Ct Vehicle Tax

The Connecticut Vehicle Tax, commonly known as the "Car Tax," is an annual tax imposed on registered vehicles in the state. This tax is a crucial component of Connecticut's revenue system, contributing significantly to the state's budget. In this comprehensive guide, we will delve into the intricacies of the CT Vehicle Tax, exploring its history, calculation methods, exemptions, and the impact it has on Connecticut residents.

A Historical Perspective

The origins of the Connecticut Vehicle Tax can be traced back to the early 20th century when automobiles began to revolutionize transportation. As the number of vehicles on the road increased, states across the nation recognized the need for a tax system to generate revenue for road maintenance and infrastructure development. Connecticut was no exception, and the Vehicle Tax was implemented as a means to fund essential transportation-related services.

Over the years, the CT Vehicle Tax has undergone several modifications to keep up with changing economic conditions and technological advancements in the automotive industry. These adjustments aim to ensure that the tax remains fair and reflective of the current vehicle landscape.

How is the CT Vehicle Tax Calculated?

The calculation of the Connecticut Vehicle Tax is based on the assessed value of the vehicle and the applicable tax rate for the municipality where the vehicle is registered. Here’s a step-by-step breakdown of the process:

Step 1: Determining the Assessed Value

The assessed value of a vehicle is typically based on its market value, which takes into account factors such as make, model, year, mileage, and overall condition. This assessment is conducted by the Department of Motor Vehicles (DMV) or a designated assessment agency.

To obtain an accurate assessment, the DMV may utilize various resources, including vehicle valuation guides, online tools, and industry data. The assessed value serves as the foundation for calculating the Vehicle Tax.

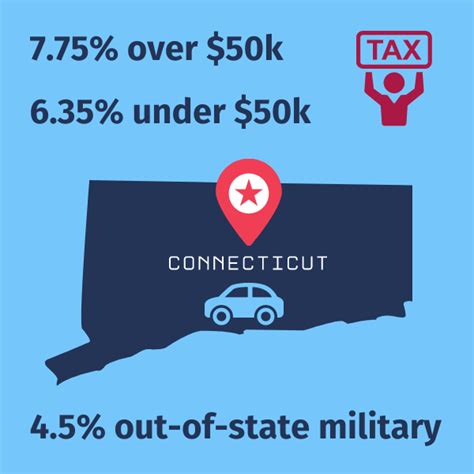

Step 2: Applying the Tax Rate

Once the assessed value is determined, the applicable tax rate is applied. It’s important to note that tax rates can vary significantly between different municipalities within Connecticut. This variation is due to the decentralized nature of tax administration, where each municipality has the autonomy to set its own tax rates.

The tax rate is usually expressed as a percentage of the assessed value. For instance, if a municipality has a tax rate of 1.5%, a vehicle with an assessed value of $10,000 would incur a Vehicle Tax of $150. It's worth mentioning that tax rates can change annually, so it's essential for vehicle owners to stay informed about any updates.

| Municipality | Tax Rate (%) |

|---|---|

| Hartford | 1.2 |

| New Haven | 1.5 |

| Stamford | 1.8 |

| Bridgeport | 1.6 |

| Waterbury | 1.4 |

Step 3: Additional Considerations

While the assessed value and tax rate are the primary factors in calculating the CT Vehicle Tax, there are a few additional considerations to keep in mind:

- Discounts and Exemptions: Certain vehicles, such as those owned by disabled individuals or used for specific purposes like farming, may be eligible for discounts or exemptions. These provisions aim to alleviate the tax burden for specific groups or situations.

- Payment Options: Connecticut offers various payment options for the Vehicle Tax. Vehicle owners can choose to pay the tax in full or opt for installment plans, making it more manageable for different financial situations.

- Due Dates: It's crucial to be aware of the due dates for the CT Vehicle Tax. Missing the deadline can result in penalties and fees. The DMV typically sends out tax notices, but it's a good practice to mark the due date on your calendar to ensure timely payment.

Exemptions and Discounts

The Connecticut Vehicle Tax recognizes the diverse needs and circumstances of its residents by offering exemptions and discounts for specific vehicles and situations. These provisions aim to provide relief to those who may face financial challenges or have unique circumstances.

Vehicle Exemptions

Certain types of vehicles are exempt from the CT Vehicle Tax. Here are some examples:

- Electric Vehicles (EVs): Connecticut encourages the adoption of environmentally friendly transportation by exempting fully electric vehicles from the Vehicle Tax for the first five years of ownership. This initiative promotes sustainable transportation and reduces the carbon footprint of the state's transportation sector.

- Hybrid Vehicles: Similar to EVs, hybrid vehicles that meet specific criteria may also be eligible for tax exemptions or reduced rates. These incentives aim to encourage the use of fuel-efficient vehicles and reduce emissions.

- Farm Vehicles: Vehicles primarily used for agricultural purposes are often exempt from the Vehicle Tax. This exemption supports the state's agricultural industry and ensures that farmers are not burdened with excessive taxation.

Discounts for Specific Groups

Connecticut recognizes the contributions and sacrifices made by certain groups and offers discounts on the Vehicle Tax as a token of appreciation. These groups include:

- Military Personnel: Active-duty military members and veterans are eligible for reduced Vehicle Tax rates as a way to show gratitude for their service. The specific discount varies depending on the municipality and the duration of service.

