Federal Tax Id Address Change

In the complex landscape of financial administration, one crucial aspect that often requires careful attention is the Federal Tax ID (Employer Identification Number, or EIN). This unique identifier is essential for businesses and organizations to efficiently manage their tax obligations and maintain compliance with the Internal Revenue Service (IRS). However, there are instances when an entity needs to update their Federal Tax ID address, a process that demands precision and adherence to specific guidelines.

This comprehensive guide aims to demystify the procedure for changing a Federal Tax ID address, providing a step-by-step breakdown, along with essential tips and insights to ensure a seamless transition. Whether you're a seasoned business owner or a financial advisor assisting clients, understanding the intricacies of this process is paramount to avoiding potential pitfalls and ensuring continued tax compliance.

Understanding the Federal Tax ID and Its Importance

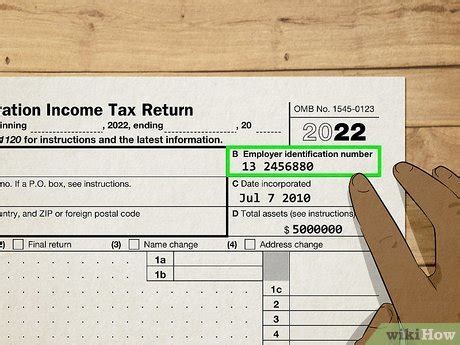

A Federal Tax ID, or EIN, is a unique nine-digit number assigned to businesses by the IRS. It serves as a critical identifier for tax purposes, enabling the IRS to track and manage tax obligations and payments. This number is vital for various financial transactions, including opening a business bank account, applying for loans or permits, and filing taxes.

EINs are particularly crucial for entities that employ staff, as they facilitate the reporting of payroll taxes. Moreover, certain businesses, such as corporations and partnerships, are legally required to obtain an EIN, while others, like sole proprietorships, may opt for one to simplify tax management.

The Federal Tax ID address, on the other hand, refers to the business's physical location associated with the EIN. This address is used by the IRS to correspond with the business regarding tax matters and is a critical component of the EIN record.

Why Change a Federal Tax ID Address

There are several scenarios that may necessitate a change in the Federal Tax ID address. The most common reason is a simple business relocation, where the entity moves to a new physical location. However, changes in address may also be triggered by mergers or acquisitions, where the legal entity’s physical location shifts.

Additionally, in some cases, businesses may need to update their Federal Tax ID address to reflect a change in their mailing or billing address. This could be due to the entity opting for a different address for receiving official communications or managing their financial transactions.

The Process of Changing a Federal Tax ID Address

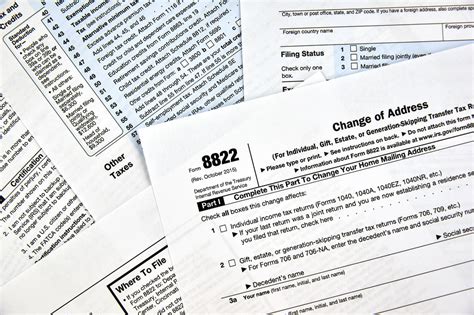

Changing a Federal Tax ID address is a straightforward process, but it requires careful attention to detail. The IRS provides a dedicated form, Form 8822-B, specifically designed for updating business address information.

Step 1: Obtain Form 8822-B

The first step is to acquire the Form 8822-B, which can be downloaded from the IRS website. This form is specifically designed for updating business address information, including the Federal Tax ID address.

Alternatively, you can request a physical copy of the form by calling the IRS at 1-800-829-1040. However, given the convenience and speed of online access, downloading the form from the IRS website is typically the preferred method.

Step 2: Fill Out the Form

Once you have the Form 8822-B, the next step is to complete it accurately. The form is straightforward and user-friendly, but it’s crucial to provide all the required information and ensure its accuracy.

The form will require the following details:

- Name and contact information of the business or organization.

- The old Federal Tax ID address.

- The new Federal Tax ID address.

- The EIN for which the address change is being made.

