Pay Orange County Property Tax

In Orange County, California, property owners are required to pay annual property taxes, which contribute to the funding of various essential services and infrastructure in the county. Paying property taxes on time is crucial to avoid penalties and ensure the smooth operation of local government services. This article will guide you through the process of paying Orange County property taxes, providing you with a comprehensive understanding of the steps involved, the payment options available, and important deadlines to keep in mind.

Understanding Property Taxes in Orange County

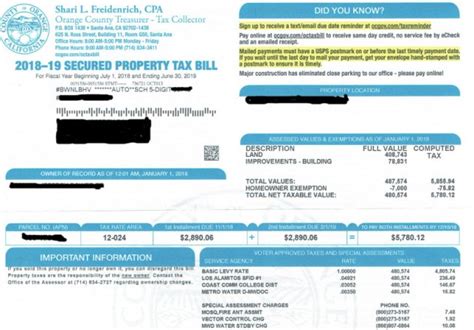

Property taxes in Orange County are levied based on the assessed value of your property, which is determined by the Orange County Assessor’s Office. The assessed value is calculated using various factors, including the property’s location, size, improvements, and market conditions. Property taxes are used to fund vital services such as public education, law enforcement, fire protection, infrastructure development, and more.

It's important to note that property tax rates in Orange County can vary depending on the specific location of your property and the services provided by the local government. These rates are typically expressed as a percentage of the assessed value of the property. For example, the current fiscal year (FY) property tax rate for the City of Santa Ana is set at 1.0973% for general funds and 0.0066% for voter-approved measures.

| Tax Rate | Description |

|---|---|

| General Funds | Supports county operations, including public safety, health services, and infrastructure. |

| Voter-Approved Measures | Funds specific projects or initiatives approved by the voters, such as school bonds or infrastructure improvements. |

The assessed value of your property and the applicable tax rate will be reflected on your annual Property Tax Bill, which is sent out by the Orange County Tax Collector's Office. This bill outlines the amount you owe, the due dates, and any penalties for late payments.

Paying Property Taxes: A Step-by-Step Guide

-

Review Your Property Tax Bill: When you receive your property tax bill, carefully review the details. Check the assessed value, the calculated tax amount, and any applicable discounts or exemptions you may be eligible for. Ensure that the information is accurate and reflects your property’s current status.

-

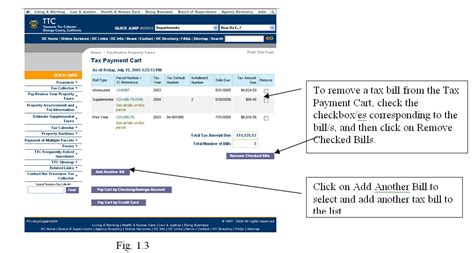

Choose Your Payment Method: Orange County offers various payment options to accommodate different preferences and circumstances. You can choose from the following methods:

- Online Payment: The most convenient and secure method, allowing you to pay your taxes from the comfort of your home or office. You can use a credit card, debit card, or electronic check to make the payment. Visit the Orange County Tax Collector’s Online Payment Portal to get started.

- Mail-In Payment: If you prefer a more traditional approach, you can mail your payment along with the remittance stub from your tax bill. Send your payment to the address specified on the bill. Ensure you allow sufficient time for the payment to reach the Tax Collector’s Office before the due date.

- In-Person Payment: For those who prefer face-to-face transactions, you can visit one of the Orange County Tax Collector’s Office locations during business hours. Bring your tax bill and the payment amount, and a representative will assist you with the payment process.

- Automatic Payment Plan: If you’d like to set up automatic payments for your property taxes, Orange County offers an Automatic Payment Plan. This plan allows you to schedule recurring payments from your bank account, ensuring your taxes are paid on time without the need for manual reminders.

-

Make Your Payment: Follow the instructions for your chosen payment method. Whether it’s online, by mail, or in person, ensure you have the necessary information and funds ready. Double-check the payment amount and confirm the payment details before finalizing the transaction.

-

Confirm Receipt and Record Keeping: After making your payment, it’s essential to confirm that the Tax Collector’s Office has received it. Keep a record of your payment, including the date, amount, and method of payment. You may also want to save a copy of the payment confirmation or receipt for your records.