- Senior Citizens: Connecticut offers discounts to senior citizens as a way to support their financial well-being. The age requirement and discount percentage can vary, so it's essential for seniors to check with their local municipality for specific details.

- Disabled Individuals: Persons with disabilities may be eligible for reduced Vehicle Tax rates or exemptions. This provision aims to ensure that individuals with disabilities have access to reliable transportation without facing excessive financial burdens.

Impact on Connecticut Residents

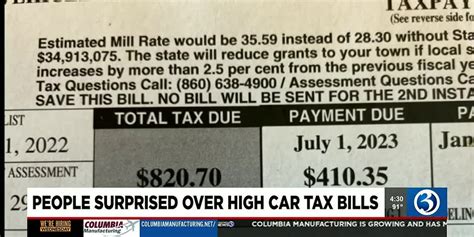

The CT Vehicle Tax has a significant impact on the daily lives of Connecticut residents. While it contributes to the state’s revenue and infrastructure development, it also affects personal finances and transportation choices.

Financial Considerations

For many Connecticut residents, the Vehicle Tax is a substantial expense that needs to be factored into their annual budget. The tax can range from a few hundred dollars to several thousand, depending on the vehicle’s value and the applicable tax rate. This financial commitment can be a burden, especially for those with lower incomes or multiple vehicles.

To manage this expense, some residents opt for older, less valuable vehicles that fall into lower tax brackets. Others may consider car-sharing or public transportation as alternatives to reduce their reliance on personal vehicles and, consequently, their Vehicle Tax obligations.

Transportation Choices

The CT Vehicle Tax also influences transportation choices within the state. The tax can be a deciding factor when individuals are considering purchasing a new vehicle. The prospect of a higher tax liability may prompt residents to opt for more fuel-efficient or environmentally friendly vehicles, which often carry lower tax rates due to incentives and exemptions.

Additionally, the tax can affect the resale value of vehicles. Older vehicles with higher mileage may have a lower assessed value, resulting in a reduced tax liability for potential buyers. This can make these vehicles more attractive to budget-conscious consumers.

Future Implications and Potential Changes

As Connecticut continues to evolve and adapt to changing economic and environmental conditions, the CT Vehicle Tax may undergo further modifications. Here are some potential future developments:

Shift towards Sustainable Transportation

With a growing emphasis on sustainability and reducing carbon emissions, Connecticut may expand its tax incentives for electric and hybrid vehicles. This shift could include extending tax exemptions beyond the current five-year period for EVs or offering more significant discounts for these environmentally friendly options.

Addressing Equity Concerns

The decentralized nature of tax administration in Connecticut can lead to variations in tax rates between municipalities. This disparity may prompt discussions about establishing a more standardized tax system to ensure fairness and consistency across the state. Addressing these equity concerns could involve setting minimum and maximum tax rate thresholds or implementing a state-level tax component to complement municipal taxes.

Technology Integration

Advancements in technology may play a role in streamlining the CT Vehicle Tax process. Online platforms and mobile applications could be developed to simplify tax assessment, payment, and record-keeping. This integration could enhance efficiency, reduce administrative burdens, and provide residents with convenient access to their Vehicle Tax information.

Economic Considerations

Connecticut’s economic landscape is dynamic, and changes in the automotive industry or the broader economy may necessitate adjustments to the Vehicle Tax. For instance, if the state experiences economic growth or faces budgetary challenges, the tax rates or exemptions may be revised to align with these shifts.

How often must I pay the CT Vehicle Tax?

+The CT Vehicle Tax is an annual tax, typically due once a year. However, it's essential to check with your local municipality for specific due dates and payment schedules, as they may vary slightly.

Can I appeal my vehicle's assessed value for tax purposes?

+Yes, if you believe your vehicle's assessed value is inaccurate, you have the right to appeal. Contact the assessing agency or the DMV to initiate the appeal process. Provide supporting documentation, such as recent sales data or independent appraisals, to strengthen your case.

Are there any penalties for late payment of the CT Vehicle Tax?

+Yes, late payment of the Vehicle Tax can result in penalties and interest charges. The specific penalties and interest rates vary by municipality, so it's crucial to pay your tax on time to avoid additional costs.

How can I stay informed about changes to the CT Vehicle Tax?

+To stay updated on any changes or modifications to the Vehicle Tax, it's recommended to regularly check the official websites of your local municipality and the Connecticut Department of Motor Vehicles (DMV). These sources provide the most accurate and up-to-date information.

Are there any alternative transportation options to reduce my Vehicle Tax burden?

+Yes, considering alternative transportation options can help reduce your reliance on personal vehicles and, consequently, your Vehicle Tax obligations. Carpooling, using public transportation, or exploring ride-sharing services can be more cost-effective and environmentally friendly choices.

In conclusion, the CT Vehicle Tax is a vital component of Connecticut’s revenue system, playing a significant role in funding essential transportation services. While it may be a financial burden for some residents, the tax also offers incentives and exemptions to support sustainable transportation, military personnel, senior citizens, and individuals with disabilities. As Connecticut moves forward, the Vehicle Tax is likely to adapt to changing economic and environmental conditions, ensuring a fair and efficient taxation system for all.