Pinellas Property Tax

Pinellas County, located in the sunny state of Florida, is renowned for its beautiful beaches, vibrant culture, and thriving communities. However, one topic that often sparks curiosity and discussion among residents and property owners is the Pinellas Property Tax. Understanding the intricacies of property taxes is crucial for homeowners and investors alike, as it directly impacts their financial planning and decision-making. In this comprehensive guide, we will delve into the world of Pinellas Property Tax, exploring its calculation, factors influencing rates, payment options, and strategies to manage this financial obligation effectively.

Understanding the Basics: What is Pinellas Property Tax?

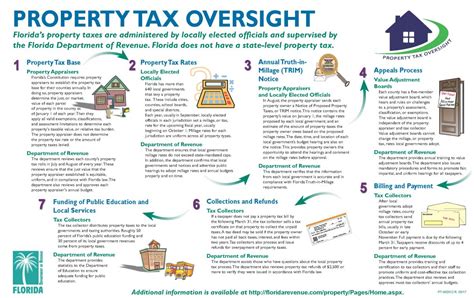

Pinellas Property Tax is a vital revenue source for local governments and various taxing authorities within Pinellas County. It is an annual tax levied on real estate properties, including residential homes, commercial buildings, and vacant land. The tax serves multiple purposes, funding essential services such as education, infrastructure development, public safety, and local government operations.

The calculation of Pinellas Property Tax involves a complex process, taking into account several factors. The tax is determined based on the assessed value of the property, which is established by the Pinellas County Property Appraiser's Office. This assessed value considers the property's market value, its improvements, and any applicable exemptions or exclusions.

Assessed Value Determination

The Pinellas County Property Appraiser’s Office employs a systematic approach to assess property values. They consider recent sales data, market trends, and other relevant factors to ensure that the assessed value reflects the property’s true market value. This process is conducted annually, allowing for adjustments based on the dynamic real estate market conditions.

To illustrate, let's consider an example. Suppose a homeowner in Pinellas County owns a single-family residence with a market value of $300,000. The Property Appraiser's Office assesses the property's value, taking into account its location, size, age, and recent sales of similar properties in the area. Based on this evaluation, the assessed value is determined to be $280,000.

| Property Characteristics | Value |

|---|---|

| Market Value | $300,000 |

| Assessed Value | $280,000 |

Factors Influencing Pinellas Property Tax Rates

The Pinellas Property Tax rate is not a static figure but rather a dynamic variable influenced by various factors. Understanding these factors is crucial for property owners to comprehend the fluctuations in their tax obligations from year to year.

Local Government Budgets

One of the primary factors affecting Pinellas Property Tax rates is the annual budget planning process of local governments and taxing authorities. These entities rely on property taxes as a significant source of revenue to fund their operations and provide essential services to residents. As a result, changes in budget requirements, such as increased spending on education, infrastructure improvements, or public safety initiatives, can impact the tax rate.

For instance, if a local government decides to invest in major infrastructure projects, such as road improvements or the construction of a new community center, the associated costs may necessitate a higher tax rate to generate the necessary funds. On the other hand, efficient budget management and cost-saving measures could lead to a decrease in the tax rate, providing some relief to property owners.

State and County Legislation

State and county-level legislation also play a significant role in shaping Pinellas Property Tax rates. Government bodies may introduce new laws, regulations, or initiatives that impact the taxation system. These changes could include adjustments to tax rates, implementation of new tax categories, or modifications to existing exemptions and exclusions.

Consider the example of a state-wide initiative aimed at promoting affordable housing. To support this cause, the government might introduce a property tax credit or exemption for homeowners who meet certain criteria, such as income limits or ownership of properties within designated affordable housing zones. Such measures can provide financial relief to eligible property owners while contributing to the state's broader housing goals.

Market Conditions and Property Values

The real estate market is another critical factor influencing Pinellas Property Tax rates. As property values fluctuate due to market dynamics, it directly impacts the tax base. When property values rise, the overall tax revenue generated from a given tax rate increases, and vice versa. This dynamic nature of the real estate market necessitates regular assessments and adjustments to ensure fairness and accuracy in tax calculations.

Let's illustrate this point with an example. Suppose a particular neighborhood in Pinellas County experiences a surge in demand, leading to a significant increase in property values. As a result, the assessed values of properties in this area rise, consequently increasing the tax base for the local government. This scenario could lead to a higher overall tax revenue for the area, providing the necessary funds to support local services and infrastructure.

Payment Options and Strategies

Understanding the payment options and strategies available to property owners is essential for effective financial planning. Pinellas County offers various methods to pay property taxes, providing flexibility and convenience to taxpayers.

Online Payment Platforms

One of the most convenient and widely used payment methods is online platforms. Pinellas County provides a user-friendly online payment system, allowing property owners to access their tax information, view their current balance, and make payments securely from the comfort of their homes. This option is particularly beneficial for those who prefer digital transactions and seek a seamless payment experience.

To utilize this platform, property owners can visit the official Pinellas County website, navigate to the tax payment section, and create an account. Once registered, they can log in, access their tax records, and initiate payments using various payment methods, including credit cards, debit cards, or electronic fund transfers. The online platform also offers features such as payment history, balance notifications, and the ability to set up automatic payments, providing added convenience and control over tax obligations.

In-Person Payments

For those who prefer a more traditional approach, in-person payments are also available. Property owners can visit designated tax payment offices or collection centers within Pinellas County to make their tax payments. This option provides a personal touch and allows for direct interaction with tax officials, offering an opportunity to address any queries or concerns regarding tax assessments or payment processes.

