Tax Exempt Form Pa

The world of taxation can be a complex and often daunting realm for individuals and businesses alike. Understanding the intricacies of tax laws and exemptions is crucial to ensure compliance and optimize financial strategies. In the state of Pennsylvania, the Tax Exempt Form plays a pivotal role in navigating the tax landscape.

This comprehensive guide aims to shed light on the Tax Exempt Form in Pennsylvania, its purpose, applicability, and the process involved. By exploring real-world examples and providing practical insights, we will empower readers to make informed decisions regarding tax exemptions and maximize their financial benefits.

Understanding the Tax Exempt Form in Pennsylvania

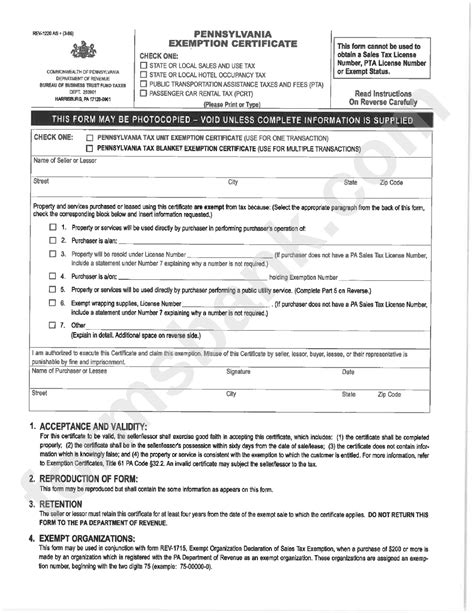

The Tax Exempt Form in Pennsylvania is a legal document that allows eligible entities to claim exemption from certain taxes imposed by the state. This form serves as a crucial tool for individuals, businesses, and organizations to assert their eligibility for tax exemptions based on specific criteria and regulations.

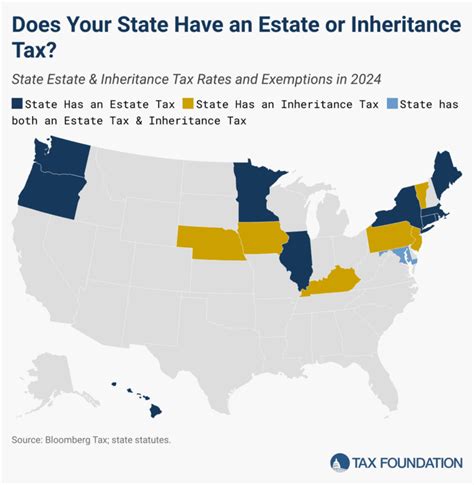

Pennsylvania, like many other states, has a diverse tax system that encompasses various taxes, including sales tax, use tax, and personal income tax. The Tax Exempt Form acts as a mechanism to navigate these taxes and provides a means to obtain relief from certain tax obligations under specific circumstances.

Eligibility and Applicability

Determining eligibility for tax exemption is a critical aspect of understanding the Tax Exempt Form. In Pennsylvania, various entities can qualify for tax exemption, including:

- Nonprofit Organizations: Charitable, educational, religious, and other nonprofit organizations often qualify for tax exemption. These entities are typically exempt from sales and use taxes on their purchases and may also be exempt from certain property taxes.

- Governmental Entities: Federal, state, and local governments, as well as their agencies and instrumentalities, are generally exempt from sales and use taxes.

- Educational Institutions: Schools, colleges, and universities may be exempt from certain taxes, particularly sales and use taxes on educational materials and equipment.

- Certain Businesses: Some businesses, such as those involved in manufacturing or agriculture, may qualify for tax exemption under specific conditions. For instance, manufacturers may be exempt from sales tax on certain raw materials and equipment.

- Individuals with Exemptions: Individuals with specific circumstances, such as disability or low income, may be eligible for tax exemptions on certain taxes, including property taxes.

The Tax Exempt Form Process

Obtaining tax exemption in Pennsylvania involves a well-defined process. Here's a step-by-step guide:

- Identify Eligibility: The first step is to determine whether your entity or circumstance aligns with the eligibility criteria for tax exemption. Review the relevant tax laws and regulations to understand the specific requirements.

- Gather Documentation: Collect the necessary documentation to support your claim for tax exemption. This may include articles of incorporation, bylaws, financial statements, or other relevant records.

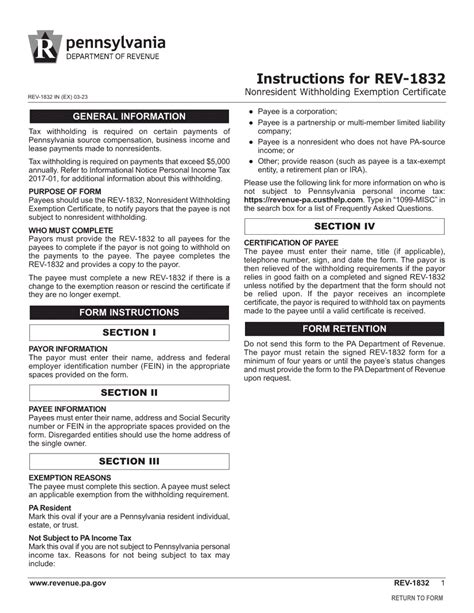

- Complete the Form: Download and carefully fill out the Tax Exempt Form. Ensure that all required information is accurate and complete. Pay attention to any specific instructions provided by the Pennsylvania Department of Revenue.

