New York Tax Return

For residents of New York State, understanding and navigating the process of filing state taxes is an annual ritual. The New York State Department of Taxation and Finance oversees the collection of taxes, and it is important for individuals and businesses to be aware of the specific regulations and requirements unique to this state. This article aims to provide a comprehensive guide to assist New Yorkers in successfully completing their New York Tax Return, offering insights into the latest regulations, deadlines, and potential deductions.

Understanding the New York Tax Landscape

New York’s tax system is known for its complexity, especially compared to many other states. The state’s tax code includes a variety of taxes, including income tax, sales tax, property tax, and various other assessments. For individual taxpayers, the primary focus is often on the New York State Income Tax, which is levied on personal income earned or received from all sources within the state.

The New York State Department of Taxation and Finance (NYS DTF) provides extensive resources and guidelines to help taxpayers navigate this complex system. These resources include detailed instructions for filing various types of tax returns, forms, and publications explaining tax laws, and online tools to assist with calculations and filings.

Tax Rates and Brackets

New York’s income tax system operates on a progressive scale, with tax rates ranging from 4% to 8.82% based on income levels. These rates are applied to taxable income, which is calculated after various deductions and credits are taken into account. The state’s tax brackets are adjusted annually to account for inflation, ensuring that taxpayers are not pushed into higher tax brackets due to simple cost-of-living increases.

For example, as of the 2023 tax year, the state's income tax rates and brackets are as follows:

| Tax Rate | Taxable Income Brackets |

|---|---|

| 4% | Up to $11,750 |

| 4.5% | $11,751 to $22,000 |

| 6.5% | $22,001 to $161,550 |

| 6.85% | $161,551 to $250,000 |

| 7.85% | $250,001 to $500,000 |

| 8.82% | Over $500,000 |

Taxable Income and Deductions

When calculating taxable income, New York State allows various deductions and adjustments to reduce the amount of income subject to tax. These deductions can significantly lower an individual’s tax liability. Some common deductions include:

- Standard Deduction: All taxpayers are eligible for a standard deduction, which reduces taxable income. The amount of the standard deduction depends on filing status.

- Itemized Deductions: Certain expenses, such as medical costs, charitable contributions, mortgage interest, and property taxes, can be deducted to lower taxable income. However, itemizing deductions may not always be beneficial, especially if the standard deduction is higher.

- Personal Exemptions: New York State offers personal exemptions for the taxpayer, spouse, and dependents. These exemptions reduce taxable income but are subject to phase-out limits for higher-income earners.

Filing Deadlines and Extensions

Understanding the filing deadlines for New York State taxes is crucial to avoid penalties and interest charges. The standard deadline for filing individual income tax returns is typically April 15th of the year following the tax year. For instance, the deadline for filing taxes for the 2022 tax year is April 15, 2023.

However, it's important to note that this deadline may be extended in certain circumstances. For instance, if a taxpayer files for an automatic six-month extension by April 15th, they will have until October 15th of the same year to file their return. Keep in mind that an extension to file does not extend the deadline to pay any taxes owed. Interest and penalties may still accrue on unpaid tax liabilities.

Late Filing and Payment Penalties

Failing to file or pay taxes on time can result in significant penalties and interest charges. The NYS DTF imposes a late filing penalty of 5% of the tax due for each month or part of a month the return is late, up to a maximum of 25%. In addition, a late payment penalty of 0.5% per month, up to a maximum of 25%, may be assessed on any unpaid tax balance.

For example, if a taxpayer files their return three months late and owes $10,000 in taxes, they could face a late filing penalty of $500 (5% of $10,000) and a late payment penalty of $150 (0.5% of $10,000 for three months). These penalties can add up quickly, so it's important to file and pay on time or request an extension if needed.

Filing Options and Resources

New York State offers several options for filing tax returns, ranging from traditional paper filing to online e-filing. The NYS DTF encourages taxpayers to use electronic filing methods, as they are faster, more secure, and often come with built-in error-checking features.

Online Filing

The most common method of filing New York State tax returns is through the New York Online Tax System (NYOTS). This system allows taxpayers to file their returns electronically, calculate their taxes, and even make payments online. It’s user-friendly and can guide taxpayers through the process step by step. NYOTS also provides the option to file an extension and make estimated tax payments.

