Arkansas Personal Property Tax

The Arkansas Personal Property Tax is an essential component of the state's tax system, impacting property owners and businesses across the state. It is a vital revenue source for local governments, funding vital services and infrastructure. This article aims to provide an in-depth analysis of the Arkansas Personal Property Tax, covering its history, calculation, implications, and its role in the state's economy.

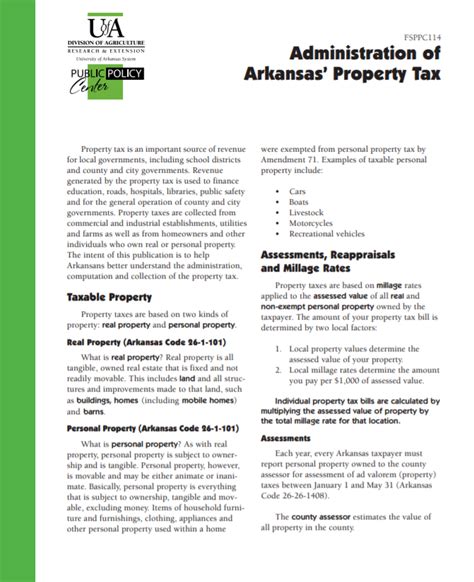

Understanding the Arkansas Personal Property Tax

The Arkansas Personal Property Tax is a form of ad valorem tax, meaning it is levied based on the assessed value of personal property owned by individuals and businesses. This tax is distinct from the Real Property Tax, which applies to real estate and land.

The tax plays a crucial role in funding local governments, including counties, cities, school districts, and other special-purpose districts. The revenue generated is used to support a wide range of public services, such as education, public safety, transportation, and community development.

History and Evolution

The roots of the Arkansas Personal Property Tax can be traced back to the late 19th century when the state began levying taxes on personal property to support local governments. Over the years, the tax system has undergone significant changes and reforms to adapt to the evolving needs of the state and its citizens.

In the early 20th century, the tax was primarily focused on tangible personal property, such as vehicles, machinery, and equipment. However, as the economy diversified and technology advanced, the tax system had to adapt to include a broader range of personal property, including intangible assets like stocks, bonds, and intellectual property.

One of the most significant reforms in recent history was the passage of Act 1466 of 2013, which aimed to simplify the tax assessment process and reduce the administrative burden on taxpayers. This act introduced a uniform assessment ratio of 35% for most personal property, replacing the previous complex assessment system that varied based on property type.

| Assessment Ratio Before Act 1466 | Assessment Ratio After Act 1466 |

|---|---|

| Vehicles: 20% | All Personal Property: 35% |

| Machinery & Equipment: 20% | |

| Furniture & Fixtures: 20% | |

| Intangible Property: 15% |

The reform also introduced a new system for assessing business personal property, known as the Central Assessment System, which aims to ensure fair and consistent valuations across the state.

Taxable Personal Property

The Arkansas Personal Property Tax applies to a wide range of personal property, including:

- Vehicles: Cars, trucks, motorcycles, and other motor vehicles are subject to the tax, with the assessment based on the vehicle's age, make, and model.

- Machinery and Equipment: This category includes industrial machinery, office equipment, and other tools used in business operations. The assessment is typically based on the original cost and depreciation.

- Furniture and Fixtures: Office furniture, retail display fixtures, and other similar items are taxed based on their current market value.

- Intangible Property: Stocks, bonds, and other financial instruments are taxed at a lower rate compared to tangible assets. The assessment is based on the property's fair market value.

- Business Inventory: Inventory held for sale or used in the production of goods is generally exempt from the tax, but certain types of inventory, such as vehicles and luxury items, may be subject to taxation.

It's important to note that personal property used exclusively for residential purposes, such as household furnishings and personal effects, is generally exempt from the tax.

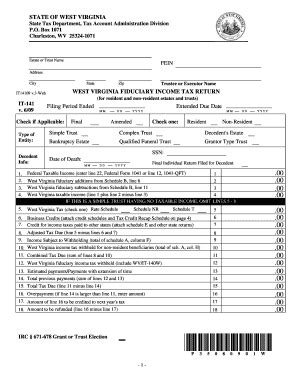

Tax Calculation and Assessment

The calculation of the Arkansas Personal Property Tax involves several steps, beginning with the determination of the property’s assessed value. The assessed value is then multiplied by the applicable tax rate to determine the tax liability.

