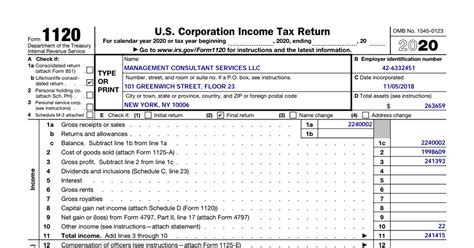

Tax Return 1120

Taxes are a complex and often daunting topic for many businesses, but understanding the intricacies of your tax obligations is crucial for compliance and financial health. In the United States, the IRS requires various entities to file specific tax forms, and one such form is the 1120, also known as the U.S. Corporation Income Tax Return. This article aims to provide an in-depth exploration of Form 1120, its purpose, key components, and the steps businesses should take to ensure accurate and timely filing.

Understanding Form 1120: A Primer on Corporate Tax Returns

Form 1120 is a cornerstone of the U.S. tax system, serving as the primary means for corporations to report their income, expenses, and profits to the IRS. It is a comprehensive form designed to capture all relevant financial data, allowing the IRS to assess the corporation’s tax liability accurately.

The U.S. Corporation Income Tax Return is a complex document, reflecting the diverse nature of corporate structures and activities. It encompasses various schedules and attachments, each serving a specific purpose in reporting different aspects of a corporation's financial health.

Key Components of Form 1120

To understand the process of filing Form 1120, it’s essential to familiarize oneself with its key components. These include:

- General Information: This section requires basic details about the corporation, such as its employer identification number (EIN), principal business activity, and the names and addresses of key personnel.

- Income: Corporations must report all sources of income, including revenue from sales, interest, dividends, and other gains. This section also includes adjustments to income, such as cost of goods sold and other deductions.

- Deductions: Form 1120 allows corporations to claim various deductions, reducing their taxable income. These may include expenses for rent, salaries, marketing, and other operational costs.

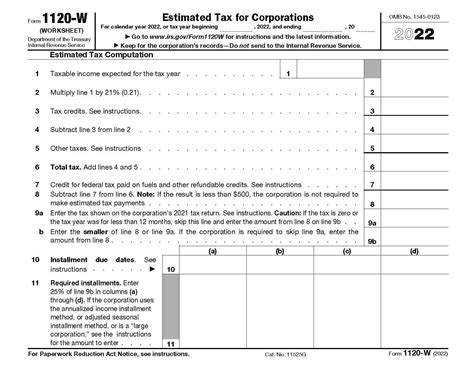

- Tax Computation: Once income and deductions are reported, the form calculates the corporation's tax liability. This involves applying the appropriate tax rates and credits to determine the final tax amount.

- Payments and Refunds: Corporations use this section to report any payments made during the tax year and to request refunds for overpayments.

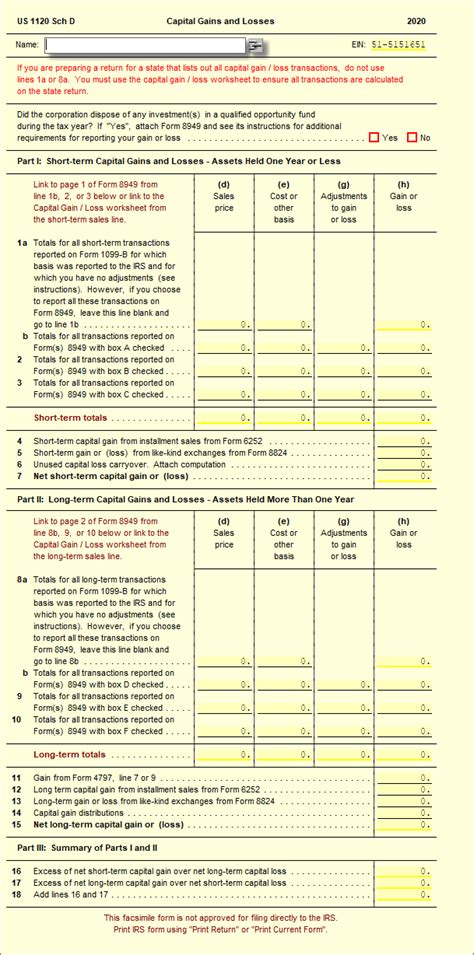

- Schedules and Attachments: Depending on the corporation's activities, additional schedules and attachments may be required. These could include details on depreciation, investments, foreign transactions, and more.

| Schedule | Description |

|---|---|

| Schedule D | Capital Gains and Losses |

| Schedule M-3 | Net Income Per Books |

| Schedule O | Other Deductions and Credits |

| Schedule R | Reconciliation of Tax-Exempt Interest |

These schedules provide additional context and detail, ensuring that the corporation's financial situation is accurately represented to the IRS.

Who Needs to File Form 1120?

The obligation to file Form 1120 falls on corporations, which are legally distinct entities from their owners. This includes C corporations, which are taxed separately from their shareholders, and S corporations, which pass through profits and losses to their shareholders for tax purposes.

Additionally, some entities with a single owner, such as limited liability companies (LLCs), may elect to be taxed as corporations by filing Form 8832. This decision often depends on the entity's size, complexity, and tax strategy.

