Georgia Sales Tax Atlanta

In the state of Georgia, sales tax is a significant source of revenue for local and state governments. It is an essential aspect of the state's tax system, impacting both consumers and businesses alike. Atlanta, being the largest city in Georgia, plays a pivotal role in the state's economy, and its sales tax regulations are of particular interest. This article delves into the intricacies of sales tax in Atlanta, exploring the rates, exemptions, and unique features that shape the tax landscape in this bustling metropolis.

Understanding Sales Tax in Atlanta: Rates and Regulations

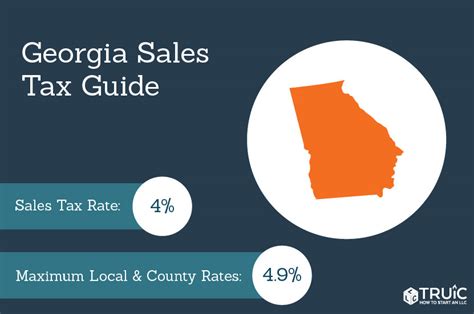

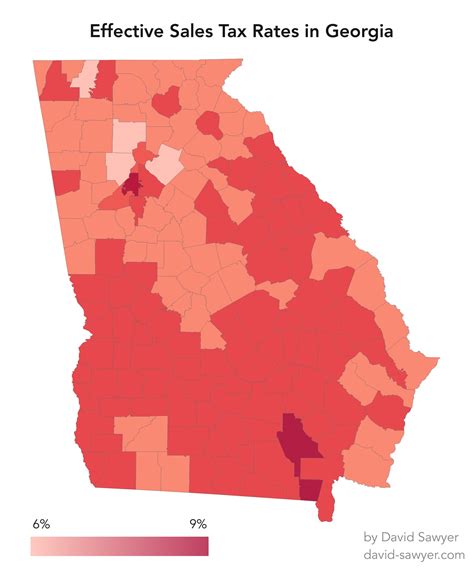

Sales tax in Atlanta is a combination of state, county, and municipal taxes, each with its own rate. As of the latest data, the state sales tax rate in Georgia stands at 4%. However, this is not the only tax applicable to purchases made within the city limits.

Atlanta, located in Fulton County, imposes an additional 3.9% county sales tax, bringing the total to 7.9%. Furthermore, the city of Atlanta itself levies a 2% sales tax, resulting in a combined 9.9% sales tax rate for goods and services purchased within the city.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Georgia | 4% |

| Fulton County | 3.9% |

| City of Atlanta | 2% |

| Total | 9.9% |

These rates are subject to change, and it is essential for businesses and consumers to stay informed about any updates. The Georgia Department of Revenue provides regular updates and resources for taxpayers to ensure compliance with the latest regulations.

Sales Tax Exemptions in Atlanta

While the sales tax rate in Atlanta may seem high compared to some other regions, it is important to note that certain goods and services are exempt from sales tax. These exemptions are designed to reduce the tax burden on essential items and promote specific economic activities.

- Grocery Items: Most food items purchased from grocery stores and supermarkets are exempt from sales tax in Atlanta. This exemption aims to ensure that essential food items remain affordable for residents.

- Prescription Drugs: Sales tax is not applicable to the purchase of prescription medications. This exemption supports access to necessary healthcare items.

- Certain Services: Some services, such as legal and medical services, are not subject to sales tax. This exemption recognizes the unique nature of these services and their importance to the community.

- Manufacturing Equipment: Sales tax exemptions are often granted for machinery and equipment used in manufacturing processes. This encourages investment in industrial development within the city.

The Impact of Sales Tax on Atlanta’s Economy

Sales tax is a critical component of Atlanta’s economic ecosystem, influencing both consumer behavior and business strategies. The relatively high sales tax rate in Atlanta can have a significant impact on the city’s retail sector and its residents’ purchasing power.

Retail Landscape and Consumer Behavior

The 9.9% sales tax rate in Atlanta can affect consumers’ purchasing decisions. For instance, residents may opt to make certain purchases outside the city limits or online to avoid the higher tax rate. This behavior can impact the city’s retail landscape, potentially leading to shifts in foot traffic and sales patterns.

On the other hand, the sales tax revenue generated in Atlanta contributes significantly to the city's budget, funding essential services and infrastructure projects. This revenue stream is vital for maintaining the city's attractiveness and competitiveness in the regional and national markets.

