Federal Tax Id Lookup

In the realm of business and finance, understanding the intricacies of federal tax identification numbers is essential for professionals and entrepreneurs alike. The Federal Tax ID Lookup is a vital tool for anyone navigating the complex world of taxation and business registration. This comprehensive guide aims to delve into the significance of Federal Tax IDs, exploring their role, the process of obtaining and verifying them, and the impact they have on various aspects of business operations.

The Importance of Federal Tax ID Numbers

A Federal Tax Identification Number, often referred to as an Employer Identification Number (EIN), is a unique numerical code assigned to businesses by the Internal Revenue Service (IRS) in the United States. This nine-digit number serves as a critical identifier for business entities, similar to how a Social Security Number identifies individuals. The EIN is crucial for various reasons, primarily because it is a key component in the process of establishing a business’s identity and ensuring compliance with tax regulations.

For entities such as corporations, partnerships, or limited liability companies (LLCs), an EIN is mandatory. It is used for a multitude of purposes, including opening business bank accounts, filing tax returns, applying for business licenses and permits, and even for identifying the business in legal documents. Without an EIN, businesses may face significant challenges in their day-to-day operations and legal obligations.

Benefits of Having a Federal Tax ID

Obtaining a Federal Tax ID offers several advantages to business owners. Firstly, it simplifies the process of tax filing. With an EIN, businesses can efficiently manage their tax obligations, separating business and personal finances and ensuring accurate reporting. This is particularly crucial for businesses with employees, as the EIN is used to report employment taxes and wages.

Additionally, a Federal Tax ID provides a layer of privacy for business owners. Instead of using their Social Security Number for business purposes, which can expose them to potential identity theft or fraud, an EIN acts as a shield, protecting their personal information. Furthermore, it facilitates various business transactions, such as applying for loans, lines of credit, or even establishing merchant accounts for accepting credit card payments.

| Federal Tax ID Uses | Real-World Applications |

|---|---|

| Tax Reporting | Filing business income tax returns, payroll taxes, and other tax obligations. |

| Business Registration | Registering with state and local authorities, applying for business licenses, and complying with regulations. |

| Banking | Opening business bank accounts, establishing lines of credit, and managing financial transactions. |

| Employment | Hiring employees, reporting wages, and managing employee benefits and payroll taxes. |

| Legal Compliance | Identifying the business in legal documents, contracts, and court proceedings. |

Obtaining a Federal Tax ID

The process of obtaining a Federal Tax ID is straightforward and can be completed online through the IRS website. The IRS provides an online application form, known as the SS-4, which businesses can fill out and submit electronically. This form requires basic information about the business, including its legal name, address, and the primary business activity.

Once the application is submitted, the IRS processes the request, and businesses typically receive their EIN within a few business days. The EIN is a random number generated by the IRS and is not based on any personal information, ensuring privacy and security. It is important to note that the EIN is not a taxable entity in itself; it merely serves as an identifier for the business.

Eligibility and Requirements

Any business entity, regardless of size or industry, is eligible to apply for a Federal Tax ID. However, there are certain requirements that must be met. For instance, sole proprietors may not need an EIN if they operate under their own Social Security Number and do not have employees. However, if they hire employees or plan to establish a business entity, obtaining an EIN becomes mandatory.

Additionally, certain entities, such as partnerships or corporations, are legally required to have an EIN. This is particularly true for entities with employees, as the EIN is crucial for reporting employment taxes and withholding Social Security and Medicare taxes from employee wages.

