When Are Llc Taxes Due 2025

LLC taxes are an essential aspect of running a limited liability company, and understanding the due dates for various tax obligations is crucial for business owners to stay compliant and avoid penalties. This article will delve into the LLC tax landscape for the year 2025, providing a comprehensive guide to help you navigate the tax calendar effectively. By the end of this article, you'll have a clear understanding of the key tax deadlines and the steps you can take to ensure a smooth and stress-free tax process.

Understanding the LLC Tax Landscape in 2025

Limited Liability Companies (LLCs) offer a flexible business structure that provides owners with personal asset protection while allowing for pass-through taxation. This unique combination makes LLCs a popular choice for small businesses and entrepreneurs. However, with the benefits come certain tax responsibilities, and it's essential to stay on top of these obligations to maintain your LLC's good standing.

The tax year for LLCs generally follows the calendar year, which means the majority of tax deadlines fall within the same period for all LLCs. However, there are some exceptions and variations depending on the specific tax type and the LLC's tax classification. Let's explore the key tax deadlines and requirements for LLCs in 2025.

Federal Income Tax Deadlines

The Internal Revenue Service (IRS) sets the federal income tax deadlines for LLCs, which are as follows:

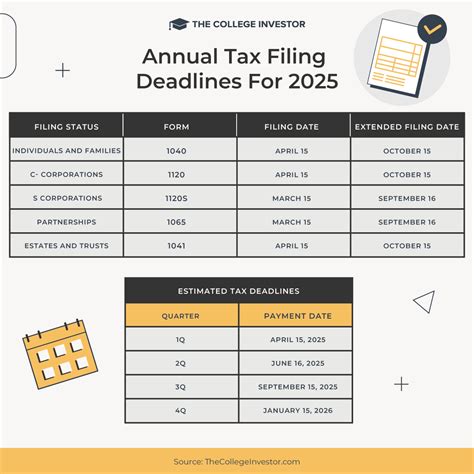

Estimated Quarterly Tax Payments

LLCs, like other businesses, are required to make estimated tax payments throughout the year if they expect to owe taxes of $1,000 or more for the year. These payments are due on specific dates to ensure a steady flow of tax revenue for the government.

| Quarter | Due Date |

|---|---|

| 1st Quarter | April 15, 2025 |

| 2nd Quarter | June 16, 2025 |

| 3rd Quarter | September 15, 2025 |

| 4th Quarter | January 15, 2026 |

It's crucial to note that these dates are not negotiable, and late payments may incur penalties and interest charges. LLCs can make these payments online through the IRS website or by mailing a check to the appropriate IRS location.

Annual Income Tax Return

The annual income tax return for LLCs is due on March 15, 2026, for the tax year ending December 31, 2025. This return, known as Form 1065, is used to report the LLC's income, deductions, and credits. LLCs must also include Schedule K-1 for each member, detailing their share of the company's income and losses.

If an LLC's tax year ends on a date other than December 31, the due date for its income tax return is the 15th day of the fourth month following the end of its tax year. For example, an LLC with a tax year ending on June 30, 2025, would have its income tax return due on October 15, 2025.

State and Local Taxes

In addition to federal taxes, LLCs must also comply with state and local tax laws, which can vary significantly across jurisdictions. Here's an overview of the key state and local tax considerations:

State Income Tax

LLCs doing business in a state are typically required to pay state income taxes. The deadlines for state income tax returns can vary, so it's essential to check the specific requirements in each state where your LLC operates. Some states, like California and New York, have dedicated tax agencies that provide resources and guidance for businesses.

