Indiana Income Tax Calculator

Are you looking for a convenient way to calculate your Indiana income tax obligations? With the Indiana Income Tax Calculator, you can effortlessly estimate your state income tax liability and plan your finances accordingly. This user-friendly tool simplifies the process, ensuring you stay compliant with Indiana's tax regulations. In this comprehensive guide, we will delve into the workings of the Indiana Income Tax Calculator, providing you with the knowledge and insights to navigate your tax responsibilities with ease.

Understanding Indiana’s Income Tax Structure

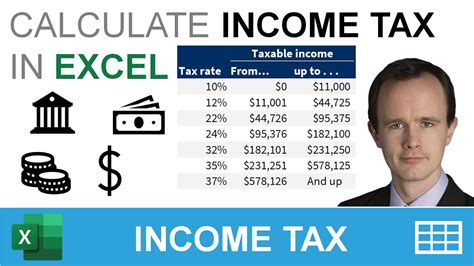

Indiana, like many other states, imposes an income tax on its residents and businesses. The tax system is designed to contribute to the state’s revenue, funding various public services and infrastructure projects. The income tax rate in Indiana is progressive, meaning it varies based on your taxable income. Understanding this structure is crucial for accurately calculating your tax liability.

Indiana's income tax rates are divided into brackets, with higher incomes facing higher tax rates. As of my last update in January 2023, the state offers a standard deduction of $1,500 for single filers and $3,000 for married couples filing jointly. Additionally, there are personal exemptions and various credits and deductions available to reduce your taxable income.

Key Components of Indiana’s Income Tax System

- Tax Brackets and Rates: Indiana has five tax brackets, ranging from 3.23% to 6.45% for taxable income above $130,000. These rates are applied to different income levels, with the tax liability increasing as income rises.

- Deductions and Exemptions: Residents can claim deductions for certain expenses, such as mortgage interest, property taxes, and charitable contributions. Personal exemptions are also available, reducing the taxable income for each dependent.

- Credits and Incentives: Indiana offers various tax credits, including the Child and Dependent Care Credit, Education Tax Credit, and the Property Tax Deduction. These credits can significantly impact your tax liability, making it essential to understand their eligibility criteria.

Using the Indiana Income Tax Calculator

The Indiana Income Tax Calculator is a powerful tool designed to assist taxpayers in estimating their state income tax liability. It considers various factors, including your filing status, income, deductions, and credits, to provide an accurate estimate of your tax obligation.

Step-by-Step Guide to Using the Calculator

- Filing Status: Begin by selecting your filing status. The options typically include Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Your filing status impacts the tax rates and deductions you are eligible for.

- Income Information: Input your total income, including wages, salaries, tips, investments, and any other taxable sources. Ensure you include all forms of income to get an accurate estimate.

- Deductions and Credits: The calculator allows you to input various deductions and credits. Here, you can enter standard deductions, itemized deductions, and applicable credits. Make sure to review Indiana’s tax guidelines to maximize your deductions.

- Calculate: Once you have entered all the necessary information, click the “Calculate” button. The calculator will process your data and provide an estimate of your Indiana income tax liability.

The calculator's output will typically display your taxable income, applicable tax rate, and the estimated tax amount. It may also provide a breakdown of your deductions and credits, helping you understand the impact of each on your tax liability.

Benefits of Using the Income Tax Calculator

- Accuracy: The calculator ensures precision by considering Indiana’s complex tax laws and regulations. It helps you avoid underpayment or overpayment of taxes, which could lead to penalties or missed opportunities for refunds.

- Time-Saving: Manually calculating taxes can be time-consuming and prone to errors. The calculator automates the process, allowing you to obtain a quick and accurate estimate, saving you valuable time.

- Planning and Budgeting: With an estimated tax liability, you can better plan your finances throughout the year. It enables you to allocate funds for tax payments, ensuring you stay on top of your financial obligations.

- Easy Adjustment: The calculator allows you to experiment with different scenarios. You can input various income levels, deductions, and credits to see how they impact your tax liability. This feature is especially useful for tax planning and optimizing your financial strategies.

Indiana Income Tax Calculator: A Valuable Tool for Taxpayers

The Indiana Income Tax Calculator is an invaluable resource for residents and businesses operating within the state. It simplifies the process of estimating tax liabilities, ensuring compliance with Indiana’s tax laws. By utilizing this tool, taxpayers can navigate the complexities of the state’s tax system with ease, leading to better financial management and planning.

Remember, while the calculator provides an accurate estimate, it is always recommended to consult with a tax professional for personalized advice and to ensure compliance with the latest tax regulations. Stay informed, and take control of your tax obligations with the help of the Indiana Income Tax Calculator.

Frequently Asked Questions

What are the tax brackets in Indiana for 2023?

+

As of my knowledge cutoff in January 2023, Indiana’s tax brackets are as follows: 3.23% on taxable income up to 10,000, 3.33% on income between 10,000 and 25,000, 3.45% for income between 25,000 and 100,000, 4.75% for income between 100,000 and 130,000, and 6.45% for taxable income above 130,000.

Are there any deductions or credits available in Indiana’s income tax system?

+

Yes, Indiana offers various deductions and credits. These include the standard deduction, itemized deductions, personal exemptions, and credits like the Child and Dependent Care Credit, Education Tax Credit, and Property Tax Deduction. Consult Indiana’s tax guidelines for detailed information on eligibility and requirements.

How accurate are the estimates provided by the Indiana Income Tax Calculator?

+

The Indiana Income Tax Calculator is designed to provide highly accurate estimates based on the information you input. However, it’s important to note that it may not account for every unique tax situation. For precise calculations, especially in complex scenarios, consulting a tax professional is recommended.

Can I use the calculator to plan my tax payments throughout the year?

+

Absolutely! The calculator’s ability to provide estimated tax liabilities allows you to plan your finances accordingly. By regularly using the calculator, you can adjust your savings or payments to ensure you have sufficient funds to meet your tax obligations.

Is the Indiana Income Tax Calculator suitable for businesses as well as individuals?

+

Yes, the calculator can be used by both individuals and businesses. It considers various income sources and deductions, making it versatile for different taxpayers. However, businesses may have additional considerations and should consult tax professionals for comprehensive guidance.