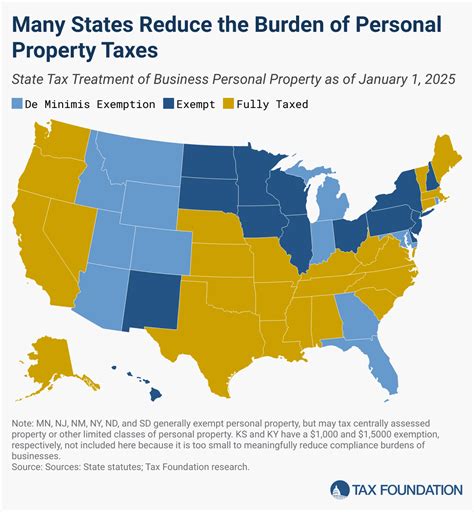

States No Property Tax

The concept of states without property taxes is an intriguing one, often generating curiosity and interest among homeowners and potential investors alike. While the idea of a state without property taxes may seem appealing, it's essential to understand the broader implications and unique circumstances that such a system entails. In this comprehensive exploration, we will delve into the reality of states with no property taxes, uncovering the facts, figures, and potential consequences associated with this unique fiscal policy.

Unveiling the States with No Property Taxes

Property taxes are a significant source of revenue for state and local governments, funding essential services like education, infrastructure, and public safety. However, there are a handful of states in the United States that have implemented alternative revenue streams, effectively eliminating the need for property taxes. Let’s take a closer look at these states and the reasons behind their unique fiscal strategies.

Alaska: A State Rich in Resources

Alaska is one of the most well-known states when it comes to property tax-free living. The Last Frontier boasts a unique revenue model, primarily relying on its vast natural resources, including oil, gas, and fisheries, to generate state income. Instead of levying property taxes, Alaska utilizes a system of dividends and royalties from its resource wealth, which are distributed to its residents. This arrangement has made Alaska a desirable destination for those seeking tax-free property ownership.

| Resource Revenue | State Income |

|---|---|

| Oil & Gas Royalties | $2.5 Billion (approx.) |

| Fisheries Taxes | $500 Million (approx.) |

However, it's important to note that Alaska's property tax-free status is not without its considerations. While residents enjoy the absence of property taxes, the state's economy is heavily dependent on resource prices, making it vulnerable to market fluctuations. Additionally, the state's remote location and harsh climate present unique challenges for residents and businesses alike.

Florida: The Sunshine State’s Approach

Florida is another state that has garnered attention for its property tax policies. While Florida does collect property taxes, it has implemented a range of measures to make property ownership more affordable and attractive.

- Homestead Exemption: Florida offers a generous homestead exemption, allowing homeowners to exempt a portion of their property's assessed value from taxation. This exemption is particularly beneficial for long-term residents and retirees.

- Save Our Homes Amendment: In 1992, Florida passed the Save Our Homes Amendment, which limits property tax increases to 3% or the Consumer Price Index, whichever is lower. This measure protects homeowners from excessive tax increases.

- Low Property Tax Rates: Florida's average effective property tax rate is one of the lowest in the nation, making it an appealing destination for homeowners seeking lower tax burdens.

Despite these tax advantages, it's worth noting that Florida relies heavily on sales tax and tourism revenue to fund its operations. This reliance on volatile revenue streams can present challenges during economic downturns.

Louisiana: A Unique Property Tax System

Louisiana has a unique property tax system that sets it apart from other states. While it does collect property taxes, the state’s assessment process is based on a complex formula that takes into account factors like property value, location, and even the type of property.

| Property Tax Rate | Median Property Tax |

|---|---|

| 0.55% (avg.) | $1,050 (approx.) |

Louisiana's property tax system is designed to ensure fairness and equity, but it can also lead to some variations in tax burdens across different parishes (counties) within the state.

Other States with Reduced Property Taxes

While the states mentioned above have implemented notable strategies to reduce or eliminate property taxes, several other states have taken steps to make property ownership more affordable.

