Reverse Tax Calc

Welcome to a comprehensive guide on the intriguing concept of Reverse Tax Calc. This innovative approach to financial planning is an essential tool for individuals and businesses alike, offering a unique perspective on tax strategies. In today's complex tax landscape, understanding how to navigate the system efficiently is crucial for optimizing financial health.

Unraveling the Concept: Reverse Tax Calc

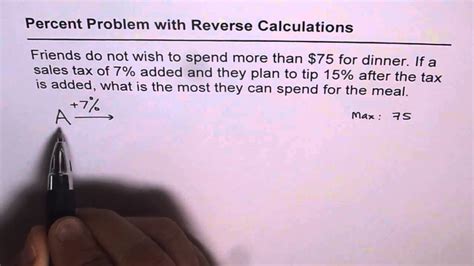

Reverse Tax Calc is an advanced financial strategy that involves a thorough analysis of one’s tax position, aiming to optimize tax planning and maximize financial returns. It’s a departure from traditional tax calculation methods, offering a more proactive and strategic approach to tax management.

This technique is particularly beneficial for those looking to minimize tax liabilities, maximize deductions, and plan for long-term financial goals. By taking a holistic view of an individual's or business's financial situation, Reverse Tax Calc allows for more effective tax strategies to be implemented.

The Benefits of Reverse Tax Calc

One of the primary advantages of this method is its ability to provide a clear roadmap for tax optimization. It helps identify areas where tax savings can be made, whether through strategic investments, pension contributions, or other tax-efficient strategies.

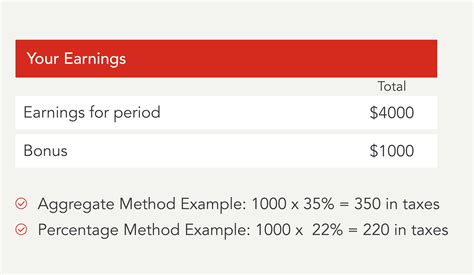

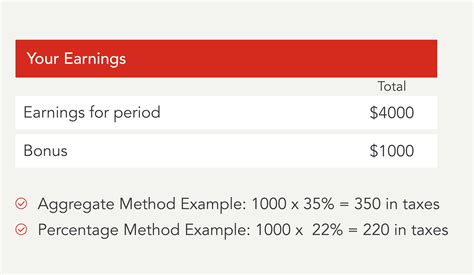

For instance, consider a small business owner who has been using traditional tax calculation methods. With Reverse Tax Calc, they might discover that by adjusting their payroll structure and implementing a more tax-efficient bonus scheme, they can significantly reduce their overall tax burden. This not only frees up capital for business growth but also improves the business's long-term financial health.

Moreover, Reverse Tax Calc can be a powerful tool for individuals looking to plan for retirement. By analyzing their current tax position and projected income, they can make informed decisions about pension contributions and other tax-efficient savings plans. This ensures a more comfortable retirement while also taking advantage of available tax breaks.

How it Works: A Step-by-Step Guide

The process of Reverse Tax Calc involves several key steps. Firstly, a comprehensive financial review is conducted, examining all aspects of an individual’s or business’s financial situation. This includes income sources, expenses, investments, and current tax liabilities.

Next, the data is analyzed to identify areas where tax savings can be achieved. This might involve reviewing existing tax strategies, exploring new tax-efficient investment opportunities, or adjusting payroll structures. The goal is to find the most effective and legal ways to minimize tax liabilities.

Once the analysis is complete, a detailed tax strategy is formulated. This strategy outlines the steps needed to achieve the desired tax savings. It might involve changing the timing of certain financial transactions, making specific investment choices, or implementing new payroll policies.

For example, an individual might discover that by contributing a larger portion of their income to a pension plan at a specific time of year, they can reduce their tax liability and boost their retirement savings. This strategy is then implemented, and the individual or business can monitor its effectiveness over time.

| Financial Aspect | Analysis |

|---|---|

| Income Sources | Diversity and Tax Efficiency |

| Expenses | Deductible and Tax-Efficient Options |

| Investments | Tax-Efficient Growth Strategies |

| Tax Liabilities | Identification of Potential Savings |

Case Study: A Real-World Application

To illustrate the power of Reverse Tax Calc, let’s look at a case study. Imagine a software development company with multiple revenue streams, including software sales, consulting services, and freelance work. Traditionally, they have managed their taxes by simply filing returns based on their income and expenses.

However, by implementing Reverse Tax Calc, they discovered that they could significantly reduce their tax burden by restructuring their revenue streams. They found that by treating their consulting services as a separate entity and charging a higher rate, they could take advantage of different tax brackets and deductions. This simple change resulted in a 15% reduction in their overall tax liability, freeing up resources for business growth and employee benefits.

The Future of Tax Planning: Implications and Opportunities

As tax landscapes continue to evolve, the role of Reverse Tax Calc is set to become even more significant. With governments worldwide introducing new tax policies and incentives, the need for strategic tax planning has never been more crucial.

Reverse Tax Calc offers a proactive approach to tax management, allowing individuals and businesses to stay ahead of the curve. By regularly reviewing and adjusting tax strategies, they can ensure they are always operating within the most tax-efficient frameworks.

Moreover, as technology continues to advance, the process of Reverse Tax Calc is becoming more accessible and efficient. Advanced tax planning software and algorithms can now automate much of the analysis process, providing quick and accurate insights into potential tax savings.

For instance, imagine a startup that wants to expand its operations internationally. With Reverse Tax Calc, they can analyze the tax implications of different business structures and jurisdictions, ensuring they choose the most tax-efficient path for growth. This not only saves them money but also simplifies their financial operations in the long run.

| Future Tax Planning Opportunities | Implications |

|---|---|

| International Expansion | Strategic Tax Planning for Global Operations |

| Advancements in Tax Software | Efficient and Automated Tax Analysis |

| Government Incentives | Maximizing Benefits for Businesses and Individuals |

| Long-Term Financial Planning | Secure Retirement and Wealth Preservation |

Conclusion: Embrace the Power of Reverse Tax Calc

In conclusion, Reverse Tax Calc is a powerful tool for anyone looking to take control of their financial future. By adopting this proactive approach to tax planning, individuals and businesses can optimize their tax positions, minimize liabilities, and maximize financial returns.

As we've seen, the benefits of Reverse Tax Calc are far-reaching, from reducing tax burdens and increasing savings to facilitating long-term financial planning and business growth. With its potential to revolutionize tax management, it's an approach that should be embraced by all seeking to maximize their financial potential.

What is the main goal of Reverse Tax Calc?

+

The primary goal is to optimize tax planning and minimize tax liabilities by taking a proactive, strategic approach to tax management.

Who can benefit from using Reverse Tax Calc?

+

Both individuals and businesses can benefit. It’s particularly useful for those with complex financial structures, multiple income streams, or a desire to plan for long-term financial goals.

How often should Reverse Tax Calc be reviewed and updated?

+

It’s recommended to review and update tax strategies annually or whenever there are significant changes in financial circumstances or tax policies.

Can Reverse Tax Calc be applied to all types of businesses and individuals?

+

Yes, Reverse Tax Calc can be tailored to suit different financial situations. However, its effectiveness may vary depending on the complexity of one’s financial structure and the availability of tax-efficient strategies.

What are some common strategies used in Reverse Tax Calc?

+

Strategies can include adjusting payroll structures, exploring tax-efficient investment options, contributing to pension plans, and taking advantage of government incentives.