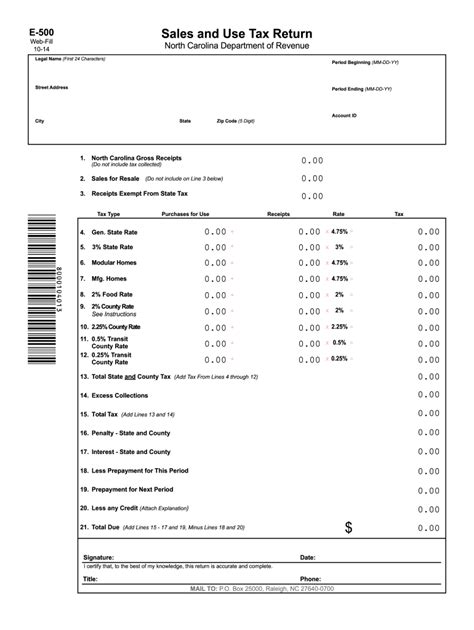

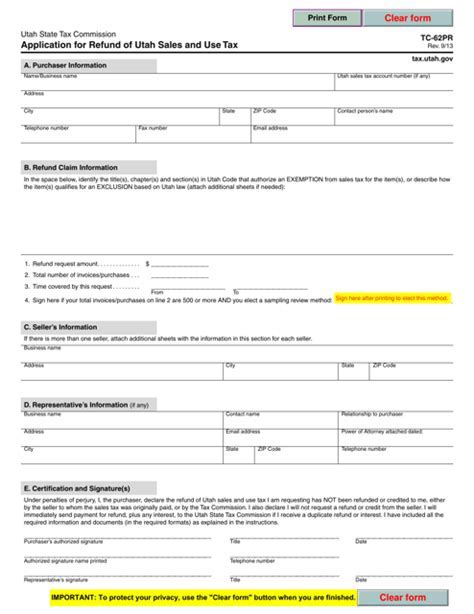

Sales and Use Taxes

If your LLC sells tangible goods or certain services, you may need to collect and remit sales tax to the state. The frequency of sales tax payments can vary, with some states requiring monthly, quarterly, or annual payments. Additionally, some states have specific requirements for online sellers, so it's crucial to understand the rules in your state.

Franchise and Privilege Taxes

Certain states impose franchise or privilege taxes on LLCs, which are fees for the privilege of doing business in that state. These taxes are often based on the LLC's net worth, assets, or gross receipts. Deadlines for franchise tax payments can vary, so it's essential to stay informed about the requirements in your state.

Employment Taxes and Payroll

If your LLC has employees, you'll have additional tax obligations related to payroll and employment taxes. Here's a breakdown of the key deadlines:

Federal Employment Taxes

LLCs must withhold federal income tax, Social Security tax, and Medicare tax from their employees' wages. These taxes are due to the IRS on a quarterly basis, with the deadlines falling on the same dates as the estimated quarterly tax payments mentioned earlier.

State Employment Taxes

Similar to federal employment taxes, LLCs must also withhold state income taxes and pay state unemployment taxes if applicable. The deadlines for these taxes vary by state, and some states may require more frequent payments, such as monthly or semi-weekly.

Payroll Tax Deposits

LLCs must deposit payroll taxes with the IRS and state tax agencies on a regular basis. The frequency of these deposits can vary based on the amount of taxes withheld and the LLC's deposit schedule, which is determined by the IRS. It's crucial to stay on top of these deposits to avoid penalties and interest.

Other Tax Considerations for LLCs

Beyond the standard tax obligations, LLCs may have additional tax responsibilities depending on their specific circumstances. Here are a few key considerations:

Self-Employment Taxes

Members of an LLC who are also employees may be subject to self-employment taxes, which fund Social Security and Medicare benefits. These taxes are due with the LLC's annual income tax return and are reported on Schedule SE.

Excise Taxes

LLCs involved in specific industries or activities may be subject to excise taxes, such as those on fuel, environmental taxes, or taxes on certain services. The deadlines and requirements for excise taxes can vary widely, so it's essential to consult with a tax professional or refer to the IRS guidelines for your specific situation.

