Huntington Ny Tax

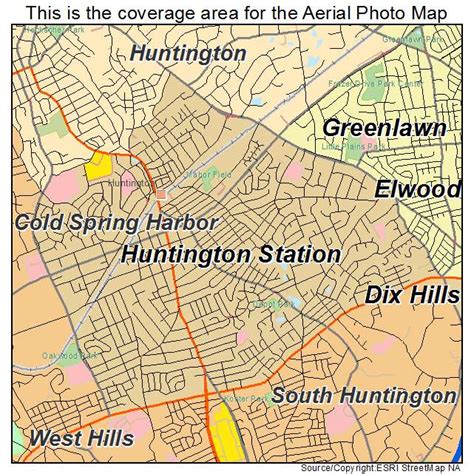

Welcome to this in-depth exploration of the tax landscape in Huntington, New York. This article aims to provide a comprehensive understanding of the tax structure, rates, and implications for residents and businesses in this vibrant community. As we delve into the specifics, we'll uncover the unique aspects of Huntington's tax system, offering valuable insights for those navigating the financial responsibilities associated with living and operating in this region.

Understanding Huntington’s Tax Structure

Huntington, located in Suffolk County, boasts a diverse tax structure that contributes significantly to the local economy and public services. This section aims to demystify the various tax components, providing a clear picture of how they function and their impact on the community.

Property Taxes: A Key Revenue Stream

Property taxes form the backbone of Huntington’s tax revenue. These taxes are levied on real estate properties, including residential, commercial, and industrial lands. The Assessor’s Office plays a pivotal role in determining the assessed value of each property, which forms the basis for tax calculations. The assessed value is typically a percentage of the property’s market value, and this percentage can vary based on the property’s classification.

For instance, consider a residential property in Huntington. The Assessor might assess its value at $500,000, which is then subject to a tax rate of, say, 1.5%. This would result in an annual property tax bill of $7,500. It's worth noting that property tax rates can fluctuate based on various factors, including the municipality's financial needs and the state of the local economy.

| Property Type | Average Assessed Value | Tax Rate (%) |

|---|---|---|

| Residential | $480,000 | 1.45 |

| Commercial | $720,000 | 1.6 |

| Industrial | $600,000 | 1.55 |

Income Taxes: Individual and Business Contributions

Huntington, like the rest of New York State, imposes income taxes on both individuals and businesses. These taxes are progressive, meaning the tax rate increases as income levels rise. The revenue generated from income taxes plays a crucial role in funding various public services, from education and healthcare to infrastructure development.

For individuals, the state income tax rate ranges from 4% to 8.82%, depending on income brackets. Residents of Huntington, like all New Yorkers, are required to file state income tax returns annually. Additionally, Huntington residents also contribute to the local economy through sales taxes, which are applied to various goods and services.

Businesses in Huntington, whether sole proprietorships, partnerships, or corporations, are subject to different tax rates and regulations. The Huntington Chamber of Commerce often provides resources and guidance to businesses navigating the complex web of tax obligations, ensuring compliance and minimizing financial burdens.

Sales and Use Taxes: Impact on Daily Transactions

Sales and use taxes are an integral part of Huntington’s tax structure, affecting most transactions within the municipality. These taxes are levied on the sale of goods and certain services, with rates varying based on the type of product or service and the jurisdiction in which the transaction occurs.

For instance, the sales tax rate in Huntington is typically combined with the state sales tax rate, resulting in a higher overall tax percentage. This combined rate is applied to most retail purchases, with certain exemptions for essential items like groceries and medications. Businesses operating within Huntington are responsible for collecting and remitting these sales taxes to the state.

| Tax Type | Rate (%) | Applicable To |

|---|---|---|

| Sales Tax | 8.625 | Retail Sales |

| Use Tax | 8.625 | Purchases from out-of-state vendors |

Tax Incentives and Programs

Huntington recognizes the importance of tax incentives and programs in fostering economic growth and community development. These initiatives aim to attract new businesses, support existing ones, and promote investment in the local economy.

