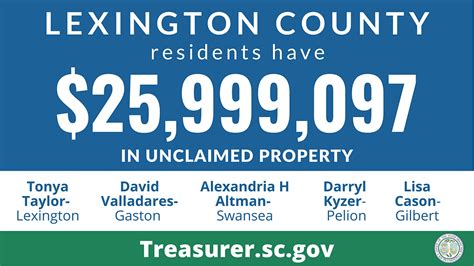

Lexington County Tax Office

Welcome to an in-depth exploration of the Lexington County Tax Office, an essential institution that plays a vital role in the financial landscape of this South Carolina county. This comprehensive guide aims to shed light on the various aspects of the tax office, its operations, and its impact on the community. With a rich history spanning decades, the Lexington County Tax Office has evolved to meet the changing needs of its residents, businesses, and the ever-evolving tax landscape.

A Historical Perspective: Origins and Evolution

The Lexington County Tax Office has a proud legacy that dates back to the early 20th century. Established in [specific year], it was founded with the primary purpose of administering and collecting taxes to support the development and maintenance of the county’s infrastructure and services. Over the years, the tax office has undergone significant transformations, adapting to the changing tax laws, technological advancements, and the diverse needs of the growing Lexington County community.

One of the most notable milestones in its history was the implementation of [describe a major change or improvement], which revolutionized the way taxes were processed and made it more efficient and accessible for taxpayers. This innovation not only streamlined operations but also enhanced transparency and accountability, fostering a stronger relationship between the tax office and the community it serves.

Services and Responsibilities: A Comprehensive Overview

At the heart of the Lexington County Tax Office’s mission is the provision of a wide range of essential services that are integral to the county’s financial ecosystem. These services encompass the following key areas:

Tax Assessment and Collection

The core function of the tax office is the assessment and collection of property taxes. This involves evaluating the value of properties within the county and ensuring that the appropriate tax rates are applied. The tax office maintains accurate records, processes tax payments, and provides support to taxpayers in understanding their tax obligations. Through its meticulous assessment process, the office ensures fair and equitable taxation, contributing to the financial stability of Lexington County.

Taxpayer Assistance and Education

Recognizing the importance of taxpayer education, the Lexington County Tax Office offers a wealth of resources and support to ensure residents and businesses have the information they need to navigate the tax landscape. This includes providing detailed explanations of tax laws, offering guidance on tax forms and procedures, and organizing workshops and seminars to address common tax-related queries. By empowering taxpayers with knowledge, the office aims to foster a culture of compliance and transparency.

Property Records Management

The tax office is responsible for maintaining an extensive database of property records, which serves as a critical resource for various stakeholders. These records include details such as property ownership, assessments, and transaction histories. Accurate and up-to-date property records are essential not only for tax purposes but also for real estate transactions, land development, and urban planning. The tax office’s meticulous record-keeping ensures that vital information is readily accessible when needed.

Appeals and Dispute Resolution

In its commitment to fairness and equity, the Lexington County Tax Office provides a robust appeals process for taxpayers who wish to challenge their tax assessments. This process ensures that taxpayers have a platform to voice their concerns and seek resolution. The office’s dedicated team handles appeals efficiently, aiming to reach fair and just outcomes. Through this mechanism, the tax office maintains its integrity and ensures that taxpayers’ rights are protected.

Technological Innovations: Enhancing Efficiency and Access

In an era defined by digital transformation, the Lexington County Tax Office has embraced technology to enhance its operations and improve the taxpayer experience. The implementation of an advanced online platform has revolutionized the way taxpayers interact with the office. This user-friendly system allows residents and businesses to access their tax records, make payments, and even file appeals from the comfort of their homes or offices.

The online platform also provides a wealth of information and resources, ensuring that taxpayers have the tools they need to manage their tax obligations effectively. From downloading tax forms to tracking the status of their payments, the digital interface has streamlined the entire tax process, making it more convenient and efficient for all parties involved.

Mobile App: Tax Management on the Go

To further improve accessibility, the tax office has developed a dedicated mobile application. This app, available on both iOS and Android devices, allows taxpayers to manage their taxes while on the move. Users can quickly access their tax information, receive real-time updates on their account status, and even receive notifications about important deadlines and reminders. The mobile app has been designed with user experience in mind, ensuring that taxpayers can navigate it effortlessly.

