Jersey City Property Tax

Jersey City, nestled along the Hudson River across from New York City, is a vibrant urban center renowned for its diverse neighborhoods, thriving arts scene, and impressive skyline views. However, for homeowners and prospective buyers, one of the most significant considerations is the property tax landscape. The property tax system in Jersey City plays a pivotal role in shaping the financial aspect of homeownership and real estate investments.

Understanding Jersey City Property Taxes

Property taxes in Jersey City are a vital source of revenue for the local government, funding essential services like schools, public safety, infrastructure, and community programs. These taxes are levied on both residential and commercial properties, with the rate determined by the assessed value of the property and the local tax rate.

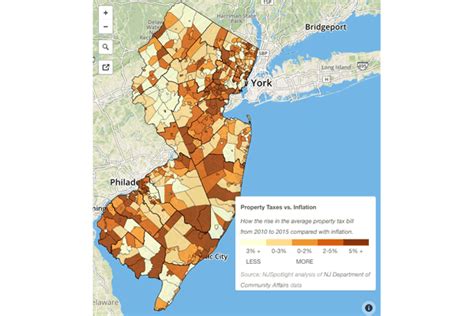

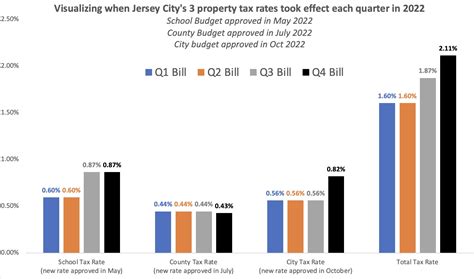

The property tax rate in Jersey City is established annually by the municipal government and is applied uniformly across all properties within the city limits. This rate is typically expressed as a percentage of the assessed value, and it can vary from one year to the next, depending on the city's budgetary requirements and financial planning.

The assessed value of a property is determined through a rigorous process that takes into account various factors, including the property's size, location, amenities, and recent sales data of comparable properties in the area. This assessment is conducted by the Jersey City Tax Assessor's Office, which ensures fairness and accuracy in the valuation process.

Key Factors Influencing Property Taxes

Several key factors contribute to the overall property tax landscape in Jersey City. These include:

- Property Value: The assessed value of a property is a primary determinant of the property tax bill. Properties with higher values typically incur higher taxes.

- Tax Rate: The tax rate, as set by the municipal government, directly impacts the tax liability. Higher tax rates result in increased property tax bills.

- Tax Exemptions and Credits: Jersey City offers various tax exemptions and credits to eligible homeowners. These can significantly reduce the tax burden, particularly for senior citizens, veterans, and homeowners with certain income levels.

- Assessor's Office Practices: The methods and practices employed by the Tax Assessor's Office in assessing property values can influence the overall tax landscape. Regular reassessments and accurate valuation processes are crucial for fairness and transparency.

Property Tax Calculation in Jersey City

The property tax calculation in Jersey City involves a straightforward process. The assessed value of the property is multiplied by the applicable tax rate to determine the annual tax liability. For instance, if a property has an assessed value of 500,000 and the tax rate is 2%, the annual property tax would be 10,000.

It's important to note that the tax rate is not a fixed percentage but can vary depending on the city's financial needs and budget allocations. This means that the tax rate can change annually, impacting the property tax bills for all homeowners in Jersey City.

Real-World Examples

Let’s consider a few real-world examples to illustrate the property tax landscape in Jersey City:

| Property Value | Tax Rate | Annual Property Tax |

|---|---|---|

| $400,000 | 1.8% | $7,200 |

| $600,000 | 2.2% | $13,200 |

| $800,000 | 2% | $16,000 |

In these examples, we can see how the property tax bill increases with higher property values and tax rates. It's worth mentioning that these figures are for illustrative purposes and may not reflect the exact tax rates or values in Jersey City at any given time.

