Ca State Estimated Tax Payments

The California State Estimated Tax Payments are a vital component of the state's tax system, impacting a significant number of individuals and businesses. Understanding the process and requirements for making estimated tax payments is crucial for maintaining compliance with state tax laws and avoiding penalties.

In California, estimated tax payments are a way for individuals and businesses to pay their state taxes throughout the year, especially for those who have income that is not subject to withholding or whose income varies significantly from month to month. These payments are designed to ensure that taxpayers meet their tax obligations in a timely manner and prevent the accumulation of large tax liabilities at the end of the year.

Understanding Estimated Tax Payments in California

California's estimated tax payment system is designed to cater to the diverse range of taxpayers in the state. It recognizes that not all income sources are subject to regular withholding, such as income from self-employment, investments, or rental properties. Additionally, for those with fluctuating income, such as freelancers or business owners, the estimated tax system provides a way to manage tax payments effectively.

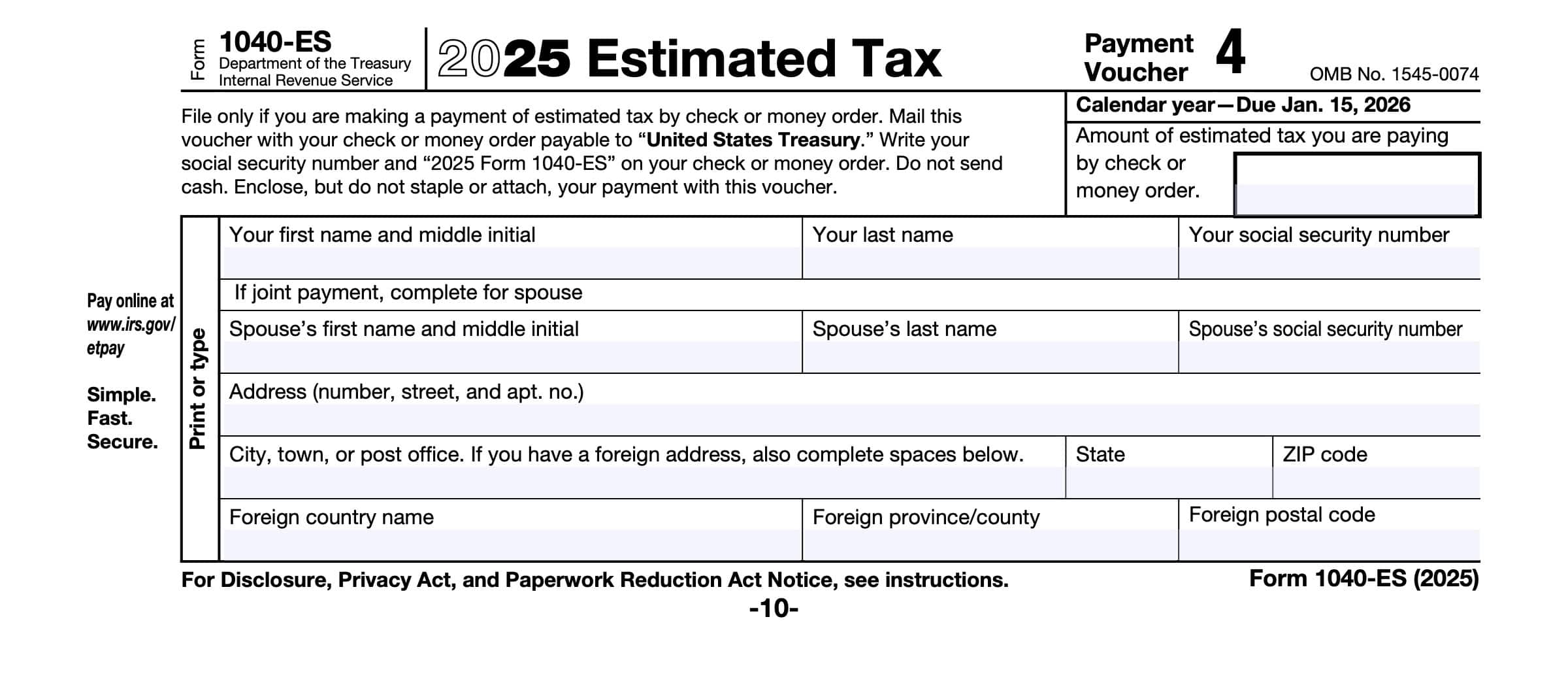

The California Franchise Tax Board (FTB) requires estimated tax payments from individuals and businesses if they expect to owe $1,000 or more in taxes for the year, after subtracting their withholdings and credits. These payments are typically made in four installments, due on the 15th of April, June, September, and January, aligning with the state's tax calendar.

Each payment represents 25% of the total estimated tax liability for the year. It's important to note that these payments are based on the previous year's tax liability, adjusted for any expected changes in income or deductions for the current year. The FTB provides a convenient Estimated Tax Calculator on their website to assist taxpayers in determining their estimated tax liability.

Who Needs to Make Estimated Tax Payments?

The requirement to make estimated tax payments in California is not universal. It primarily applies to individuals and businesses with the following characteristics:

- Self-employed individuals or business owners whose income is not subject to regular withholding.

- Individuals with multiple jobs or income sources, where not all income is subject to withholding.

- Those who expect a significant increase in income from the previous year.

- Business owners with varying income, especially if the business is new or has experienced significant growth.

- Individuals or businesses with substantial income from investments, rentals, or other sources not subject to withholding.