Business Strategies and Tax Planning

Businesses operating in Atlanta must carefully consider sales tax regulations when formulating their pricing and marketing strategies. The tax rate can impact a business’s competitive position and overall profitability.

For instance, businesses may choose to absorb the sales tax in their pricing to make their products more competitive. Alternatively, they might pass on the tax to the consumer, but this strategy can impact consumer perception and loyalty. Effective tax planning and understanding the local market dynamics are crucial for businesses to thrive in Atlanta's competitive environment.

Navigating Sales Tax Compliance in Atlanta

Compliance with sales tax regulations is essential for businesses operating in Atlanta. The Georgia Department of Revenue provides extensive resources and guidelines to ensure businesses understand their obligations and responsibilities.

Registration and Reporting Requirements

Businesses selling taxable goods or services in Atlanta must register with the Georgia Department of Revenue and obtain a sales and use tax certificate. This certificate allows businesses to collect and remit sales tax on behalf of the state and local governments.

The registration process typically involves providing business information, obtaining a certificate number, and understanding the reporting requirements. Businesses must then file sales tax returns regularly, usually on a quarterly basis, to report and remit the collected tax.

Audit and Enforcement

The Georgia Department of Revenue has the authority to audit businesses to ensure compliance with sales tax regulations. Audits can be random or targeted, depending on various factors, including the size and nature of the business. During an audit, the department may review sales records, tax returns, and other financial documents to verify the accuracy of reported sales tax.

Businesses found to be non-compliant with sales tax regulations may face penalties, interest charges, and even criminal prosecution in severe cases. It is crucial for businesses to maintain accurate records and ensure timely filing of sales tax returns to avoid such consequences.

Future Outlook and Potential Changes

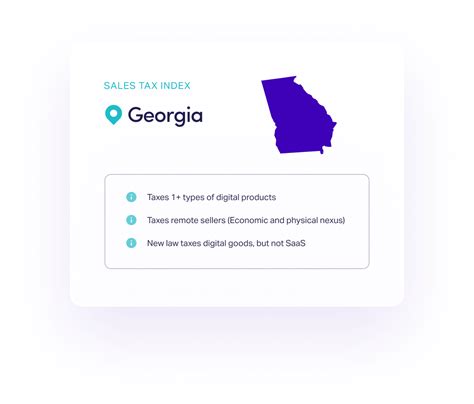

The sales tax landscape in Atlanta, like any other tax system, is subject to potential changes and reforms. As economic conditions evolve and new challenges arise, the state and local governments may consider adjustments to the tax rates or exemptions to promote economic growth and fairness.

Proposed Reforms and Their Impact

There have been ongoing discussions about sales tax reforms in Georgia, including proposals to simplify the tax system and reduce rates. While these reforms are still in the proposal stage, they could significantly impact businesses and consumers in Atlanta.

For instance, a potential reduction in the state sales tax rate could make Atlanta more competitive in the regional market, attracting businesses and consumers. On the other hand, any changes to exemptions or tax base could also impact the city's revenue stream and the services it can provide to its residents.

It is essential for stakeholders, including businesses, consumers, and policymakers, to engage in these discussions and understand the potential implications of any proposed changes.

Conclusion

Sales tax in Atlanta is a complex yet crucial aspect of the city’s economic framework. It influences consumer behavior, shapes business strategies, and provides a significant revenue stream for local and state governments. Understanding the rates, exemptions, and compliance requirements is essential for both businesses and consumers to navigate the tax landscape effectively.

As Atlanta continues to evolve and adapt to changing economic conditions, the sales tax system will likely undergo reforms to remain competitive and equitable. Staying informed and engaged with the latest developments is key to ensuring compliance and maximizing the benefits of this essential tax system.

How often do businesses need to file sales tax returns in Atlanta?

+Businesses in Atlanta typically need to file sales tax returns on a quarterly basis. However, the frequency can vary depending on the business’s sales volume and other factors. Some businesses with higher sales may be required to file more frequently, such as monthly.

Are there any online resources available to help businesses understand sales tax in Atlanta?

+Yes, the Georgia Department of Revenue provides an extensive online resource center with guidelines, forms, and tools to help businesses understand and comply with sales tax regulations. This includes information on registration, tax rates, exemptions, and reporting requirements.

Can individuals claim a refund for overpaid sales tax in Atlanta?

+Yes, individuals who believe they have overpaid sales tax can claim a refund. The process involves completing a sales and use tax refund claim form and providing supporting documentation. The Georgia Department of Revenue will review the claim and, if valid, issue a refund.