Colorado State Tax Form

The Colorado State Tax Form is a vital document for residents and businesses operating within the state, as it facilitates the payment of taxes to the Colorado Department of Revenue. Accurate completion and timely submission of this form are essential to ensure compliance with state tax laws and avoid potential penalties. In this comprehensive guide, we will delve into the intricacies of the Colorado State Tax Form, providing you with an expert understanding of its purpose, structure, and key considerations.

Understanding the Colorado State Tax Form

The Colorado State Tax Form serves as the primary instrument for taxpayers to declare their income, expenses, deductions, and credits to the state government. It enables the calculation and assessment of state income taxes, sales taxes, and other applicable levies. By completing this form accurately, taxpayers can ensure they fulfill their tax obligations and receive any eligible tax benefits.

Colorado's tax system is structured to promote fairness and economic growth, with various tax rates and incentives tailored to different types of taxpayers. The state offers multiple forms and schedules, each designed for specific types of taxpayers and tax situations. The complexity of the system underscores the importance of understanding the nuances of the Colorado State Tax Form.

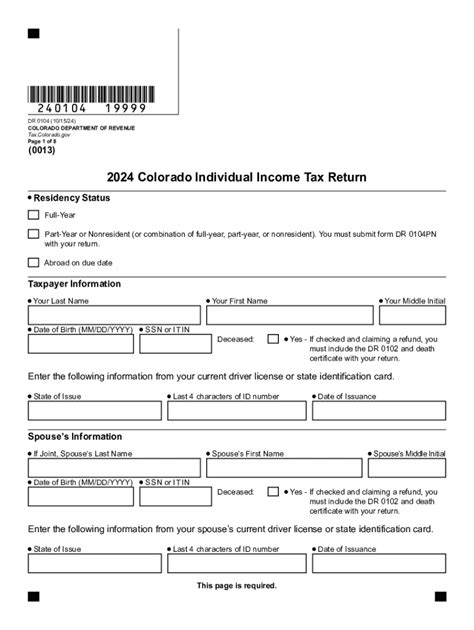

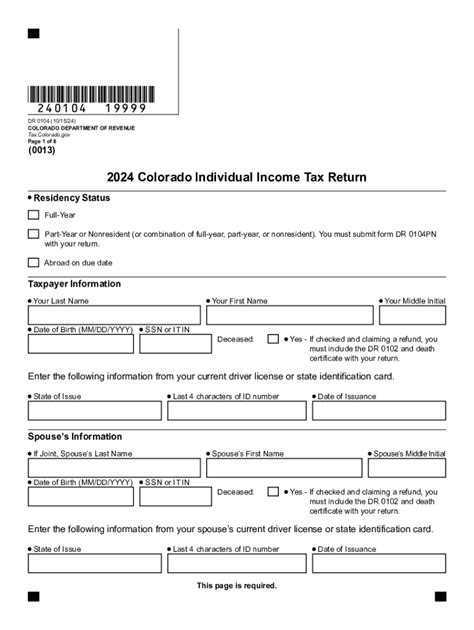

Key Components of the Colorado State Tax Form

The Colorado State Tax Form consists of several sections, each requiring detailed and accurate information. Let’s explore some of the critical components:

- Personal Information: This section includes basic details such as your name, address, and taxpayer identification number (SSN or ITIN). Ensure you provide accurate and up-to-date information to avoid processing delays.

- Income Details: Here, you will report your income from various sources, including wages, salaries, business income, investments, and any other taxable income. Be sure to include all applicable income, as missing information could lead to underpayment of taxes.

- Deductions and Credits: Colorado offers a range of deductions and credits to reduce your taxable income or the amount of tax you owe. These may include standard deductions, itemized deductions for specific expenses, and credits for various purposes, such as child care, education, or energy efficiency.

- Tax Calculation: This section involves applying the appropriate tax rates to your taxable income. Colorado has a progressive tax system, with tax rates varying based on income brackets. Ensure you use the correct tax rates and calculations to determine your tax liability accurately.

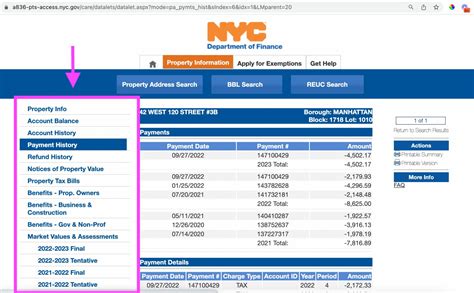

- Payment Information: Once you have calculated your tax liability, you will need to provide payment information. This includes the amount owed, payment method (e.g., check, credit card, or electronic funds transfer), and any necessary payment instructions.

| Form Name | Description |

|---|---|

| Form 1040 | The primary form for individual income tax returns, used by most taxpayers. |

| Form 1040-SR | Designed for senior citizens, offering a simpler format for those aged 65 and above. |

| Form 1040-PR | A Puerto Rico-specific form for residents of Puerto Rico reporting their income to the U.S. Internal Revenue Service. |

Filing Options and Deadlines

Colorado offers multiple options for filing your state tax return, including traditional paper filing, electronic filing through authorized software, and online filing through the Colorado Department of Revenue’s website. Each method has its advantages and considerations, and taxpayers should choose the option that best suits their needs and preferences.

The filing deadline for Colorado state tax returns typically aligns with the federal tax deadline, which is usually April 15th. However, it's crucial to note that this deadline may vary based on the specific circumstances of your tax situation. For instance, if you are due a refund, you have three years from the original filing deadline to claim it.

