Tax Lien Sales

Tax lien sales are a crucial aspect of the real estate and financial world, offering unique opportunities and complexities. These sales involve the auctioning of tax liens, which are legal claims placed on properties by government entities when property owners fail to pay their taxes. This process can lead to significant benefits for investors and provide a way for delinquent taxpayers to resolve their debts. In this comprehensive guide, we delve into the world of tax lien sales, exploring the process, strategies, and potential outcomes to provide a deep understanding of this niche investment opportunity.

Understanding Tax Lien Sales

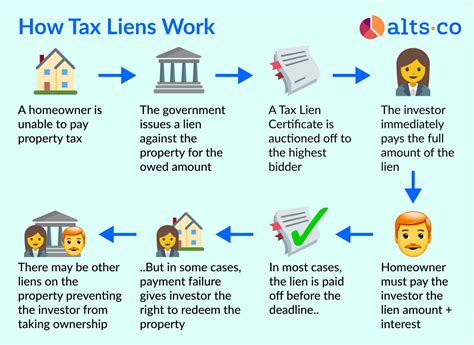

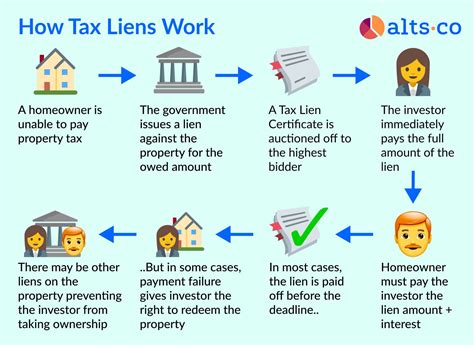

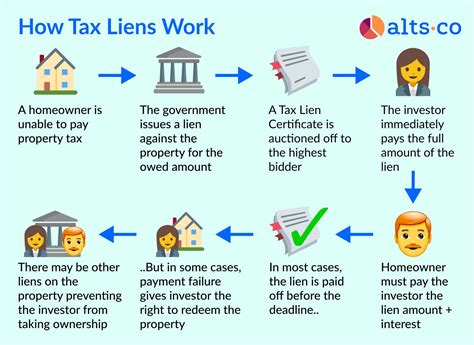

Tax lien sales are a mechanism used by local governments to collect unpaid property taxes. When a property owner fails to pay their taxes, the government places a lien on the property, essentially claiming a legal right to the property until the taxes are paid. If the taxes remain unpaid, the government may offer these liens for sale at public auctions, allowing investors to purchase them.

The primary goal of tax lien sales is to provide a way for governments to recoup unpaid taxes and ensure the continued operation of essential public services. For investors, tax lien sales present an opportunity to earn a fixed rate of return on their investment, as well as the potential for ownership of the property if the lien is not redeemed by the original property owner.

The Tax Lien Process

The tax lien process begins when a property owner becomes delinquent on their property taxes. The government sends notices to the property owner, outlining the amount owed and the potential consequences of non-payment. If the taxes remain unpaid, the government will file a tax lien against the property.

At this point, the government will set a date for the tax lien sale. Investors can research and identify properties of interest, studying their potential for return and the likelihood of redemption by the original property owner. On the sale date, investors bid on the liens, with the winning bidder purchasing the right to collect the full amount of the delinquent taxes from the property owner.

It's important to note that the winning bidder does not immediately gain ownership of the property. Instead, they hold a lien, which gives them the right to foreclose on the property if the taxes are not paid within a specified redemption period.

Tax Lien Sales: An Overview

| Key Term | Description |

|---|---|

| Tax Lien | A legal claim placed on a property by the government when taxes are not paid. |

| Lien Redemption Period | The time frame during which the original property owner can pay their taxes and retain ownership. |

| Tax Lien Sale | An auction where investors bid on tax liens, purchasing the right to collect delinquent taxes. |

| Redemption Rights | The property owner’s right to pay their taxes and retain ownership during the redemption period. |

Strategies for Tax Lien Sales

Investing in tax lien sales requires a strategic approach, as the outcomes can vary significantly. Here are some key strategies to consider:

Research and Due Diligence

Before investing in tax liens, thorough research is essential. Investors should analyze the property’s value, the amount of delinquent taxes, and the likelihood of redemption. This research can help identify properties with a high chance of return and low risk.

Additionally, understanding the local laws and regulations surrounding tax lien sales is crucial. Each jurisdiction may have unique rules regarding redemption periods, interest rates, and foreclosure procedures.

