Auto Sales Tax In Md

The state of Maryland, affectionately known as the Old Line State, has a rich history and a vibrant automotive industry. When it comes to purchasing a vehicle, understanding the sales tax landscape is crucial for residents and potential car buyers. This comprehensive guide will delve into the specifics of auto sales tax in Maryland, offering valuable insights and clarity on this important aspect of vehicle ownership.

Understanding Auto Sales Tax in Maryland

In Maryland, auto sales tax is a vital component of the state’s revenue system, contributing significantly to its overall economic framework. The state imposes a 6% sales and use tax on the purchase of motor vehicles, which includes cars, trucks, motorcycles, and certain types of recreational vehicles. This tax is applicable to both new and used vehicles, ensuring a consistent revenue stream for the state.

The Maryland Department of Transportation Motor Vehicle Administration (MVA) is responsible for overseeing and administering the auto sales tax process. They provide clear guidelines and resources to ensure a smooth and compliant transaction for both buyers and sellers.

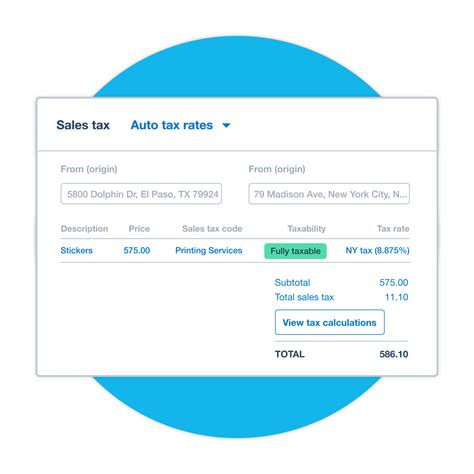

Calculating Auto Sales Tax

Calculating the sales tax on a vehicle purchase in Maryland is straightforward. The tax is based on the purchase price of the vehicle, including any additional fees and options. For example, if you buy a new car priced at 30,000, the sales tax due would be <strong>1,800 (6% of $30,000). It’s important to note that this tax is in addition to any other fees and charges associated with the purchase, such as title fees and registration costs.

For used vehicles, the sales tax calculation remains the same. If you purchase a used car for $15,000, the sales tax would be $900 (6% of $15,000). This uniformity in taxation applies to all vehicle purchases, ensuring fairness and simplicity in the tax structure.

| Vehicle Type | Sales Tax Rate |

|---|---|

| New Vehicles | 6% |

| Used Vehicles | 6% |

Exemptions and Special Cases

While the standard 6% sales tax applies to most vehicle purchases, there are certain exemptions and special cases to be aware of. For instance, Maryland offers a sales tax exemption for certain military personnel who are either residents of Maryland or stationed in the state. This exemption applies to the purchase of a new vehicle and can provide significant savings for those who qualify.

Additionally, Maryland has specific provisions for trade-ins. If you trade in your old vehicle as part of the purchase of a new one, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that you are only taxed on the net amount you are paying for the new vehicle, providing a potential tax benefit for those who opt for a trade-in.

The Registration and Titling Process

In Maryland, the process of registering and titling your vehicle is closely tied to the sales tax payment. After purchasing a vehicle, you have 30 days to register and title it with the MVA. This process involves submitting various documents, including the Certificate of Title, Bill of Sale, and Odometer Disclosure Statement, along with the appropriate fees and the sales tax payment.

The MVA provides a step-by-step guide to the registration and titling process, ensuring that buyers understand their responsibilities and the required timelines. Failure to register and title your vehicle within the specified timeframe can result in penalties and additional fees, so it's crucial to stay informed and proactive.

Online Registration and Titling

To streamline the process and offer convenience to residents, Maryland offers an online registration and titling service through the MVA’s official website. This digital platform allows you to complete the necessary paperwork, pay fees and taxes, and receive your registration documents and license plates without the need for an in-person visit. It’s a time-saving option that aligns with the state’s commitment to digital accessibility and efficiency.

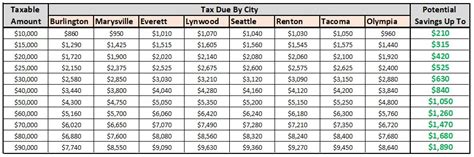

The Impact of Sales Tax on Vehicle Ownership

The auto sales tax in Maryland has a significant impact on the overall cost of vehicle ownership. While the 6% sales tax may seem straightforward, it can represent a substantial financial commitment, especially for those purchasing higher-priced vehicles. For example, on a 50,000 vehicle, the sales tax alone would amount to <strong>3,000, which is a notable addition to the overall cost.

This tax structure encourages buyers to consider their options carefully, whether it's negotiating a better price with the dealership or exploring financing and leasing alternatives. It also underscores the importance of understanding the full financial implications of vehicle ownership, beyond just the sticker price.

Financial Strategies for Buyers

To navigate the financial aspect of vehicle ownership effectively, buyers in Maryland can employ several strategies. One approach is to negotiate the purchase price with the dealer, aiming to reduce the overall cost and, consequently, the sales tax liability. This negotiation process can be facilitated by doing thorough research on the vehicle’s market value and by leveraging competitive pricing from multiple dealerships.

Additionally, buyers can explore financing options that may offer more favorable terms and potentially reduce the overall financial burden. Leasing, in particular, can be an attractive option for those who want a new vehicle without the high upfront costs associated with sales tax and other fees. By understanding these financial strategies, buyers can make more informed decisions and potentially save money on their vehicle purchase.

Conclusion: Navigating Auto Sales Tax in Maryland

Understanding the intricacies of auto sales tax in Maryland is an essential part of the vehicle purchasing process. From calculating the tax based on the purchase price to exploring exemptions and special cases, buyers can make informed decisions that align with their financial goals. The registration and titling process, which is closely tied to sales tax payment, further emphasizes the importance of staying informed and compliant with state regulations.

By leveraging the resources provided by the MVA and staying updated on any changes to the tax structure, buyers can navigate the auto sales tax landscape with confidence. Whether it's negotiating a better deal, exploring financing options, or taking advantage of potential exemptions, Maryland residents have the tools to make their vehicle ownership experience as seamless and cost-effective as possible.

Frequently Asked Questions

How often does Maryland update its auto sales tax rates?

+

Maryland typically reviews and updates its sales tax rates on an annual basis, often aligned with the fiscal year. However, it’s important to note that any changes to the sales tax structure must be approved by the state legislature, so the process can vary based on legislative schedules and priorities.

Are there any additional fees or charges associated with registering a vehicle in Maryland?

+

Yes, in addition to the sales tax, there are other fees and charges associated with registering a vehicle in Maryland. These include a title fee, registration fee, and potentially an emissions testing fee, depending on the county where the vehicle is registered. It’s advisable to check with the MVA or your local tax authority for a comprehensive breakdown of these fees.

Can I register and title my vehicle online if I purchased it out of state?

+

Yes, Maryland offers an online registration and titling service for vehicles purchased out of state. However, there are specific requirements and documents that must be submitted, including an out-of-state title, odometer disclosure statement, and proof of insurance. It’s important to carefully review the MVA’s guidelines for out-of-state purchases to ensure a smooth online registration process.