How To View Old Tax Returns

Accessing old tax returns can be a necessary task for various reasons, such as verifying previous filings, resolving tax-related issues, or simply maintaining a comprehensive record of your financial history. While the process may seem daunting, it is relatively straightforward with the right guidance. This article will provide a step-by-step guide on how to view old tax returns efficiently and securely.

Understanding the Importance of Old Tax Returns

Old tax returns serve as vital records that reflect your financial standing and tax obligations in previous years. They contain crucial information such as income sources, deductions claimed, tax credits applied, and any outstanding liabilities. Accessing these records can be essential for a variety of purposes, including:

- Tax Amendment: If you need to correct errors or make adjustments to previous tax returns, having access to the original documents is indispensable.

- Financial Planning: Old tax returns provide a historical perspective on your financial situation, helping you make informed decisions and set realistic goals for the future.

- Legal and Auditing Purposes: In certain situations, such as audits or legal proceedings, having accurate and accessible tax records is mandatory.

- Documenting Assets and Liabilities: Tax returns can be valuable when applying for loans, purchasing properties, or undergoing significant financial transactions.

Locating and Retrieving Old Tax Returns

The first step in viewing old tax returns is locating them. Depending on the year and your preferred method of record-keeping, there are several avenues to explore:

Paper Records

If you’ve been diligent about maintaining physical copies of your tax returns, start by searching through your files and storage spaces. Organize your documents by year and ensure they are stored securely to prevent loss or damage.

Electronic Records

With the advent of digital technology, many taxpayers opt for electronic storage of their tax returns. Here’s how to access them:

- IRS Online Account: Create an account on the Internal Revenue Service website (IRS.gov) to access your tax information. You’ll need to provide personal details and set up security measures to ensure your information remains secure.

- Tax Preparation Software: If you used software like TurboTax or H&R Block to file your taxes, you can often retrieve old returns through their platforms. Log in to your account and navigate to the appropriate section for previous filings.

- Email and Cloud Storage: Check your email archives and cloud storage accounts for any saved tax return PDFs or relevant documents.

IRS Records

In case you’re unable to locate your old tax returns, the IRS maintains records of tax returns for a certain period. You can request a transcript or copy of your tax return by following these steps:

- Form 4506: Download and complete the Request for Copy of Tax Return form from the IRS website. This form allows you to request a copy of your original tax return.

- Submit the form along with the applicable fee to the address specified on the form. The IRS will process your request and send you a copy of the requested return.

- Alternatively, you can use the Get Transcript tool on the IRS website to access a transcript of your tax return, which contains most of the information from the original return.

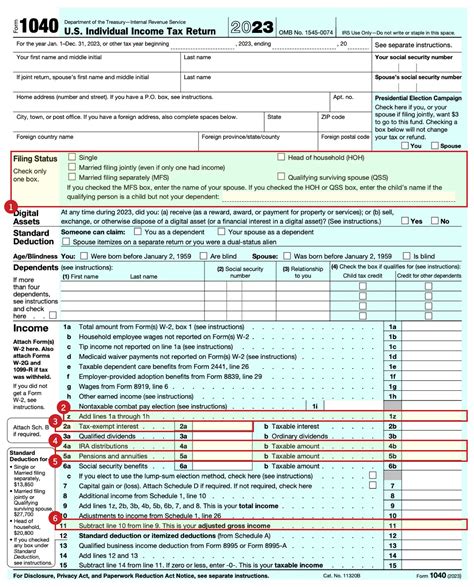

Reviewing and Understanding Old Tax Returns

Once you have located and retrieved your old tax returns, it’s essential to review them thoroughly. Here are some key aspects to focus on:

Personal Information

Verify that the returns belong to you and that all personal details, such as name, address, and Social Security Number, are accurate. This ensures that you are reviewing the correct documents.

Income and Deductions

Examine the income sources and deductions claimed on your old returns. Compare them with your current financial situation to identify any significant changes or anomalies. This step is crucial for accurate tax planning and compliance.

Tax Credits and Refunds

Review any tax credits or refunds you received in previous years. This information can be valuable for understanding your eligibility for credits in the current tax year and maximizing your refund potential.

Amending Returns

If you identify any errors or discrepancies, consider amending your old tax returns. The IRS allows taxpayers to correct mistakes and adjust their tax liabilities through the Form 1040X, Amended U.S. Individual Income Tax Return. This process ensures accuracy and prevents potential penalties.

Securing and Organizing Old Tax Returns

Once you’ve located and reviewed your old tax returns, it’s essential to secure and organize them properly. Here are some best practices:

Digital Storage

Consider scanning your physical tax returns and storing them digitally. This ensures easy access and prevents the risk of physical damage or loss. Use secure cloud storage platforms or external hard drives for added security.

Paper Storage

If you prefer physical storage, invest in a fireproof and waterproof safe or cabinet. Store your tax returns in acid-free folders or archival-quality boxes to prevent deterioration over time. Label each folder or box with the year and a brief description of its contents for easy retrieval.

Backup and Redundancy

Implement a backup system for your tax records. Consider using multiple storage methods, such as cloud storage and physical backups, to ensure redundancy. This minimizes the risk of data loss and provides peace of mind.

Retention Periods

The IRS recommends retaining tax returns and supporting documents for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. However, certain situations may require longer retention periods, such as if you filed a fraudulent return or if the IRS is auditing your return.

FAQ

How far back can I access my tax returns?

+The IRS maintains tax return records for a period of up to seven years from the filing date. However, it’s advisable to keep your own records for at least three years to facilitate easy access and ensure compliance.

What if I can’t find my old tax returns anywhere?

+If you’re unable to locate your old tax returns, you can request a transcript or copy of your tax return from the IRS using Form 4506. This form allows you to retrieve your tax information directly from the IRS, ensuring you have accurate and complete records.

Can I view my tax returns online without an IRS account?

+While you can view certain tax information without an IRS account, accessing your complete tax returns online requires setting up an account. This ensures security and privacy for your tax data.

How often should I review my old tax returns?

+It’s recommended to review your old tax returns annually, especially when filing your current year’s return. This practice helps you identify any changes in your financial situation, ensure accuracy, and take advantage of applicable tax credits and deductions.

Are there any penalties for amending old tax returns?

+Amending old tax returns to correct errors or adjust liabilities is a responsible practice. While there may be interest or penalties applied if you owe additional taxes, the IRS encourages taxpayers to amend their returns voluntarily. However, it’s best to consult a tax professional for specific advice.