Racine County Property Tax

Welcome to an in-depth exploration of property taxes in Racine County, Wisconsin. This comprehensive guide will provide you with a detailed understanding of the property tax landscape in this vibrant community. From the intricacies of tax assessment to the strategies for effective management, we will navigate through the process to empower homeowners and investors with the knowledge they need to make informed decisions.

Understanding Racine County’s Property Tax System

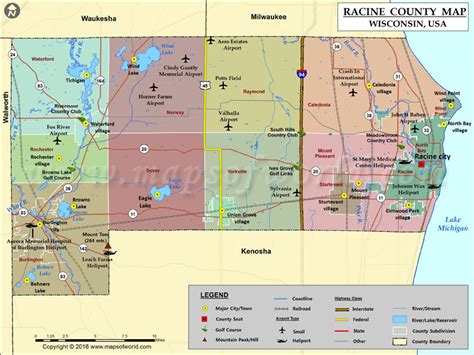

Racine County, known for its charming lakeside communities and thriving industries, has a property tax system that plays a vital role in funding essential services and infrastructure. This section aims to demystify the process, ensuring that residents and stakeholders have a clear grasp of how their property taxes are calculated and utilized.

The Assessment Process: A Critical Step

Property tax assessment is a crucial phase in the tax lifecycle. In Racine County, the Board of Assessors is responsible for this task. They evaluate each property within the county, considering factors such as location, size, improvements, and recent sales data to determine its fair market value. This value forms the basis for calculating the property tax due.

| Assessment Year | Average Market Value | Assessment Ratio |

|---|---|---|

| 2022 | $250,000 | 90% |

| 2023 | $260,000 (projected) | 90% |

The assessment ratio, a critical component, is applied to the market value to determine the assessed value on which taxes are calculated. In Racine County, this ratio has been consistent at 90% for several years.

Tax Rates and Their Impact

The tax rate, also known as the mill rate, is the other critical component in property tax calculations. It is set annually by the local government and is used to determine the tax amount owed. The rate is expressed in mills, where one mill equals one dollar of tax for every $1,000 of assessed value.

| Tax Year | Mill Rate | Estimated Tax |

|---|---|---|

| 2022 | 10.25 mills | $2,562.50 (for a property assessed at $250,000) |

| 2023 (projected) | 10.50 mills (estimate) | $2,685 (for a property assessed at $250,000) |

The tax rate can vary based on the services and facilities provided by the local government. It is essential to monitor these rates annually to understand potential changes in tax obligations.

Exemptions and Credits: Reducing Your Tax Burden

Racine County offers various exemptions and credits to eligible property owners, helping reduce their tax liabilities. These include:

- Homestead Exemption: Provides a reduction in taxable value for owner-occupied properties.

- Senior Exemption: Offers a property tax credit to homeowners aged 65 and above.

- Veteran's Exemption: Provides tax relief for military veterans and their families.

- Farmland Exemption: Encourages agricultural use by reducing taxes on eligible farmland.

These exemptions and credits can significantly impact your tax bill, so it's crucial to understand your eligibility and apply for them when appropriate.

Strategies for Effective Property Tax Management

Understanding the property tax system is the first step, but effective management requires a proactive approach. Here are some strategies to navigate the process successfully:

Stay Informed and Engage

Keep yourself updated on tax-related news and changes. Attend local government meetings, especially those discussing budgets and tax rates. Engage with your elected officials and voice your concerns or suggestions. Being an informed citizen ensures your interests are represented in the tax process.

Review Your Assessment Notice

When you receive your assessment notice, carefully review it for accuracy. Ensure that the details match your property’s current state. If you notice discrepancies, contact the assessor’s office to rectify them. Accurate assessments are crucial to avoid overpayment.

Consider Tax Appeals

If you believe your property’s assessment is significantly higher than its fair market value, you have the right to appeal. The process involves submitting evidence and arguments to support your case. It can be a complex procedure, so consider seeking professional guidance.

Explore Tax-Saving Opportunities

Beyond exemptions, explore other tax-saving strategies. For instance, investing in energy-efficient upgrades can qualify you for tax credits. Additionally, consider the impact of property improvements on your tax burden. While improvements can increase your property’s value, they may also trigger a higher assessment, so plan strategically.

Utilize Online Resources

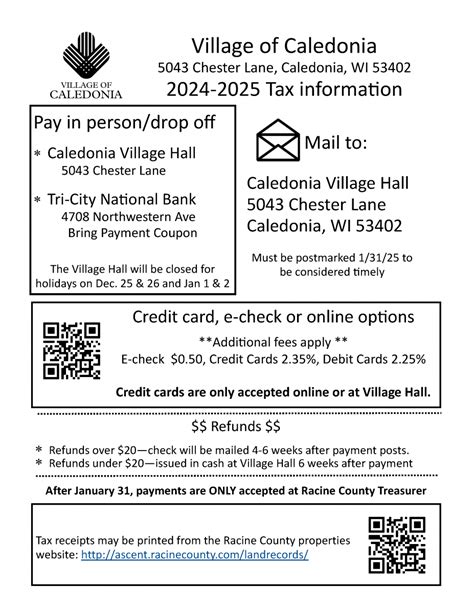

Racine County provides a wealth of online resources to assist homeowners and investors. The Racine County Treasurer’s Office website offers tools for property tax lookup, payment options, and important dates. Leverage these resources to stay organized and informed.

Conclusion: Empowering Racine County Residents

Property taxes are an essential part of our community’s fabric, funding the services and infrastructure that make Racine County a great place to live and invest. By understanding the assessment process, tax rates, and available exemptions, residents can navigate the system confidently. Effective management strategies, such as staying informed, reviewing assessments, and exploring tax-saving opportunities, empower homeowners and investors to make the most of their financial obligations.

As we continue to thrive and grow, a solid understanding of property taxes will ensure that our community remains strong and resilient. Remember, knowledge is power, and in the world of property taxes, it's a powerful tool to protect your financial interests.

How often are property taxes assessed in Racine County?

+

Property taxes are typically assessed annually. The assessment process ensures that the taxable value of properties is up-to-date, reflecting any changes or improvements made during the year.

Can I dispute my property’s assessed value?

+

Absolutely! If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process involves submitting evidence and arguments to support your case. It’s recommended to consult a professional for guidance.

What are the tax rates for 2023 in Racine County?

+

While the official tax rates for 2023 are not yet finalized, the projected mill rate for 2023 is 10.50 mills. This rate may be subject to change based on the county’s budget and the services provided.

Are there any online tools to estimate my property taxes?

+

Yes, the Racine County Treasurer’s Office website provides an online tool for property tax lookup and estimation. You can input your property details to get an estimate of your potential tax liability.

How can I stay updated on tax-related news and changes in Racine County?

+

Stay connected with local news sources, especially those covering Racine County. Additionally, subscribe to newsletters or alerts from the county government or the treasurer’s office. These sources will keep you informed about any changes or updates regarding property taxes.