Ga Tax Valorem

Welcome to an in-depth exploration of the Ga Tax Valorem, a unique tax system employed in the state of Georgia, USA. This article aims to unravel the intricacies of this taxation method, providing a comprehensive guide for individuals and businesses alike. As we delve into the specifics, we'll uncover the purpose, mechanics, and implications of the Ga Tax Valorem, ensuring a thorough understanding of its role in Georgia's economic landscape.

Understanding the Ga Tax Valorem

The Ga Tax Valorem, officially known as the ad valorem tax, is a significant component of Georgia’s tax structure. It is a crucial revenue generator for the state, contributing substantially to the funding of various public services and infrastructure projects.

At its core, the Ga Tax Valorem is a property tax system, levied on the assessed value of real and personal property within the state. This tax plays a vital role in maintaining the state's financial stability and supporting essential services like education, healthcare, and public safety.

Historical Context and Development

The origins of the Ga Tax Valorem can be traced back to the early 20th century when Georgia, like many other states, sought a more equitable and efficient method of taxation. The traditional property tax systems of the time often led to disparities and complexities, prompting a need for reform.

In the 1970s, Georgia embarked on a comprehensive tax reform journey, aiming to simplify and standardize its tax structure. This reform process resulted in the implementation of the ad valorem tax system, which aimed to bring fairness and transparency to property taxation.

Key Features of Ga Tax Valorem

The Ga Tax Valorem operates on several key principles that distinguish it from other tax systems:

- Assessment: Properties are assessed annually by county tax assessors. This assessment determines the value of the property, which serves as the basis for taxation.

- Tax Rate: The tax rate, also known as the millage rate, is set by local governments, including counties, cities, and school districts. This rate is applied to the assessed value to calculate the tax amount.

- Homestead Exemption: Georgia offers a homestead exemption, which reduces the assessed value of a primary residence, providing a tax relief benefit to homeowners.

- Equalization: The Ga Tax Valorem aims for equal taxation across properties with similar values. This is achieved through regular reassessments and adjustments to ensure fairness.

- Appeal Process: Property owners have the right to appeal their assessed value if they believe it is incorrect or unfair. This process ensures transparency and allows for corrections.

| Assessment Year | Total Tax Revenue (in USD) |

|---|---|

| 2022 | 4.2 Billion |

| 2021 | 3.9 Billion |

| 2020 | 3.6 Billion |

The table above provides a glimpse of the Ga Tax Valorem's financial impact, showcasing the steady growth in tax revenue over the past few years.

How the Ga Tax Valorem Works

Understanding the mechanics of the Ga Tax Valorem is crucial for property owners and businesses operating in Georgia. Let’s break down the process step by step:

Assessment Process

Each year, county tax assessors are responsible for determining the fair market value of properties within their jurisdiction. This involves conducting physical inspections, reviewing sales data, and considering other relevant factors.

Once the assessment is complete, property owners receive a notice of assessment, detailing the estimated value of their property. This assessment forms the basis for calculating the tax liability.

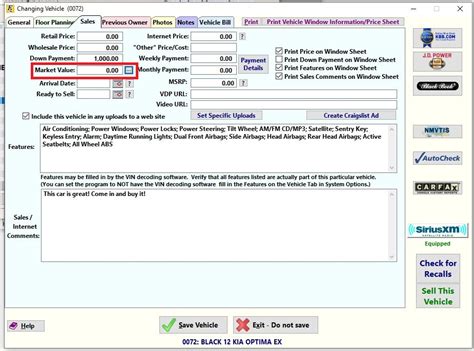

Tax Calculation

The tax calculation is a straightforward process. The assessed value is multiplied by the applicable millage rate to determine the tax amount. The millage rate is a decimal representation of the tax rate per dollar of assessed value.

For instance, if a property has an assessed value of $200,000 and the millage rate is 10 mills (0.010), the tax calculation would be:

$200,000 x 0.010 = $2,000

Thus, the property owner would owe $2,000 in Ga Tax Valorem for that year.

Payment and Due Dates

Property taxes in Georgia are typically due in two installments. The exact due dates may vary by county, but they generally align with specific periods in the year. Late payments often incur penalties and interest.

Tax Relief Programs

Georgia offers several tax relief programs to ease the burden on certain property owners. These include:

- Homestead Exemption: As mentioned earlier, this exemption reduces the assessed value of a primary residence, providing a direct tax benefit.