Tax Exemptions and Credits

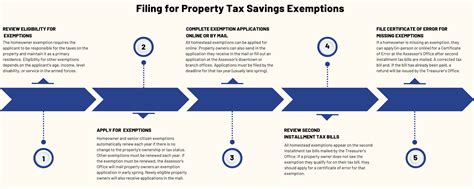

Jersey City offers several tax exemptions and credits to eligible homeowners, which can provide significant savings on property taxes. These include:

- Senior Citizen Exemption: Senior citizens who are at least 65 years old and meet certain income criteria may be eligible for a property tax exemption. This exemption can reduce the taxable value of their property, resulting in lower tax bills.

- Veteran's Exemption: Qualified veterans may be entitled to a property tax exemption, which can significantly lower their tax liability.

- Income-Based Tax Credits: Jersey City provides tax credits to low- and moderate-income homeowners, helping to make homeownership more affordable and sustainable.

Navigating the Property Tax Landscape

Understanding the property tax system in Jersey City is essential for homeowners and prospective buyers. It enables them to make informed decisions about their financial obligations and plan their budgets accordingly.

Tips for Managing Property Taxes

Here are some practical tips for effectively managing property taxes in Jersey City:

- Stay Informed: Keep up-to-date with the latest tax rates, assessment practices, and available exemptions. Regularly check the Jersey City government website and official communication channels for any updates or changes.

- Review Your Assessment: Property assessments can sometimes contain errors or discrepancies. It's essential to review your assessment notice carefully and dispute any inaccuracies. The Tax Assessor's Office provides guidelines on the dispute process.

- Consider Tax Exemptions: If you believe you are eligible for any tax exemptions or credits, be sure to apply for them. These benefits can significantly reduce your tax burden and improve your financial situation.

- Plan Your Budget: Property taxes are a significant expense for homeowners. It's crucial to budget for these taxes annually and plan your finances accordingly. Consider setting aside funds specifically for property tax payments to ensure timely payments and avoid penalties.

The Impact of Property Taxes on Real Estate Investments

For real estate investors, property taxes are a critical factor in evaluating the financial viability of their investments. High property taxes can significantly impact the cash flow and overall profitability of a rental property or investment portfolio.

Investors should carefully consider the property tax landscape when evaluating potential investment properties in Jersey City. They should analyze the tax implications alongside other financial metrics, such as rental income, appreciation potential, and maintenance costs, to make informed investment decisions.

Future Outlook

The property tax landscape in Jersey City is subject to ongoing changes and developments. As the city continues to grow and evolve, the municipal government may adjust tax rates and policies to meet the changing needs of the community and fund essential services.

Homeowners and investors should stay informed about any proposed changes to the tax system and engage with local government representatives to voice their concerns and suggestions. By staying proactive and involved, they can contribute to shaping a fair and sustainable tax landscape in Jersey City.

Conclusion

Jersey City’s property tax system is a vital component of the local economy and plays a significant role in shaping the financial landscape for homeowners and investors. Understanding the intricacies of property taxes, including the assessment process, tax rates, and available exemptions, is crucial for making informed decisions and effectively managing financial obligations.

As Jersey City continues to thrive and attract new residents and businesses, the property tax system will remain a key consideration for those seeking to call this vibrant city home. By staying informed and proactive, homeowners and investors can navigate the property tax landscape with confidence and contribute to the continued success and growth of Jersey City.

How often are property tax rates updated in Jersey City?

+Property tax rates in Jersey City are typically updated annually, based on the city’s budgetary needs and financial planning. The municipal government sets the tax rate each year, ensuring that it aligns with the city’s revenue requirements and services.

Are there any ways to reduce my property tax bill in Jersey City?

+Yes, there are several strategies to reduce your property tax bill in Jersey City. These include taking advantage of available tax exemptions (such as the Senior Citizen Exemption or Veteran’s Exemption), ensuring your property assessment is accurate, and considering tax credits for low- and moderate-income homeowners. Consulting with a tax professional or the Jersey City Tax Assessor’s Office can provide valuable guidance.

What happens if I dispute my property assessment in Jersey City?

+If you dispute your property assessment in Jersey City, you can file an appeal with the Tax Assessor’s Office. The appeal process typically involves submitting documentation and evidence to support your claim of an inaccurate assessment. The Assessor’s Office will review your case, and if they agree with your dispute, they may adjust your property’s assessed value, resulting in a lower tax bill.