Sales Tax Al

Welcome to an in-depth exploration of sales tax in the state of Alabama, a critical component of the state's revenue system and a topic of interest for businesses and consumers alike. This article aims to provide a comprehensive guide, shedding light on the intricacies of Alabama's sales tax regulations and their impact on various industries and transactions.

Understanding Sales Tax in Alabama

Sales tax in Alabama is a vital source of revenue for the state, contributing significantly to the funding of essential services and infrastructure. The state imposes a uniform sales tax rate, applicable across all counties and municipalities, with certain exceptions for specific goods and services.

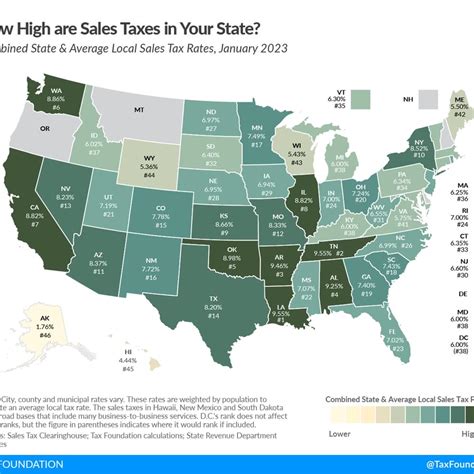

As of the most recent updates, Alabama's state sales tax rate stands at 4%, which is then combined with local sales tax rates, varying between 0% and 7%. This results in a combined sales tax rate ranging from 4% to 11%, depending on the location of the transaction.

Taxable Goods and Services

Alabama’s sales tax applies to a broad range of tangible personal property and certain services. This includes items like clothing, electronics, furniture, and groceries. However, there are several notable exceptions and exemptions, which we will delve into later in this article.

| Category | Tax Rate |

|---|---|

| General Merchandise | 4% - 11% |

| Food and Beverages | 4% - 11% |

| Services (e.g., repairs, admissions) | 4% - 11% |

| Vehicles | 2% |

| Prescription Drugs | 0% |

Sales Tax Exemptions and Exceptions

While Alabama’s sales tax applies broadly, there are several categories of goods and services that are exempt from sales tax. Understanding these exemptions is essential for both consumers and businesses to navigate the state’s tax landscape accurately.

Food and Medicine Exemptions

One notable exemption in Alabama is for unprepared food items, such as raw produce, meat, and dairy products. This exemption extends to essential food staples, providing some relief for households and encouraging healthier food choices. Additionally, prescription medications are exempt from sales tax, ensuring that essential healthcare items remain more affordable for Alabamians.

Industrial Machinery and Equipment

Alabama also exempts the sale of industrial machinery and equipment used in manufacturing processes. This exemption aims to encourage industrial growth and development within the state, fostering a competitive business environment. By exempting these essential tools, Alabama allows businesses to reinvest their savings into expansion and innovation.

Exemptions for Specific Industries

Certain industries, such as agriculture and education, benefit from specific sales tax exemptions in Alabama. For instance, sales of agricultural machinery and equipment are exempt, supporting Alabama’s agricultural sector. Similarly, educational resources and materials are exempt, aiding schools and educational institutions in their mission.

Compliance and Reporting for Businesses

Ensuring compliance with Alabama’s sales tax regulations is a crucial responsibility for businesses operating within the state. Accurate tax collection and reporting not only fulfill legal obligations but also contribute to the state’s financial stability.

Registration and Collection

Businesses are required to register with the Alabama Department of Revenue to obtain a sales tax permit. This permit authorizes the business to collect sales tax from customers and remit it to the state. The sales tax is typically calculated as a percentage of the sale price and must be collected at the point of sale.

Filing and Payment Schedules

Alabama has a streamlined sales tax filing process, with businesses required to file returns and remit tax payments on a monthly, quarterly, or annual basis, depending on their sales volume. Online filing options are available, making the process more efficient and convenient for businesses.

Penalties and Audits

Non-compliance with Alabama’s sales tax regulations can result in penalties, including fines and interest charges. In severe cases, businesses may face audits, which involve a detailed examination of their financial records to ensure accurate tax reporting. Therefore, it is essential for businesses to maintain proper records and seek professional guidance when necessary.

Impact on Consumers and Businesses

Sales tax in Alabama has a significant impact on both consumers and businesses, shaping their economic decisions and strategies.

Consumer Perspective

For consumers, sales tax adds to the cost of goods and services, influencing their purchasing decisions and overall spending power. The varying rates across the state can also create price disparities, prompting consumers to seek out lower-taxed areas for specific purchases.

Business Strategies

Businesses, on the other hand, must factor in sales tax when pricing their goods and services. They must also navigate the complex web of exemptions and regulations to ensure compliance and maintain a competitive edge. Additionally, businesses may explore strategic pricing and promotional strategies to mitigate the impact of sales tax on their customers.

Economic Growth and Development

From an economic perspective, Alabama’s sales tax system plays a pivotal role in funding essential services and infrastructure projects. The revenue generated contributes to the state’s overall economic development, impacting everything from education and healthcare to transportation and public safety.

Future Considerations and Trends

As Alabama’s economy evolves, so too does its sales tax system. Staying abreast of emerging trends and potential changes is essential for businesses and consumers to adapt their strategies accordingly.

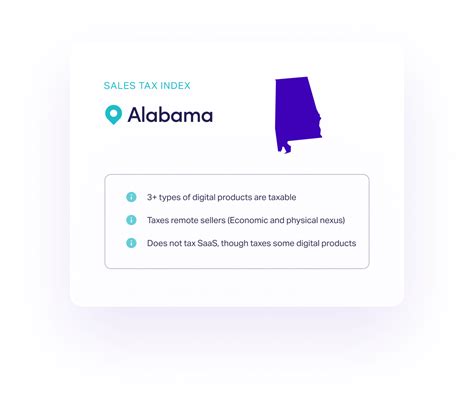

Online Sales and E-Commerce

With the rise of e-commerce, the taxation of online sales has become a focal point for states. Alabama has implemented measures to ensure the proper collection of sales tax for online transactions, especially for out-of-state sellers. This shift toward online sales tax compliance is a trend that businesses must navigate to stay competitive and compliant.

Potential Rate Changes

While the current sales tax rates in Alabama are relatively stable, there is always the possibility of future rate changes. Whether it’s an increase to bolster state revenues or a decrease to stimulate economic growth, businesses and consumers must remain vigilant and adaptable to such shifts.

Simplification and Reform

Efforts to simplify and reform Alabama’s sales tax system are ongoing, with a focus on reducing administrative burdens for businesses and improving clarity for consumers. These initiatives aim to enhance compliance and make the tax system more efficient and user-friendly.

How often are sales tax rates updated in Alabama?

+Sales tax rates in Alabama are subject to change periodically, typically to align with the state’s budgetary needs and economic conditions. While there is no set schedule for updates, businesses and consumers should stay informed through official channels to ensure they are aware of any changes.

Are there any sales tax holidays in Alabama?

+Yes, Alabama occasionally holds sales tax holidays, which are specific periods when certain items are exempt from sales tax. These holidays often coincide with major shopping events like back-to-school season or the holiday season. They are a way to encourage consumer spending and provide temporary tax relief.

How can businesses stay updated on sales tax regulations in Alabama?

+Businesses can stay informed by regularly checking the Alabama Department of Revenue’s website, which provides the latest updates and resources on sales tax regulations. Additionally, subscribing to tax newsletters or consulting with tax professionals can ensure businesses are compliant with the latest rules.