Fairfax City Property Tax

Understanding Fairfax City property taxes is essential for homeowners and prospective buyers alike. In this comprehensive guide, we will delve into the intricacies of property taxes in Fairfax City, offering a detailed breakdown of how they are calculated, the factors that influence them, and the resources available to navigate the process effectively.

The Fundamentals of Fairfax City Property Taxes

Property taxes are a significant financial obligation for property owners, and in Fairfax City, they are an integral part of the local economy and community. These taxes are levied on both residential and commercial properties, with the revenue generated playing a crucial role in funding essential services, infrastructure, and public amenities.

The Fairfax City government assesses properties annually to determine their fair market value, which forms the basis for calculating property taxes. This assessment process ensures that property owners contribute proportionally to the city's budget, reflecting the value of their property and its potential tax liability.

Assessment Methodology

The assessment process in Fairfax City is meticulous, involving a comprehensive evaluation of each property’s characteristics. Assessors consider factors such as the property’s size, location, age, recent sales data, and improvements made to determine its market value. This value is then subject to a tax rate, which is set by the city council, to arrive at the property tax liability.

For instance, consider a residential property located in a desirable neighborhood. If this property has recently undergone renovations, increasing its market value, the assessment would reflect these improvements, leading to a higher tax liability. On the other hand, an older property in need of updates may have a lower assessment and, consequently, a lower tax bill.

| Property Type | Assessment Methodology |

|---|---|

| Residential | Market value based on sales data, location, and improvements. |

| Commercial | Evaluation of income potential, comparable leases, and market trends. |

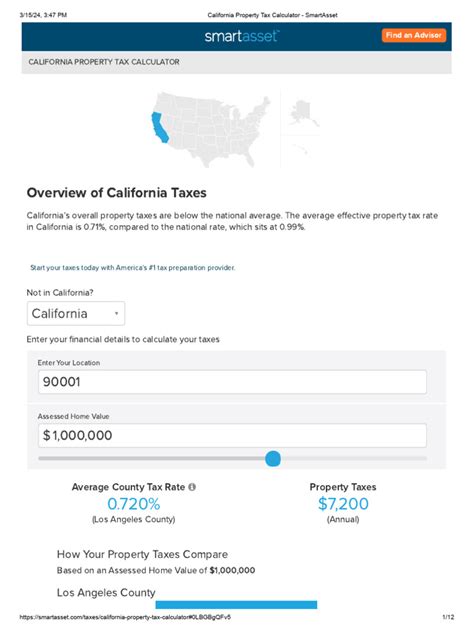

Tax Rates and Calculations

The tax rate, expressed as a percentage, is a crucial determinant of the property tax bill. This rate is typically set annually by the city council, taking into account the city’s budgetary needs and the assessment values of properties within its jurisdiction.

To illustrate, let's consider a residential property with an assessed value of $500,000 and a tax rate of 1.2%. The property tax liability for this property would be calculated as follows: $500,000 x 0.012 = $6,000. Thus, the owner of this property would be responsible for paying an annual property tax of $6,000.

Exemptions and Credits

Fairfax City offers various exemptions and credits to eligible property owners, aiming to provide relief and support to specific segments of the community. These exemptions and credits can significantly reduce the property tax liability for qualifying homeowners.

- Homestead Exemption: This exemption reduces the assessed value of a primary residence by a certain amount, resulting in a lower tax bill. It is designed to provide relief to homeowners, especially those on fixed incomes.

- Senior Citizen Exemption: Fairfax City offers an additional exemption for senior citizens, further reducing the tax burden for eligible individuals aged 65 and above.

- Military Service Exemption: Active-duty military personnel and veterans may be eligible for property tax exemptions, as a token of appreciation for their service.

- Disabled Veterans Credit: Disabled veterans can apply for a credit that reduces their property tax liability, providing much-needed financial support.

Resources and Support for Property Owners

Navigating the complexities of property taxes can be daunting, but Fairfax City provides an array of resources and support to assist property owners. These resources aim to ensure transparency, fairness, and ease of understanding in the property tax process.

