Iowa Tax Refund

Are you an Iowa resident eagerly awaiting your tax refund? Look no further! In this comprehensive guide, we will delve into the intricacies of the Iowa tax refund process, offering expert insights and practical tips to ensure a smooth and timely refund journey. From understanding the eligibility criteria to navigating the online portals, we've got you covered. Let's explore the steps, timelines, and strategies to maximize your Iowa tax refund and make the most of this financial boost.

Understanding Iowa Tax Refunds

The Iowa tax refund system is designed to provide relief to residents by returning excess tax payments. Whether you’re a salaried professional, a business owner, or a retiree, understanding the tax refund process is essential to manage your finances effectively. In this section, we’ll break down the key aspects of Iowa tax refunds, including eligibility, timelines, and the different types of refunds.

Eligibility Criteria

To be eligible for an Iowa tax refund, certain criteria must be met. Firstly, you must be a resident of Iowa, with your primary place of residence within the state. Additionally, you should have filed your Iowa state tax return accurately and on time. It’s important to note that eligibility may vary based on your income level, deductions claimed, and specific tax credits applicable to your situation.

For instance, Iowa offers various tax credits, such as the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, and the Property Tax Credit. These credits can significantly impact your refund amount. Let's explore an example to illustrate this:

| Tax Credit | Amount |

|---|---|

| Earned Income Tax Credit (EITC) | $2,800 |

| Child and Dependent Care Credit | $1,200 |

| Property Tax Credit | $500 |

In this scenario, the taxpayer is eligible for a total tax credit of $4,500, which can substantially increase their refund amount. It's crucial to understand these credits and ensure you claim all applicable ones to maximize your refund.

Tax Refund Timelines

Timely filing of your Iowa tax return is essential to receive your refund promptly. The Iowa Department of Revenue processes tax refunds on a first-come, first-served basis, so it’s advisable to file your return as soon as possible after the filing season opens. Generally, the Iowa tax filing season begins in late January or early February, allowing residents ample time to gather necessary documents and file their returns.

Once you've filed your return, the Iowa Department of Revenue aims to process refunds within a specific timeframe. While the exact processing time may vary based on the complexity of your return and the method of filing, the standard timeline is as follows:

- For returns filed electronically with direct deposit: Refunds are typically issued within 7-14 business days.

- For returns filed electronically with paper checks: Refunds may take 2-4 weeks to process.

- For paper returns: Processing times can range from 6-8 weeks.

It's worth noting that these timelines are approximate and may be subject to change. External factors, such as system updates or high volumes of returns, can impact the processing time. However, the Iowa Department of Revenue strives to provide timely refunds to taxpayers.

Types of Iowa Tax Refunds

Iowa offers several types of tax refunds, each catering to different taxpayer needs. Understanding these refund types can help you choose the most suitable option for your financial situation.

- Standard Refund: This is the most common type of refund, where excess tax payments are returned to the taxpayer. It is typically issued when your deductions and credits result in a refund.

- Direct Deposit Refund: Iowa taxpayers have the option to receive their refunds via direct deposit. This method is faster and more secure than receiving a paper check, as it eliminates the risk of lost or stolen mail.

- Paper Check Refund: For those who prefer a traditional method, Iowa also offers paper check refunds. These checks are mailed to the taxpayer's address on record and typically arrive within 2-4 weeks of the refund being issued.

- Electronic Funds Transfer (EFT) Refund: Iowa has implemented an EFT refund system, allowing taxpayers to receive their refunds directly into their bank accounts. This option is convenient and ensures a swift transfer of funds.

When choosing your refund method, consider factors such as speed, convenience, and security. Direct deposit and EFT refunds are generally faster and more secure, while paper checks provide a tangible record of your refund. The choice ultimately depends on your personal preferences and financial situation.

Maximizing Your Iowa Tax Refund

Maximizing your Iowa tax refund involves a combination of strategic planning and understanding the various deductions and credits available to you. In this section, we’ll explore some expert tips and strategies to help you optimize your refund and make the most of your financial resources.

Utilizing Deductions and Credits

Iowa offers a range of deductions and credits that can significantly reduce your tax liability and increase your refund. Here are some key deductions and credits to consider:

- Standard Deduction: Iowa taxpayers can claim a standard deduction based on their filing status. This deduction reduces your taxable income, resulting in a lower tax liability. For the tax year 2022, the standard deduction amounts are as follows:

Filing Status Standard Deduction Amount Single $4,600 Married Filing Jointly $9,200 Head of Household $7,150 - Itemized Deductions: If your expenses exceed the standard deduction, you may opt for itemized deductions. This allows you to deduct specific expenses, such as mortgage interest, state and local taxes, medical expenses, and charitable contributions. Itemizing can be beneficial if your expenses in these categories are substantial.