Assessment of Value

The assessed value of personal property is typically determined by the local assessor’s office. Assessors use various methods to estimate the value, including physical inspection, market analysis, and cost-based approaches. The assessed value is then multiplied by the uniform assessment ratio of 35% as mandated by Act 1466.

For business personal property, the Central Assessment System is used to ensure consistency and fairness. This system involves the Arkansas Public Service Commission, which assigns a central assessor to each county to conduct valuations. The central assessor considers factors such as original cost, depreciation, and market conditions to determine the assessed value.

Tax Rates

The tax rate for personal property varies depending on the type of property and the jurisdiction in which it is located. Tax rates are set by local governments, such as counties and cities, and are typically expressed as a percentage of the assessed value. These rates can range from less than 1% to over 5%, depending on the locality.

It's important to note that the tax rate may also vary based on the property's use. For example, personal property used for commercial purposes may be taxed at a higher rate than property used for residential or personal use.

Filing and Payment

Taxpayers are required to file personal property tax returns with their local assessor’s office. The filing deadline is typically between January 15th and March 1st of each year. However, the exact deadline may vary depending on the locality.

Taxpayers must declare all personal property they own as of January 1st of the tax year. The assessor's office will then assess the value and determine the tax liability. Once the tax bill is issued, taxpayers have a set period to pay the tax, typically by June 30th. Failure to pay the tax by the due date may result in penalties and interest.

Exemptions and Deductions

Arkansas provides several exemptions and deductions from the Personal Property Tax to relieve certain taxpayers of their liability or reduce their tax burden. These exemptions and deductions are designed to promote economic development, support specific industries, and provide relief to vulnerable populations.

Common Exemptions

The most common exemptions include:

- Residential Property: Personal property used exclusively for residential purposes is generally exempt from the tax. This exemption covers household furnishings, personal effects, and other items used in the home.

- Agricultural Equipment: Machinery and equipment used in agricultural production, such as tractors, harvesters, and irrigation systems, are exempt from the tax to support the state's agricultural industry.

- Inventory: As mentioned earlier, inventory held for sale or used in the production of goods is generally exempt. This exemption encourages businesses to maintain sufficient inventory levels to meet customer demand.

Deductions and Credits

In addition to exemptions, Arkansas offers several deductions and credits to reduce the tax burden on taxpayers. These include:

- Personal Property Tax Credit: Taxpayers may be eligible for a credit against their personal property tax liability if they meet certain income and property value requirements. This credit aims to provide relief to low-income taxpayers.

- Manufacturing Equipment Deduction: Businesses may deduct a portion of the assessed value of their manufacturing equipment from their tax liability. This deduction encourages investment in manufacturing and supports the state's industrial sector.

- Green Energy Deduction: To promote the adoption of renewable energy, Arkansas offers a deduction for personal property used in the production of green energy, such as solar panels and wind turbines.

Impact and Implications

The Arkansas Personal Property Tax has a significant impact on both taxpayers and the state’s economy. It influences business decisions, affects property values, and shapes the distribution of tax revenue across the state.

Economic Impact

The tax has both positive and negative economic implications. On the one hand, it provides a stable source of revenue for local governments, allowing them to invest in infrastructure, education, and other public services. This, in turn, can attract businesses and create a more attractive business environment.

However, the tax can also be a burden on businesses, particularly small and medium-sized enterprises. The tax can increase the cost of doing business, impacting their profitability and competitiveness. Additionally, the tax can discourage businesses from investing in new equipment and machinery, hindering their growth and innovation.

Property Values and Market Dynamics

The tax can influence property values and market dynamics in several ways. For tangible personal property, such as vehicles and machinery, the tax can impact the resale value of these assets. A higher tax rate can reduce the after-tax returns from selling these assets, potentially affecting their market value.

For intangible personal property, such as stocks and bonds, the tax can impact investment decisions. A higher tax rate may discourage investors from holding certain assets, leading to a shift in investment patterns and potentially affecting the state's financial markets.

