What Do Taxes Pay For

Taxes are an essential part of any functioning society, as they provide the financial backbone for various public services and infrastructure. Understanding what our taxes pay for can give us a clearer picture of how governments allocate resources and the impact these allocations have on our daily lives. In this comprehensive guide, we will delve into the various aspects of tax revenue and explore the myriad ways in which it is utilized to support and enhance our communities.

The Role of Taxes in Society

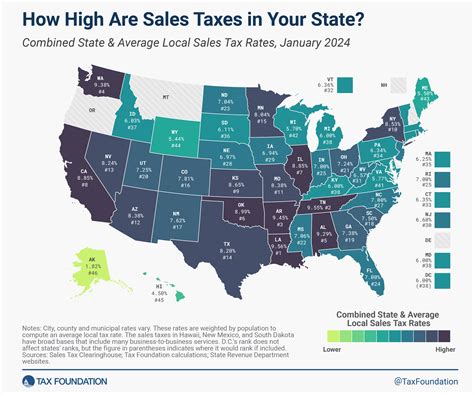

Taxes serve as a primary source of revenue for governments, enabling them to fund essential services and initiatives that benefit the public. This revenue is collected through various mechanisms, including income taxes, property taxes, sales taxes, and corporate taxes, among others. The funds generated are then distributed across different sectors, ensuring the smooth functioning of public services and infrastructure.

Funding Public Services

One of the primary uses of tax revenue is to fund a wide range of public services. These services are vital to the well-being and development of a society, and they encompass various sectors, including:

Education

Tax revenue plays a crucial role in supporting the education system. It funds public schools, universities, and vocational training programs, ensuring that every individual has access to quality education. This investment in education not only enhances individual opportunities but also contributes to the overall growth and prosperity of the nation.

For instance, in the United States, tax dollars fund the Department of Education, which provides grants and programs to improve school infrastructure, teacher training, and student support services. These investments have a direct impact on student outcomes and the overall quality of education.

Healthcare

Taxes are a significant source of funding for healthcare systems worldwide. They support the operation of public hospitals, clinics, and healthcare programs, ensuring that citizens have access to essential medical services. In many countries, tax revenue also finances universal healthcare initiatives, making healthcare more accessible and affordable for all.

Consider the example of the National Health Service (NHS) in the United Kingdom, which relies heavily on tax revenue to provide free healthcare to its citizens. The NHS is a renowned example of a tax-funded healthcare system, offering comprehensive care to all without financial barriers.

Public Safety and Security

Taxes contribute to maintaining public safety and security. They fund law enforcement agencies, emergency services, and criminal justice systems, ensuring that communities are protected and justice is served. Additionally, tax revenue supports initiatives to prevent crime, such as community development programs and rehabilitation services.

The New York City Police Department, for example, receives a significant portion of its funding from city and state taxes. This revenue enables the department to maintain a robust police force, invest in technology, and implement community policing strategies to keep the city safe.

Social Welfare Programs

Taxes play a vital role in funding social welfare programs, which aim to provide support and assistance to vulnerable populations. These programs include unemployment benefits, social security, disability support, and housing assistance. By investing in these programs, governments ensure that individuals facing economic hardships or personal challenges have a safety net to rely on.

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is a prime example of a tax-funded social welfare program in the United States. SNAP provides food assistance to low-income families, helping to alleviate hunger and promote nutritional well-being.

Infrastructure Development

Tax revenue is instrumental in developing and maintaining critical infrastructure, which forms the backbone of a nation’s economy and society. It funds projects such as:

Transportation Networks

Taxes contribute to the construction and maintenance of roads, bridges, railways, and public transportation systems. These investments enhance mobility, facilitate trade, and connect communities, contributing to economic growth and improved quality of life.

In many countries, a portion of fuel taxes is dedicated to road infrastructure development. For instance, the Highway Trust Fund in the United States uses gas tax revenue to finance road construction and maintenance, ensuring safe and efficient travel for all.

Energy and Utilities

Tax revenue supports the development of energy infrastructure, including power plants, transmission lines, and renewable energy projects. It also funds public utilities such as water treatment facilities, ensuring access to essential services for citizens.

The Clean Energy for America Act, proposed in the U.S. Congress, aims to use tax incentives to promote the adoption of clean energy technologies and reduce carbon emissions. This demonstrates how tax policy can drive infrastructure development and environmental sustainability.

Communication Systems

Taxes contribute to the establishment and upkeep of communication networks, including internet infrastructure and telecommunications systems. This ensures that communities have access to reliable communication services, which are essential for economic activity, education, and social connectivity.

The Broadband Infrastructure Program, funded by the U.S. government, aims to expand broadband internet access in rural and underserved areas. This initiative demonstrates how tax-funded infrastructure projects can bridge the digital divide and enhance connectivity nationwide.

Economic Stability and Growth

Tax revenue is not only used to fund immediate needs but also to support long-term economic stability and growth. Governments utilize tax revenue for various economic initiatives, including:

Debt Management

Taxes contribute to the repayment of government debt, ensuring fiscal responsibility and maintaining the country’s creditworthiness. This, in turn, attracts foreign investment and promotes economic growth.

Economic Stimulus

During economic downturns, tax revenue can be used to fund stimulus packages, which provide financial support to individuals and businesses. These packages aim to boost consumer spending, stimulate economic activity, and prevent widespread unemployment.