Late Filing and Penalties

Failing to file your Colorado State Tax Form by the deadline can result in penalties and interest charges. The penalties for late filing can vary based on the amount of tax owed and the duration of the delay. It’s essential to understand these potential consequences and take steps to avoid them by filing your return promptly.

If you are unable to meet the filing deadline, consider filing for an extension. Colorado offers the option to request an automatic six-month extension for filing your state tax return. However, it's important to note that an extension only extends the filing deadline; it does not extend the payment deadline. You must still pay any taxes owed by the original deadline to avoid penalties and interest.

Special Considerations for Businesses

For businesses operating in Colorado, the state tax landscape becomes more complex. In addition to income taxes, businesses may need to consider sales and use taxes, payroll taxes, and other specific business taxes. The Colorado Department of Revenue provides comprehensive resources and guidance for businesses to ensure compliance with all applicable tax regulations.

Businesses should also be aware of their tax obligations related to employees. This includes withholding and remitting income taxes, as well as managing payroll taxes, such as Social Security and Medicare taxes. Accurate reporting and timely payment of these taxes are crucial to avoid penalties and maintain good standing with the state.

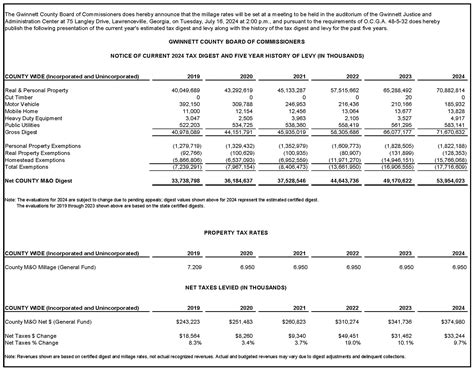

Sales and Use Taxes

Colorado imposes a sales tax on the sale of goods and certain services within the state. The sales tax rate varies depending on the location of the sale, with different localities applying their own additional sales tax rates. Businesses must collect and remit sales tax to the state, and accurate reporting is essential to avoid audits and potential penalties.

In addition to sales tax, Colorado also has a use tax, which applies to purchases made outside the state but used or consumed within Colorado. Businesses should be aware of their obligations regarding use tax and ensure they are compliant with the applicable regulations.

Tax Credits and Incentives

Colorado offers a range of tax credits and incentives to promote economic development, encourage investment, and support specific industries. These credits can significantly reduce a taxpayer’s tax liability and provide financial benefits. It’s crucial to stay informed about the available credits and determine whether you are eligible to claim them on your Colorado State Tax Form.

Some common tax credits in Colorado include the Enterprise Zone Tax Credit, which provides incentives for businesses operating in designated enterprise zones, and the Research and Development Tax Credit, which encourages investment in research and development activities. Additionally, Colorado offers credits for renewable energy systems, historic preservation, and more.

Navigating Tax Credits

To claim tax credits effectively, taxpayers should carefully review the eligibility criteria and requirements for each credit. Some credits may have specific documentation or reporting requirements, and failing to meet these criteria could result in the denial of the credit. It’s recommended to consult with a tax professional or refer to the Colorado Department of Revenue’s guidelines to ensure you are claiming credits correctly.

Seeking Professional Assistance

The Colorado State Tax Form can be complex, especially for individuals and businesses with unique tax situations. In such cases, seeking the assistance of a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), can provide valuable guidance and ensure accurate and compliant tax filing.

Tax professionals can help navigate the complexities of the tax system, identify applicable deductions and credits, and ensure all necessary forms and schedules are completed correctly. They can also provide valuable advice on tax planning strategies to minimize tax liabilities and maximize potential tax benefits.

Finding the Right Tax Professional

When selecting a tax professional, consider their expertise, experience, and credentials. Look for professionals who specialize in Colorado state taxes and have a solid understanding of the state’s tax laws and regulations. It’s also beneficial to choose a professional who aligns with your specific needs, whether you require assistance with personal taxes, business taxes, or both.

Online resources and directories can help you find qualified tax professionals in your area. Additionally, referrals from trusted sources, such as friends, family, or business associates, can provide valuable insights into the quality of service provided by specific tax professionals.

Conclusion

The Colorado State Tax Form is a critical document for taxpayers to navigate the state’s tax landscape effectively. By understanding the form’s components, filing options, and special considerations, taxpayers can ensure compliance with state tax laws and access any eligible tax benefits. Whether you are an individual taxpayer or a business owner, staying informed and seeking professional guidance when needed can help you manage your tax obligations efficiently and avoid potential pitfalls.

What are the income tax rates in Colorado for the current tax year?

+Colorado has a progressive income tax system with five tax brackets: 2.55%, 4.55%, 5.40%, 6.90%, and 7.78%. The tax rates vary based on taxable income, with higher rates applying to higher income levels.

Are there any special tax credits or deductions available for residents of Colorado?

+Yes, Colorado offers various tax credits and deductions to residents. These include the Child Care Contribution Tax Credit, the Renewable Energy System Tax Credit, the Historic Preservation Tax Credit, and more. It’s essential to review the eligibility criteria for each credit to determine if you qualify.

How do I know which Colorado tax form to use for my specific situation?

+The Colorado Department of Revenue provides a comprehensive guide to help taxpayers determine the appropriate tax form for their situation. Factors such as your filing status, income level, and specific tax circumstances will determine which form(s) you need to complete.