Who Is Exempt From Fica Taxes

The Federal Insurance Contributions Act (FICA) is a crucial aspect of the U.S. tax system, ensuring that workers contribute to social security and Medicare, providing essential benefits for retirees, the disabled, and other eligible individuals. However, there are certain groups of individuals who are exempt from FICA taxes, and understanding these exemptions is vital for employers and employees alike.

In this comprehensive article, we will delve into the world of FICA tax exemptions, exploring the specific categories of individuals who are exempt and the reasons behind these exemptions. By the end, you will have a clear understanding of the FICA landscape and the implications for both employers and employees.

Understanding FICA Taxes

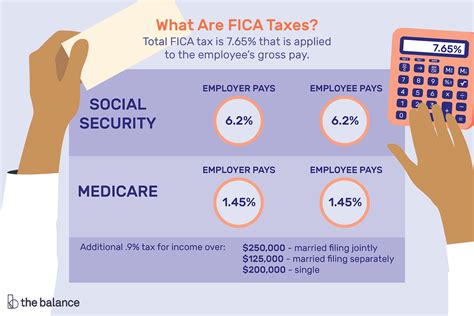

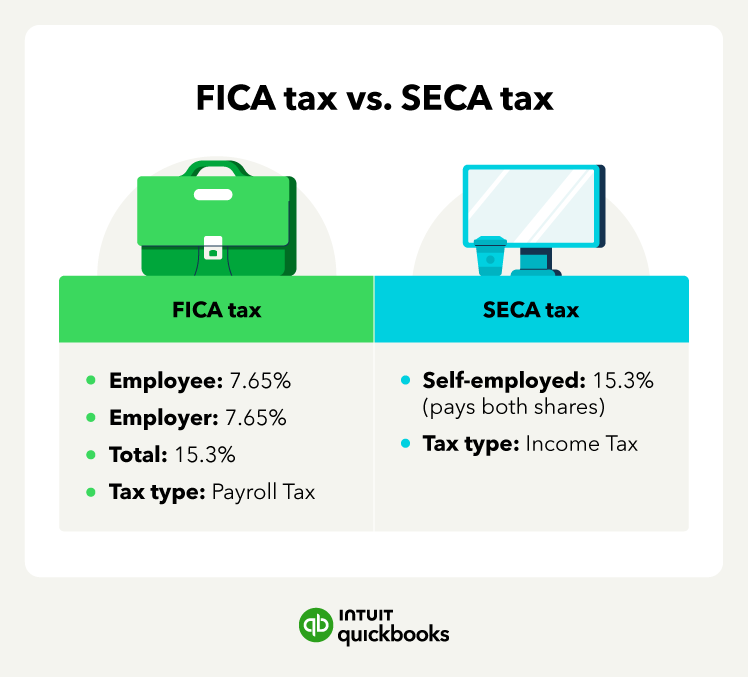

Before we dive into the exemptions, let’s briefly revisit the fundamentals of FICA taxes. FICA taxes are payroll taxes that fund Social Security and Medicare programs, offering financial support to eligible individuals during retirement, disability, or other qualifying circumstances.

The Social Security tax, also known as the Old-Age, Survivors, and Disability Insurance (OASDI) tax, is imposed on both employees and employers, with each contributing 6.2% of the employee's wages up to an annual maximum. The Medicare tax, on the other hand, is slightly different, with employees contributing 1.45% of their wages without an annual limit, and employers matching this contribution.

While these taxes are a vital part of the social safety net, certain individuals are exempt from paying them. Let's explore these exemptions in detail.

Exemptions from FICA Taxes

The Internal Revenue Service (IRS) outlines specific categories of individuals who are exempt from FICA taxes. These exemptions are designed to accommodate unique employment situations and ensure fairness in the tax system.

Students Employed by Certain Educational Institutions

One notable exemption applies to students employed by related educational institutions. Under certain conditions, students working for a college or university where they are enrolled can be exempt from paying FICA taxes. This exemption is commonly known as the “Section 3121(b)(10) exemption”, referring to the relevant section of the Internal Revenue Code.

To qualify for this exemption, the student must meet specific criteria. They must be a degree candidate at the educational institution, and the work performed must be directly related to their studies. This can include teaching, research, or administrative tasks. The exemption is intended to foster educational opportunities without imposing an additional tax burden.

It's important to note that this exemption is not automatic. Both the student and the educational institution must meet specific requirements, and the institution must properly document and report the exemption to the IRS.

Employees of Foreign Governments and International Organizations

Another category of individuals exempt from FICA taxes are employees of foreign governments and international organizations. This exemption is granted under section 3121(b)(19) of the Internal Revenue Code. It ensures that individuals employed by these entities are not subject to U.S. payroll taxes, recognizing the unique nature of their employment.

To qualify for this exemption, the employee must be a citizen or national of the foreign government or international organization, and the work must be performed in an official capacity. This exemption applies to a wide range of positions, from diplomatic staff to employees of international agencies like the United Nations.