The American Recovery and Reinvestment Act of 2009 is a notable example of a tax-funded economic stimulus package. It provided tax cuts, extended unemployment benefits, and invested in infrastructure and clean energy projects to counteract the effects of the Great Recession.

Research and Development

Tax revenue supports research and development initiatives, fostering innovation and technological advancement. This investment can lead to breakthroughs in various fields, including healthcare, energy, and technology, which have long-term economic and societal benefits.

The National Science Foundation (NSF) in the United States is funded by tax dollars and plays a pivotal role in supporting basic research and education in all non-medical fields of science and engineering. The NSF's investments have led to numerous scientific discoveries and technological advancements.

Environmental Conservation and Sustainability

Tax revenue is increasingly being utilized to support environmental conservation and sustainability initiatives. Governments are recognizing the importance of investing in a greener future, and taxes are a crucial tool in this endeavor.

Environmental Protection Programs

Taxes fund programs aimed at preserving and protecting the environment, such as wildlife conservation, habitat restoration, and pollution control initiatives. These programs ensure the long-term health and sustainability of our natural resources.

The Land and Water Conservation Fund (LWCF) in the United States is a prime example of tax-funded environmental protection. It uses revenue from offshore oil and gas leasing to acquire and protect important natural areas, ensuring that future generations can enjoy and benefit from these resources.

Climate Change Mitigation

Taxes can be used to incentivize and support initiatives that reduce carbon emissions and mitigate the impacts of climate change. This includes funding renewable energy projects, implementing carbon pricing mechanisms, and supporting adaptation strategies.

The European Union's Emissions Trading System (EU ETS) is a cap-and-trade system that uses taxes and allowances to reduce greenhouse gas emissions from power plants and industrial facilities. This demonstrates how tax policy can drive the transition to a low-carbon economy.

Global Impact and Foreign Aid

Tax revenue also plays a role in shaping a nation’s global impact and its commitment to international development. Governments allocate a portion of tax revenue to foreign aid and international assistance programs, which can have a significant impact on global poverty reduction and sustainable development.

Foreign Aid and Development Assistance

Taxes fund foreign aid programs, which provide financial and technical support to developing countries. These programs aim to alleviate poverty, improve healthcare and education, and promote economic development in recipient nations.

The United States Agency for International Development (USAID) is a prime example of a tax-funded foreign aid organization. USAID works in over 100 countries, providing assistance in areas such as health, education, governance, and economic growth.

International Partnerships

Tax revenue supports international partnerships and collaborations, which are essential for addressing global challenges such as climate change, disease outbreaks, and refugee crises. These partnerships enhance global cooperation and solidarity.

The Global Fund to Fight AIDS, Tuberculosis, and Malaria is a multilateral organization that relies on donations from governments, including tax-funded contributions. This fund has played a critical role in reducing the burden of these diseases worldwide, demonstrating the power of international cooperation funded by taxes.

The Impact of Tax Revenue on Society

The efficient and transparent allocation of tax revenue is crucial for a society’s well-being and progress. When tax dollars are effectively utilized, they can lead to significant improvements in public services, infrastructure, and overall quality of life. However, it is essential to hold governments accountable for how they spend this revenue to ensure that it is used for the benefit of all citizens.

Public engagement and transparency in tax allocation processes can help ensure that tax revenue is distributed equitably and used efficiently. This includes advocating for policies that prioritize the needs of vulnerable communities and investing in initiatives that promote social and economic justice.

Conclusion

Taxes are not merely a financial obligation; they are a crucial tool for shaping the society we live in. From funding essential public services to driving economic growth and promoting environmental sustainability, tax revenue plays a pivotal role in creating a better future for all. By understanding how taxes are utilized, we can appreciate the impact of our contributions and actively engage in discussions about how tax revenue can be allocated more effectively to address the most pressing needs of our communities.

What percentage of tax revenue goes to specific sectors like education or healthcare?

+

The allocation of tax revenue varies greatly between countries and regions. In the United States, for example, about 25% of federal tax revenue goes towards healthcare, while education receives funding from both federal and state taxes, with state-level allocations varying significantly.

How do taxes impact the economy and business operations?

+

Taxes have a significant impact on the economy and business operations. They can influence consumer spending, investment decisions, and business profitability. Governments often use tax policies to encourage certain economic behaviors, such as promoting renewable energy adoption or incentivizing research and development.

Are there any tax-funded initiatives that focus on community development and social equity?

+

Yes, many governments allocate tax revenue to community development initiatives aimed at reducing inequality and promoting social equity. These initiatives may include housing assistance programs, job training initiatives, and community-based health and wellness programs.

How can citizens ensure their tax dollars are used effectively and transparently?

+

Citizens can engage in public discussions, advocate for transparency in government spending, and support organizations that monitor and advocate for effective tax allocation. Additionally, participating in the democratic process and holding elected officials accountable can help ensure that tax dollars are used in the best interests of the community.

What is the role of tax revenue in addressing climate change and environmental issues?

+

Tax revenue plays a crucial role in funding environmental protection and climate change mitigation efforts. Governments can use tax policies to incentivize sustainable practices, support renewable energy projects, and promote the transition to a low-carbon economy. Additionally, tax-funded research and development can lead to technological advancements that help address environmental challenges.