Williamson County Tax Property

Welcome to an in-depth exploration of the Williamson County Tax Property, a vital administrative entity within the Williamson County government. This comprehensive guide will delve into the various aspects of this organization, its role in the community, and the services it provides. As a hub for tax-related matters, the Williamson County Tax Property office is an essential service center for property owners and residents. From property assessments to tax payments, this office plays a crucial role in the financial health and management of the county.

The Role and Services of Williamson County Tax Property

Williamson County Tax Property, located in the heart of Williamson County, Tennessee, is responsible for the efficient management and administration of property tax-related affairs. The office serves as a critical link between the county government and its residents, ensuring the smooth operation of the local economy through effective property tax collection and management.

The primary function of this department is the assessment of property values for taxation purposes. This process is integral to the county's financial stability, as it determines the tax revenue that funds essential public services such as education, infrastructure development, and public safety. The tax assessment process is conducted annually, with the aim of ensuring fairness and accuracy in tax liabilities for all property owners.

Property Assessment Procedures

The property assessment process is a meticulous undertaking, involving a thorough evaluation of each property within the county. The Williamson County Tax Property office employs a team of skilled assessors who visit and inspect properties, taking into account various factors such as location, size, improvements, and market trends. This comprehensive approach ensures that property values are accurately reflected, providing a fair and equitable basis for taxation.

Property owners are encouraged to review their assessment notices carefully. If there are any discrepancies or if the owner believes the assessed value is inaccurate, they have the right to appeal. The appeal process is designed to ensure transparency and fairness, allowing property owners to present their case and have their assessment reviewed by an independent panel.

Tax Payment and Collection

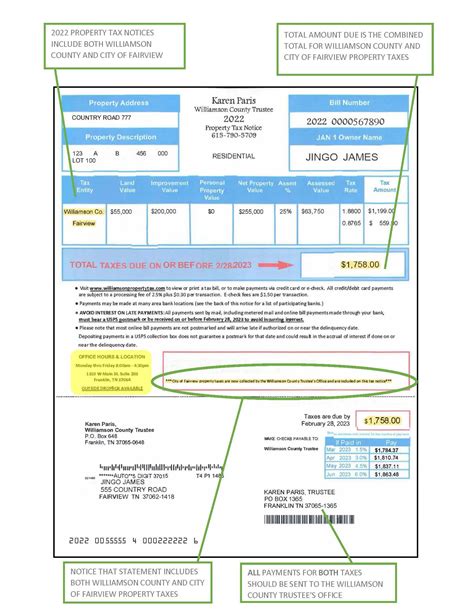

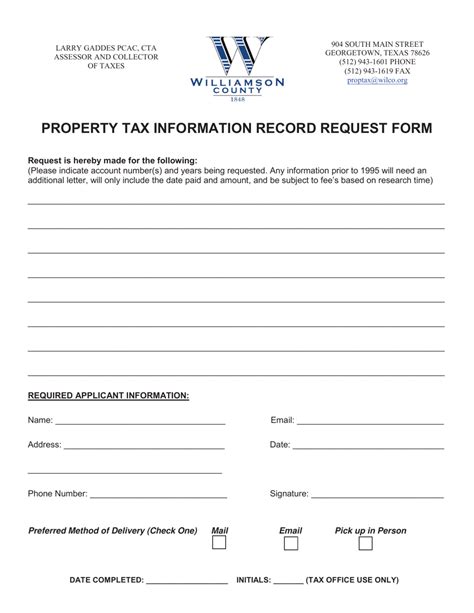

Once property values are assessed, the Williamson County Tax Property office generates tax bills and sends them to property owners. These bills outline the amount due, the due date, and payment options. Property owners have the flexibility to choose from various payment methods, including online payments, mail-in payments, or in-person payments at the tax office. The office also provides assistance to those who may require payment plans or face financial hardships.

The tax collection process is vital for the county's financial health. The revenue generated from property taxes is a significant source of funding for local services and infrastructure projects. Timely tax payments ensure that these essential services can continue uninterrupted, benefiting the entire community.

| Service | Description |

|---|---|

| Property Tax Assessments | Annual valuation of properties for tax purposes, ensuring fairness and accuracy. |

| Tax Bill Generation | Issuing detailed tax bills to property owners, outlining payment amounts and due dates. |

| Payment Options | Offering a range of payment methods for convenience and accessibility. |

| Appeals Process | A transparent system for property owners to challenge their assessments if necessary. |

| Tax Assistance | Providing support and guidance to property owners facing financial difficulties. |

Online Services and Convenience

In an effort to enhance efficiency and convenience, the Williamson County Tax Property office has embraced digital technology. Property owners can now access a wide range of services online, including viewing their property information, tracking tax payments, and accessing past tax bills. The online platform also allows for quick and easy tax bill payments, reducing the need for in-person visits.