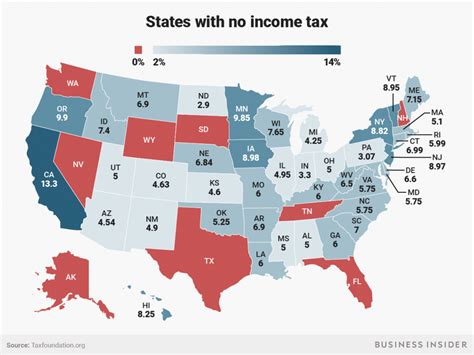

- Texas: Texas has a relatively low effective property tax rate, ranking among the lowest in the nation. The state offers a variety of exemptions and limits on property tax increases to protect homeowners.

- Delaware: Delaware has no state income tax, which can make it an attractive destination for retirees and investors. The state's property tax rates are also relatively low compared to other states.

- Wyoming: Wyoming's property tax system is designed to be fair and transparent. The state offers a homestead exemption and has a relatively low effective property tax rate.

The Impact and Implications

The absence or reduction of property taxes in certain states can have far-reaching implications for both residents and the state’s overall economy.

Benefits for Residents

- Lower Housing Costs: Property tax-free states or those with reduced property taxes can make homeownership more affordable, attracting buyers and potentially increasing property values.

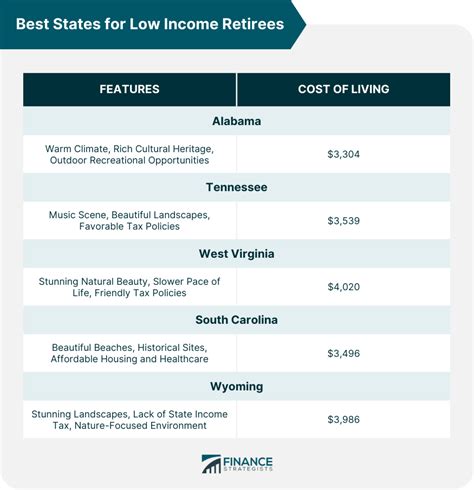

- Retirement Haven: States like Florida and Delaware, with their tax-friendly policies, have become popular retirement destinations, offering retirees a more financially viable option.

- Business Incentives: Lower property taxes can encourage businesses to relocate or expand in these states, creating job opportunities and boosting the local economy.

Challenges and Considerations

- Limited Revenue Streams: States that rely heavily on non-property tax revenue, like Alaska, may face challenges during economic downturns or shifts in resource markets.

- Inequality and Fairness: While property tax reductions can benefit homeowners, they can also lead to disparities in funding for essential services, potentially impacting the quality of education, healthcare, and infrastructure.

- Reliance on Federal Funding: States with reduced property taxes may rely more heavily on federal funding for certain programs, which can be subject to political and budgetary changes.

Conclusion: A Complex Fiscal Landscape

The concept of states without property taxes offers a fascinating glimpse into the diverse fiscal strategies employed by different states. While the idea of tax-free property ownership may be enticing, it’s essential to consider the broader implications and unique circumstances of each state’s fiscal model.

From Alaska's resource-rich economy to Florida's retirement haven and Louisiana's unique assessment system, each state's approach to property taxes reflects its distinct needs and priorities. As we navigate the complexities of the real estate market and fiscal policies, understanding these nuances can provide valuable insights for homeowners, investors, and policymakers alike.

Frequently Asked Questions

Are there any other states with no property taxes aside from Alaska and Florida?

+While Alaska and Florida are the most well-known states with reduced or no property taxes, there are other states that have implemented strategies to make property ownership more affordable. Texas, Delaware, and Wyoming, for instance, have relatively low property tax rates and offer various exemptions to homeowners.

How do states without property taxes fund their operations and essential services?

+States like Alaska rely heavily on revenue from natural resources, such as oil and gas royalties. Florida, on the other hand, relies on sales tax and tourism revenue. Other states may have a mix of revenue sources, including income tax, sales tax, and various fees.

What are the potential drawbacks of living in a state without property taxes?

+While property tax-free states can offer financial benefits, they may also face challenges. States heavily reliant on resource revenue, like Alaska, are vulnerable to market fluctuations. Additionally, reduced property taxes can lead to funding disparities for essential services, impacting the quality of public amenities.

Can states without property taxes still have high costs of living?

+Absolutely. While property taxes can be a significant expense, the cost of living is influenced by a multitude of factors, including housing, healthcare, and consumer prices. States without property taxes may still have high living costs due to other economic factors.