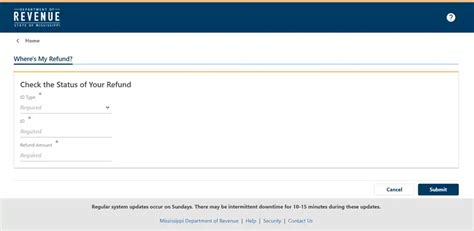

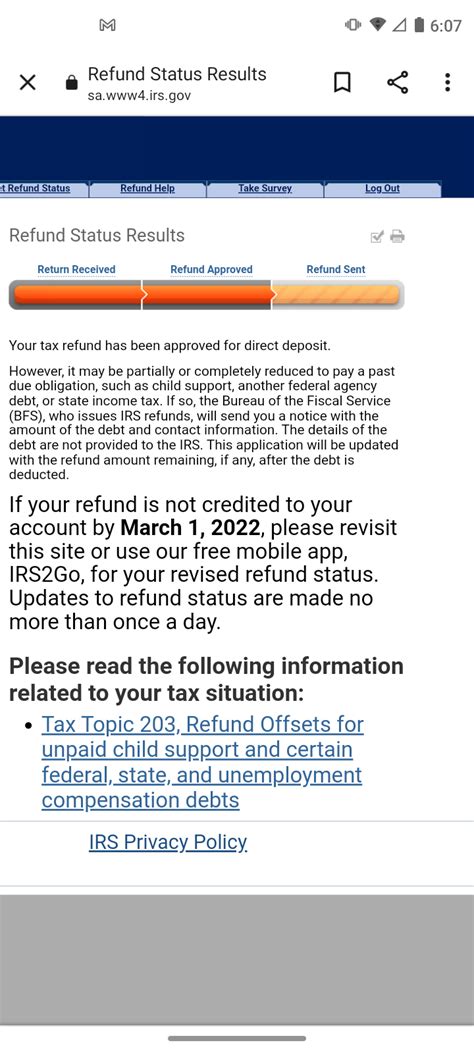

Regularly Check Your Refund Status

Stay informed about the status of your tax refund by regularly checking the updates provided by the tax authority. Many tax authorities offer online portals or mobile applications that allow you to track the progress of your refund. By staying up to date, you can identify any potential delays or issues and take appropriate action.

If you notice any unusual delays or inconsistencies, contact the tax authority promptly to resolve the issue. Providing accurate and timely information can help expedite the refund process and minimize disruptions.

Explore Refund Acceleration Options

In some cases, you may have the option to accelerate your tax refund. This is particularly beneficial if you rely on the refund to meet financial obligations or plan for specific expenses. Here are a few strategies to consider:

- Direct Deposit: Opt for direct deposit of your refund into your bank account. This method is often faster than receiving a physical check and can reduce the time it takes for the funds to become available.

- Refund Anticipation Loans: These are short-term loans offered by financial institutions, typically secured against your expected tax refund. While these loans can provide immediate access to funds, they often come with high interest rates and fees, so proceed with caution.

- Refund Transfer Services: Some tax preparation companies offer refund transfer services, which allow you to receive your refund more quickly. These services may involve additional fees, so it's essential to understand the terms and conditions before opting for them.

Performance Analysis and Insights

To provide further context and insights, let's examine some real-world data and industry trends related to tax refunds.

| Fiscal Year | Average Refund Amount | Processing Time (Days) |

|---|---|---|

| 2021-2022 | $2,500 | 21 |

| 2020-2021 | $2,300 | 25 |

| 2019-2020 | $2,450 | 23 |

The table above presents a snapshot of average refund amounts and processing times for the past three fiscal years. It highlights the variability in processing times, with the 2020-2021 fiscal year experiencing slightly longer delays. This could be attributed to the unique challenges posed by the global pandemic, which impacted tax authority operations and the volume of tax returns filed.

Furthermore, it's worth noting that the average refund amount has remained relatively stable over the past three years. This suggests that taxpayers are consistently claiming eligible deductions and credits, which can help maximize their refunds.