The online system is designed with user-friendliness in mind, making it accessible to all property owners, regardless of their technical expertise. This digital transformation not only improves service delivery but also reduces administrative costs, allowing the office to focus more resources on ensuring the accuracy and fairness of property assessments.

The Impact and Benefits of Efficient Property Tax Management

Efficient property tax management, as exemplified by the Williamson County Tax Property office, brings about a myriad of benefits for both the county and its residents. One of the most significant advantages is the promotion of economic stability and growth. Accurate property assessments and fair taxation policies ensure that the county’s financial foundation remains strong, attracting businesses and fostering economic development.

Promoting Fairness and Transparency

The Williamson County Tax Property office’s dedication to fairness and transparency is evident in its assessment and appeals processes. By ensuring that property values are assessed accurately and consistently, the office upholds the principle of equality before the law. This approach builds trust between the government and its citizens, fostering a sense of community and civic engagement.

Furthermore, the transparency in the assessment process allows property owners to understand the basis for their tax liabilities. This understanding, coupled with the right to appeal, empowers property owners and encourages active participation in the local governance process.

Funding Essential Public Services

Property taxes are a primary source of revenue for local governments, and Williamson County is no exception. The funds generated through property tax collections are instrumental in supporting a wide range of vital public services. From maintaining and improving infrastructure to funding public education and social services, property taxes play a crucial role in enhancing the quality of life for all residents.

For instance, property tax revenue contributes significantly to the county's education budget, ensuring that schools have the necessary resources to provide quality education. It also supports public safety initiatives, from maintaining a robust police force to funding emergency response services.

Encouraging Homeownership and Community Development

Efficient property tax management also has a positive impact on homeownership rates and community development. By ensuring fair and consistent tax assessments, the Williamson County Tax Property office creates an environment that encourages long-term homeownership. Property owners can plan their finances more effectively, knowing that their tax liabilities are based on accurate and transparent valuations.

Additionally, the revenue generated from property taxes can be reinvested into community development projects. This may include initiatives to improve neighborhoods, enhance recreational facilities, or support local businesses, all of which contribute to a higher quality of life and a sense of community pride.

The Future of Property Tax Management in Williamson County

As technology continues to advance and societal needs evolve, the Williamson County Tax Property office is poised to embrace new innovations and strategies. The future of property tax management in Williamson County may involve further integration of technology to streamline processes and enhance service delivery.

Potential Technological Advancements

One area of focus could be the development of advanced property assessment tools. These tools could leverage artificial intelligence and machine learning to analyze vast amounts of data, including satellite imagery and market trends, to provide even more accurate property valuations. Such advancements could reduce the need for physical inspections, saving time and resources while maintaining a high level of accuracy.

Furthermore, the office could explore the implementation of blockchain technology for secure and transparent tax record management. This technology could enhance data security, prevent fraud, and provide an immutable record of property transactions and tax payments, further building trust between the government and its citizens.

Community Engagement and Outreach

In addition to technological advancements, the Williamson County Tax Property office can continue to strengthen its community engagement efforts. This may involve hosting educational workshops to help property owners understand the tax assessment process and their rights. By demystifying the process and fostering transparency, the office can further build trust and encourage active participation in local governance.

The office could also explore partnerships with community organizations and local businesses to provide support and resources to property owners facing financial hardships. This collaborative approach would not only help alleviate the financial burden on individuals but also contribute to the overall economic stability of the county.

How often are property assessments conducted in Williamson County?

+Property assessments in Williamson County are conducted annually to ensure accurate tax liabilities for property owners.

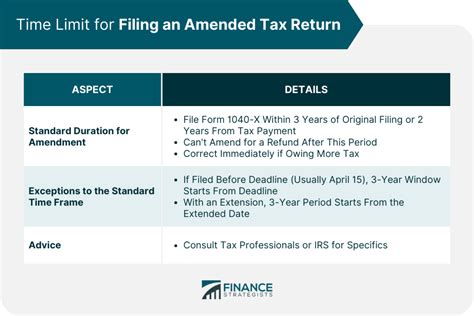

What happens if I disagree with my property assessment?

+If you disagree with your property assessment, you have the right to appeal. The Williamson County Tax Property office provides a transparent appeals process where you can present your case to an independent panel.

How can I pay my property taxes in Williamson County?

+You can pay your property taxes through various methods, including online payments, mail-in payments, or in-person payments at the tax office. The office also offers assistance for those requiring payment plans or facing financial difficulties.

What is the role of property tax revenue in Williamson County?

+Property tax revenue is a significant source of funding for local services and infrastructure projects in Williamson County. It supports public education, public safety initiatives, and community development projects.

How does the Williamson County Tax Property office ensure transparency and fairness in its processes?

+The office ensures transparency and fairness through meticulous property assessment procedures, a transparent appeals process, and the provision of detailed tax bill information. These measures build trust between the government and its citizens.