Charleston Sales Tax

The city of Charleston, nestled along the southeastern coast of the United States, is renowned for its vibrant culture, rich history, and vibrant culinary scene. As a popular tourist destination and a thriving economic hub, Charleston's sales tax structure plays a significant role in shaping the city's fiscal landscape and influencing the daily lives of its residents and visitors alike. In this comprehensive article, we delve into the intricacies of Charleston's sales tax, exploring its history, current rates, exemptions, and the impact it has on the local economy.

A Historical Perspective on Charleston’s Sales Tax

Sales tax in Charleston, South Carolina, has a fascinating history that mirrors the state’s overall tax evolution. South Carolina’s sales tax system dates back to the 1950s, with Charleston being one of the first cities to implement this form of taxation. The initial purpose was to generate revenue for the state and local governments, aiding in the funding of essential services and infrastructure development.

Over the decades, Charleston's sales tax rates have undergone several adjustments, reflecting the changing economic landscape and the city's evolving needs. These adjustments have been influenced by various factors, including economic growth, inflation, and the state's budgetary requirements.

Current Sales Tax Rates in Charleston

As of my last update in January 2023, Charleston, like the rest of South Carolina, follows a combined sales tax structure, which includes both state and local sales taxes. The current sales tax rates applicable in Charleston are as follows:

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Charleston County Sales Tax | 1% |

| Total Sales Tax in Charleston | 7% |

It's important to note that while the state sales tax rate is consistent across South Carolina, local sales tax rates can vary depending on the county and municipality. Charleston County, which encompasses the city of Charleston, levies an additional 1% sales tax on top of the state rate.

Sales Tax on Specific Items

Charleston, like many other cities, applies sales tax to a wide range of goods and services. However, there are certain categories that are exempt from sales tax or have reduced tax rates. For instance, groceries, prescription drugs, and certain medical supplies are exempt from sales tax in South Carolina. Additionally, some counties, including Charleston County, offer reduced sales tax rates for certain categories, such as prepared foods.

Understanding Sales Tax Exemptions and Deductions

Sales tax exemptions and deductions play a crucial role in shaping Charleston’s tax landscape and providing relief to specific sectors and individuals. Here’s an overview of some of the key exemptions and deductions in Charleston’s sales tax structure:

Food and Beverage Exemptions

One of the most notable exemptions in Charleston’s sales tax system is the exemption on unprepared food items, commonly known as groceries. This exemption ensures that essential food items remain affordable for residents and visitors alike. Additionally, Charleston County offers a reduced sales tax rate of 2% on prepared foods, providing a financial incentive for tourists and locals to enjoy the city’s renowned culinary scene.

Prescription Drugs and Medical Supplies

South Carolina, including Charleston, exempts prescription drugs and certain medical supplies from sales tax. This exemption is designed to alleviate the financial burden on individuals requiring essential medical care and support.

Manufacturing and Industrial Exemptions

Charleston, being a thriving economic hub, offers sales tax exemptions to support its manufacturing and industrial sectors. These exemptions aim to encourage economic growth and job creation by reducing the tax burden on businesses operating in these sectors. By offering tax incentives, Charleston attracts and retains businesses, contributing to the city’s economic vitality.

Other Specific Exemptions

Charleston’s sales tax structure also includes exemptions for specific items such as agricultural equipment, certain machinery, and supplies used in manufacturing. These exemptions are tailored to support specific industries and promote economic development in the region.

Impact of Sales Tax on Charleston’s Economy

Charleston’s sales tax structure plays a pivotal role in shaping the city’s economic landscape and influencing its growth trajectory. The sales tax revenue generated contributes significantly to the city’s fiscal health, funding essential services and infrastructure projects that benefit residents and businesses alike.

Funding Essential Services

Sales tax revenue is a primary source of funding for Charleston’s public services, including education, healthcare, public safety, and transportation. The city’s robust sales tax system ensures that these critical services receive adequate financial support, enhancing the overall quality of life for residents.

Economic Development and Infrastructure

The revenue generated from sales tax also drives economic development initiatives and infrastructure projects in Charleston. This includes investments in road and transportation networks, public spaces, and tourism-related developments. By allocating sales tax revenue strategically, Charleston can enhance its appeal as a business and tourism destination, fostering sustained economic growth.

Tourism and the Sales Tax

Charleston’s thriving tourism industry is a significant contributor to the city’s sales tax revenue. The city’s unique blend of history, culture, and cuisine attracts millions of visitors each year, generating substantial sales tax revenue from accommodations, dining, and retail activities. This revenue stream supports the city’s overall economic stability and contributes to the funding of essential services.

