Nyc Dept Of Finance Property Tax

Welcome to an in-depth exploration of the New York City Department of Finance's Property Tax system, a critical component of the city's revenue generation and a key area of interest for property owners and real estate professionals alike. This comprehensive guide will delve into the intricacies of NYC's property tax landscape, offering a detailed analysis of its structure, calculation methods, payment processes, and the implications it holds for both residential and commercial property owners.

Understanding NYC Property Taxes: An Overview

The New York City Department of Finance is responsible for assessing and collecting property taxes, a vital source of revenue for the city’s operations and services. These taxes are levied on both real property, such as land and buildings, and personal property, encompassing a wide range of assets from vehicles to business equipment.

The property tax system in NYC is designed to ensure that all property owners contribute their fair share to the city's fiscal health. The tax rates and assessment processes are subject to regular review and adjustment to reflect changes in the real estate market and the city's financial needs.

Property taxes in New York City are a complex interplay of various factors, including the property's location, size, use, and market value. The Department of Finance employs a team of assessors who are tasked with determining the value of each property, a process that forms the basis for the subsequent tax calculations.

Key Components of NYC Property Tax Assessment

The property tax assessment process in NYC involves several critical steps, each contributing to the final tax amount owed by property owners. Here’s a breakdown of these components:

- Market Value Assessment: The Department of Finance uses a variety of methods, including sales comparisons and income capitalization, to estimate the market value of each property. This value is a key determinant of the property's tax liability.

- Tax Rate Determination: NYC property taxes are calculated based on a set tax rate, which is established annually by the city's government. This rate is applied to the assessed value of the property to determine the tax amount.

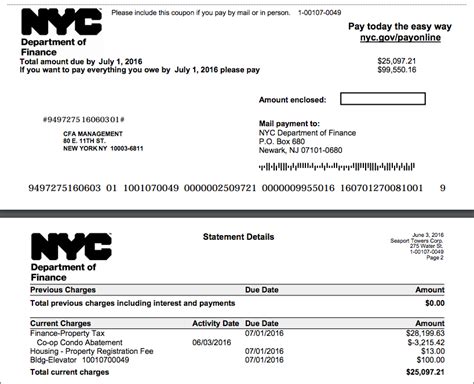

- Exemptions and Abatements: NYC offers a range of exemptions and abatements to certain property owners. These can include homestead exemptions, senior citizen exemptions, and abatements for specific types of properties or uses. These reductions can significantly lower a property's tax liability.

- Payment Options and Due Dates: Property owners in NYC have various options for paying their taxes, including online payments, check payments, and payment plans. The due dates for property taxes are typically set at the beginning of the fiscal year, with penalties applied for late payments.

The property tax system in NYC is designed to be fair and equitable, taking into account the unique characteristics of each property and the diverse range of property owners in the city. However, it is a complex system that requires a thorough understanding to ensure compliance and minimize tax burdens.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 6.5% |

| Commercial | 45% |

| Industrial | 45% |

The assessment ratio is a crucial factor in determining the property tax liability. It represents the percentage of the property's market value that is subject to taxation. As seen in the table, residential properties have a lower assessment ratio compared to commercial and industrial properties, reflecting the different tax burdens for each type of property.

Navigating the NYC Property Tax Process

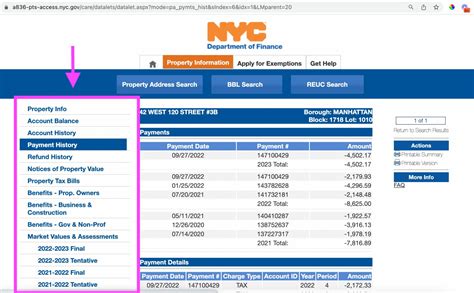

The property tax process in NYC involves a series of steps, from receiving the tax bill to making payments and appealing assessments. Here’s a detailed guide to help property owners navigate this process effectively:

Receiving Your Property Tax Bill

The Department of Finance issues property tax bills to all property owners in NYC. These bills are typically sent out twice a year, with due dates set for each billing period. The tax bill includes important information such as the property’s assessed value, the tax rate, and the total tax amount due.

It's essential to review the tax bill carefully to ensure its accuracy. Any discrepancies or errors should be reported to the Department of Finance promptly. The tax bill also outlines the payment options available, including online payments, check payments, and payment plans.

Making Property Tax Payments

Property owners in NYC have several options for making their tax payments. The most common methods include:

- Online Payments: The Department of Finance offers an online payment portal, which allows property owners to pay their taxes securely and conveniently. This method is particularly useful for those who prefer digital transactions.

- Check Payments: Property owners can also pay their taxes by check. The check should be made payable to the "New York City Department of Finance" and include the property's tax bill number and block and lot number.

- Payment Plans: For property owners who may struggle to pay their taxes in full, the Department of Finance offers payment plans. These plans allow property owners to pay their taxes in installments, making it more manageable to meet their tax obligations.

It's important to note that late payments can result in penalties and interest charges. Therefore, property owners should aim to make their payments on time or explore payment plan options if necessary.

Appealing Property Tax Assessments

If a property owner believes that their property has been assessed incorrectly, they have the right to appeal the assessment. The Department of Finance provides a formal process for appealing assessments, which typically involves submitting documentation to support the appeal.