- Child and Dependent Care Credit: If you have children or dependents for whom you provide care, you may be eligible for the Child and Dependent Care Credit. This credit can help offset the cost of childcare, allowing you to claim a portion of your expenses as a credit on your tax return. The credit amount varies based on your income and the number of dependents.

- Education Credits: Iowa offers two education-related tax credits: the Iowa Tuition and Textbook Credit and the Iowa College Tuition Credit. These credits can help offset the cost of higher education, making it more affordable for Iowa residents pursuing their academic goals.

- Property Tax Credit: Iowa residents who own their homes may be eligible for the Property Tax Credit. This credit provides a refund on a portion of the property taxes paid, offering financial relief to homeowners.

It's crucial to carefully review your financial situation and consult with a tax professional to identify the deductions and credits that apply to you. Maximizing these opportunities can significantly increase your Iowa tax refund and provide much-needed financial support.

Tax Planning Strategies

Effective tax planning can help you minimize your tax liability and maximize your refund. Here are some strategies to consider:

- Maximize Retirement Contributions: Contributing to retirement accounts, such as 401(k)s or IRAs, can reduce your taxable income. These contributions are typically tax-deductible, and the money grows tax-free until withdrawal. Consult with a financial advisor to determine the appropriate contribution amount for your retirement goals.

- Charitable Donations: Donating to qualified charitable organizations can provide a tax benefit. You can deduct the value of your donations from your taxable income, reducing your tax liability. Ensure you keep accurate records of your donations to claim the full benefit.

- Review Tax Withholdings: Regularly reviewing your tax withholdings throughout the year can help ensure you're not overpaying or underpaying your taxes. Adjusting your withholdings can result in a more accurate tax refund or reduce the chances of owing additional taxes at the end of the year.

- Explore Tax Software or Professionals: Utilizing tax software or hiring a tax professional can be beneficial, especially if your tax situation is complex. These tools and experts can help you navigate the tax code, identify applicable deductions and credits, and ensure accurate filing.

By implementing these tax planning strategies and staying informed about the latest tax laws and incentives, you can optimize your Iowa tax refund and make the most of your financial resources.

Iowa Tax Refund Process: Step-by-Step Guide

Now that we’ve covered the eligibility, timelines, and strategies for maximizing your Iowa tax refund, let’s delve into the step-by-step process of obtaining your refund. This guide will walk you through the entire journey, from gathering necessary documents to receiving your well-deserved refund.

Step 1: Gather Required Documents

Before you begin the tax refund process, it’s crucial to have all the necessary documents ready. Here’s a checklist of the information you’ll need:

- Social Security Numbers for you, your spouse, and any dependents

- Dates of birth for you, your spouse, and dependents

- W-2 forms from all employers for the tax year

- 1099 forms for any additional income, such as self-employment, interest, or dividends

- Records of deductions and credits, including receipts, invoices, and statements

- Information on any dependent care expenses

- Property tax statements if claiming the Property Tax Credit

- Education-related expenses if claiming education credits

- Any other relevant tax documents or forms

Organize your documents and ensure they are easily accessible during the filing process. This will help streamline the process and prevent any delays.

Step 2: Choose Your Filing Method

Iowa taxpayers have the option to file their tax returns electronically or through traditional paper methods. Here’s a breakdown of the two filing methods:

Electronic Filing

Electronic filing, also known as e-filing, is the preferred method for most taxpayers due to its convenience and speed. Here’s how you can e-file your Iowa tax return:

- Select a Tax Software: Choose a reputable tax software provider that suits your needs. Many tax software options are available, ranging from free basic versions to premium packages with additional features.

- Gather Your Information: Ensure you have all the necessary documents and information gathered from Step 1.

- Complete the Tax Return: Follow the step-by-step instructions provided by the tax software to input your personal and financial information. The software will guide you through the process, making it easy to claim applicable deductions and credits.

- Review and Submit: Carefully review your tax return for accuracy. Once you're satisfied, submit your return electronically. The tax software will automatically calculate your refund amount and provide an estimate of when you can expect it.