Business Incentive Programs

The Huntington Economic Development Corporation (HEDC) plays a pivotal role in promoting economic growth and job creation in the town. HEDC offers a range of incentives and programs tailored to the needs of local businesses. These initiatives often include tax abatements, grants, and low-interest loans to encourage business expansion and investment.

For instance, the Business Investment Program provides tax abatements to businesses that create new jobs or invest in capital improvements. This program aims to stimulate economic activity and attract new businesses to Huntington. The Small Business Grant Program, on the other hand, offers financial assistance to small businesses, helping them overcome initial barriers and fostering their long-term success.

Residential Tax Relief Programs

Huntington also recognizes the importance of supporting its residents through various tax relief programs. These initiatives aim to ease the financial burden on homeowners and encourage homeownership within the community.

The Senior Citizen Rent and Property Tax Relief Program provides eligible seniors with a credit against their rent or property taxes. This program aims to support senior residents, ensuring they can continue to live comfortably in their homes. Additionally, Huntington offers the STAR (School Tax Relief) Program, which provides a partial exemption from school taxes for owner-occupied, primary residences.

Tax Collection and Compliance

Ensuring tax compliance is a critical aspect of maintaining a fair and efficient tax system. Huntington, like other municipalities, has established robust processes for tax collection and enforcement to ensure that all taxpayers meet their financial obligations.

Tax Collection Processes

The Town of Huntington Tax Receiver’s Office is responsible for the collection of various taxes, including property taxes, sales taxes, and local income taxes. This office ensures that taxpayers receive accurate tax bills and provides assistance with any inquiries or issues related to tax payments.

Property taxes, for instance, are collected semi-annually or annually, depending on the homeowner's preference. The Tax Receiver's Office provides convenient payment options, including online payments, mail-in checks, and in-person payments at designated locations. Late payments are subject to penalties and interest, encouraging timely compliance.

Compliance and Enforcement

The Town of Huntington takes tax compliance seriously and has established measures to ensure that all taxpayers meet their obligations. This includes regular audits, which are conducted to verify the accuracy of tax returns and ensure that businesses and individuals are paying their fair share.

For instances of non-compliance, the town has a graduated system of penalties and enforcement actions. This may include initial notices, followed by more stringent measures like liens and levies if the issue persists. The goal is to encourage voluntary compliance while maintaining a fair and equitable tax system for all residents and businesses.

Future Implications and Conclusion

As Huntington continues to evolve, its tax structure will play a pivotal role in shaping the future of the community. The town’s tax policies and incentives will continue to attract new businesses and residents, fostering economic growth and development. However, the municipality must also balance these incentives with the need to fund essential public services and infrastructure projects.

Looking ahead, Huntington's tax system will need to adapt to changing economic landscapes and demographic shifts. This may involve revisiting tax rates, exploring new revenue streams, and ensuring that tax policies remain fair and equitable for all residents and businesses. The ongoing collaboration between the town government, local businesses, and residents will be crucial in shaping a tax system that supports the community's long-term prosperity.

How often are property taxes assessed in Huntington, NY?

+Property taxes in Huntington are assessed annually by the Assessor’s Office. This means that the assessed value of your property is reviewed and updated each year, which can impact your property tax bill.

Are there any tax incentives for businesses in Huntington?

+Yes, the Town of Huntington offers various tax incentive programs to attract and support businesses. These programs include tax abatements, grants, and low-interest loans, especially for businesses creating new jobs or investing in capital improvements.

What are the tax benefits for senior citizens in Huntington?

+Senior citizens in Huntington can benefit from the Senior Citizen Rent and Property Tax Relief Program, which provides a credit against their rent or property taxes. This program aims to support seniors in maintaining their homes and living comfortably in their later years.

How can I ensure I’m paying the correct amount of sales tax in Huntington?

+To ensure you’re paying the correct sales tax, it’s important to understand the current tax rate and its application. The sales tax rate in Huntington is typically combined with the state sales tax rate, so make sure to verify the combined rate with the Town’s Tax Receiver’s Office. Additionally, stay informed about any changes or exemptions that may apply to your purchases.