Vanguard Tax Forms

Tax season is a crucial time for investors, and having the right resources and information is essential. Vanguard, a leading investment management company, understands the importance of providing comprehensive support to its clients during this period. Vanguard Tax Forms serve as a vital tool for investors to manage their tax obligations effectively and efficiently. In this article, we will delve into the world of Vanguard Tax Forms, exploring their purpose, benefits, and how they simplify the tax process for investors.

Understanding Vanguard Tax Forms

Vanguard Tax Forms are a collection of documents and resources designed to assist investors in reporting their investment income and transactions accurately to the relevant tax authorities. These forms play a critical role in ensuring compliance with tax regulations and helping investors optimize their tax strategies.

Vanguard recognizes that tax obligations can be complex, especially for those with diverse investment portfolios. Therefore, the company has developed a comprehensive suite of tax forms and resources to cater to the unique needs of its clients. Let's explore the key aspects of Vanguard Tax Forms and how they contribute to a seamless tax experience.

1. Comprehensive Form Library

Vanguard offers an extensive library of tax forms, covering a wide range of investment products and transactions. This comprehensive collection ensures that investors can find the specific forms they need, regardless of their investment strategies. Some of the commonly available forms include:

- Form 1099-DIV: This form reports dividends and distributions from investments, including capital gains and ordinary dividends.

- Form 1099-B: Used to report the sale or exchange of investment property, such as stocks, bonds, and mutual funds.

- Form 1099-INT: Reports interest income earned from various investment accounts, including savings accounts and certificates of deposit.

- Form 1099-R: Designed for reporting distributions from retirement accounts, such as IRAs or pensions.

- Form 5498: Provides information about IRA contributions and balances.

The availability of these forms ensures that investors can accurately report their investment activities and comply with tax regulations. Vanguard's form library is regularly updated to reflect the latest tax laws and changes, providing investors with peace of mind and confidence in their tax reporting.

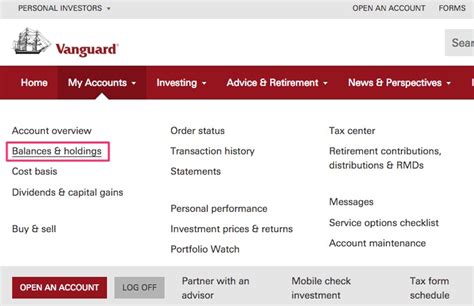

2. Online Access and Convenience

Vanguard understands the importance of accessibility and convenience in today’s digital world. As such, investors can access their tax forms securely through the Vanguard website. By logging into their online accounts, investors can:

- View and download tax forms for the current tax year and previous years.

- Search for specific forms or transactions using intuitive search functionalities.

- Receive email notifications when new tax forms are available.

- Utilize tax estimation tools to project their potential tax liabilities.

The online platform offers a user-friendly interface, making it easy for investors to navigate and find the information they need. Additionally, Vanguard provides helpful resources and tutorials to guide investors through the process, ensuring a seamless and stress-free experience.

3. Timely Delivery and Deadlines

Vanguard is committed to delivering tax forms to investors promptly. The company aims to make forms available as soon as possible, typically by the end of January or early February. This allows investors ample time to review and process their tax documents before the official tax filing deadline.

By providing early access to tax forms, Vanguard empowers investors to start planning their tax strategies and seek professional advice if needed. Investors can work with tax professionals or use tax preparation software to ensure accurate and timely filings.

4. Secure and Confidential Data

Vanguard places utmost importance on the security and confidentiality of investor data. The company utilizes advanced encryption technologies to protect sensitive information, ensuring that tax forms and personal details remain secure during transmission and storage.

Vanguard's data protection measures align with industry best practices, giving investors the assurance that their information is safe and inaccessible to unauthorized individuals. This commitment to data security is a cornerstone of Vanguard's service, providing investors with peace of mind during the tax season.

5. Additional Tax Resources and Support

Beyond tax forms, Vanguard offers a wealth of resources and support to assist investors in navigating the tax landscape. These resources include:

- Tax Guides: Comprehensive guides providing insights into tax strategies, deductions, and credits specific to investment income.

- Tax Tools: Online calculators and estimators to help investors estimate their tax liabilities and optimize their tax planning.

- Educational Articles: Informative articles covering a range of tax-related topics, from understanding tax-efficient investing to managing capital gains.

- Tax Professional Referrals: A network of trusted tax professionals who specialize in investment-related tax matters, offering personalized advice and support.

By providing these additional resources, Vanguard ensures that investors have the knowledge and tools they need to make informed decisions regarding their tax obligations.

The Benefits of Vanguard Tax Forms

Vanguard Tax Forms offer a multitude of benefits to investors, simplifying the tax process and providing valuable advantages. Let’s explore some of the key advantages:

1. Compliance and Accuracy

Vanguard Tax Forms ensure that investors meet their tax compliance obligations accurately and efficiently. The forms are meticulously designed to capture all relevant investment activities, reducing the risk of errors or omissions. By using these forms, investors can have confidence in the completeness and accuracy of their tax filings.

2. Time and Effort Savings

The comprehensive nature of Vanguard Tax Forms eliminates the need for investors to gather and organize numerous documents from different sources. Instead, investors can access all their tax-related information in one centralized location, saving valuable time and effort. This streamlined process allows investors to focus on other aspects of their financial planning and tax strategy.

3. Tax Strategy Optimization

Vanguard Tax Forms provide a comprehensive overview of an investor’s investment activities, allowing for a more strategic approach to tax planning. By analyzing the forms, investors can identify opportunities to optimize their tax strategies, such as leveraging tax-efficient investment vehicles or timing transactions to minimize tax liabilities. This proactive approach can lead to significant tax savings over time.

4. Ease of Tax Filing

The online accessibility of Vanguard Tax Forms simplifies the tax filing process. Investors can easily download and import their tax data into tax preparation software or share the forms with their tax professionals. This streamlined process reduces the complexity and stress associated with tax filing, allowing investors to complete their obligations efficiently.

5. Peace of Mind

Knowing that Vanguard provides a comprehensive suite of tax forms and resources gives investors peace of mind. The company’s commitment to staying up-to-date with tax regulations and offering timely support ensures that investors can navigate the tax landscape with confidence. With Vanguard’s tax forms, investors can focus on their investment goals without worrying about the complexities of tax compliance.

Vanguard Tax Forms: A Comprehensive Solution

Vanguard Tax Forms are a testament to the company’s commitment to providing exceptional service and support to its investors. By offering a comprehensive suite of tax forms, resources, and guidance, Vanguard simplifies the tax process and empowers investors to make informed decisions. Whether it’s ensuring compliance, optimizing tax strategies, or seeking professional advice, Vanguard Tax Forms serve as a valuable tool for investors during tax season.

As investors navigate the ever-evolving tax landscape, having access to accurate and timely tax information is crucial. Vanguard understands this need and continues to enhance its tax support offerings, ensuring that investors can manage their tax obligations with confidence and ease.

When are Vanguard Tax Forms typically made available for investors?

+

Vanguard aims to make tax forms available by the end of January or early February each year. This early access allows investors to start their tax planning and filing process promptly.

Can I access my tax forms online through the Vanguard website?

+

Yes, Vanguard provides an online platform where investors can securely access their tax forms. By logging into their online accounts, investors can view, download, and manage their tax documents conveniently.

What if I need assistance understanding my tax forms or have specific tax-related questions?

+

Vanguard offers a range of resources and support options for investors. This includes tax guides, educational articles, and a network of trusted tax professionals who can provide personalized advice. Investors can also reach out to Vanguard’s customer support team for further assistance.