Foreign LLCs

If your LLC has foreign members or does business internationally, you may have additional tax obligations related to foreign income, withholding, and reporting requirements. The IRS provides specific guidelines for foreign LLCs, and it's crucial to stay compliant with these regulations to avoid penalties.

Strategies for Tax Preparation and Compliance

Staying on top of your LLC's tax obligations can be challenging, but with the right strategies and resources, you can ensure a smooth and stress-free tax process. Here are some tips to help you prepare for the 2025 tax year:

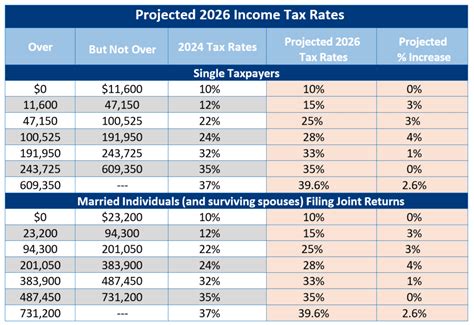

1. Stay Informed

Tax laws and regulations can change frequently, so it's essential to stay updated on any new developments that may impact your LLC. Sign up for tax newsletters, follow reputable tax blogs, and consult with tax professionals to ensure you're aware of any changes that may affect your tax obligations.

2. Organize Your Records

Proper record-keeping is crucial for tax preparation. Ensure that you maintain accurate and organized records of your LLC's income, expenses, and transactions throughout the year. This will make the tax preparation process more efficient and help you identify any potential deductions or credits you may be eligible for.

3. Consider Professional Assistance

Tax laws can be complex, and LLCs may have unique tax situations that require specialized knowledge. Consider working with a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), who can provide expert guidance and ensure your tax obligations are met accurately and on time.

4. Utilize Tax Software

Tax software can simplify the tax preparation process and help you file your taxes accurately. There are various tax software options available, ranging from basic to advanced features. Choose a software that suits your needs and ensures compatibility with your LLC's tax situation.

5. Plan for Quarterly Payments

To avoid late payment penalties, plan ahead for your estimated quarterly tax payments. Consider setting aside funds specifically for taxes and creating a payment schedule to ensure you have the necessary funds available when the deadlines approach.

6. Stay on Top of State and Local Requirements

State and local tax obligations can be complex and vary widely. Make sure you understand the specific requirements in each state where your LLC operates. Stay informed about any changes to state tax laws and consider seeking guidance from state tax agencies or tax professionals familiar with local tax regulations.

FAQs

Q: Can LLCs choose a different tax year than the calendar year?

+Yes, LLCs have the option to choose a tax year that aligns with their business cycle or fiscal year. However, changing the tax year requires approval from the IRS, and the process can be complex. It’s recommended to consult with a tax professional before making any changes.

Q: How often do LLCs need to file estimated tax payments?

+LLCs are required to make estimated tax payments quarterly if their tax liability for the year is expected to be $1,000 or more. These payments help ensure a steady flow of tax revenue for the government.

Q: What happens if an LLC misses a tax deadline?

+Missing a tax deadline can result in penalties and interest charges. It’s important to stay on top of your tax obligations to avoid these additional costs. If you anticipate missing a deadline, consider requesting an extension, but be aware that extensions only apply to the filing of tax returns, not the payment of taxes.

Q: Can LLC members deduct their business losses on their personal tax returns?

+The tax treatment of LLC losses depends on the LLC’s tax classification. For pass-through entities, members can generally deduct their share of the LLC’s losses on their personal tax returns. However, there are limits and restrictions on loss deductions, so it’s essential to consult with a tax professional for guidance.

Q: Are there any tax benefits for LLCs that hire employees?

+Yes, LLCs that hire employees may be eligible for certain tax credits and deductions related to payroll taxes and employee benefits. These can include credits for hiring veterans or individuals from targeted groups, as well as deductions for providing health insurance or retirement plans to employees. Consult with a tax professional to explore these potential benefits.