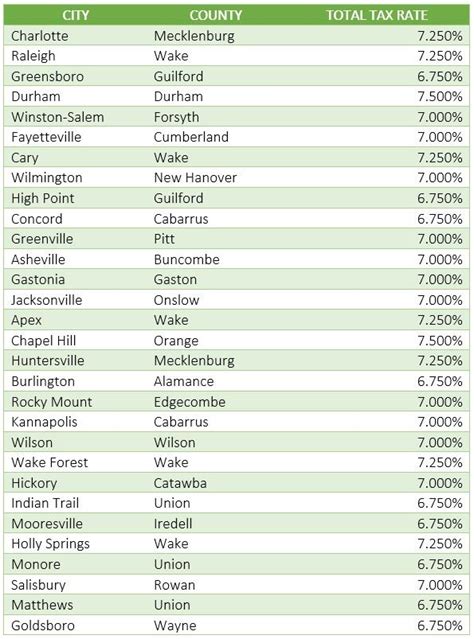

Is Ein Number The Same As Tax Id

The EIN number and the Tax ID are closely related but distinct concepts in the realm of taxation and business identification. This article aims to clarify their differences, uses, and significance in the business world, providing a comprehensive guide for entrepreneurs and accountants alike.

Understanding the EIN Number

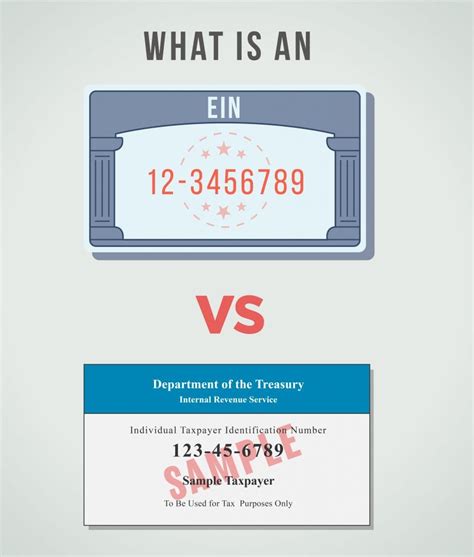

The Employer Identification Number (EIN), often referred to as a Federal Tax Identification Number or simply an EIN, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) in the United States. It serves as a crucial identifier for businesses of all sizes, including corporations, partnerships, sole proprietorships, and non-profit organizations.

An EIN is required for various business activities, such as opening a business bank account, applying for business loans, and filing tax returns. It acts as a vital tool for the IRS to track business transactions and enforce tax regulations. Notably, an EIN does not expire and remains active as long as the business entity exists.

Application Process

The process of obtaining an EIN is straightforward and can be done online through the IRS website. The application requires basic information about the business, including the legal name, address, and the nature of the business activities. It’s important to note that the EIN is unique to each business entity and cannot be shared or used by other entities, even if they are affiliated.

Structure and Format

An EIN is typically structured in the format of two digits, a hyphen, two digits, another hyphen, and four digits (XX-XX-XXXX). The first two digits indicate the type of business, with 01-09 reserved for corporations, 10-39 for partnerships, and 40-99 for exempt organizations. The remaining digits are sequentially assigned by the IRS.

Importance in Business Operations

Beyond its use in tax filings and financial transactions, an EIN plays a critical role in business operations. It facilitates compliance with various regulations, including employment tax reporting, payroll processing, and withholding taxes. Furthermore, an EIN is often required for licensing and permitting processes, as well as for establishing credit with vendors and suppliers.

| EIN Number Benefits |

|---|

| Enables tax reporting and compliance |

| Facilitates business banking and financial transactions |

| Aids in establishing business credibility |

| Required for employment and payroll processes |

Demystifying the Tax ID

While the term Tax ID is often used interchangeably with EIN, it’s important to clarify that a Tax ID is a broader term encompassing various identification numbers used for tax purposes. These can include the EIN, Social Security Number (SSN), and Individual Taxpayer Identification Number (ITIN), each serving different purposes in the tax system.

Social Security Number (SSN)

An SSN is a nine-digit number issued by the Social Security Administration (SSA) in the U.S. It is primarily used to track individuals’ earnings and benefits for Social Security purposes. However, SSNs are also used for tax filing, as they serve as the Tax ID for individuals and sole proprietors who do not require an EIN for their business activities.

Individual Taxpayer Identification Number (ITIN)

The ITIN is a tax processing number issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, an SSN. This includes foreign nationals and their dependents who are residing in the U.S. and need to file U.S. tax returns.

Differences Between EIN and Tax ID

While an EIN is specifically designed for business entities, a Tax ID encompasses the various identification numbers used for tax purposes by both individuals and businesses. The choice of Tax ID depends on the individual’s or business’s circumstances and legal status.

| EIN | Tax ID |

|---|---|

| Specific to business entities | Covers individual and business tax identification |

| Assigned by the IRS | Issued by SSA or IRS |

| Required for business operations and tax filings | Used for individual and business tax purposes |

The Intersection of EIN and Tax ID

Despite their differences, the EIN and Tax ID often intersect in the business world. For instance, when a sole proprietor or an independent contractor incorporates their business, they must apply for an EIN, as their SSN can no longer be used for business tax purposes. Similarly, when a foreign national starts a business in the U.S., they may need to obtain both an ITIN and an EIN, depending on their business structure and tax obligations.

Tax Compliance and Reporting

The use of the correct Tax ID, whether it’s an EIN, SSN, or ITIN, is critical for accurate tax compliance and reporting. Misusing or failing to use the appropriate Tax ID can lead to significant penalties and complications with the IRS. It’s important for businesses and individuals to understand their tax obligations and seek professional advice when necessary.

Future Trends and Developments

As the tax landscape continues to evolve, the use of Tax IDs is likely to become more sophisticated. The IRS is continually working on enhancing its systems to improve tax administration and reduce fraud. This includes potential changes to the structure and application process of Tax IDs, which businesses and individuals should stay informed about to ensure compliance.

Conclusion

In conclusion, while the terms EIN and Tax ID are often used interchangeably, they represent distinct concepts in the world of taxation. An EIN is a unique identifier for business entities, while a Tax ID encompasses the various identification numbers used for tax purposes, including the EIN, SSN, and ITIN. Understanding the differences and applications of these identifiers is crucial for businesses and individuals to navigate the complex landscape of tax regulations effectively.

Can an EIN be used for personal tax filings?

+No, an EIN is exclusively used for business tax filings and cannot be used for personal tax purposes. Individuals should use their SSN for personal tax filings unless they are non-residents or ineligible for an SSN, in which case they would use an ITIN.

Do all businesses need an EIN?

+Not all businesses require an EIN. Sole proprietors who do not have employees and who do not need to file employment tax returns can use their SSN for tax purposes. However, many businesses choose to obtain an EIN for simplicity and to establish a separate business identity.

Can a business have multiple EINs?

+Yes, a business can have multiple EINs, especially if it has multiple entities or operates in different states. Each distinct business entity requires its own EIN for tax and compliance purposes.