Paper Filing

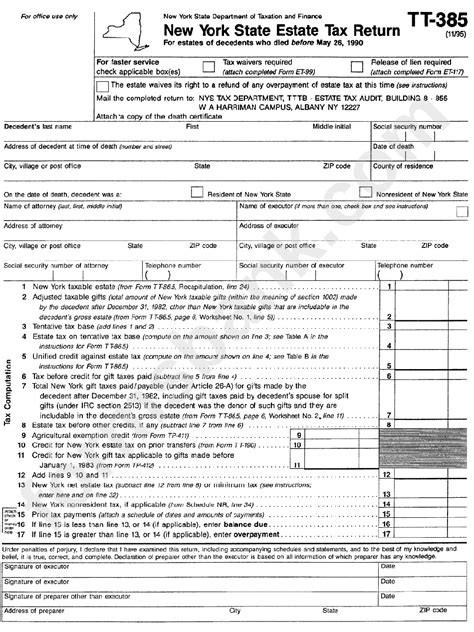

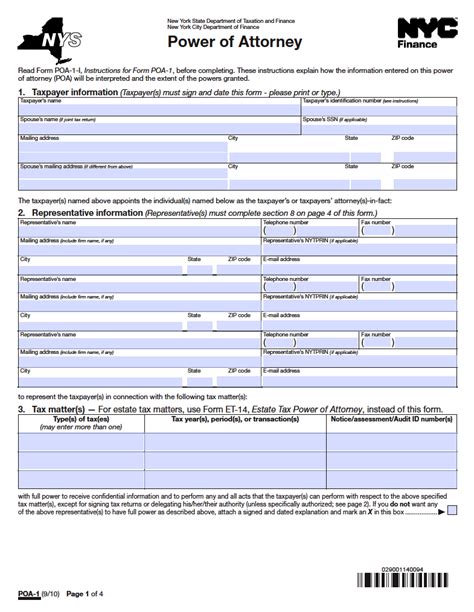

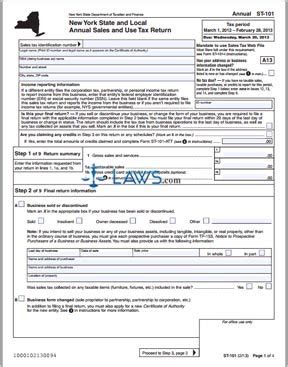

For those who prefer or need to file a paper return, the NYS DTF provides official forms that can be downloaded from their website or obtained from local tax offices. The forms vary based on the taxpayer’s filing status, income level, and other factors. It’s important to ensure that the correct forms are used and that all necessary supporting documents are included.

Tax Preparation Software

Various tax preparation software programs are available to assist taxpayers in preparing and filing their New York State tax returns. These programs often include features such as automatic calculations, error checking, and the ability to e-file directly from the software. Some popular options include TurboTax, H&R Block, and TaxAct.

Special Considerations and Deductions

New York State offers several deductions and credits that can further reduce a taxpayer’s liability. Understanding these deductions and determining eligibility can be crucial in minimizing tax obligations.

New York State Tax Credits

The state provides a variety of tax credits to eligible taxpayers, including:

- Child and Dependent Care Credit: This credit can help offset the cost of childcare expenses, allowing working parents to claim a credit for a percentage of their childcare costs.

- Child and Family Tax Credit: A refundable credit available to families with at least one qualifying child and income below a certain threshold.

- New York State Resident Tuition Credit: Taxpayers who are New York residents and pay tuition at an eligible institution within the state may be eligible for this credit.

- Credit for Property Taxes Paid: A credit for property taxes paid on a primary residence, subject to income limitations.

Other Deductions

New York State also allows deductions for certain expenses, including:

- Student Loan Interest Deduction: Taxpayers can deduct interest paid on qualified student loans.

- Retirement Contributions: Contributions to certain retirement plans, such as IRAs and 401(k)s, may be deductible.

- Alimony Payments: Taxpayers who pay alimony may be able to deduct these payments from their taxable income.

Filing Tips and Best Practices

Navigating the complexities of New York State taxes can be challenging, but by following some best practices and tips, taxpayers can ensure a smoother filing process and potentially minimize their tax liability.

Gather Necessary Documents

Before beginning the filing process, gather all necessary documents, including:

- W-2 forms from all employers

- 1099 forms for any interest, dividends, or other income

- Records of deductions and credits, such as medical expenses, charitable contributions, and education expenses

- Records of any income or expenses related to a home office or business

Review and Understand Tax Forms

Take the time to thoroughly review and understand the tax forms you’ll be using. The NYS DTF provides detailed instructions and publications to guide taxpayers through the process. If you’re unsure about a particular deduction or credit, seek clarification from the department or a tax professional.

Consider Seeking Professional Help

For complex tax situations or if you’re unsure about certain aspects of your tax return, consider seeking assistance from a tax professional. Certified Public Accountants (CPAs), Enrolled Agents (EAs), and tax attorneys are qualified to provide tax advice and can ensure your return is accurate and compliant with state regulations.

Double-Check Your Return

Before submitting your tax return, double-check all the information for accuracy. Ensure that all income, deductions, and credits are correctly entered and that your calculations are correct. This step can help prevent errors that could lead to audits or additional taxes owed.

Conclusion

Filing a New York Tax Return can be a complex process, but with the right knowledge and resources, it can be successfully navigated. By understanding the state’s tax landscape, staying informed about deadlines and extensions, and taking advantage of available deductions and credits, New Yorkers can ensure they meet their tax obligations accurately and efficiently.

Remember, staying up-to-date with the latest tax regulations and seeking professional guidance when needed can make a significant difference in your tax liability and overall financial well-being. With careful planning and attention to detail, filing your New York State tax return can be a manageable task.

When is the deadline to file my New York State tax return?

+The standard deadline for filing individual income tax returns in New York State is April 15th of the year following the tax year. For instance, the deadline for filing taxes for the 2022 tax year is April 15, 2023.

Can I file for an extension to file my tax return in New York State?

+Yes, you can file for an automatic six-month extension by April 15th. This will give you until October 15th of the same year to file your return. However, keep in mind that an extension to file does not extend the deadline to pay any taxes owed.

What are some common deductions and credits available in New York State?

+New York State offers various deductions and credits, including the Child and Dependent Care Credit, Child and Family Tax Credit, New York State Resident Tuition Credit, and Credit for Property Taxes Paid. There are also deductions for student loan interest, retirement contributions, and alimony payments.

How can I minimize my New York State tax liability?

+To minimize your tax liability, it’s important to understand and take advantage of all eligible deductions and credits. Additionally, consider seeking professional tax advice to ensure you’re maximizing your tax benefits and staying compliant with state regulations.

Where can I find more information and resources for filing my New York State tax return?

+The New York State Department of Taxation and Finance (NYS DTF) provides extensive resources and guidelines on their website. You can find detailed instructions, forms, publications, and online tools to assist with calculations and filings. Additionally, tax preparation software and professional tax services can offer further guidance.