- Submit the Form: Submit the completed Tax Exempt Form to the appropriate department or agency. This may be done electronically or by mail, depending on the specific tax exemption you are seeking.

- Wait for Approval: Once your form is submitted, the relevant authorities will review your application. The processing time may vary, so it's essential to be patient and ensure you have submitted all the required information.

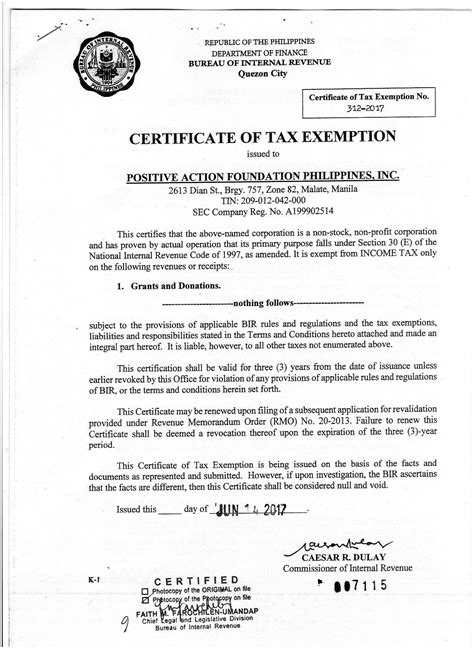

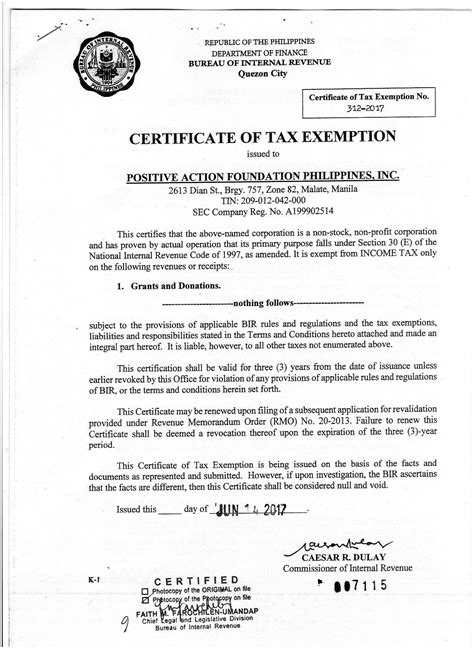

- Obtain Certificate of Exemption: Upon approval, you will receive a Certificate of Exemption. This certificate serves as proof of your tax-exempt status and should be retained for future reference and tax compliance purposes.

It's important to note that the Tax Exempt Form and the associated process may vary depending on the specific tax exemption you are pursuing. For instance, the form and requirements for sales and use tax exemption differ from those for property tax exemption.

Real-World Examples of Tax Exemptions

To illustrate the practical application of tax exemptions, let's explore a few real-world scenarios in Pennsylvania:

- Nonprofit Organization Exemption: The Community Foundation, a charitable organization dedicated to supporting local communities, applies for tax exemption. They complete the Tax Exempt Form, providing details about their mission, financial statements, and proof of nonprofit status. Upon approval, they receive a Certificate of Exemption, allowing them to make tax-exempt purchases and conduct their charitable activities without the burden of certain taxes.

- Governmental Entity Exemption: The City of Philadelphia, as a local government entity, is automatically exempt from sales and use taxes. However, to facilitate tax compliance and ensure proper documentation, they still need to obtain a Certificate of Exemption. This certificate simplifies their tax reporting and ensures smooth operations.

- Educational Institution Exemption: Penn State University, a renowned educational institution, seeks exemption from sales and use taxes on educational materials and equipment. They submit the Tax Exempt Form, highlighting their educational mission and providing supporting documentation. With the exemption in place, the university can focus its resources on providing quality education without the added tax burden.

| Entity | Tax Exemption |

|---|---|

| Community Foundation | Sales and Use Tax Exemption for Charitable Organizations |

| City of Philadelphia | Automatic Exemption for Governmental Entities |

| Penn State University | Sales and Use Tax Exemption for Educational Institutions |

Maximizing Tax Exemptions: Strategies and Considerations

Navigating the world of tax exemptions requires a strategic approach. Here are some key considerations to maximize the benefits of tax exemptions in Pennsylvania:

Stay Informed about Tax Laws and Regulations

Tax laws and regulations are subject to change, and staying updated is crucial. The Pennsylvania Department of Revenue regularly publishes updates and guidance on tax exemptions. By keeping abreast of these changes, entities can ensure they remain compliant and take advantage of any new exemptions or modifications.

