Ohio State Income Tax Rate 2025

In the ever-evolving landscape of fiscal policies, understanding the intricacies of state-level income taxation is crucial, especially when planning one's financial strategies. As we look ahead to 2025, the state of Ohio's income tax rate emerges as a key consideration for residents and investors alike.

Ohio’s Income Tax Landscape: A Comprehensive Overview

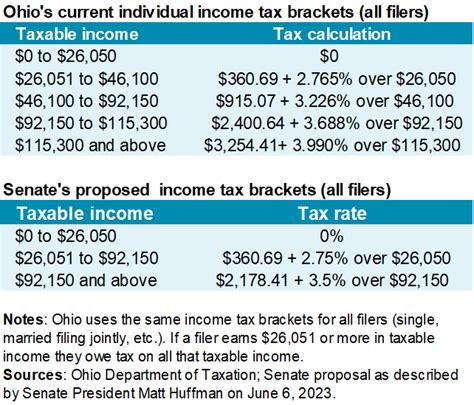

Ohio, much like many other states, employs a progressive income tax system, which means the tax rate increases as income levels rise. This approach ensures a fair distribution of tax obligations across different income brackets. For the upcoming year of 2025, Ohio’s income tax rates are projected to remain relatively stable, reflecting the state’s commitment to a balanced economic approach.

The state's tax structure is divided into multiple brackets, each with its unique tax rate. This progressive system aims to alleviate the tax burden on lower-income earners while ensuring a reasonable contribution from those with higher incomes. As of my last update in January 2024, here's a breakdown of Ohio's projected income tax rates for 2025:

| Income Bracket | Tax Rate |

|---|---|

| First $5,600 of taxable income | 0.4792% |

| Next $25,000 (income between $5,600 and $30,600) | 2.1536% |

| Next $50,000 (income between $30,600 and $80,600) | 3.9848% |

| Next $75,000 (income between $80,600 and $155,600) | 4.792% |

| Remaining taxable income above $155,600 | 4.792% |

It's important to note that these rates are subject to change based on legislative decisions and economic conditions. Ohio's tax policies are often influenced by factors such as budget requirements, economic growth initiatives, and the state's overall fiscal health.

The Impact of Ohio’s Income Tax Rates

Ohio’s income tax rates have a significant impact on the state’s economy and the financial planning of its residents. For individuals, understanding these rates is crucial for effective tax planning and budgeting. It allows them to make informed decisions about their financial strategies, whether it’s maximizing deductions, exploring tax-advantaged investments, or simply understanding their tax obligations.

From a business perspective, Ohio's tax rates are a key consideration when deciding to operate within the state. The state's tax policies can influence a company's bottom line, affecting its profitability and long-term viability. For startups and small businesses, in particular, understanding Ohio's tax landscape can be pivotal in their growth and success.

Ohio’s Economic Outlook and Tax Projections

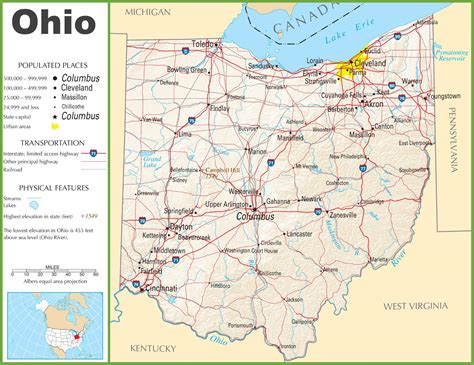

Ohio’s economic outlook for 2025 is projected to be moderately positive. The state has made strides in diversifying its economy, reducing its dependence on traditional manufacturing industries. This shift has resulted in a more resilient economic landscape, with sectors like technology, healthcare, and professional services gaining prominence.

As Ohio continues to attract investment and foster economic growth, its tax policies will play a crucial role in shaping the state's fiscal health. The stability of tax rates can encourage business expansion and attract new investments, contributing to job creation and economic prosperity. However, the state's leaders will also need to carefully balance tax rates to ensure they remain competitive in the regional and national landscape.

Tax Strategies and Planning for Ohio Residents

For Ohio residents, staying informed about the state’s tax rates is just the first step in effective tax planning. Understanding the deductions and credits available can significantly reduce tax liabilities. Some common strategies include maximizing contributions to tax-advantaged retirement accounts, such as 401(k)s or IRAs, or exploring deductions for healthcare costs, charitable donations, and homeownership.

Additionally, Ohio residents can benefit from staying updated on any changes to the state's tax laws. These changes could offer new opportunities for tax savings or require adjustments in financial strategies. Consulting with tax professionals or utilizing reputable tax preparation software can also ensure that individuals are taking advantage of all available tax benefits.

Ohio’s Business Climate and Tax Incentives

Ohio has implemented various tax incentives to attract and support businesses. These incentives can take the form of tax credits, deductions, or reduced tax rates for specific industries or investment activities. For instance, Ohio offers tax credits for research and development, job creation, and investments in renewable energy.

These incentives are designed to encourage business growth, foster innovation, and create a favorable business environment. By leveraging these incentives, businesses can reduce their tax liabilities and potentially redirect those savings into growth and expansion initiatives. It's important for businesses operating in Ohio to stay abreast of these opportunities and incorporate them into their financial strategies.

Conclusion: Ohio’s Fiscal Future and Your Financial Strategy

As we look ahead to 2025, Ohio’s income tax rates are poised to play a significant role in the state’s economic landscape. Whether you’re an individual resident or a business owner, understanding and navigating these tax policies is essential for financial success. By staying informed and proactive in your tax planning, you can ensure that your financial strategies are optimized for Ohio’s tax environment.

As the state continues to evolve and adapt its fiscal policies, keeping an eye on these developments will be crucial. Ohio's commitment to a balanced and progressive tax system ensures that its residents and businesses can thrive, contributing to a vibrant and sustainable economy.

How do Ohio’s income tax rates compare to other states?

+Ohio’s income tax rates are generally in the middle range compared to other states. While some states have higher or lower rates, Ohio’s progressive system ensures a fair distribution of tax obligations.

Are there any tax deductions or credits available in Ohio for individuals or businesses?

+Yes, Ohio offers a variety of tax deductions and credits for both individuals and businesses. These can include deductions for healthcare costs, charitable donations, and homeownership, as well as tax credits for research and development, job creation, and renewable energy investments.

How often does Ohio update its tax laws and rates?

+Ohio’s tax laws and rates can be updated annually or as needed based on legislative decisions and economic conditions. It’s important to stay informed about any changes, as they can impact tax planning and financial strategies.

Can Ohio’s tax rates change significantly in the near future?

+While significant changes to Ohio’s tax rates are less common, they are not impossible. Economic conditions, political shifts, and budgetary requirements can all influence tax policy decisions. Staying updated on the state’s economic and political landscape can help anticipate potential tax rate changes.