Certain Employees of State and Local Governments

In certain circumstances, employees of state and local governments are exempt from FICA taxes. This exemption, outlined in section 3121(b)(21) of the Internal Revenue Code, applies to individuals who work for state and local governments and meet specific criteria.

The exemption typically covers employees whose work is considered integral to the core functions of the government, such as police officers, firefighters, and other essential public servants. It's important to note that the specific criteria and eligibility vary depending on the state and local laws, so employers and employees should consult relevant regulations for detailed information.

Certain Domestic Employees

Domestic employees, such as housekeepers, nannies, and gardeners, are also eligible for FICA tax exemptions under specific conditions. The exemption, detailed in section 3121(b)(7) of the Internal Revenue Code, applies to individuals who meet the definition of a “domestic worker” and whose earnings fall below a certain threshold.

To qualify for this exemption, the domestic worker must earn less than $2,400 from a single employer in a calendar year. Additionally, the work must be performed in a private home, and the employer must not be the worker's spouse or a member of their immediate family. This exemption ensures that low-income domestic workers are not subject to FICA taxes, providing a measure of financial relief.

Certain Nonresident Alien Students and Scholars

Nonresident alien students and scholars can also be exempt from FICA taxes under certain conditions. This exemption, outlined in section 3121(b)(15) of the Internal Revenue Code, applies to individuals who are temporarily in the United States for educational purposes and meet specific criteria.

To qualify for this exemption, the student or scholar must be a nonresident alien, and their earnings must be directly related to their studies. This can include teaching, research, or other academic activities. The exemption is designed to accommodate the unique circumstances of international students and scholars, ensuring they are not subject to unnecessary tax obligations.

Other Exemptions and Special Cases

In addition to the exemptions mentioned above, there are several other special cases where individuals may be exempt from FICA taxes. These include:

- Certain religious groups: Members of certain religious groups, such as the Amish, may be exempt from FICA taxes if their religious beliefs conflict with the acceptance of such benefits.

- Wage limit exemptions: In some cases, individuals who earn below a certain wage threshold may be exempt from paying FICA taxes.

- Certain types of service: Some types of service, such as volunteer work or work performed under specific programs, may be exempt from FICA taxes.

It's important to note that these exemptions are complex and subject to specific criteria and regulations. Employers and employees should consult with tax professionals or refer to IRS guidelines for detailed information on these special cases.

Consequences and Considerations

While FICA tax exemptions provide financial relief for certain individuals, it’s important to consider the broader implications. Exemptions can impact an individual’s eligibility for Social Security and Medicare benefits in the future. Those who are exempt from paying FICA taxes may have reduced or no benefits upon retirement or in the event of disability.

Employers should also be mindful of their responsibilities when it comes to FICA tax exemptions. Proper documentation and reporting are essential to avoid penalties and ensure compliance with tax laws. Employers should carefully review the criteria for each exemption and consult with tax experts to ensure accurate classification of their employees.

The Future of FICA Tax Exemptions

As the U.S. tax landscape continues to evolve, the future of FICA tax exemptions remains uncertain. While these exemptions serve important purposes, they may be subject to change or revision as the government seeks to balance the needs of various stakeholder groups.

One potential area of focus is ensuring that FICA tax exemptions are fair and equitable for all individuals. As the tax system adapts to changing societal needs, it's possible that exemptions could be revised to better align with modern employment dynamics and ensure that all workers are treated fairly.

Additionally, the ongoing debate surrounding Social Security and Medicare funding may impact the future of FICA tax exemptions. As the government works to address long-term funding challenges, changes to FICA tax exemptions could be on the table as part of broader reforms.

Conclusion

FICA tax exemptions are a vital aspect of the U.S. tax system, providing relief to specific groups of individuals while ensuring the stability of Social Security and Medicare programs. By understanding these exemptions and their implications, employers and employees can navigate the complex tax landscape with confidence.

As the tax system continues to evolve, staying informed about FICA tax exemptions and their potential changes is essential. By staying up-to-date with tax regulations and seeking expert guidance, individuals and businesses can make informed decisions and ensure compliance with the law.

How do I know if I qualify for a FICA tax exemption?

+Determining FICA tax exemption eligibility depends on your specific circumstances. It’s best to consult with a tax professional or refer to IRS guidelines to understand the criteria for each exemption and determine if you qualify.

Are there any penalties for employers who misclassify employees as exempt from FICA taxes?

+Yes, employers who misclassify employees as exempt from FICA taxes may face penalties and fines. It’s crucial to carefully review exemption criteria and consult with tax experts to ensure accurate classification and compliance with tax laws.

How do FICA tax exemptions impact an individual’s eligibility for Social Security and Medicare benefits in the future?

+FICA tax exemptions can impact an individual’s eligibility for Social Security and Medicare benefits. Those who are exempt from paying FICA taxes may have reduced or no benefits upon retirement or in the event of disability. It’s important to consider the long-term implications of FICA tax exemptions.

Are there any changes to FICA tax exemptions expected in the near future?

+The future of FICA tax exemptions is uncertain, as the tax landscape continues to evolve. While specific changes cannot be predicted, it’s possible that exemptions could be revised to align with changing societal needs and ensure fairness for all workers.