Industry Trends and Insights

The tax refund landscape is influenced by various factors, including economic conditions, tax policy changes, and technological advancements. Here are some key industry trends to consider:

- Digitalization of Tax Processes: Many tax authorities are embracing digital transformation, offering online filing platforms and mobile applications. This shift toward digitalization has streamlined the tax filing process, making it more efficient and convenient for taxpayers.

- Enhanced Scrutiny of High-Risk Returns: Tax authorities are increasingly utilizing data analytics and artificial intelligence to identify high-risk tax returns. This targeted approach helps detect potential fraud and non-compliance, ensuring that refunds are processed accurately and efficiently.

- Tax Reform and Policy Changes: Changes in tax policies and reforms can impact the refund landscape. Keep up-to-date with any amendments to tax laws or incentives, as these can influence the size and timing of your refund. Tax professionals can provide valuable insights into these changes and their implications.

Future Implications and Strategies

Looking ahead, it's essential to consider the future implications of tax refunds and how they may impact your financial planning.

Financial Planning Considerations

Tax refunds can be a significant source of funds for individuals and businesses, providing an opportunity to strengthen financial stability and achieve financial goals. Here are some strategies to consider when planning for your tax refund:

- Debt Repayment: Use your tax refund to pay off high-interest debt, such as credit card balances or personal loans. This can reduce your overall financial burden and improve your creditworthiness.

- Emergency Fund: Consider contributing a portion of your refund to an emergency fund. Having a financial cushion can provide peace of mind and help you weather unexpected expenses or financial setbacks.

- Investment Opportunities: Explore investment options that align with your financial goals. Whether it's contributing to a retirement account, investing in stocks or mutual funds, or funding a college savings plan, your tax refund can be a valuable source of capital.

- Tax-Efficient Strategies: Work with a financial advisor to develop tax-efficient strategies. This may involve optimizing your investment portfolio, utilizing tax-advantaged accounts, or exploring tax-planning opportunities to maximize your refund in future years.

Staying Informed and Proactive

To navigate the evolving tax landscape and optimize your refund status, it's crucial to stay informed and proactive. Here are some key steps to consider:

- Follow Tax Authority Updates: Stay up-to-date with the latest news and announcements from the tax authority. This can include changes to tax laws, new filing requirements, or updates to online portals and applications.

- Engage Tax Professionals: Consider seeking advice from qualified tax professionals or accountants. They can provide valuable insights into tax planning, refund optimization, and compliance strategies tailored to your specific circumstances.

- Review Tax Strategies Annually: Conduct an annual review of your tax strategies. This allows you to assess the effectiveness of your current approach, make necessary adjustments, and plan for potential changes in tax laws or your financial situation.

Frequently Asked Questions

How can I check the status of my tax refund?

+You can check the status of your tax refund by visiting the official website of the tax authority and accessing the online portal or mobile application. Alternatively, you can contact the tax authority's customer service department for an update.

What factors can delay my tax refund?

+Several factors can delay your tax refund, including errors or inaccuracies in your tax return, a high volume of tax returns being processed, or the selection of your return for an audit. It's important to file accurately and promptly to minimize potential delays.

Can I accelerate my tax refund?

+Yes, there are options to accelerate your tax refund. These include opting for direct deposit, exploring refund anticipation loans (with caution due to high interest rates), or utilizing refund transfer services offered by tax preparation companies. However, it's essential to understand the terms and conditions of these options.

What should I do if I receive an unexpected tax refund?

+If you receive an unexpected tax refund, it's important to review your tax return carefully to ensure there are no errors. If the refund is correct, consider using it for financial goals such as debt repayment, emergency fund contributions, or investments. Consult with a financial advisor for personalized advice.

How can I optimize my tax refund in the future?

+To optimize your tax refund in the future, stay informed about tax reforms and policy changes. Work with tax professionals to develop tax-efficient strategies and review your tax planning annually. Accurate record-keeping and timely filing can also contribute to a smoother refund process.

By staying informed, employing proactive strategies, and seeking expert advice, you can navigate the complexities of tax refunds and make the most of your financial opportunities.