| Entity Type | EIN Requirement |

|---|---|

| Sole Proprietorship | Optional, unless hiring employees or forming a business entity. |

| Partnership | Mandatory, regardless of employee status. |

| Corporation | Mandatory, as a separate taxable entity from its owners. |

| Limited Liability Company (LLC) | Mandatory if the LLC has employees or elects to be taxed as a corporation. |

| Nonprofit Organization | Mandatory for tax-exempt organizations. |

Verifying Federal Tax IDs

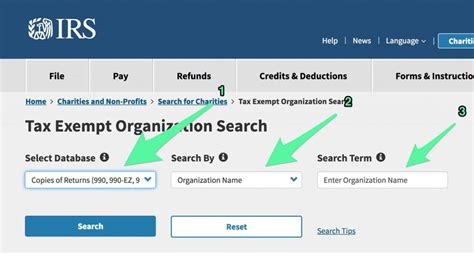

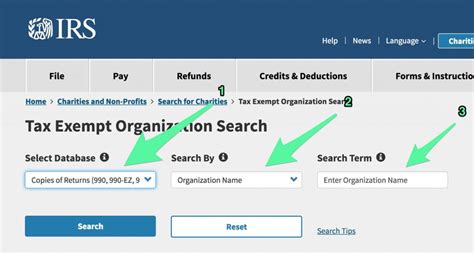

Verifying the validity of a Federal Tax ID is crucial, especially when dealing with external entities, such as business partners, vendors, or financial institutions. The IRS provides tools and resources to assist in this process. One of the most common methods is through the EIN Verification tool on the IRS website.

The EIN Verification tool allows users to input an EIN and receive information about the associated business, including its name, address, and tax status. This tool is particularly useful for businesses seeking to verify the legitimacy of potential partners or for financial institutions verifying the authenticity of a business's EIN during account opening processes.

Challenges and Best Practices

While the EIN Verification tool is a valuable resource, it has its limitations. The tool only provides basic information and does not guarantee the accuracy or validity of the EIN. Additionally, it does not reveal the specific business activities or financial health of the associated entity. Therefore, it is essential to complement EIN verification with other due diligence practices.

Business owners and professionals should consider conducting thorough background checks on potential partners or clients. This may involve researching the business's history, financial records, and reputation in the industry. Additionally, consulting with legal or financial advisors can provide valuable insights and ensure compliance with relevant regulations.

Future Implications and Innovations

As technology advances and the business landscape evolves, the role of Federal Tax IDs is likely to adapt and expand. The IRS and other regulatory bodies are continuously working to enhance the efficiency and security of tax identification systems.

One potential future development is the integration of Federal Tax IDs with digital identity verification systems. This could streamline the process of verifying businesses and individuals, reducing the risk of fraud and enhancing overall security. Additionally, the IRS may explore the use of blockchain technology to create a more secure and transparent system for tax identification and compliance.

The Impact of Digital Transformation

The digital transformation of the business world has already had a significant impact on Federal Tax ID processes. Online application systems and verification tools have made it more convenient and efficient for businesses to obtain and manage their EINs. Additionally, the increasing use of digital signatures and electronic documentation has streamlined the process of applying for and using Federal Tax IDs.

Looking ahead, the continued integration of technology into business operations is likely to further enhance the efficiency and security of Federal Tax ID systems. This may include the development of mobile applications for EIN management, real-time data sharing between businesses and regulatory bodies, and even the use of artificial intelligence for more advanced tax compliance and verification.

As the business world embraces digital transformation, it is crucial for professionals and entrepreneurs to stay informed about these advancements and adapt their practices accordingly. By leveraging technology and staying abreast of regulatory changes, businesses can ensure they are compliant, efficient, and well-positioned for future growth.

How long does it take to obtain a Federal Tax ID?

+Obtaining a Federal Tax ID typically takes a few business days. Once the online application is submitted, the IRS processes the request, and businesses usually receive their EIN within 2 to 5 business days. However, during periods of high volume or if there are any issues with the application, the process may take longer.

Can I change my Federal Tax ID if I need to?

+Changing a Federal Tax ID is a complex process and should only be done under specific circumstances. Typically, an EIN change is necessary if there is a significant change in the business structure, such as a merger or acquisition, or if the business moves to a new jurisdiction. It is important to consult with tax professionals and follow the official IRS guidelines for changing an EIN.

Are there any fees associated with obtaining a Federal Tax ID?

+Obtaining a Federal Tax ID through the IRS is a free service. There are no application fees or charges associated with the online application process. However, it is important to be cautious of third-party services that may charge fees for assisting with the application or providing EIN-related services. Always verify the legitimacy of such services before engaging with them.