Distribution of Tax Revenue

The Arkansas Personal Property Tax plays a crucial role in funding local governments and their services. The distribution of tax revenue across the state varies based on the tax base and tax rates in each locality. This distribution can impact the quality and availability of public services, affecting the overall well-being of communities.

Local governments use the tax revenue to fund a wide range of services, including:

- Education: Funding for schools, teachers, and educational programs.

- Public Safety: Police, fire protection, and emergency services.

- Infrastructure: Roads, bridges, and other public works projects.

- Community Development: Economic development initiatives, parks, and recreational facilities.

- Health and Welfare: Support for social services and healthcare programs.

Future Outlook and Reforms

The Arkansas Personal Property Tax is a dynamic system that is subject to ongoing evaluation and potential reforms. As the state’s economy and population continue to evolve, the tax system must adapt to meet the changing needs of taxpayers and local governments.

Potential Reforms

Several reforms have been proposed to address the challenges and opportunities presented by the tax. These reforms aim to simplify the tax system, improve fairness, and promote economic development.

- Uniform Assessment Ratio: Some have proposed further simplifying the tax system by adopting a uniform assessment ratio for all personal property, eliminating the need for different assessment ratios based on property type. This could reduce administrative complexity and ensure greater fairness.

- Central Assessment System Expansion: Expanding the Central Assessment System to cover all business personal property could enhance consistency and fairness in valuations. However, this expansion would require significant investment in training and technology.

- Exemption and Deduction Review: Regular reviews of exemptions and deductions could ensure that they remain relevant and effective in promoting the state's economic development goals. This review could also identify areas where exemptions or deductions may be unnecessary or overly generous.

- Tax Rate Harmonization: Harmonizing tax rates across localities could reduce disparities in the tax burden and promote a more uniform business environment. This reform could be challenging to implement, as it would require agreement and coordination among local governments.

Potential Challenges

Implementing these reforms is not without its challenges. The state and local governments must carefully consider the potential impact on taxpayers, businesses, and local economies. Any changes to the tax system must strike a balance between promoting economic growth and maintaining a stable revenue stream for local governments.

Additionally, the implementation of reforms may require significant investment in technology, training, and administrative resources. The state and local governments must carefully plan and budget for these expenses to ensure a smooth transition and minimize disruptions to taxpayers and businesses.

Conclusion

The Arkansas Personal Property Tax is a complex yet essential component of the state’s tax system. It provides a vital revenue stream for local governments, funding critical public services and infrastructure. While the tax has its challenges and implications, ongoing reforms and evaluations aim to improve its fairness, simplicity, and effectiveness in supporting the state’s economy.

As Arkansas continues to evolve and adapt to changing economic conditions, the Personal Property Tax will remain a crucial tool for funding local governments and promoting economic development. By carefully considering the tax's impact and implementing thoughtful reforms, the state can ensure a sustainable and equitable tax system that benefits all Arkansans.

What is the Arkansas Personal Property Tax used for?

+

The Arkansas Personal Property Tax is a vital source of revenue for local governments, including counties, cities, and school districts. The tax funds a wide range of public services, such as education, public safety, infrastructure, and community development.

Who is required to pay the Arkansas Personal Property Tax?

+

All individuals and businesses that own personal property in Arkansas are generally required to pay the tax. Personal property includes vehicles, machinery, equipment, furniture, fixtures, and certain intangible assets.

How is the assessed value of personal property determined in Arkansas?

+

The assessed value of personal property is determined by local assessors. They use various methods, including physical inspection, market analysis, and cost-based approaches, to estimate the value. For business personal property, the Central Assessment System assigns a central assessor to each county to conduct valuations.

Are there any exemptions or deductions from the Arkansas Personal Property Tax?

+

Yes, Arkansas offers several exemptions and deductions to relieve certain taxpayers of their liability or reduce their tax burden. Common exemptions include residential property, agricultural equipment, and inventory. Deductions and credits include the Personal Property Tax Credit, Manufacturing Equipment Deduction, and Green Energy Deduction.

What is the impact of the Arkansas Personal Property Tax on the economy?

+

The tax has both positive and negative economic implications. It provides a stable revenue source for local governments, which can attract businesses and create a more attractive business environment. However, it can also be a burden on businesses, particularly small and medium-sized enterprises, impacting their profitability and competitiveness.