Common reasons for appealing a property tax assessment include:

- Discrepancies in the property's assessed value compared to its actual market value.

- Changes in the property's condition or use that were not reflected in the assessment.

- Errors in the property's characteristics, such as square footage or number of units.

It's important to gather all relevant documentation and evidence to support the appeal. The Department of Finance may require additional information or an in-person inspection to make a determination.

The Impact of NYC Property Taxes on Real Estate Investments

For real estate investors and professionals, understanding the impact of property taxes on their investments is crucial. NYC’s property tax system can significantly influence investment decisions and the overall financial performance of real estate holdings.

Tax Considerations for Real Estate Investors

When evaluating potential real estate investments in NYC, investors should carefully consider the property tax implications. High property taxes can eat into a property’s cash flow and reduce the overall return on investment. Therefore, it’s essential to factor in the tax burden when assessing the financial viability of a property.

Investors should also be aware of any available tax incentives or abatements that may apply to their investment properties. These can provide significant savings and make certain investments more attractive.

Managing Property Tax Burdens

Managing property tax burdens is a critical aspect of real estate portfolio management. Investors and property owners can employ various strategies to minimize their tax liabilities, including:

- Exemptions and Abatements: As mentioned earlier, NYC offers a range of exemptions and abatements that can reduce property tax liabilities. Investors should research and take advantage of these opportunities to lower their tax burdens.

- Tax Appeals: If a property's assessment seems excessive, investors can consider appealing the assessment to reduce their tax liability. A successful appeal can result in significant savings over the long term.

- Strategic Property Ownership: Investors can structure their property ownership to optimize tax benefits. This may involve forming entities, such as LLCs or trusts, to take advantage of tax benefits associated with certain ownership structures.

By actively managing their property tax burdens, investors can improve the financial performance of their real estate holdings and enhance their overall investment returns.

The Future of NYC Property Taxes: Trends and Innovations

The property tax system in NYC is constantly evolving, influenced by changing economic conditions, technological advancements, and shifts in the real estate market. Here’s a look at some of the trends and innovations that are shaping the future of NYC’s property tax landscape:

Digital Transformation

The Department of Finance is embracing digital technologies to streamline the property tax process. Online portals for tax payments, assessment inquiries, and appeals are becoming more sophisticated and user-friendly. This digital transformation enhances efficiency and convenience for property owners and taxpayers.

Data-Driven Assessments

The use of advanced data analytics and machine learning is transforming the way property assessments are conducted. By analyzing vast amounts of data, including real estate transactions, market trends, and property characteristics, the Department of Finance can make more accurate and equitable assessments.

Green Initiatives and Tax Incentives

NYC is increasingly focusing on sustainability and environmental initiatives. As a result, the city is offering tax incentives for property owners who adopt green technologies and practices. These incentives can include tax abatements for energy-efficient buildings, solar panel installations, and other sustainable improvements.

Tax Equity and Social Initiatives

There is a growing emphasis on tax equity and social initiatives in NYC’s property tax system. The city is exploring ways to ensure that the property tax burden is distributed fairly among different income levels and property types. This may involve adjusting tax rates or implementing new tax structures to promote social equity.

Artificial Intelligence in Tax Administration

Artificial intelligence (AI) is being utilized to enhance tax administration processes. AI-powered systems can automate certain tasks, such as data analysis and tax calculation, reducing the potential for errors and improving overall efficiency. This technology can also help identify tax evasion and fraud more effectively.

As NYC continues to innovate and adapt its property tax system, property owners and taxpayers can expect a more efficient, equitable, and technologically advanced tax landscape. These advancements aim to improve the overall tax experience and ensure that NYC remains a competitive and desirable place to own property.

Conclusion

The New York City Department of Finance’s Property Tax system is a complex yet vital component of the city’s financial infrastructure. It plays a crucial role in funding essential services and shaping the real estate market. By understanding the intricacies of this system, property owners, investors, and professionals can make informed decisions, optimize their tax strategies, and contribute to the vibrant economic landscape of NYC.

FAQ

How often are property tax assessments conducted in NYC?

+Property tax assessments in NYC are conducted on a regular basis, typically every 5 years. However, certain properties, such as those that have undergone significant changes or improvements, may be reassessed more frequently.

Are there any property tax exemptions available in NYC?

+Yes, NYC offers a range of property tax exemptions, including the STAR exemption for homeowners, senior citizen exemptions, and abatements for certain types of properties or uses. These exemptions can significantly reduce a property’s tax liability.

What happens if I don’t pay my property taxes in NYC?

+Late payment of property taxes in NYC can result in penalties and interest charges. If taxes remain unpaid, the property may be subject to a tax lien, which can lead to foreclosure proceedings. It’s crucial to stay current with property tax payments to avoid these consequences.

How can I appeal my property tax assessment in NYC?

+To appeal a property tax assessment in NYC, property owners must submit an application to the Department of Finance within a specified timeframe. The appeal process typically involves providing documentation to support the appeal, such as comparable property sales or expert appraisals. It’s important to gather all necessary evidence and follow the official procedures for a successful appeal.