Car Taxes Ct

Car taxes are an important consideration for vehicle owners, especially in the context of Connecticut, where specific regulations and rates apply. This comprehensive guide aims to provide an in-depth analysis of car taxes in CT, offering valuable insights for residents and potential vehicle buyers. We will delve into the various aspects of these taxes, including the types, rates, exemptions, and strategies to optimize costs.

Understanding Car Taxes in Connecticut

Connecticut imposes several types of taxes on vehicle ownership and operation, which can significantly impact the overall cost of owning a car. These taxes are designed to generate revenue for the state and are used to fund various infrastructure and public services. Understanding these taxes is crucial for car owners to budget effectively and navigate the legal requirements.

Types of Car Taxes in CT

Connecticut employs a range of taxes related to vehicles, each serving a specific purpose. Here’s a breakdown of the primary types of car taxes in the state:

- Property Tax: This is perhaps the most significant tax for vehicle owners in CT. Property taxes are assessed annually based on the value of the vehicle. The tax rate varies across different towns and cities within the state.

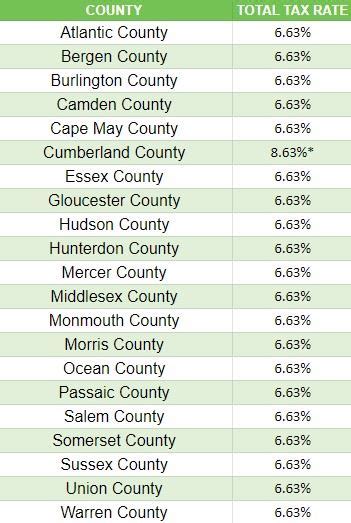

- Sales Tax: When purchasing a new or used car in Connecticut, you are subject to a sales tax. The current sales tax rate for vehicles is 6.35%, which is applied to the purchase price.

- Use Tax: If you buy a car from a private party or out-of-state and register it in CT, you may be liable for a use tax. This tax ensures that all vehicle purchases are taxed equally, regardless of where the purchase was made.

- Registration Fees: Vehicle registration in Connecticut incurs fees, which are determined by the weight and type of the vehicle. These fees are due annually and are separate from the property tax.

- Excise Tax: Certain vehicles, such as luxury cars or those with high fuel consumption, may be subject to an excise tax. This tax is calculated based on specific criteria and is in addition to other taxes.

Each of these taxes contributes to the overall cost of owning a car in Connecticut, and understanding their implications is essential for effective financial planning.

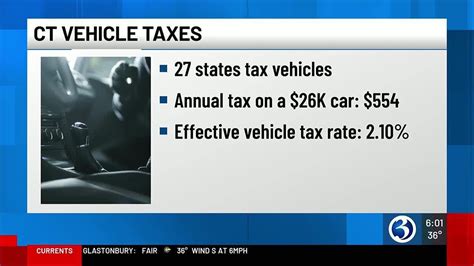

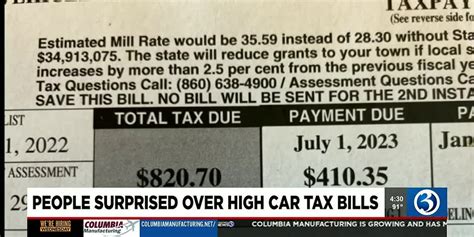

Tax Rates and Exemptions

The tax rates in Connecticut vary depending on the type of tax and the specific circumstances of the vehicle owner. For instance, the property tax rate can differ significantly from one town to another. As of the latest data available, the average property tax rate for cars in Connecticut is approximately 2.5% of the vehicle’s assessed value.

| Tax Type | Rate or Fee |

|---|---|

| Property Tax | Varies by town (average ~2.5% of assessed value) |

| Sales Tax | 6.35% of purchase price |

| Use Tax | Varies (based on vehicle cost) |

| Registration Fees | Varies by vehicle type and weight |

| Excise Tax | Varies based on vehicle specifications |

It's important to note that Connecticut offers certain exemptions and discounts for specific groups of vehicle owners. For example, veterans and seniors may be eligible for reduced property tax rates. Additionally, hybrid and electric vehicles often benefit from lower registration fees and are exempt from certain taxes.

Strategies for Minimizing Car Taxes

While car taxes are a necessary part of vehicle ownership, there are strategies that can help minimize their impact on your finances. Here are some effective approaches:

Purchase Considerations

When buying a car, consider the following to optimize your tax situation:

- Research and compare the tax implications of different vehicle types and models. Certain makes and models may have lower registration fees or be exempt from specific taxes.

- Explore the option of purchasing a hybrid or electric vehicle, which often comes with tax incentives and discounts.

