Oklahoma Tax Rate

When it comes to taxes, understanding the rates and regulations is crucial for individuals and businesses alike. In the state of Oklahoma, the tax system plays a significant role in shaping the economic landscape. This article aims to delve into the intricacies of the Oklahoma tax rate, exploring its structure, impact, and implications for taxpayers.

Understanding the Oklahoma Tax Structure

Oklahoma operates under a progressive tax system, meaning that the tax rate increases as taxable income rises. This approach ensures that higher-income earners contribute a larger proportion of their income towards state revenue. The state’s tax structure consists of several key components, including income tax, sales tax, and property tax.

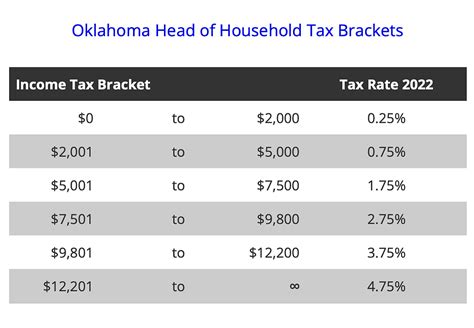

Income Tax Rates

The income tax rate in Oklahoma is determined by the taxpayer’s income bracket. As of the 2023 tax year, there are five income tax brackets, ranging from 0.5% to 5.0%:

- 0.5% for taxable income up to 10,000</li> <li><strong>1.5%</strong> for income between 10,001 and 25,000</li> <li><strong>2.5%</strong> for income between 25,001 and 60,000</li> <li><strong>3.5%</strong> for income between 60,001 and 100,000</li> <li><strong>5.0%</strong> for taxable income above 100,000

These rates are applied to the taxable income, which is calculated after deductions and credits are taken into account.

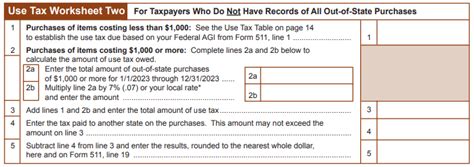

Sales and Use Tax

Oklahoma imposes a sales and use tax on the sale of tangible personal property and certain services. The state sales tax rate is set at 4.5%, while local governments have the authority to levy additional sales taxes, resulting in varying rates across the state.

For example, in the city of Oklahoma City, the total sales tax rate is 8.5%, consisting of the state rate and a local rate of 4%. On the other hand, in Tulsa, the total sales tax rate is 8.25%, with a local rate of 3.75%.

Property Tax

Property taxes in Oklahoma are primarily levied by local governments, including counties, cities, and school districts. The tax rate varies depending on the location and the type of property. Generally, property taxes are calculated based on the assessed value of the property and the millage rate set by the local taxing authorities.

The millage rate represents the number of mills, with one mill equivalent to 1 of tax for every 1,000 of assessed property value. For instance, a property with an assessed value of 200,000 and a millage rate of 20 mills would incur a property tax of 4,000 (200,000 x 0.020 = 4,000).

The Impact of Oklahoma’s Tax Rates

The tax rates in Oklahoma have a significant influence on the state’s economy and the financial decisions of its residents and businesses.

Economic Effects

The progressive income tax structure aims to promote economic fairness and provide essential public services. Higher-income earners contribute a larger share, ensuring that the state can invest in infrastructure, education, and social programs. This approach encourages a more equitable distribution of resources.

On the other hand, the sales tax and property tax rates can impact consumer spending and business operations. Higher sales tax rates may discourage out-of-state purchases, while property taxes can influence real estate investment decisions and business expansion plans.

Tax Incentives and Credits

Oklahoma offers various tax incentives and credits to attract businesses and support economic growth. These incentives can significantly reduce the overall tax burden for eligible businesses and individuals. Some notable tax incentives include:

- The Quality Jobs Program, which provides a refundable income tax credit for new job creation and capital investment.

- The Investment Tax Credit for investing in qualified projects, promoting economic development.

- The Research and Development Tax Credit, encouraging innovation and technological advancement.

Comparative Analysis: Oklahoma vs. Other States

When comparing Oklahoma’s tax rates to those of other states, it’s essential to consider the overall tax burden and the state’s unique economic factors.

Income Tax Comparison

Oklahoma’s income tax rates are relatively competitive compared to neighboring states. For instance, Texas, a neighboring state with no income tax, might seem more attractive to individuals. However, Oklahoma’s progressive tax structure ensures a fairer distribution of tax burdens.

In comparison to states like California, which has a higher top marginal tax rate of 13.3%, Oklahoma’s 5.0% top rate appears more favorable for high-income earners.

Sales Tax Comparison

Oklahoma’s sales tax rate of 4.5% is on the lower end of the spectrum when compared to other states. For instance, neighboring Arkansas has a higher sales tax rate of 6.5%, while Tennessee has a rate of 7%. This can make Oklahoma a more attractive destination for consumers seeking tax-friendly shopping experiences.

Property Tax Rates

Property tax rates in Oklahoma vary widely depending on the location. While some areas have relatively low property tax rates, others can be higher. It’s essential to consider the overall cost of living and the services provided by local governments when evaluating the property tax burden.

Future Implications and Tax Planning

Understanding the current tax landscape in Oklahoma is crucial, but staying informed about potential changes and future implications is equally important for effective tax planning.

Tax Reform Proposals

Oklahoma has seen discussions and proposals for tax reform in recent years. Some lawmakers have advocated for simplifying the tax code, reducing tax rates, and eliminating certain deductions and credits. These proposals aim to make the tax system more efficient and competitive.

However, it’s essential to note that tax reform efforts can be complex and may face political challenges. Staying updated on these proposals is crucial for taxpayers to anticipate potential changes and adjust their financial strategies accordingly.

Long-Term Financial Planning

For individuals and businesses, long-term financial planning is essential to navigate the tax landscape effectively. Here are some key considerations:

- Maximizing Deductions and Credits: Understanding the available deductions and credits is crucial. From mortgage interest deductions to business tax credits, taking advantage of these opportunities can reduce the overall tax liability.

- Strategic Investment Decisions: Businesses should carefully consider the impact of tax rates when making investment decisions. Evaluating the tax implications of expanding operations or acquiring new assets is vital for long-term financial health.

- Tax-Efficient Retirement Planning: For individuals, planning for retirement while considering tax implications is essential. Strategies like contributing to tax-advantaged retirement accounts can help optimize tax efficiency.

| Tax Type | Oklahoma Rate |

|---|---|

| Income Tax (5-bracket system) | 0.5% - 5.0% |

| Sales Tax | 4.5% (state) + local rates |

| Property Tax | Varies by location (millage rate) |

How often are Oklahoma tax rates updated or revised?

+Oklahoma’s tax rates are subject to periodic revisions and updates. The Oklahoma Legislature typically reviews and adjusts tax laws during regular legislative sessions, which occur biennially. Any changes to tax rates or structures must be approved through legislation.

Are there any special tax incentives for renewable energy projects in Oklahoma?

+Yes, Oklahoma offers tax incentives for renewable energy projects through the Renewable Energy Production Tax Credit. This credit provides a tax credit for the production of electricity from qualifying renewable energy sources, encouraging the development of clean energy initiatives.

What are the consequences for non-compliance with Oklahoma tax laws?

+Non-compliance with Oklahoma tax laws can result in penalties, interest, and potential legal consequences. The Oklahoma Tax Commission has the authority to enforce tax laws and may impose fines, assess penalties, and even initiate legal actions against individuals or businesses that fail to meet their tax obligations.