- Senior Citizen Exemption: Property owners aged 65 or older may qualify for a tax exemption based on their income level.

- Disabled Veteran Exemption: Certain disabled veterans are eligible for a partial or full exemption on their property taxes.

- Other Exemptions: Georgia also offers exemptions for religious organizations, charitable institutions, and certain types of agricultural land.

Impact and Implications

The Ga Tax Valorem has a significant impact on both individuals and businesses in Georgia. Let’s explore some of these implications in more detail.

For Property Owners

Property owners bear the direct responsibility for paying Ga Tax Valorem. This tax forms a substantial part of their annual expenses and can influence their financial planning and investment decisions.

The homestead exemption provides a much-needed relief for homeowners, making property ownership more affordable and sustainable. Additionally, the appeal process ensures that property owners have a say in their tax assessments, promoting fairness and accountability.

For Businesses

Businesses, particularly those with substantial real estate holdings, are also affected by the Ga Tax Valorem. The tax liability can impact their operating costs and overall profitability.

However, the transparency and fairness of the Ga Tax Valorem system provide businesses with a predictable tax environment. This stability can be beneficial for long-term planning and investment decisions, especially for companies considering expansion or relocation.

Economic Impact

The Ga Tax Valorem plays a pivotal role in Georgia’s economy. The tax revenue generated supports critical public services, infrastructure development, and education. It also contributes to the state’s fiscal health and stability.

Furthermore, the tax system's focus on fairness and transparency fosters a positive business environment, attracting investment and promoting economic growth. The steady increase in tax revenue over the years is a testament to the system's effectiveness and its contribution to Georgia's economic prosperity.

Future Outlook and Potential Reforms

As with any tax system, the Ga Tax Valorem is subject to ongoing evaluation and potential reforms. Here are some key considerations for the future:

Fairness and Equity

Ensuring that the Ga Tax Valorem remains fair and equitable is a continuous challenge. As property values fluctuate and economic conditions change, regular reassessments and adjustments are necessary to maintain fairness.

Additionally, addressing issues like the disparity in tax rates across counties and the impact of rising property values on long-term residents will be crucial in maintaining public support for the system.

Technological Advancements

The integration of technology can enhance the efficiency and accuracy of the Ga Tax Valorem system. Implementing advanced assessment tools, digital record-keeping, and online payment systems can streamline the process for both tax authorities and taxpayers.

Public Awareness and Education

Promoting public awareness and education about the Ga Tax Valorem is essential. Clear communication about the system’s workings, benefits, and appeal processes can foster a better understanding and reduce potential conflicts.

Potential Reforms

While the Ga Tax Valorem has been successful in achieving its goals, there are always opportunities for improvement. Some potential reforms could include:

- Expanding tax relief programs to support more property owners, especially those facing economic challenges.

- Exploring alternatives to the current assessment methodology to ensure accuracy and fairness.

- Implementing measures to reduce the administrative burden on property owners and tax authorities.

Conclusion

The Ga Tax Valorem is a vital component of Georgia’s tax structure, playing a critical role in funding public services and driving economic growth. Its focus on fairness, transparency, and efficiency has made it a model for other states seeking tax reform.

As Georgia continues to evolve and adapt to changing economic landscapes, the Ga Tax Valorem will likely undergo further refinements to ensure its sustainability and effectiveness. By staying informed and engaged, property owners and businesses can navigate this tax system with confidence, contributing to the state's prosperity.

What is the Ga Tax Valorem’s role in funding public services?

+The Ga Tax Valorem is a significant revenue generator for Georgia, contributing to the funding of essential public services such as education, healthcare, and public safety. The tax revenue ensures that these services remain accessible and of high quality for residents across the state.

How often are properties assessed for the Ga Tax Valorem?

+Properties are typically assessed annually by county tax assessors. This assessment determines the property’s value, which forms the basis for calculating the Ga Tax Valorem.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is incorrect or unfair. This process ensures transparency and allows for corrections to be made if needed.

Are there any tax relief programs available in Georgia?

+Yes, Georgia offers several tax relief programs, including the homestead exemption, senior citizen exemption, and disabled veteran exemption. These programs provide direct tax benefits to eligible property owners.