Tax Deferred Meaning

In the world of finance and investment, the concept of tax deferral plays a pivotal role, offering significant advantages to investors and influencing their long-term financial strategies. This article delves into the intricacies of tax deferral, exploring its definition, mechanisms, benefits, and the diverse strategies it enables.

Understanding Tax Deferral

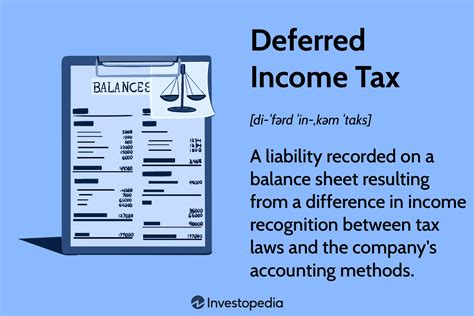

Tax deferral, a cornerstone of modern financial planning, refers to the strategic postponement of taxes on certain income, gains, or profits until a later date. This strategy leverages the power of time and compounding to optimize investment returns and minimize the financial burden of taxation.

At its core, tax deferral is about delaying the payment of taxes, allowing individuals and entities to invest their money in a tax-efficient manner. This strategy is particularly prevalent in retirement planning, where the goal is to maximize the growth of savings over time while minimizing the impact of taxes.

The Mechanics of Tax Deferral

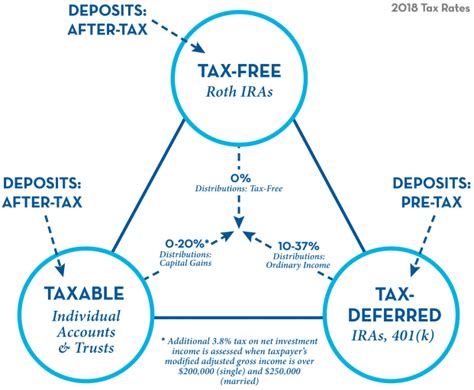

The process of tax deferral involves several key components. Firstly, it often involves the use of specific financial products or accounts, such as retirement plans like 401(k)s or Individual Retirement Accounts (IRAs), which offer tax advantages. These accounts allow individuals to contribute pre-tax dollars, effectively reducing their taxable income in the current year.

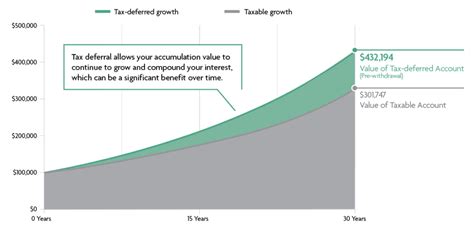

Secondly, tax deferral relies on the principle of compounding. By deferring taxes, the investor's money can grow over time without the immediate burden of taxes. This means that the investment has the potential to earn returns on both the initial investment and the accumulated earnings, leading to exponential growth.

For instance, consider an investor who contributes $5,000 to a tax-deferred account. If this account generates an average annual return of 7%, after 30 years, the initial investment would have grown to approximately $44,438. However, if taxes were paid annually on the gains, the final value could be significantly lower due to the erosion of returns by taxes.

| Time (Years) | Account Value with Tax Deferral | Account Value with Annual Taxation |

|---|---|---|

| 1 | $5,350 | $5,265 |

| 5 | $6,433 | $6,034 |

| 10 | $8,163 | $7,336 |

| 20 | $15,358 | $12,535 |

| 30 | $44,438 | $28,642 |

This example highlights the power of tax deferral, demonstrating how it can significantly boost an investor's wealth over time.

Benefits of Tax Deferral

Tax deferral offers a multitude of benefits to investors, making it a cornerstone of effective financial planning.

- Increased Savings: By deferring taxes, individuals can maximize their savings, allowing their investments to grow faster. This is particularly beneficial for long-term goals like retirement, where time is a critical factor.

- Reduced Tax Burden: Deferring taxes means that individuals pay less tax in the short term, freeing up cash flow for other investments or personal expenses. This can be especially advantageous for high-income earners in high tax brackets.

- Compounding Effect: As mentioned, tax deferral leverages the power of compounding. By avoiding annual taxation, investors can accumulate wealth more rapidly, leading to significant long-term gains.

- Flexibility in Retirement Planning: Tax-deferred accounts often offer a range of investment options, allowing individuals to customize their portfolios. This flexibility ensures that investors can align their strategies with their risk tolerance and financial goals.

Strategies Enabled by Tax Deferral

Tax deferral opens up a world of strategic possibilities for investors, enabling them to optimize their financial plans and achieve their goals more effectively.

Retirement Planning

One of the primary applications of tax deferral is in retirement planning. By contributing to tax-deferred retirement accounts, individuals can save for their golden years while reducing their immediate tax liabilities. This strategy ensures that their retirement funds have the potential to grow substantially over time, providing a comfortable nest egg for the future.

Investment Growth and Diversification

Tax-deferred accounts offer a range of investment options, from stocks and bonds to mutual funds and ETFs. This diversity allows investors to construct well-balanced portfolios, mitigating risks and maximizing returns. By deferring taxes on these investments, individuals can further enhance their growth potential.

Wealth Accumulation Strategies

Tax deferral is a key component of wealth accumulation strategies. By utilizing tax-efficient accounts and investments, individuals can accelerate their wealth-building process. This is particularly relevant for high-net-worth individuals who seek to maximize their financial growth while minimizing tax liabilities.

Estate Planning Considerations

In estate planning, tax deferral plays a crucial role. By strategically utilizing tax-deferred accounts, individuals can ensure that their wealth passes on to their heirs with minimal tax implications. This can be a powerful tool for preserving and growing family wealth across generations.

Long-Term Financial Goals

Tax deferral is a long-term strategy, making it ideal for achieving significant financial goals. Whether it’s saving for a child’s education, purchasing a second home, or funding a business venture, tax-deferred accounts can provide the necessary financial boost while keeping taxes at bay.

Financial Freedom and Flexibility

By taking advantage of tax deferral, individuals can achieve a higher level of financial freedom. The reduced tax burden and increased savings potential allow for greater flexibility in life choices, from early retirement to pursuing entrepreneurial ventures.

Conclusion

Tax deferral is a powerful financial tool that offers a range of benefits to investors. By understanding its mechanisms and strategic applications, individuals can optimize their financial plans and achieve their long-term goals more effectively. Whether it’s retirement planning, wealth accumulation, or simply maximizing investment returns, tax deferral is a cornerstone of successful financial management.

What is an example of tax deferral in practice?

+A common example is contributing to a 401(k) plan. When you contribute to a 401(k), the money is deducted from your pre-tax income, reducing your taxable earnings for the year. This deferred tax allows your investments to grow tax-free until you withdraw them during retirement.

Are there any downsides to tax deferral strategies?

+While tax deferral offers significant advantages, it’s important to consider the long-term implications. When you eventually withdraw funds from tax-deferred accounts, you’ll likely pay taxes on the accumulated gains. This can result in a larger tax bill during retirement, so it’s crucial to plan accordingly.

Can tax deferral be used for short-term financial goals?

+Tax deferral is primarily designed for long-term financial planning, such as retirement. While it can offer benefits for short-term goals, the impact may be less significant due to the shorter time frame. It’s best suited for strategies with a horizon of at least 10 years.