- The reason for the change (e.g., business relocation, change in mailing address, etc.).

- The signature of an authorized representative of the business.

It's essential to ensure that all the information provided is correct and up-to-date. Any inaccuracies or inconsistencies could lead to delays in processing the address change or, in extreme cases, result in legal complications.

Step 3: Submit the Form to the IRS

After completing the Form 8822-B, the next step is to submit it to the IRS. The IRS provides multiple ways to submit the form, including by mail, fax, or online.

If you choose to submit the form by mail, ensure that you send it to the correct IRS address. The IRS website provides specific instructions on where to mail the form based on your state. It's crucial to use the correct address to avoid delays in processing.

Alternatively, you can fax the completed form to the IRS. The fax number for address changes is provided on the IRS website. Ensure that you keep a copy of the fax confirmation for your records.

For those who prefer online submission, the IRS provides an online portal where you can upload and submit the Form 8822-B. This method is the most convenient and typically results in the fastest processing times.

Step 4: Await Confirmation

Once you’ve submitted the Form 8822-B, the IRS will process the change. The processing time can vary depending on the method of submission and the volume of applications the IRS is handling. In general, it can take several weeks to receive confirmation of the address change.

During the processing period, it's important to continue using the old Federal Tax ID address for all tax-related matters. Only use the new address once you've received official confirmation from the IRS.

Step 5: Update Internal Records

After receiving confirmation from the IRS, it’s essential to update your internal records to reflect the new Federal Tax ID address. This includes updating your business address in all relevant systems and databases, such as your accounting software, payroll system, and banking information.

It's also crucial to inform your business partners, clients, and vendors about the address change. This ensures that all future communications and transactions are directed to the correct address.

Tips for a Smooth Federal Tax ID Address Change

While the process of changing a Federal Tax ID address is straightforward, there are several tips and best practices to ensure a smooth transition.

Plan Ahead

If you know in advance that you’ll be changing your business address, it’s best to initiate the address change process well ahead of the move. This allows you to receive confirmation from the IRS before the move, ensuring a seamless transition without any disruptions to your tax obligations.

Keep Accurate Records

Maintaining accurate and up-to-date records is crucial when changing a Federal Tax ID address. This includes keeping track of all correspondence with the IRS and ensuring that all your internal records reflect the correct address once the change has been confirmed.

Inform Relevant Parties

Once the address change has been confirmed, it’s essential to inform all relevant parties, including your employees, business partners, clients, and vendors. This ensures that they continue to send communications and transactions to the correct address, preventing potential delays or misunderstandings.

Monitor for Confirmation

After submitting the Form 8822-B, it’s important to monitor your correspondence with the IRS. Keep an eye out for any notifications or updates regarding the status of your address change request. If you haven’t received confirmation within a reasonable timeframe, consider following up with the IRS to ensure that your request is being processed.

Consider Using an Online Address Change Service

For those who prefer a more streamlined and automated process, there are online services that can assist with changing a Federal Tax ID address. These services typically provide a more user-friendly interface for completing the Form 8822-B and often offer faster processing times through direct connections with the IRS.

Address Changes for Specific Entity Types

While the general process for changing a Federal Tax ID address is the same for most entities, there are some nuances for specific entity types that are worth noting.

Sole Proprietorships

Sole proprietorships often use the owner’s home address as their business address. If the owner moves, the business address will likely change as well. In this case, the sole proprietor will need to update their Federal Tax ID address using the Form 8822-B, just like any other business entity.

Partnerships

Partnerships may have a physical office or operate from the homes of the partners. If the partnership moves to a new location, the Federal Tax ID address will need to be updated. The process for updating the address is the same as for other business entities, using the Form 8822-B.

Corporations

Corporations typically have a registered office address, which may be different from the actual physical location of the business. If the corporation changes its registered office address, it will need to update its Federal Tax ID address using the Form 8822-B. This is a common scenario when corporations move to new headquarters or change their registered agent.