Diversification

Diversifying your portfolio is a key strategy to mitigate risk. Investing in a variety of tax liens can help spread out the potential for both high returns and potential losses. Diversification can also provide a more stable income stream, as some properties may be redeemed quickly while others take longer.

Focus on High-Value Properties

While tax liens can be found on properties of all values, targeting high-value properties can offer greater potential for return. These properties often attract more bidders, which can drive up the sale price and, consequently, the potential for profit.

Understanding Redemption Rates

Redemption rates vary greatly by location and property type. Understanding the historical redemption rates in a particular area can help investors gauge the likelihood of their investment being redeemed. Lower redemption rates may indicate a higher chance of foreclosure and property ownership.

The Benefits and Risks of Tax Lien Sales

Tax lien sales present a unique set of benefits and risks that investors should carefully consider.

Benefits

- Fixed Rate of Return: Tax liens typically offer a fixed rate of return, providing a predictable income stream for investors.

- Potential for Property Ownership: If the original property owner fails to redeem the lien, investors may gain ownership of the property, offering the potential for significant capital gains.

- Low Entry Barrier: Tax lien sales often have a lower barrier to entry compared to other real estate investments, making them accessible to a wider range of investors.

- Secured Investment: Tax liens are secured by the property, reducing the risk of loss compared to other types of investments.

Risks

- Redemption by Property Owner: The primary risk in tax lien sales is the original property owner redeeming the lien, which can result in a lower return on investment.

- Foreclosure Complications: Foreclosure procedures can be complex and time-consuming, and there is no guarantee that the investor will successfully gain ownership of the property.

- Market Volatility: Real estate markets can be volatile, and changes in property values can impact the potential return on investment.

- Legal and Administrative Fees: Investing in tax liens may involve legal and administrative costs, which can reduce the overall return.

Performance Analysis and Case Studies

To gain a deeper understanding of tax lien sales, it’s beneficial to analyze real-world performance and case studies. These examples can illustrate the potential outcomes and provide valuable insights for investors.

Successful Tax Lien Investments

Consider the case of an investor who purchased a tax lien on a high-value residential property. The lien was redeemed by the property owner within a year, resulting in a return of 18% on the investor’s initial investment. This outcome demonstrates the potential for quick and profitable returns in tax lien sales.

Challenges and Long-Term Investments

In contrast, another investor purchased a tax lien on a commercial property, but the property owner did not redeem the lien within the specified period. The investor then had to navigate the foreclosure process, which took several years. While the investor eventually gained ownership of the property, the lengthy process and associated costs highlight the potential challenges and time commitments involved.

Future Implications and Market Trends

The world of tax lien sales is continually evolving, and understanding the future implications and market trends is essential for investors. Here are some key considerations:

Market Expansion

Tax lien sales are gaining traction as an investment opportunity, with more investors and financial institutions entering the market. This increased competition can drive up the prices of tax liens, but it also presents a wider range of investment options.

Online Platforms

The rise of online platforms and auction sites dedicated to tax lien sales is transforming the industry. These platforms provide increased accessibility and convenience for investors, allowing them to participate in auctions remotely and access a wider range of investment opportunities.

Regulatory Changes

Changes in tax laws and regulations can impact the tax lien sales market. Investors should stay informed about any upcoming changes that may affect their investments, such as alterations to redemption periods or interest rates.

Conclusion

Tax lien sales offer a unique and potentially lucrative investment opportunity, providing a fixed rate of return and the possibility of property ownership. While the process can be complex and carries certain risks, a strategic approach and thorough research can help investors navigate this niche market successfully. By understanding the process, implementing effective strategies, and staying informed about market trends, investors can make informed decisions and potentially achieve significant returns in the world of tax lien sales.

What is the typical redemption period for tax liens?

+The redemption period can vary widely depending on the jurisdiction. In some states, the redemption period may be as short as six months, while in others, it can extend up to three years. It’s crucial to understand the specific redemption period for each tax lien investment.

How do interest rates on tax liens work?

+Interest rates on tax liens are typically set by the local government and can vary. They are often calculated as a percentage of the delinquent taxes owed and may be compounded annually. Understanding the interest rate structure is essential for evaluating the potential return on investment.

What happens if the property owner does not redeem the lien?

+If the property owner fails to redeem the lien within the specified redemption period, the investor holding the lien may initiate the foreclosure process. This process can vary by jurisdiction but typically involves legal proceedings to gain ownership of the property.

Are there any tax implications for investors in tax lien sales?

+Yes, investors in tax lien sales should be aware of the tax implications. The interest earned on tax liens is typically taxable income, and investors may need to report and pay taxes on these earnings. Consulting with a tax professional is advisable to ensure compliance.