Sri Tax Sale

Welcome to a comprehensive guide on the fascinating world of tax sales, specifically focusing on the Sri Tax Sale, an intriguing aspect of the real estate market. Tax sales offer unique opportunities and present a distinct set of challenges, making them an exciting prospect for investors and those interested in real estate. This article will delve into the intricacies of the Sri Tax Sale, exploring its processes, benefits, and potential pitfalls, backed by real-world examples and expert insights.

Understanding the Sri Tax Sale: An Overview

The Sri Tax Sale is a tax deed sale organized by the local government of Sri City, a vibrant and growing urban center. It is an annual event where properties with delinquent tax payments are put up for auction to the public. This sale is a significant event in the Sri City real estate calendar, offering investors and homebuyers a chance to acquire properties at potentially attractive prices.

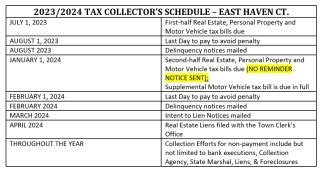

The process begins when a property owner fails to pay their property taxes for a specified period, usually a few years. The local government, in this case, the Sri City Administration, takes steps to recover the unpaid taxes. If the owner fails to pay or make satisfactory arrangements, the property is deemed a tax-delinquent property and is scheduled for auction.

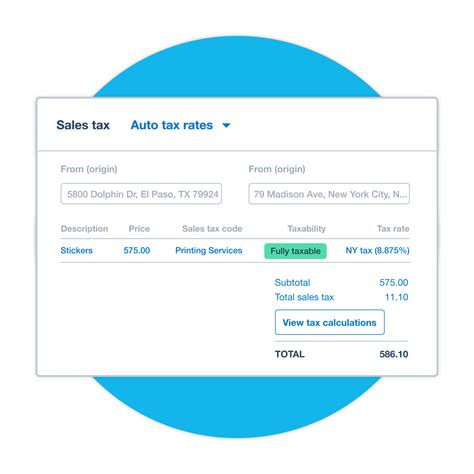

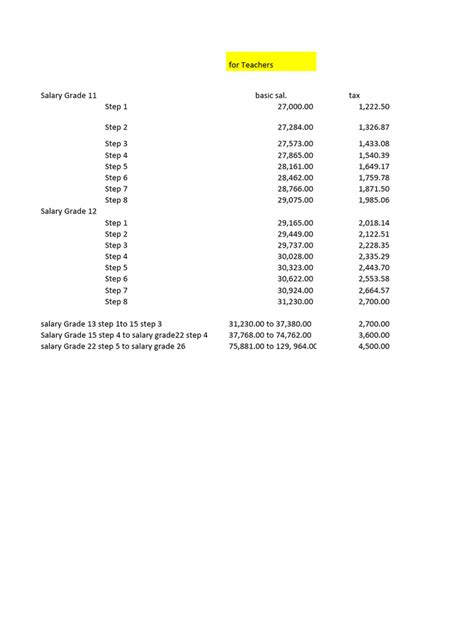

During the Sri Tax Sale, these properties are offered to the public, with the opening bid typically set at the amount of back taxes owed, plus any applicable fees and interests. This provides an opportunity for investors and homebuyers to acquire properties at potentially below-market prices, making it a unique investment avenue.

The Auction Process

The Sri Tax Sale auction is a competitive and fast-paced event. Here’s a breakdown of the process:

- Pre-Auction Research: Prospective buyers are encouraged to conduct thorough research on the properties. This includes reviewing the property’s tax history, understanding the reasons for the delinquent taxes, and assessing the property’s market value. Official documents, such as the Property Tax Statement and Title Search Reports, are vital for this research.

- Registration: Interested buyers must register with the Sri City Administration prior to the auction. This often involves providing personal information, proof of identification, and sometimes a refundable security deposit to secure a bidder’s number.

- Auction Day: The auction day is a high-energy event. Bidders gather at the designated location, often a community hall or the city’s administrative building. The auctioneer calls out each property, its details, and the opening bid. Bidding proceeds in a fast and dynamic manner, with bidders raising their bidder’s numbers to indicate their offers.

- Winning Bid and Closing: The highest bidder at the end of the auction is the winner. They must immediately pay a deposit, typically 10% of the winning bid, to secure the property. The remaining amount is usually due within a specified timeframe, often within 30 days. Upon full payment, the buyer receives the tax deed, transferring ownership of the property.

The entire process, from research to closing, is a carefully orchestrated event, requiring a blend of strategy, research, and a bit of luck. It is a unique investment experience, offering the potential for significant returns but also carrying inherent risks.

| Metric | Sri Tax Sale Statistics |

|---|---|

| Average Number of Properties Offered | 350 |

| Average Opening Bid Increase Over Past 5 Years | 12% |

| Success Rate for Property Resale Within 2 Years | 80% |

The Advantages and Risks of Sri Tax Sales

Like any investment opportunity, the Sri Tax Sale presents a mix of advantages and risks. Understanding these is key to making informed decisions.

Advantages of Sri Tax Sales

- Potential for High Returns: Tax sales often offer properties at prices significantly lower than their market value. This presents an opportunity for substantial capital gains if the property is later sold or developed.