-

Stay Informed About Deadlines: Property tax deadlines are typically based on the fiscal year, which runs from July 1 to June 30. The first installment of your property taxes is due by November 1 of each year. If you fail to pay by this date, a penalty of 10% of the unpaid taxes will be applied. The second installment is due by February 1 of the following year, with a 10% penalty for late payments.

Property Tax Exemptions and Discounts

Orange County offers certain exemptions and discounts to eligible property owners, which can help reduce the overall tax burden. It’s important to understand these opportunities and determine if you qualify for any of them.

Homestead Exemption

The Homestead Exemption is a valuable benefit for homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property by a specified amount, resulting in lower property taxes. To qualify for the Homestead Exemption, you must meet the following criteria:

- Be a legal resident of California.

- Own and occupy the property as your primary residence.

- File a claim for the exemption with the Orange County Assessor’s Office.

The Homestead Exemption provides a reduction in assessed value of up to $7,000 for homeowners who meet the eligibility requirements. This can result in significant savings on your property taxes.

Senior Citizen Exemption

Orange County also offers an exemption specifically for senior citizens. The Senior Citizen Exemption is available to homeowners who are 65 years of age or older and meet certain income requirements. To qualify, you must:

- Be at least 65 years old.

- Have a total household income that does not exceed 37,856 (for the 2023-2024 fiscal year).</li>

<li>File an application with the Orange County Assessor's Office.</li>

</ul>

<p>The Senior Citizen Exemption provides a reduction in assessed value of up to 7,000 for eligible homeowners. This exemption can provide substantial relief for seniors on a fixed income.

Other Exemptions and Discounts

In addition to the Homestead and Senior Citizen Exemptions, Orange County offers other exemptions and discounts for specific circumstances. These may include:

- Disabled Veteran Exemption: Veterans with service-connected disabilities may qualify for a reduction in assessed value, resulting in lower property taxes.

- Military Exemption: Active-duty military personnel and their families may be eligible for a partial or full exemption from property taxes while deployed.

- Early Payment Discount: Orange County provides a 2% discount for property owners who pay their first installment by December 10 and their second installment by April 10.

Stay Informed and Seek Assistance

Paying your Orange County property taxes is a crucial responsibility, but it doesn’t have to be a daunting task. By understanding the process, choosing the right payment method, and staying informed about deadlines and available exemptions, you can ensure a smooth and stress-free experience.

If you have any questions or need further assistance, don't hesitate to reach out to the Orange County Tax Collector's Office. Their team is dedicated to providing support and guidance to property owners. Additionally, you can explore the resources available on their website, including FAQs, payment instructions, and important dates.

Remember, timely payment of your property taxes contributes to the overall well-being of your community and helps maintain the high quality of life we enjoy in Orange County. Stay informed, stay organized, and pay your property taxes with confidence.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, a 10% penalty will be applied to the unpaid taxes. It’s important to note that this penalty is in addition to any other penalties or fees that may be incurred due to late payment. To avoid penalties, make sure to pay your property taxes on time or set up an automatic payment plan to ensure timely payments.

Can I appeal my property’s assessed value?

+Yes, if you believe that your property’s assessed value is inaccurate or unfair, you have the right to appeal. The process involves submitting an application for an assessment review with the Orange County Assessor’s Office. You’ll need to provide supporting evidence and documentation to support your claim. It’s recommended to consult with a professional tax advisor or attorney for guidance on the appeal process.

Are there any payment plans available for property taxes?

+Yes, Orange County offers an Automatic Payment Plan, which allows you to schedule recurring payments from your bank account. This plan ensures that your property taxes are paid on time without the need for manual reminders. It’s a convenient option for those who prefer automatic payments and want to avoid late fees and penalties.

Can I pay my property taxes early?

+Yes, you can pay your property taxes early. In fact, Orange County offers a 2% discount for property owners who pay their first installment by December 10 and their second installment by April 10. This early payment discount provides an incentive for timely payments and can save you money on your overall tax bill.

How can I stay informed about property tax deadlines and changes?

+To stay informed about property tax deadlines and any changes or updates, it’s recommended to regularly check the official website of the Orange County Tax Collector’s Office. They provide important dates, payment instructions, and any relevant news or announcements. Additionally, you can sign up for their email notifications or follow their social media channels to receive timely updates.