Online Tax Estimator

The Fairfax City website offers an online tax estimator tool, allowing property owners to estimate their tax liability based on their property’s assessed value and the current tax rate. This tool provides a quick and convenient way to gain insights into potential tax obligations.

Assessment Review Process

If a property owner believes their assessment is inaccurate, they have the right to request a review. The assessment review process in Fairfax City is designed to be accessible and fair, providing an opportunity for property owners to present their case and potentially adjust their assessment.

During the review process, owners can provide evidence such as recent sales data, appraisals, or other relevant information to support their claim. The assessor's office carefully considers this information and may adjust the assessment if warranted, ensuring fairness and accuracy in the tax assessment process.

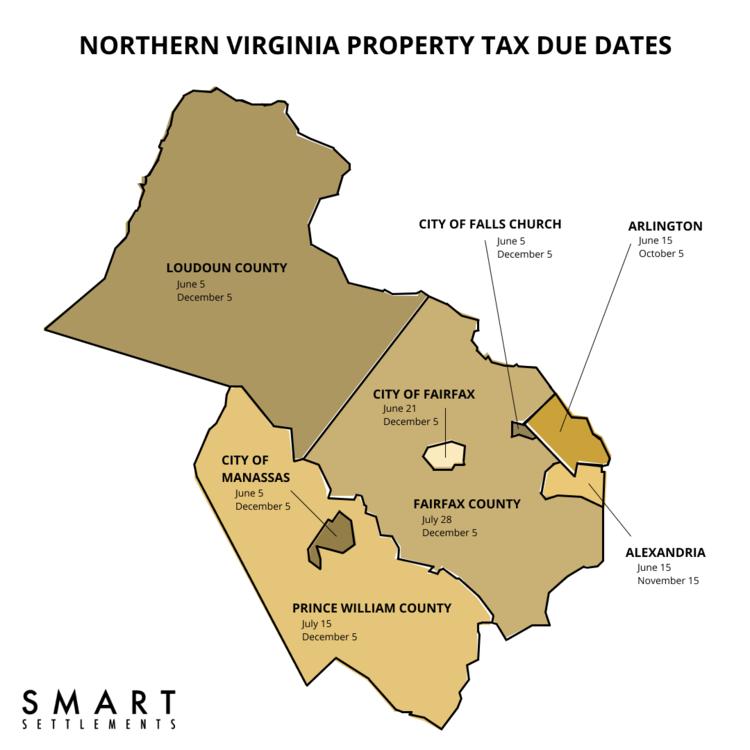

Payment Options and Assistance

Fairfax City offers flexible payment options to accommodate the diverse financial circumstances of property owners. Taxpayers can choose to pay their property taxes in full or opt for installment plans, providing financial flexibility.

Additionally, the city provides resources and information on various tax relief programs, such as deferred payment plans for eligible homeowners facing financial hardship. These programs aim to ensure that property owners can meet their tax obligations without undue strain.

Conclusion: A Comprehensive Guide to Fairfax City Property Taxes

Understanding Fairfax City property taxes is essential for property owners to navigate their financial obligations effectively. This guide has provided an in-depth look at the assessment process, tax calculations, exemptions, and the resources available to support property owners.

By staying informed and utilizing the resources provided by Fairfax City, homeowners can ensure they are prepared for their property tax obligations, contributing to the vibrant community and essential services the city provides.

How often are properties assessed in Fairfax City?

+Properties in Fairfax City are assessed annually to ensure that property taxes reflect the current market value.

Are there any online resources to understand my property’s assessment?

+Yes, Fairfax City provides an online property assessment database, allowing property owners to view their assessment details and compare them with similar properties.

Can I appeal my property’s assessment if I believe it’s inaccurate?

+Absolutely! Fairfax City offers a fair and transparent assessment review process. Property owners can request a review and provide evidence to support their case.

Are there any exemptions or credits available for homeowners in Fairfax City?

+Yes, Fairfax City provides various exemptions and credits, including the Homestead Exemption, Senior Citizen Exemption, Military Service Exemption, and Disabled Veterans Credit, to provide relief to eligible homeowners.