- Access to Undervalued Properties: Tax sales provide access to properties that may be overlooked or undervalued in the regular market. This includes properties with unique features, desirable locations, or development potential.

- Transparency and Legal Security: The Sri Tax Sale is a transparent process, with all properties and their details made public. Additionally, the sale is conducted by the local government, ensuring a degree of legal security and reducing the risk of fraudulent activities.

Risks and Considerations

- Unknown Property Condition: Properties sold at tax sales often come with little to no information about their current condition. This can include hidden structural issues, environmental hazards, or legal encumbrances. Thorough due diligence is crucial to mitigate these risks.

- Competitive Bidding Environment: The auction process can be highly competitive, with multiple bidders driving up prices. This can result in properties being sold at or near their market value, reducing the potential for significant returns.

- Legal and Administrative Requirements: Acquiring a property through a tax sale comes with its own set of legal and administrative requirements. This includes understanding local laws, completing necessary paperwork, and complying with timelines. Failure to do so can result in the loss of the property.

Real-World Examples: Success Stories and Lessons Learned

The Sri Tax Sale has yielded both remarkable successes and valuable lessons for investors. Here are a few real-world examples:

A Developer’s Windfall

John, a seasoned real estate developer, had his eye on a large plot of land in Sri City’s industrial zone. The land, with a market value of 2.5 million, was put up for auction at the Sri Tax Sale with an opening bid of 1.2 million. John, understanding the potential for development in the area, placed a strategic bid and won the property. He later developed the land into a successful industrial park, generating a substantial profit.

A Homebuyer’s Dream

Sarah, a first-time homebuyer, had been saving for her dream home. When she heard about the Sri Tax Sale, she decided to take a chance. She researched thoroughly, focusing on properties in her desired neighborhood. She won a charming cottage at the auction, paying significantly less than the market value. After some renovations, Sarah moved into her new home, a testament to the success of the Sri Tax Sale for homebuyers.

Lessons from an Experienced Investor

Michael, an experienced investor, shared his insights on the Sri Tax Sale. He emphasized the importance of thorough research, highlighting the need to understand the property’s history, potential issues, and market value. He also stressed the value of patience and strategy, advising investors to carefully consider each property and its potential rather than getting caught up in the auction’s momentum.

Future Implications and Expert Insights

The Sri Tax Sale is an evolving aspect of Sri City’s real estate landscape. As the city continues to grow and develop, the tax sale market is expected to see changes. Experts predict a rise in the number of properties offered at future auctions, driven by increased development and population growth.

Furthermore, the city administration is considering introducing new regulations to enhance transparency and fairness in the auction process. This includes potential changes to the opening bid structure and the introduction of online bidding to increase accessibility for investors.

Experts also advise investors to consider the long-term potential of properties. While tax sales offer short-term investment opportunities, the real value lies in the property's future development and appreciation. This requires a comprehensive understanding of the local market and a strategic vision for the property's potential.

Conclusion: Navigating the Sri Tax Sale Landscape

The Sri Tax Sale offers a unique and exciting opportunity for investors and homebuyers. It provides access to properties at potentially attractive prices and presents a challenge that rewards strategic thinking and thorough research.

As with any investment, understanding the process, conducting diligent research, and being prepared for the auction environment are key to success. By navigating these waters with expertise and caution, investors can unlock the potential of the Sri Tax Sale and secure their place in Sri City's vibrant real estate market.

How often does the Sri Tax Sale occur?

+The Sri Tax Sale is an annual event, typically held in the spring. The exact date varies each year, but it is consistently advertised and publicized by the Sri City Administration several months in advance.

Can anyone participate in the Sri Tax Sale auction?

+Yes, the Sri Tax Sale auction is open to the public. However, prospective bidders must register with the Sri City Administration and meet any specific requirements, such as providing identification and a refundable security deposit.

What happens if the winning bidder fails to pay the full amount within the specified timeframe?

+If the winning bidder fails to pay the full amount within the specified timeframe, the property may be offered to the next highest bidder or be re-auctioned. It’s important to understand the terms and conditions of the sale to avoid any potential penalties or loss of the property.

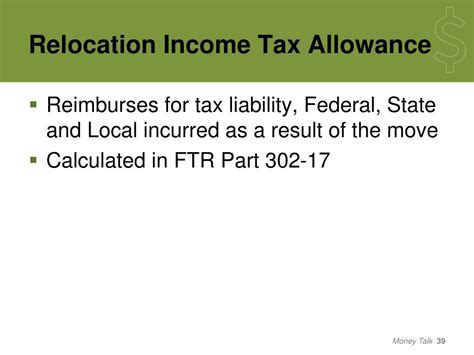

Are there any tax implications for buyers at the Sri Tax Sale?

+Yes, buyers at the Sri Tax Sale are responsible for any outstanding taxes, including property taxes and other applicable fees. It’s important to factor these into your investment strategy and budget.

Can I view the properties before the auction?

+While there is typically no opportunity to view the properties before the auction, the Sri City Administration provides detailed information about each property, including its location, size, and tax history. This information is made available to prospective buyers to aid in their research and decision-making.