Idaho Sales Tax On Cars

When it comes to purchasing a car, understanding the sales tax implications is crucial, especially when considering a state like Idaho, known for its unique tax landscape. This comprehensive guide will delve into the intricacies of Idaho's sales tax on cars, providing you with a clear understanding of the process, rates, and potential exemptions to ensure a smooth and informed transaction.

The Idaho Sales Tax System

Idaho operates a sales tax system that applies to a wide range of goods and services, including vehicle purchases. The state sales tax rate is set at 6%, which serves as the base rate for most transactions. However, it’s important to note that local governments within Idaho have the authority to impose additional sales taxes, resulting in varying effective tax rates across different regions of the state.

The Idaho State Tax Commission oversees the administration and enforcement of sales tax laws, ensuring compliance and providing resources for taxpayers. Their website offers detailed guidelines and resources for businesses and individuals navigating the sales tax process, including specific instructions for vehicle purchases.

Local Sales Tax Variations

One of the distinctive features of Idaho’s sales tax system is the allowance for local governments to levy additional taxes, often referred to as local option sales taxes. These supplemental taxes can be imposed by counties, cities, or other local jurisdictions, leading to a range of effective sales tax rates throughout the state.

For instance, in Ada County, which includes the city of Boise, the local option sales tax adds an extra 0.5% to the state's 6% base rate, resulting in a total effective sales tax rate of 6.5% for car purchases. Similarly, Canyon County, home to the city of Nampa, applies an additional 0.5% local option sales tax, bringing the total rate to 6.5% as well.

However, it's essential to recognize that local sales tax rates can vary significantly across Idaho. Some counties may have higher or lower rates, or even no additional tax at all, making it crucial for car buyers to research the specific sales tax rate applicable to their intended purchase location.

| County | Local Option Sales Tax | Total Effective Rate |

|---|---|---|

| Ada County | 0.5% | 6.5% |

| Canyon County | 0.5% | 6.5% |

| Other Counties | Varies | Varies |

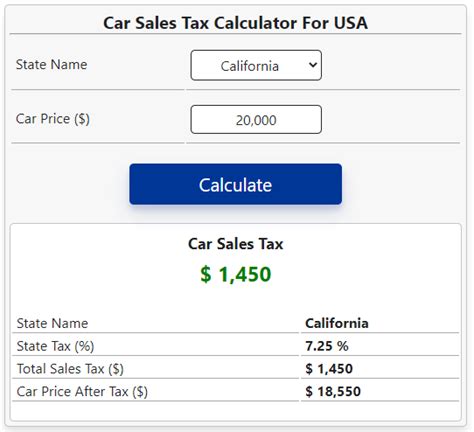

Calculating Sales Tax on Car Purchases

Determining the sales tax due on a car purchase in Idaho involves a straightforward calculation. The process remains consistent regardless of whether the vehicle is purchased from a dealership, a private seller, or an online platform.

To illustrate, let's consider an example. Suppose you're purchasing a car priced at $25,000 in a county with a 6.5% effective sales tax rate. The sales tax due on this transaction would be calculated as follows:

Sales Tax Due = Purchase Price x Sales Tax Rate

In this case, the sales tax would amount to $1,625 ($25,000 x 0.065).

Sales Tax on Used Cars

The sales tax calculation for used cars in Idaho follows a similar approach. Whether you’re buying a pre-owned vehicle from a dealership or a private party, the sales tax is typically based on the purchase price, ensuring fairness and consistency across the market.

For instance, if you're purchasing a used car priced at $18,000 in a county with a 6.5% effective sales tax rate, the sales tax due would be $1,170 ($18,000 x 0.065).

Exemptions and Special Considerations

While Idaho’s sales tax system generally applies to most vehicle purchases, there are certain exemptions and special considerations that buyers should be aware of.

Leased Vehicles

When leasing a vehicle in Idaho, the sales tax is typically calculated based on the total lease price, including any applicable taxes and fees. This means that the sales tax is spread out over the lease term, with a portion of the tax due with each monthly payment.

For example, if you're leasing a car for 36 months with a total lease price of $21,000 (including taxes and fees) and an effective sales tax rate of 6.5%, the sales tax component would amount to $1,365 ($21,000 x 0.065). This tax would be divided evenly across the 36 monthly payments, resulting in an additional $38 in sales tax due with each payment.

Trade-Ins and Vehicle Transfers

In Idaho, when trading in a vehicle or transferring ownership within the family, the sales tax is generally calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This approach ensures that buyers are only taxed on the net value gained from the transaction.

Let's consider an example. If you're trading in a vehicle with a trade-in value of $10,000 and purchasing a new car priced at $20,000, the sales tax would be calculated on the $10,000 difference. With an effective sales tax rate of 6.5%, the sales tax due would be $650 ($10,000 x 0.065).