The Process of Filing Form 1120

Filing Form 1120 is a multi-step process that requires careful preparation and attention to detail. Here’s a step-by-step guide to ensure a smooth filing experience:

- Gather Information: Begin by collecting all relevant financial documents, including income statements, balance sheets, and expense records. Ensure that all data is up-to-date and accurate.

- Determine Filing Status: Corporations must decide whether to file as a C corporation or an S corporation. This decision impacts tax liability and should be made with the guidance of a tax professional.

- Complete Form 1120: Using the gathered information, complete all sections of Form 1120, ensuring that all income, deductions, and credits are accurately reported. Pay close attention to the instructions and any additional schedules or attachments required.

- Calculate Tax Liability: Based on the information provided, the form will calculate the corporation's tax liability. Review this calculation carefully to ensure its accuracy.

- Prepare Payments or Refunds: If the corporation owes taxes, ensure that the required amount is available for payment. If a refund is due, review the amount and prepare the necessary documentation.

- Sign and Submit: Once all sections are complete and accurate, sign the form and submit it to the IRS by the filing deadline. This can be done electronically or by mail, depending on the corporation's preference and the volume of attachments.

Common Challenges and Best Practices

Filing Form 1120 can present several challenges, especially for entities new to the process or with complex financial structures. Some common challenges include:

- Accuracy: Ensuring that all income, deductions, and credits are reported accurately is crucial. Mistakes can lead to audits, penalties, and interest charges.

- Timeliness: Meeting the filing deadline is essential to avoid late fees and potential penalties. Corporations should plan their filing process well in advance to ensure they have sufficient time.

- Complexity: Form 1120 is a complex form, and its requirements can vary based on the corporation's activities. Seeking professional guidance can help navigate these complexities and ensure compliance.

To address these challenges, corporations should consider the following best practices:

- Start Early: Begin the filing process as early as possible to allow for ample time to gather information, complete the form, and review for accuracy.

- Seek Professional Help: Engaging a tax professional or accountant can provide valuable expertise, ensuring that the form is completed accurately and on time.

- Stay Informed: Keep abreast of any changes to tax laws and regulations that may impact the corporation's tax obligations. The IRS website is a valuable resource for the latest information.

The Importance of Accurate Tax Reporting

Accurate tax reporting is not just a legal obligation; it’s a cornerstone of good financial management. By filing Form 1120 accurately, corporations can ensure they meet their tax obligations, avoid penalties, and maintain a positive relationship with the IRS.

Furthermore, accurate tax reporting provides valuable insights into the corporation's financial health. It allows stakeholders, including shareholders, investors, and lenders, to assess the entity's performance and make informed decisions.

The Impact of Tax Obligations on Business Strategy

Tax obligations, including the filing of Form 1120, can significantly impact a corporation’s business strategy. Corporations must consider tax implications when making decisions about expansion, investment, and operational expenses.

For instance, decisions about where to locate facilities or how to structure international operations can have significant tax implications. Similarly, choices about employee compensation, benefits, and retirement plans can impact tax liability.

Future Implications and Potential Changes

The tax landscape is subject to change, and corporations must stay informed about potential modifications to tax laws and regulations. While it’s difficult to predict future changes with certainty, some potential developments could impact the filing of Form 1120.

- Tax Reform: Changes to corporate tax rates, deductions, or credits could impact the calculation of tax liability on Form 1120. Corporations should monitor proposed legislation and work with tax professionals to understand the potential impact.

- Digital Transformation: The IRS is increasingly moving towards digital services and online filing. Corporations should stay updated on these developments to ensure they can take advantage of improved efficiency and security.

- International Tax Considerations: With the increasing globalization of business, corporations with international operations must stay informed about changes to tax treaties and regulations. This ensures compliance and optimizes their tax position.

By staying informed and adapting to changes, corporations can ensure they remain compliant and competitive in the evolving tax landscape.

Conclusion

Filing Form 1120 is a critical aspect of corporate tax compliance in the United States. By understanding the form’s purpose, components, and filing process, corporations can ensure they meet their tax obligations accurately and on time.

Accurate tax reporting not only ensures compliance with the law but also provides valuable financial insights and informs strategic decision-making. With the right preparation and guidance, corporations can navigate the complexities of Form 1120 and focus on their core business objectives.

FAQ

What is the deadline for filing Form 1120?

+The standard deadline for filing Form 1120 is March 15 for C corporations and March 15 or April 15 for S corporations, depending on the corporation’s fiscal year. However, corporations can request an extension until September 15 by filing Form 7004.

How can I minimize the risk of an IRS audit when filing Form 1120?

+To minimize audit risk, ensure that all income, deductions, and credits are accurately reported. Keep detailed records and document all financial transactions. It’s also beneficial to consult a tax professional to ensure compliance with the latest IRS guidelines.

Can I file Form 1120 electronically?

+Yes, Form 1120 can be filed electronically using approved IRS e-file providers. Electronic filing is faster, more secure, and reduces the risk of errors compared to paper filing. However, certain attachments may still need to be mailed.

What happens if I miss the filing deadline for Form 1120?

+Missing the filing deadline can result in penalties and interest charges. The IRS may impose a late filing penalty of 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax from the original due date until the tax is paid in full.