Comparative Analysis: Charleston’s Sales Tax vs. Other Cities

When comparing Charleston’s sales tax structure to that of other cities, it’s evident that the city’s approach is well-aligned with the broader state and regional trends. South Carolina’s sales tax system, including Charleston’s rates, is relatively moderate compared to many other states. This moderation strikes a balance between generating adequate revenue and maintaining a competitive business environment.

However, it's worth noting that Charleston's sales tax structure, particularly the reduced rate on prepared foods, positions the city as a more attractive destination for tourists and food enthusiasts. This unique aspect of Charleston's sales tax system enhances the city's appeal and contributes to its thriving culinary scene.

Future Implications and Potential Changes

As Charleston continues to evolve and adapt to changing economic conditions, its sales tax structure may also undergo adjustments. Here are some potential future implications and changes that could impact Charleston’s sales tax landscape:

Economic Growth and Development

As Charleston’s economy expands and diversifies, the city may explore strategies to optimize its sales tax structure. This could involve adjusting rates to align with the changing economic landscape or introducing new incentives to attract specific industries and businesses.

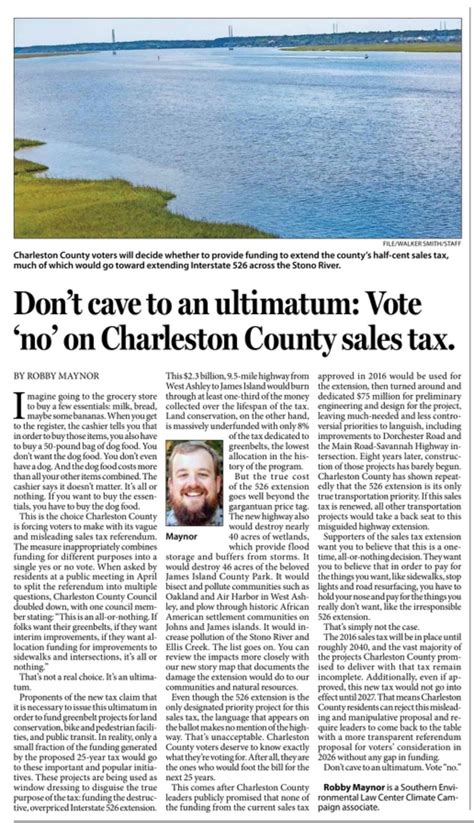

Fiscal Responsibilities and Budgetary Needs

The city’s budgetary requirements and fiscal responsibilities may drive future changes in the sales tax structure. If there is a need to increase revenue to fund essential services or infrastructure projects, Charleston may consider adjusting sales tax rates or exploring new revenue streams.

Legislative and Policy Changes

Changes in state or local legislation could impact Charleston’s sales tax system. For instance, amendments to the state’s tax laws or the introduction of new policies could influence the city’s tax structure, exemptions, or deductions.

Technology and E-Commerce

The rapid growth of e-commerce and digital platforms presents unique challenges and opportunities for sales tax collection. Charleston may need to adapt its sales tax system to accommodate these changes, ensuring that revenue from online sales is captured effectively.

Frequently Asked Questions (FAQ)

What is the total sales tax rate in Charleston, including state and local taxes?

+The total sales tax rate in Charleston, as of my last update, is 7%. This includes the state sales tax rate of 6% and the Charleston County sales tax rate of 1%.

Are there any items exempt from sales tax in Charleston?

+Yes, Charleston, like the rest of South Carolina, exempts certain items from sales tax. This includes groceries (unprepared food items), prescription drugs, and specific medical supplies.

How does Charleston’s sales tax structure compare to other cities in South Carolina?

+Charleston’s sales tax structure, including the state and local rates, is consistent with most cities in South Carolina. However, Charleston County offers a reduced sales tax rate of 2% on prepared foods, which is a unique feature compared to other counties.

Can tourists expect to pay sales tax when visiting Charleston?

+Yes, tourists, like residents, are subject to sales tax when making purchases in Charleston. However, the reduced sales tax rate on prepared foods can make dining out more affordable and attractive for visitors.

How does Charleston’s sales tax revenue contribute to the city’s economy?

+Sales tax revenue is a significant source of funding for Charleston’s public services, infrastructure projects, and economic development initiatives. It ensures the city’s financial stability and enhances its overall appeal as a business and tourism destination.