Utilize Professional Expertise

The tax landscape can be complex, and seeking professional advice can be invaluable. Tax consultants, accountants, and legal experts specializing in tax law can provide tailored guidance based on your specific circumstances. They can help navigate the Tax Exempt Form process, ensure accuracy, and identify additional tax-saving opportunities.

Keep Detailed Records

Maintaining organized and detailed records is essential for tax exemption eligibility and compliance. Proper record-keeping ensures that you have the necessary documentation to support your claim and facilitates smooth interactions with tax authorities. It also helps in auditing and provides a clear trail of financial transactions.

Explore Multiple Exemptions

Entities may qualify for multiple tax exemptions based on their activities and status. For instance, a nonprofit organization may be eligible for both sales and use tax exemption and property tax exemption. Exploring and understanding the various exemptions available can lead to significant tax savings and a more robust financial strategy.

Leverage Technology for Compliance

In today's digital age, leveraging technology can streamline the tax exemption process. Tax software and online platforms can help with form completion, record-keeping, and compliance. These tools can automate certain tasks, reduce errors, and provide real-time updates on tax regulations, ensuring a more efficient and accurate approach to tax exemption management.

Stay Proactive and Plan Ahead

Tax exemption is not a one-time process. Entities should stay proactive and plan ahead to ensure continuous compliance. Regularly review your tax strategies, assess your eligibility for new exemptions, and stay informed about any changes in tax laws. By staying ahead of the curve, you can optimize your tax position and avoid potential penalties or complications.

The Impact of Tax Exemptions: Case Studies

To understand the real-world impact of tax exemptions, let's delve into a couple of case studies:

Case Study 1: Small Business Success

Imagine a small manufacturing business, "Precision Engineering," located in Pittsburgh, PA. They produce precision machinery parts and have a limited budget for operations. By obtaining a sales and use tax exemption for manufacturers, they can reduce their tax burden on raw materials and equipment purchases. This exemption allows them to reinvest those savings into business growth, hire additional staff, and expand their operations, ultimately contributing to the local economy.

Case Study 2: Community Development

Consider a local community development organization, "Neighborhood Revitalization," dedicated to improving housing conditions in underserved areas of Philadelphia. By obtaining a property tax exemption for their nonprofit status, they can redirect those funds toward their mission. This exemption enables them to invest more resources into renovating dilapidated housing, creating affordable housing opportunities, and revitalizing the community, ultimately enhancing the quality of life for residents.

The Ripple Effect of Tax Exemptions

Tax exemptions not only benefit the entities themselves but also have a broader impact on the community and the economy. By reducing tax burdens, organizations can allocate more resources to their core missions, whether it's education, community development, or economic growth. This, in turn, creates a positive ripple effect, leading to improved social outcomes, job creation, and a more vibrant community.

Conclusion: Navigating the Tax Exempt Form for a Brighter Financial Future

The Tax Exempt Form in Pennsylvania is a powerful tool for individuals, businesses, and organizations to navigate the complex tax landscape and optimize their financial strategies. By understanding the eligibility criteria, completing the form accurately, and staying informed about tax laws, entities can unlock significant tax savings and focus on their core objectives.

Whether you're a nonprofit striving to make a difference, a business seeking growth, or an individual facing unique financial circumstances, tax exemptions can provide a vital boost. By embracing the opportunities presented by the Tax Exempt Form, you can take control of your financial destiny and contribute to a stronger, more prosperous community.

Frequently Asked Questions

What is the purpose of the Tax Exempt Form in Pennsylvania?

+The Tax Exempt Form serves as a legal document to claim exemption from certain taxes imposed by the state of Pennsylvania. It allows eligible entities to assert their eligibility for tax exemption based on specific criteria and regulations.

<div class="faq-item">

<div class="faq-question">

<h3>Who is eligible for tax exemption in Pennsylvania?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Various entities can qualify for tax exemption in Pennsylvania, including nonprofit organizations, governmental entities, educational institutions, certain businesses, and individuals with specific circumstances, such as disability or low income.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I obtain a Certificate of Exemption in Pennsylvania?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To obtain a Certificate of Exemption, you need to complete and submit the appropriate Tax Exempt Form to the Pennsylvania Department of Revenue. The process involves identifying your eligibility, gathering necessary documentation, and following the instructions provided by the department. Upon approval, you will receive the certificate.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there different Tax Exempt Forms for different types of tax exemptions in Pennsylvania?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the Tax Exempt Form process and requirements may vary depending on the specific tax exemption you are seeking. For instance, the form and criteria for sales and use tax exemption differ from those for property tax exemption. It's essential to review the relevant guidelines and forms provided by the Pennsylvania Department of Revenue.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often do tax exemption rules and regulations change in Pennsylvania?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Tax laws and regulations can change periodically, and it's crucial to stay updated. The Pennsylvania Department of Revenue regularly publishes updates and guidance on tax exemptions. It's advisable to review their website and relevant publications to ensure you are aware of any changes that may impact your tax exemption status or eligibility.</p>

</div>

</div>