Mississippi Income Tax Rate

The state of Mississippi is known for its relatively low income tax rates, which have contributed to its reputation as a business-friendly state. However, the income tax structure in Mississippi is unique and can be somewhat complex, with various brackets and deductions. Let's delve into the specifics of Mississippi's income tax system and explore how it compares to other states.

Understanding Mississippi’s Income Tax Structure

Mississippi imposes a graduated income tax, meaning that the tax rate increases as your income rises. This progressive tax system aims to ensure fairness and alleviate the tax burden on lower-income individuals. The state’s income tax brackets are adjusted annually to account for inflation and cost-of-living changes.

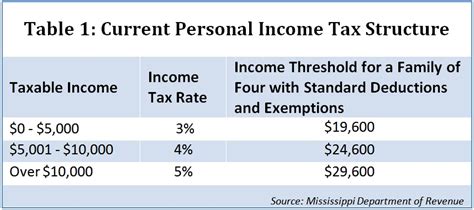

Current Income Tax Rates and Brackets

As of the 2023 tax year, Mississippi has four income tax brackets, each with its own tax rate:

| Income Bracket | Tax Rate |

|---|---|

| First $5,000 of taxable income | 3% |

| $5,001 - $10,000 | 4% |

| $10,001 - $25,000 | 5% |

| Income over $25,000 | 5.5% |

It's important to note that these tax rates apply to Mississippi residents' federal adjusted gross income (AGI). Non-residents who earn income from sources within the state also pay income tax, but the calculation and rates may differ.

Deductions and Credits

Mississippi offers various deductions and tax credits to reduce the overall tax liability. These include standard deductions, itemized deductions, and several tax credits designed to encourage specific behaviors or support certain populations. Some of the notable deductions and credits include:

- Standard Deduction: All taxpayers can claim a standard deduction, which reduces taxable income. The amount of the standard deduction depends on the taxpayer's filing status.

- Itemized Deductions: Taxpayers have the option to itemize deductions if their total itemized expenses exceed the standard deduction. Common itemized deductions include mortgage interest, charitable contributions, and certain medical expenses.

- Personal Exemptions: Mississippi allows personal exemptions for each taxpayer and dependent, further reducing taxable income.

- Education Credits: The state offers a variety of education credits, such as the Mississippi Tuition Assistance Grant (MTAG) and the Mississippi Charitable Organization Grant (MCOG), to support higher education.

- Property Tax Rebate: A property tax rebate is available for homeowners over the age of 65 or with disabilities, providing relief on property taxes.

Comparison with Other States

Mississippi’s income tax rates are generally lower than many other states, making it an attractive destination for businesses and individuals seeking a more favorable tax environment. However, it’s important to consider the overall tax burden, which includes not just income tax but also sales tax, property tax, and other levies.

Income Tax Rates Across the US

When compared to other states, Mississippi’s income tax rates are among the lowest. Only a handful of states, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, have no income tax at all. Most other states have progressive tax structures similar to Mississippi’s, but with varying rates and brackets.

Total Tax Burden

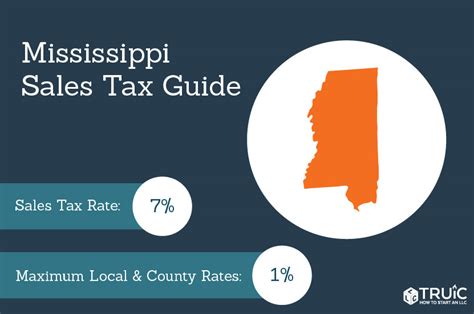

While Mississippi’s income tax rates are low, the state’s overall tax burden is slightly above the national average. This is primarily due to the state’s relatively high sales tax and property tax rates. Mississippi’s sales tax, which can reach up to 8% depending on the locality, is one of the highest in the nation. Additionally, property taxes in Mississippi are above average, with rates varying by county.

Business-Friendly Environment

Mississippi’s low income tax rates and other tax incentives have contributed to its reputation as a business-friendly state. The state offers various tax breaks and incentives to attract new businesses and support existing ones. These include tax credits for job creation, research and development, and investments in certain industries.

Future Implications and Tax Policy Changes

Mississippi’s tax policies are subject to change, and there have been ongoing discussions and proposals to modify the state’s tax structure. Some key considerations and potential changes include:

- Tax Reform: There have been proposals to simplify the tax code and reduce the number of brackets. This could make the system more efficient and easier to understand for taxpayers.

- Revenue Generation: Mississippi's tax system faces challenges in generating sufficient revenue to fund public services and infrastructure. Discussions are ongoing about finding a balance between tax rates and the need for government funding.

- Tax Incentives: The state regularly evaluates and updates its tax incentives to ensure they are effective in attracting businesses and supporting economic growth.

- Education Funding: Mississippi's education system relies heavily on state funding, and tax policies play a crucial role in determining the level of support for schools and universities.

Conclusion

Mississippi’s income tax rate is an important factor in the state’s economic landscape, offering a relatively low tax burden for individuals and businesses. While the tax system is progressive and provides deductions and credits to reduce the tax liability, it is essential to consider the state’s overall tax burden, which includes sales tax and property tax. As Mississippi continues to evolve and adapt its tax policies, it will aim to maintain a competitive business environment while ensuring adequate funding for public services.

What is the average income tax rate in Mississippi?

+The average income tax rate in Mississippi varies depending on income level. For the 2023 tax year, the average rate is approximately 4.9%, taking into account the progressive tax brackets.

Are there any tax incentives for businesses in Mississippi?

+Yes, Mississippi offers a range of tax incentives to attract and support businesses. These include tax credits for job creation, research and development, and investments in specific industries.

How does Mississippi’s income tax rate compare to other southern states?

+Mississippi’s income tax rates are generally lower than many other southern states. However, the overall tax burden should be considered, as sales tax and property tax rates can vary significantly.

Can non-residents be subject to Mississippi income tax?

+Yes, non-residents who earn income from sources within Mississippi may be subject to income tax. The tax calculation and rates may differ for non-residents.

Are there any plans to reform Mississippi’s tax system?

+Yes, there have been ongoing discussions and proposals to reform Mississippi’s tax system. Potential changes include simplifying the tax code and adjusting tax rates to address revenue generation and funding for public services.