Taxpayers can visit the designated locations during specified business hours, bringing their tax bill or account information to facilitate the payment process. Cash, checks, and money orders are typically accepted as payment methods at these physical locations. It's advisable to check the county's official website or contact the tax collector's office for specific details regarding payment hours, accepted forms of payment, and any additional requirements.

Mail-In Payments

Pinellas County also accommodates property owners who prefer to make their tax payments through the mail. This option provides flexibility and convenience, especially for those who reside outside the county or have limited access to online or in-person payment methods.

To utilize mail-in payments, property owners should carefully follow the instructions provided on their tax bill. They should ensure that they have the correct remittance address and complete the necessary paperwork accurately. It's essential to include the payment amount, property identification details, and any additional information required by the county. Sending the payment via certified or registered mail with a return receipt can provide added security and peace of mind.

Payment Plans and Installments

Recognizing that property taxes can be a significant financial burden, Pinellas County offers payment plans and installment options to provide relief and flexibility to taxpayers. These plans allow property owners to spread their tax payments over a specified period, making it more manageable and reducing the strain on their finances.

To qualify for a payment plan, property owners should contact the Pinellas County Tax Collector's Office and inquire about the available options. The office may require certain documentation, such as proof of income or financial hardship, to approve the payment plan. Once approved, taxpayers can make regular payments according to the agreed-upon schedule, ensuring that their tax obligations are met in a timely and affordable manner.

Managing Property Taxes: Strategies and Tips

Effectively managing property taxes is an essential aspect of financial planning for property owners. By implementing strategic approaches and staying informed about tax-related matters, individuals can optimize their tax obligations and ensure compliance with relevant regulations.

Stay Informed about Tax Assessments

One of the key strategies for managing property taxes is to stay informed about tax assessments. Property owners should regularly review their tax assessments to ensure accuracy and identify any potential discrepancies. This proactive approach allows for early identification of issues and provides an opportunity to address them before they become significant problems.

Pinellas County provides property owners with access to their tax assessment information through online platforms or by requesting copies of their assessment records. By reviewing these documents, individuals can verify the assessed value of their property, understand the factors influencing the assessment, and identify any errors or inconsistencies. If any discrepancies are found, property owners can initiate the necessary correction processes, ensuring fairness and accuracy in their tax obligations.

Utilize Exemptions and Exclusions

Pinellas County offers various exemptions and exclusions that can reduce property tax liabilities for eligible property owners. These provisions are designed to provide financial relief to specific groups or individuals, such as veterans, seniors, or homeowners with certain income levels. Understanding the available exemptions and exclusions and determining eligibility is crucial for maximizing tax savings.

For instance, Pinellas County offers a homestead exemption, which reduces the taxable value of a primary residence for eligible homeowners. To qualify for this exemption, individuals must meet specific residency and ownership requirements and provide the necessary documentation. By taking advantage of this exemption, homeowners can significantly reduce their property tax obligations, providing much-needed financial relief.

Appeal Unfair Assessments

In certain circumstances, property owners may believe that their assessed value is unfairly high or inaccurate. In such cases, it is important to know that they have the right to appeal the assessment and seek a review of the valuation. Pinellas County provides a formal appeals process, allowing property owners to challenge their assessments and present evidence or arguments supporting their claim.

To initiate an appeal, property owners should carefully follow the county's guidelines and timelines. They should gather relevant documentation, such as recent property appraisals, comparable sales data, or expert opinions, to support their case. By presenting a well-prepared and compelling argument, individuals can potentially obtain a reduction in their assessed value, resulting in lower property tax obligations.

Conclusion

Understanding and effectively managing Pinellas Property Tax is a crucial aspect of financial planning for property owners in the county. By grasping the calculation process, staying informed about influencing factors, and exploring available payment options, individuals can navigate their tax obligations with confidence. Additionally, implementing strategic approaches, such as staying informed about tax assessments, utilizing exemptions, and appealing unfair assessments, can further optimize their financial position and ensure compliance with relevant regulations.

As Pinellas County continues to thrive and develop, property taxes will remain an essential component of local governance and community support. By actively engaging with the tax system, property owners can contribute to the well-being of their communities while effectively managing their financial responsibilities. It is through this collective effort that Pinellas County can continue to flourish, providing its residents with a high quality of life and a vibrant, sustainable future.

What is the timeline for receiving my Pinellas County tax bill?

+Pinellas County typically mails tax bills to property owners in late August or early September. However, it’s advisable to check the official Pinellas County website or contact the Tax Collector’s Office for the most accurate and up-to-date information regarding the tax bill distribution timeline.

Are there any late payment penalties for Pinellas Property Taxes?

+Yes, Pinellas County imposes late payment penalties for property taxes. The penalty amount varies depending on the timing of the late payment. It’s important to pay your taxes on time to avoid incurring these additional fees. The specific penalty structure can be found on the official Pinellas County website or by contacting the Tax Collector’s Office.

Can I pay my Pinellas Property Taxes in installments?

+Yes, Pinellas County offers an installment payment plan for property taxes. This plan allows taxpayers to divide their tax payments into multiple installments, making it more manageable. To enroll in the installment plan, you need to contact the Tax Collector’s Office and meet certain eligibility criteria. The office can provide detailed information on the application process and payment schedules.

Are there any tax relief programs available for seniors in Pinellas County?

+Yes, Pinellas County offers tax relief programs specifically designed for eligible senior citizens. These programs provide financial assistance to seniors with limited income and assets. To qualify, seniors must meet certain age and income requirements and apply through the Tax Collector’s Office. The office can provide detailed information on the application process and eligibility criteria.