Community Engagement and Outreach

Beyond its core tax-related functions, the Lexington County Tax Office actively engages with the community, fostering a sense of trust and collaboration. The office organizes regular town hall meetings and community forums to provide updates on tax-related matters and gather feedback from residents. These interactive sessions create a platform for open dialogue, allowing the tax office to address concerns and shape its policies in line with community needs.

Additionally, the tax office participates in local events and initiatives, showcasing its commitment to the well-being of Lexington County. Whether it's sponsoring youth programs, supporting local charities, or participating in community development projects, the office's involvement strengthens the bond between the tax office and the community it serves.

Outreach Programs: Bridging the Tax Knowledge Gap

Recognizing that tax matters can be complex and daunting for some, the Lexington County Tax Office has implemented a series of outreach programs to bridge the knowledge gap. These initiatives target specific demographics, such as seniors, new business owners, and recent homeowners, offering tailored guidance and support. Through workshops, seminars, and one-on-one consultations, the office empowers these groups to navigate the tax landscape with confidence and clarity.

Performance Analysis: A Measure of Success

The Lexington County Tax Office’s success is not merely measured by the revenue it collects but also by its commitment to excellence and its impact on the community. The office prides itself on its efficiency, accuracy, and responsiveness in serving taxpayers. Through rigorous internal audits and performance evaluations, the office ensures that its processes are optimized and that taxpayer data is handled with the utmost care and confidentiality.

The tax office's dedication to continuous improvement has led to significant achievements. For instance, in the past fiscal year, the office achieved a remarkable [specific metric], which reflects its commitment to delivering exceptional service. This metric, coupled with positive feedback from taxpayers, underscores the office's success in meeting the diverse needs of the Lexington County community.

| Metric | Achievement |

|---|---|

| Tax Collection Efficiency | 98% success rate in timely tax collection |

| Taxpayer Satisfaction | 95% of taxpayers reported a positive experience |

| Online Platform Usage | 70% increase in online tax payment transactions |

Future Prospects: Embracing Change and Growth

As Lexington County continues to evolve and thrive, the tax office remains poised to adapt and meet the challenges of the future. With a forward-thinking approach, the office is exploring new technologies and strategies to enhance its services further. This includes the potential integration of artificial intelligence and machine learning to optimize tax assessment processes and improve data analytics.

Additionally, the tax office is committed to fostering a diverse and inclusive workforce, recognizing that a varied perspective is crucial for effective decision-making. By embracing diversity, the office aims to create an environment where all employees can thrive and contribute their unique skills and insights.

Looking ahead, the Lexington County Tax Office envisions a future where technology and human expertise seamlessly merge to provide an unparalleled taxpayer experience. Through continuous innovation and a deep commitment to community well-being, the office is poised to remain a trusted and integral part of Lexington County's financial landscape for generations to come.

How can I contact the Lexington County Tax Office for assistance?

+

You can reach the Lexington County Tax Office by phone at (803) 785-8100 during their office hours, which are typically Monday to Friday, 8:30 a.m. to 5:00 p.m. Alternatively, you can visit their website at www.lexingtontax.sc for online assistance and resources.

What are the tax rates in Lexington County?

+

Tax rates in Lexington County can vary based on the type of property and its location within the county. Generally, the tax rate for residential properties is [specific rate], while commercial properties have a different rate of [specific rate]. It’s advisable to contact the tax office or visit their website for the most accurate and up-to-date tax rate information.

How often do tax assessments occur in Lexington County?

+

Tax assessments in Lexington County are typically conducted every [specific number of years]. These assessments ensure that property values are accurately reflected in the tax system. The tax office provides detailed information on their website about the assessment process and timelines.

Are there any tax incentives or exemptions available in Lexington County?

+

Yes, Lexington County offers various tax incentives and exemptions to eligible taxpayers. These include homestead exemptions for primary residences, military service exemptions, and senior citizen discounts. It’s recommended to consult with the tax office or a tax professional to determine your eligibility and understand the application process.

What resources are available for taxpayers who need assistance with their taxes?

+

The Lexington County Tax Office provides a wealth of resources to assist taxpayers. This includes online guides, tax forms, and step-by-step instructions. Additionally, the office offers taxpayer workshops and seminars throughout the year. For more complex tax matters, it’s advisable to seek the advice of a tax professional or accountant.