Sacramento California Sales Tax

The city of Sacramento, nestled in the heart of California's Central Valley, boasts a thriving economy and a diverse range of businesses. One aspect that influences the financial landscape of this vibrant city is its sales tax structure. Understanding the intricacies of Sacramento's sales tax is essential for both residents and businesses alike, as it impacts daily transactions and financial planning.

The Complexity of Sacramento’s Sales Tax

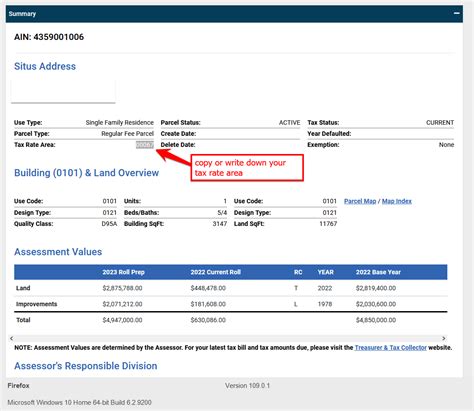

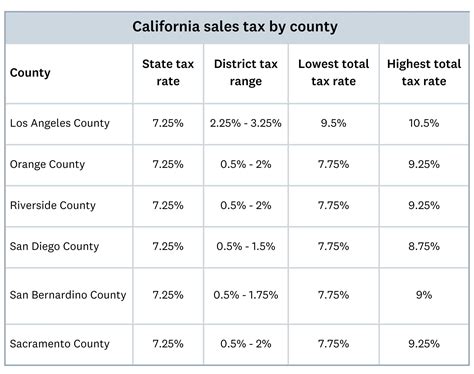

Sales tax in Sacramento is a multifaceted system, comprising various components that collectively contribute to the overall tax rate. At the core of this structure is the state sales tax, a uniform tax applicable across California. However, the landscape becomes more intricate with the addition of local sales taxes, which vary based on the specific city and county.

Sacramento, being the capital city, is subject to a unique set of local sales tax rates. These rates are not static and can change over time, influenced by factors such as economic trends, voter-approved initiatives, and legislative decisions. As a result, keeping abreast of the current sales tax rates is crucial for accurate financial calculations and compliance.

Breaking Down the Sales Tax Components

To gain a comprehensive understanding of Sacramento’s sales tax, let’s delve into its key components:

- State Sales Tax: As of [most recent update], the state sales tax in California stands at [current rate]%, a rate that is consistent across the state.

- Sacramento City Sales Tax: The city of Sacramento imposes an additional sales tax to support local initiatives and infrastructure. Currently, this tax is set at [current rate]%, making it a significant contributor to the overall sales tax burden.

- Sacramento County Sales Tax: Sacramento County, within which the city of Sacramento is located, also imposes its own sales tax. This tax rate, at [current rate]%, further increases the overall sales tax obligation for businesses and consumers.

- Special District Taxes: In addition to the state, city, and county taxes, certain special districts within Sacramento may levy their own sales taxes. These districts, which could include transportation authorities or specific economic development zones, have the authority to collect additional sales tax. The rates for these special districts can vary, adding further complexity to the sales tax landscape.

| Tax Component | Current Rate |

|---|---|

| State Sales Tax | [Current State Rate]% |

| Sacramento City Sales Tax | [Current City Rate]% |

| Sacramento County Sales Tax | [Current County Rate]% |

| Special District Taxes | Varies |

Impact on Businesses and Consumers

The sales tax structure in Sacramento has a profound impact on both businesses and consumers. For businesses, especially those engaged in retail or e-commerce, understanding and accurately calculating sales tax is crucial for financial planning and compliance. Failure to remit the correct sales tax can result in penalties and legal consequences.

From a consumer perspective, the sales tax directly influences their purchasing decisions and overall spending power. Higher sales tax rates can deter consumers from making certain purchases, particularly for high-value items. Conversely, lower sales tax rates can stimulate consumer spending and boost local economies.

Strategies for Businesses

To navigate the complexities of Sacramento’s sales tax, businesses can employ the following strategies:

- Sales Tax Registration: Ensure timely registration with the California Department of Tax and Fee Administration (CDTFA) to obtain a valid seller's permit. This permit is essential for legally collecting and remitting sales tax.

- Sales Tax Calculation Tools: Utilize reliable sales tax calculation tools or software that take into account the various tax rates and rules applicable in Sacramento. These tools can simplify the process and reduce the risk of errors.

- Regular Rate Updates: Stay updated with the latest sales tax rates by subscribing to notifications from the CDTFA or other reputable sources. This ensures that businesses are aware of any changes and can adjust their systems accordingly.

- Sales Tax Compliance: Implement robust sales tax compliance processes, including accurate record-keeping and timely filing of sales tax returns. Compliance not only avoids penalties but also helps maintain a positive relationship with tax authorities.

Future Outlook and Potential Changes

The sales tax landscape in Sacramento, and California as a whole, is subject to potential changes. These changes could be driven by various factors, including economic shifts, legislative reforms, or voter initiatives.

One notable trend is the increasing focus on e-commerce and online sales. As online shopping continues to grow, the challenge of accurately collecting sales tax from out-of-state sellers becomes more prominent. California, including Sacramento, may explore new ways to address this issue, potentially leading to changes in the sales tax structure for online transactions.

Additionally, the ongoing debate surrounding sales tax fairness and equity may result in reforms aimed at ensuring a more balanced distribution of tax burdens. This could involve reevaluating the rates or structures of sales taxes to better align with the needs and characteristics of different regions.

Conclusion

Understanding and navigating the sales tax landscape in Sacramento is a critical aspect of financial management for both businesses and individuals. The city’s unique sales tax structure, with its combination of state, city, county, and special district taxes, requires careful consideration and accurate calculations. By staying informed and adopting strategic approaches, businesses can ensure compliance and consumers can make informed purchasing decisions.

How often do sales tax rates change in Sacramento?

+Sales tax rates in Sacramento can change periodically, typically influenced by legislative decisions or voter-approved initiatives. While there is no set schedule, it is advisable to monitor sales tax rates at least annually to ensure compliance with the latest regulations.

Are there any special exemptions or discounts available for certain purchases in Sacramento?

+Yes, California offers various sales tax exemptions and discounts for specific purchases. These can include exemptions for certain types of goods, such as groceries or prescription medications, or discounts for senior citizens or veterans. It’s important to stay informed about these exemptions to take advantage of potential savings.

How do online retailers handle sales tax for Sacramento customers?

+Online retailers are required to collect sales tax from customers based on the shipping destination. For Sacramento customers, online retailers should charge the appropriate sales tax rate, which includes the state, city, and county rates applicable in Sacramento. This ensures compliance with sales tax regulations.