It's worth noting that even if an individual or business does not fall into these categories, they may still benefit from making estimated tax payments to avoid underpayment penalties. It's always a good practice to review one's tax situation with a qualified tax professional to ensure compliance and optimize tax strategies.

Calculating and Paying Estimated Taxes

Calculating estimated taxes in California involves a few key steps. Firstly, taxpayers must estimate their total income for the year, including all sources such as wages, self-employment income, interest, dividends, rentals, and other income. It's important to consider any changes in income or deductions compared to the previous year.

Once the estimated income is determined, taxpayers can use the FTB's Estimated Tax Calculator to estimate their tax liability. This calculator takes into account the taxpayer's filing status, deductions, and credits to provide an estimate of the total tax due. The calculator also assists in determining the amount of each installment payment.

The FTB offers several methods for making estimated tax payments, including online payment options through their website, payment by phone, or traditional methods such as mailing a check. It's crucial to ensure that payments are made on time to avoid penalties. Late payments may result in interest charges and penalties, which can quickly add up.

Tips for Accurate Estimation

To ensure accuracy in estimating tax liabilities, taxpayers can consider the following strategies:

- Reviewing previous year's tax returns and making adjustments based on expected changes in income or deductions.

- Keeping track of income and expenses throughout the year to get a clear picture of financial activities.

- Seeking professional tax advice, especially for complex tax situations or when starting a new business.

- Utilizing tax preparation software or apps that can assist in estimating taxes and managing payments.

By staying organized and keeping accurate records, taxpayers can make more precise estimates, reducing the risk of underpayment or overpayment.

Penalties and Interest for Non-Compliance

The California FTB imposes penalties and interest for taxpayers who fail to make estimated tax payments on time or underpay their estimated taxes. These penalties are designed to encourage compliance and ensure that taxpayers meet their tax obligations.

The penalty for underpaying estimated taxes is 10% of the unpaid tax, with a minimum penalty of $50. Additionally, interest is charged on the unpaid tax amount from the original due date of the installment payment until the date the tax is paid. The interest rate is adjusted quarterly and is based on the federal short-term rate plus 3%.

It's important to note that these penalties can quickly accumulate, especially for taxpayers who consistently underpay or fail to make payments. Therefore, it's in the best interest of taxpayers to make accurate estimates and ensure timely payments to avoid unnecessary financial burdens.