- If you’re buying from a private seller or out-of-state, understand the use tax implications and plan accordingly.

Tax Deductions and Credits

Connecticut offers various tax deductions and credits that can reduce your overall tax liability. Here are some key considerations:

- If you use your vehicle for business purposes, you may be able to deduct a portion of your car-related expenses, including taxes, on your federal and state tax returns.

- Keep track of all vehicle-related expenses, as these can be valuable deductions when filing your taxes.

- Stay informed about any new tax credits or incentives introduced by the state, especially for environmentally friendly vehicles.

Regular Maintenance and Registration

Proper maintenance and timely registration can help avoid additional fees and penalties:

- Ensure your vehicle is well-maintained to avoid potential tax penalties for non-compliance with safety and emission standards.

- Register your vehicle annually and pay the required fees on time to avoid late fees and potential registration suspension.

- Keep your vehicle registration and insurance documents up-to-date to avoid legal issues and unnecessary expenses.

The Impact of Car Taxes on CT Residents

Car taxes significantly influence the financial planning and decision-making of Connecticut residents. The cumulative effect of these taxes can be substantial, especially for those with multiple vehicles or high-value cars. Understanding the tax landscape is crucial for residents to make informed choices about vehicle ownership and maintenance.

Financial Planning and Budgeting

When planning your finances, consider the following tax-related aspects:

- Estimate the total tax cost for your vehicle(s) annually, including property taxes, registration fees, and any other applicable taxes.

- Compare the tax implications of different vehicle options, especially when considering a new purchase.

- Take advantage of tax deductions and credits to reduce your overall tax burden.

Vehicle Ownership Decisions

Car taxes can influence decisions about vehicle ownership, such as:

- Choosing between buying a new or used car, considering the sales tax implications.

- Exploring alternative transportation options, such as public transit or car-sharing services, to reduce the financial burden of car ownership.

- Considering the long-term costs of vehicle ownership, including taxes, maintenance, and fuel expenses.

Future Implications and Potential Changes

The landscape of car taxes in Connecticut is subject to change, influenced by various factors, including economic conditions, legislative decisions, and technological advancements. Staying informed about potential changes is crucial for vehicle owners to adapt their financial strategies accordingly.

Legislative Updates

Connecticut’s legislature periodically reviews and updates tax laws, including those related to vehicles. Keep an eye on any proposed changes, as they can impact the tax rates, exemptions, and overall tax structure.

Technological Advancements

The rise of electric and autonomous vehicles may lead to new tax considerations. As these technologies become more prevalent, the state may introduce specific taxes or incentives to encourage their adoption or manage their impact on the road network.

Economic Factors

Economic conditions, such as inflation and budget deficits, can influence tax rates. In times of economic hardship, the state may consider increasing taxes to generate more revenue. Conversely, during prosperous periods, tax rates may be adjusted downward.

Conclusion

Car taxes in Connecticut are a complex but essential aspect of vehicle ownership. By understanding the various types of taxes, their rates, and potential exemptions, vehicle owners can make informed decisions and optimize their financial strategies. Staying informed about potential changes and exploring tax-saving opportunities is crucial for effective financial planning in the context of car ownership in CT.

How often do I need to pay property taxes on my vehicle in CT?

+Property taxes on vehicles in Connecticut are typically assessed and paid annually. The specific due date may vary depending on your town or city, so it’s important to check with your local tax assessor’s office to ensure timely payment.

Are there any tax benefits for electric or hybrid vehicles in Connecticut?

+Yes, Connecticut offers tax incentives for electric and hybrid vehicles. These vehicles are often exempt from certain taxes, such as the sales tax on the purchase, and may be eligible for reduced registration fees. Additionally, there are federal tax credits available for the purchase of qualified electric vehicles.

Can I deduct car-related expenses from my taxes in Connecticut?

+Yes, if you use your vehicle for business purposes, you may be able to deduct certain car-related expenses from your federal and state tax returns. These deductions can include fuel costs, maintenance, insurance, and even a portion of your property taxes. It’s important to keep detailed records of these expenses for accurate deductions.

What happens if I fail to pay my car taxes on time in CT?

+Failure to pay your car taxes on time in Connecticut can result in penalties and interest charges. Additionally, your vehicle registration may be suspended, and you may face legal consequences. It’s crucial to stay on top of your tax obligations to avoid these issues.

Are there any exemptions or discounts for car taxes in Connecticut for certain groups of people?

+Yes, Connecticut offers exemptions and discounts for specific groups, such as veterans and seniors. These exemptions can reduce the property tax rate or provide other benefits. It’s important to check with your local tax assessor’s office to understand the specific eligibility criteria and requirements.