Vehicle Registration and Title Fees

In addition to sales tax, it’s important to consider the various fees associated with vehicle registration and titling in Idaho. These fees can vary based on factors such as vehicle weight, fuel type, and registration duration.

The Idaho Transportation Department provides a comprehensive fee schedule outlining the costs associated with registering and titling vehicles. These fees typically include a registration fee, a title transfer fee, and potentially other charges depending on the specific circumstances of the transaction.

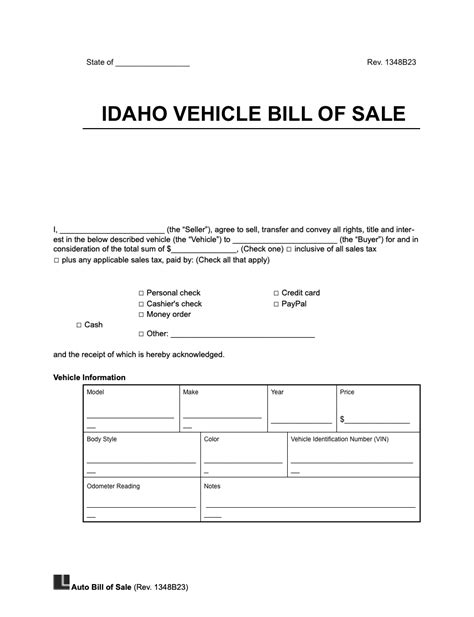

Understanding Sales Tax Documentation

When purchasing a vehicle in Idaho, it’s crucial to obtain the appropriate sales tax documentation to ensure compliance with state laws and facilitate the registration process.

Sales Tax Exemption Certificates

In certain situations, individuals or entities may be eligible for sales tax exemptions. These exemptions are typically granted to specific groups, such as government agencies, non-profit organizations, or individuals with qualifying disabilities. To claim an exemption, the buyer must provide the seller with a valid Sales Tax Exemption Certificate or other required documentation.

Sales Tax Returns and Reporting

For businesses engaged in vehicle sales, understanding their sales tax return and reporting obligations is essential. The Idaho State Tax Commission provides detailed guidelines on sales tax returns, including deadlines, filing methods, and payment requirements. Businesses must ensure accurate reporting to avoid penalties and maintain compliance with state regulations.

Resources and Support

Navigating the intricacies of Idaho’s sales tax system can be simplified with the right resources and support. The Idaho State Tax Commission offers a wealth of information and guidance through their website, including:

- Sales Tax Guides: Comprehensive guides tailored to specific industries, including automotive sales, provide detailed instructions on sales tax compliance.

- Sales Tax Rates: An interactive map allows users to explore sales tax rates across Idaho's counties, ensuring buyers are aware of the applicable tax rate for their location.

- Online Services: The website offers convenient online tools for filing sales tax returns, making payments, and accessing account information.

- Contact Information: Direct contact details for the Idaho State Tax Commission are available, enabling taxpayers to seek assistance and clarify any sales tax-related queries.

Future Implications and Trends

As Idaho’s economy evolves, the state’s sales tax system is likely to undergo adjustments to accommodate changing market dynamics and revenue needs. While the current sales tax rate of 6% has remained stable, there have been discussions and proposals to modify the rate or explore alternative tax structures to address emerging fiscal challenges.

Additionally, the rise of e-commerce and online vehicle sales platforms has prompted discussions around tax collection and compliance in the digital realm. Idaho, like many other states, is actively exploring strategies to ensure fair and efficient tax collection from online transactions, which could impact the sales tax landscape for vehicle purchases in the future.

Conclusion

Understanding Idaho’s sales tax on cars is essential for making informed purchasing decisions. By navigating the state’s sales tax system, researching local variations, and staying informed about exemptions and special considerations, buyers can ensure a seamless and compliant transaction. With the right knowledge and resources, the process of purchasing a vehicle in Idaho can be a smooth and rewarding experience.

How often do Idaho’s sales tax rates change?

+Idaho’s sales tax rates are relatively stable, with the state sales tax rate remaining at 6% for many years. However, local option sales taxes can change more frequently, often as a result of local ballot initiatives or legislative actions. It’s essential to stay updated on any local tax changes that may impact your vehicle purchase.

Are there any sales tax holidays in Idaho for car purchases?

+Idaho does not currently have specific sales tax holidays designated for car purchases. However, the state may occasionally offer sales tax holidays for certain categories of goods, so it’s worth checking the Idaho State Tax Commission’s website for any upcoming events.

How can I find the local sales tax rate for my county in Idaho?

+The Idaho State Tax Commission provides an interactive map on its website that allows you to easily find the local sales tax rate for any county in Idaho. Simply navigate to the sales tax rates section of their website and select your county to view the applicable tax rate.