Limited Liability Companies (LLCs)

LLCs, like corporations, often have a registered office address that may differ from the actual business location. If the LLC changes its registered office address, it will need to update its Federal Tax ID address using the Form 8822-B. This is particularly important if the LLC has employees, as the address change will affect payroll tax reporting.

Nonprofit Organizations

Nonprofit organizations, like other entities, may need to change their Federal Tax ID address if they move to a new location. The process for updating the address is the same as for other business entities, using the Form 8822-B. Nonprofits should ensure that they keep their address information up-to-date with the IRS to maintain their tax-exempt status.

Common Challenges and How to Overcome Them

While the process of changing a Federal Tax ID address is generally straightforward, there can be challenges and potential pitfalls. Being aware of these challenges and knowing how to overcome them can help ensure a smooth and successful address change.

Delay in Processing

One of the most common challenges is a delay in processing the address change by the IRS. This can be due to a variety of reasons, including high volume of requests, system issues, or incomplete or inaccurate information on the Form 8822-B. To mitigate this challenge, it’s important to submit the form as early as possible and ensure that all the information provided is accurate and complete.

Inaccurate Information

Another challenge is providing inaccurate or outdated information on the Form 8822-B. This can lead to delays in processing or even rejection of the address change request. To overcome this challenge, always double-check the information before submitting the form and keep all your records up-to-date.

Confusion Over Multiple Addresses

For businesses with multiple locations or complex address structures, there may be confusion over which address to use for the Federal Tax ID. This can lead to errors in the address change process. To avoid this challenge, clearly understand and document all the different addresses associated with your business and ensure that you’re updating the correct Federal Tax ID address.

Limited Access to IRS Resources

In some cases, businesses may have limited access to IRS resources or support, especially if they are located in remote areas or have limited internet access. This can make the process of changing a Federal Tax ID address more challenging. To overcome this challenge, consider using online address change services or seeking assistance from a tax professional who can help navigate the process.

Conclusion

Changing a Federal Tax ID address is an important administrative task for any business or organization. While the process may seem daunting, with the right knowledge and preparation, it can be a straightforward and efficient procedure. By following the steps outlined in this guide and keeping in mind the tips and challenges discussed, you can ensure a smooth transition to your new Federal Tax ID address.

Remember, keeping your Federal Tax ID address up-to-date is crucial for maintaining compliance with the IRS and ensuring the smooth operation of your business. By staying informed and taking proactive steps, you can navigate the process of changing your Federal Tax ID address with confidence and ease.

FAQ

How long does it take for the IRS to process a Federal Tax ID address change?

+The processing time for a Federal Tax ID address change can vary depending on the method of submission and the volume of applications the IRS is handling. Generally, it can take several weeks to receive confirmation of the address change. It’s important to continue using the old Federal Tax ID address for all tax-related matters until you receive official confirmation from the IRS.

Can I change my Federal Tax ID address online?

+Yes, the IRS provides an online portal where you can upload and submit the Form 8822-B. This method is the most convenient and typically results in faster processing times. However, it’s important to ensure that you have all the necessary information and documentation ready before starting the online process.

What happens if I don’t update my Federal Tax ID address when I move?

+Failing to update your Federal Tax ID address when you move can lead to a variety of issues. For example, you may miss important tax-related correspondence from the IRS, which could result in penalties or legal complications. Additionally, your tax returns and other tax documents may be sent to the wrong address, causing further delays and complications.

Can I change my Federal Tax ID address if I’m a sole proprietor working from home?

+Yes, if you’re a sole proprietor working from home and you move to a new location, you will need to update your Federal Tax ID address. The process is the same as for any other business entity, using the Form 8822-B. It’s important to keep your address information up-to-date with the IRS to ensure compliance and avoid potential issues.

Do I need to notify the IRS if my business’s mailing address changes but the physical location stays the same?

+Yes, even if your business’s physical location stays the same but the mailing address changes, you should still update your Federal Tax ID address with the IRS. This ensures that all official communications from the IRS are sent to the correct mailing address. You can use the Form 8822-B to update your address information.