Paper Filing

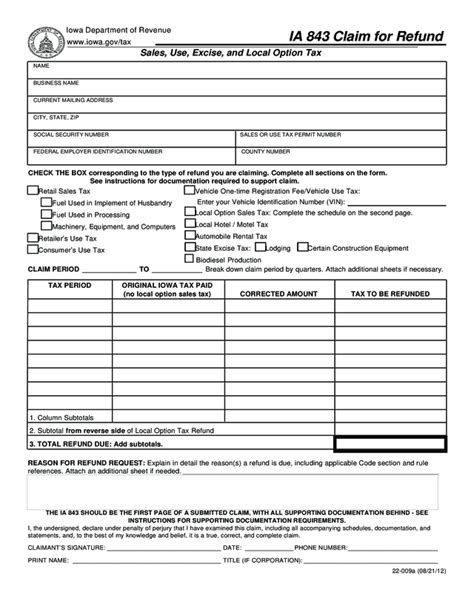

While electronic filing is recommended, some taxpayers prefer the traditional paper filing method. Here’s how you can file your Iowa tax return on paper:

- Download the Tax Forms: Visit the Iowa Department of Revenue website and download the necessary tax forms for the current tax year. You can also obtain these forms from local libraries or post offices.

- Gather Your Information: Similar to electronic filing, ensure you have all the required documents and information from Step 1.

- Complete the Tax Forms: Fill out the tax forms accurately and completely. Take your time and double-check your calculations to avoid errors.

- Mail Your Return: Once your tax forms are complete, mail them to the address specified by the Iowa Department of Revenue. Ensure you use the correct mailing address to avoid delays in processing.

Step 3: Submit Your Tax Return

After gathering your documents and choosing your filing method, it’s time to submit your Iowa tax return. Whether you’re e-filing or using paper forms, follow these steps:

- Electronic Filing: If you're e-filing, simply submit your tax return through the tax software you've chosen. The software will guide you through the submission process and provide confirmation once your return has been successfully transmitted.

- Paper Filing: If you've opted for paper filing, carefully review your completed tax forms for accuracy. Ensure all calculations are correct and that you've included all necessary schedules and supporting documents. Finally, mail your return to the Iowa Department of Revenue using the provided mailing address.

It's important to note that the Iowa Department of Revenue may require additional information or documents to process your tax return. If you receive a notice requesting additional documentation, respond promptly to avoid delays in receiving your refund.

Step 4: Track Your Refund

Once you’ve submitted your tax return, you’ll likely be eager to track your refund’s progress. The Iowa Department of Revenue provides several options for refund tracking:

- Online Refund Tracker: The Iowa Department of Revenue offers an online refund tracking tool. You can access this tool by visiting their website and entering your personal information, such as your Social Security Number and the amount of your refund. The tracker will provide real-time updates on the status of your refund.

- Refund Hotline: If you prefer a more traditional method, you can call the Iowa Department of Revenue's Refund Hotline. The hotline provides recorded messages with refund status updates. You'll need to have your Social Security Number and refund amount ready when calling.

- Email Notifications: For those who prefer digital updates, the Iowa Department of Revenue offers an email notification service. By providing your email address during the filing process, you'll receive email updates on the status of your refund.

It's important to remember that refund tracking tools provide estimates, and actual refund processing times may vary. The Iowa Department of Revenue aims to process refunds within the timelines mentioned earlier, but external factors can impact the process. Stay patient and monitor your refund status regularly.

Step 5: Receive Your Refund

Finally, the moment you’ve been waiting for: receiving your Iowa tax refund! The method you choose for receiving your refund will depend on the option you selected during the filing process.

- Direct Deposit: If you opted for direct deposit, your refund will be deposited directly into your bank account. Ensure your banking details are accurate to avoid any issues. You'll typically receive your refund within 7-14 business days of submitting your return.

- Paper Check: If you chose to receive your refund via paper check, it will be mailed to the address on record. Keep an eye on your mailbox, as it may take 2-4 weeks for the check to arrive.

- Electronic Funds Transfer (EFT): For those who selected the EFT option, your refund will be transferred directly to your bank account. This method is similar to direct deposit and offers a swift and secure transfer of funds.

Once you receive your refund, it's essential to review it carefully to ensure it matches the amount you expected. If there are any discrepancies, contact the Iowa Department of Revenue promptly to resolve the issue.

Iowa Tax Refund FAQ

What if I don’t receive my Iowa tax refund within the expected timeframe?

+If you don’t receive your Iowa tax refund within the expected timeframe, it’s advisable to contact the Iowa Department of Revenue. They can provide updates on the status