Exception for Low-Income Taxpayers

California recognizes that estimated tax payments may be a burden for low-income taxpayers. Therefore, the FTB provides an exception for those who meet certain income criteria. Taxpayers whose annual income is below a certain threshold (currently $50,000 for single filers and $100,000 for joint filers) are exempt from the estimated tax payment requirement.

However, even for low-income taxpayers, it's still essential to file tax returns accurately and on time to avoid any potential penalties or issues with the FTB.

The Importance of Timely Payments

Making timely estimated tax payments is crucial for several reasons. Firstly, it ensures that taxpayers remain in compliance with state tax laws, avoiding penalties and interest charges. Secondly, it helps taxpayers manage their cash flow effectively, spreading out tax payments throughout the year instead of facing a large tax bill at the end of the year.

Timely payments also allow taxpayers to plan their finances more effectively. By making regular estimated tax payments, taxpayers can allocate their resources accordingly, reducing the financial strain that often comes with large, lump-sum tax payments.

Strategies for Managing Estimated Tax Payments

To manage estimated tax payments effectively, taxpayers can consider the following strategies:

- Setting up automatic payments through the FTB's online system to ensure payments are made on time without manual intervention.

- Reviewing estimated tax liabilities regularly and adjusting payments as necessary to account for any significant changes in income or deductions.

- Considering payment options that offer flexibility, such as paying by credit card or using a payment plan, especially for larger tax liabilities.

- Seeking professional tax advice to develop a comprehensive tax strategy that aligns with individual financial goals and circumstances.

By adopting these strategies, taxpayers can not only ensure compliance but also optimize their tax payments to suit their financial situation.

Future Implications and Potential Changes

The estimated tax payment system in California is subject to potential changes and updates, especially as the state's tax laws evolve. It's important for taxpayers to stay informed about any changes that may impact their estimated tax obligations.

For instance, changes in tax rates, deductions, or credits can affect the calculation of estimated tax liabilities. Additionally, the FTB may introduce new payment methods or update their online systems to enhance the efficiency and convenience of estimated tax payments.

Taxpayers should keep an eye on official communications from the FTB, such as news releases, updates on their website, or mailings, to stay abreast of any changes that may affect their estimated tax payments. Being proactive about staying informed can help taxpayers avoid surprises and ensure they remain compliant with the latest tax regulations.

Frequently Asked Questions

What happens if I forget to make an estimated tax payment in California?

+If you forget to make an estimated tax payment in California, you may be subject to penalties and interest. The FTB imposes a 10% penalty on the unpaid tax, with a minimum penalty of $50. Additionally, interest is charged on the unpaid amount from the original due date until the tax is paid. It's important to make payments as soon as possible to minimize penalties and interest.

<div class="faq-item">

<div class="faq-question">

<h3>Can I make estimated tax payments online in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the FTB offers online payment options for estimated taxes. You can make payments through their website using a credit card, debit card, or electronic check. This method provides a convenient and secure way to manage your estimated tax payments.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any exceptions to the estimated tax payment requirement in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are exceptions. Taxpayers whose annual income is below a certain threshold (currently $50,000 for single filers and $100,000 for joint filers) are exempt from the estimated tax payment requirement. However, it's still important for these taxpayers to file their tax returns accurately and on time.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I know if I need to make estimated tax payments in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You need to make estimated tax payments in California if you expect to owe $1,000 or more in taxes for the year, after subtracting withholdings and credits. This requirement applies to individuals and businesses with income not subject to withholding or those with varying income.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I overpay my estimated taxes in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you overpay your estimated taxes, the excess amount will be applied to your next estimated tax payment or your final tax return. You can also request a refund by filing Form FTB 3519, Request for Refund of Overpayment of Estimated Tax. However, it's generally recommended to estimate your taxes accurately to avoid overpaying or underpaying.</p>

</div>

</div>