Tax Evasion Punishment

Tax evasion is a serious offense that carries significant legal consequences. It involves intentionally failing to pay taxes owed to the government, either by underreporting income, claiming false deductions, or failing to file tax returns altogether. This act of tax evasion not only undermines the integrity of the tax system but also impacts the financial stability and services provided by governments. In this article, we delve into the various aspects of tax evasion punishment, exploring the legal repercussions, potential penalties, and the far-reaching implications for individuals and businesses found guilty of such offenses.

Understanding Tax Evasion and Its Legal Ramifications

Tax evasion is a criminal act that falls under the jurisdiction of tax authorities and legal systems worldwide. It is defined as the deliberate attempt to avoid paying taxes that are legally owed. This can take various forms, including:

- Underreporting Income: Individuals or businesses may understate their taxable income, often by omitting certain sources of revenue or misrepresenting financial records.

- Claiming False Deductions: Taxpayers might inflate expenses or claim deductions for non-existent costs to reduce their tax liability.

- Failure to File Tax Returns: Intentionally not filing tax returns when legally obligated to do so is a common form of tax evasion.

- Concealing Assets: Some individuals or entities hide assets or transfer them to offshore accounts to evade taxes.

Tax evasion is a serious crime that undermines the fairness and effectiveness of the tax system. It shifts the tax burden onto honest taxpayers and can lead to significant revenue losses for governments, impacting their ability to provide essential public services and infrastructure.

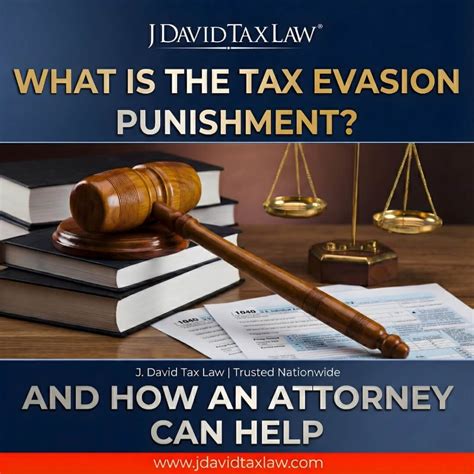

Legal Consequences and Penalties for Tax Evasion

The punishment for tax evasion varies across jurisdictions, but it typically involves a combination of monetary fines, imprisonment, and additional legal repercussions. Here's an overview of the potential consequences:

Criminal Charges and Prison Sentences

In many countries, tax evasion is considered a criminal offense. Individuals found guilty of tax evasion can face prison sentences, especially in cases of significant tax fraud or repeat offenses. The length of imprisonment can vary based on the jurisdiction and the severity of the crime.

| Jurisdiction | Maximum Prison Sentence |

|---|---|

| United States | Up to 5 years for each count of tax evasion |

| United Kingdom | Up to 7 years for fraud offenses |

| Canada | Up to 2 years for tax evasion |

It's important to note that these are maximum sentences, and actual penalties may be lower depending on the specific circumstances of the case.

Monetary Fines and Penalties

Tax evaders often face substantial monetary penalties in addition to potential imprisonment. These fines can include:

- Back Taxes: Individuals or businesses found guilty of tax evasion must pay the outstanding taxes they owe, along with interest and penalties.

- Criminal Fines: Courts may impose additional fines as a punishment for the crime. These fines can be substantial, often exceeding the amount of tax evaded.

- Civil Penalties: Tax authorities may also levy civil penalties, which can be a percentage of the underpaid taxes or a fixed amount based on the severity of the offense.

Loss of Professional Licenses and Reputational Damage

Tax evasion can have severe consequences for professionals, especially those in regulated industries. Lawyers, accountants, and financial advisors found guilty of tax evasion may face the loss of their professional licenses, effectively ending their careers in those fields.

Additionally, the reputational damage caused by tax evasion charges can be significant. Individuals and businesses may struggle to regain trust from clients, partners, and the public, impacting their future business prospects.

Asset Seizure and Forfeiture

In some cases, tax authorities have the power to seize assets belonging to tax evaders. This can include property, vehicles, bank accounts, and even luxury items. The proceeds from the sale of these assets may be used to offset the tax debt.

The Impact of Tax Evasion on Individuals and Businesses

The consequences of tax evasion extend beyond legal penalties. Individuals and businesses found guilty of tax evasion can face a range of negative outcomes, including:

- Financial Strain: Paying back taxes, interest, and penalties can put a significant financial burden on individuals and businesses, potentially leading to bankruptcy or severe financial distress.

- Criminal Record: A criminal conviction for tax evasion can follow individuals for life, impacting their ability to find employment, obtain loans, or even travel to certain countries.

- Loss of Business Opportunities: Businesses may lose contracts, clients, and investors due to the negative publicity and reputational damage associated with tax evasion charges.

- Increased Scrutiny: Tax authorities often subject individuals and businesses to heightened scrutiny after a tax evasion conviction. This can lead to more frequent audits and investigations, adding to the administrative burden.

Prevention and Compliance Measures

To avoid the severe consequences of tax evasion, individuals and businesses should prioritize tax compliance. Here are some key measures to consider:

- Hire Qualified Tax Professionals: Engaging the services of reputable tax advisors, accountants, or lawyers can help ensure accurate tax reporting and compliance.

- Keep Detailed Records: Maintain organized financial records, including income statements, expense receipts, and bank statements, to facilitate accurate tax reporting.

- Understand Tax Laws and Regulations: Stay informed about tax laws and any changes that may impact your tax obligations. Seek professional advice if you have questions or concerns.

- File Tax Returns on Time: Ensure that tax returns are filed promptly and accurately. Late filings can attract penalties and increase the risk of audits.

The Role of Tax Authorities in Combating Tax Evasion

Tax authorities play a crucial role in detecting and prosecuting tax evasion cases. They employ various strategies, including:

- Audits: Tax authorities conduct audits to examine the financial records of individuals and businesses, ensuring compliance with tax laws.

- Data Analytics: Advanced data analytics tools help tax authorities identify patterns and anomalies in tax returns, which can indicate potential tax evasion.

- Whistleblower Programs: Many countries have implemented whistleblower programs that encourage individuals to report tax evasion. These programs often offer financial incentives for successful tips.

- International Cooperation: Tax authorities collaborate across borders to combat tax evasion, especially in cases involving offshore accounts or international tax schemes.

Future Implications and Technological Advances

As technology advances, the methods used to detect and prosecute tax evasion are also evolving. Here are some potential future implications:

- Artificial Intelligence and Machine Learning: Tax authorities are increasingly leveraging AI and machine learning algorithms to analyze vast amounts of data and identify potential tax evasion cases more efficiently.

- Blockchain Technology: Blockchain's transparent and secure nature could be utilized to enhance tax reporting and tracking, making it more difficult for tax evaders to hide assets.

- Enhanced International Cooperation: With increasing globalization, tax authorities are likely to continue strengthening their cross-border collaborations to tackle tax evasion on a global scale.

Frequently Asked Questions

What is the difference between tax evasion and tax avoidance?

+Tax evasion involves illegal actions to avoid paying taxes, such as underreporting income or claiming false deductions. Tax avoidance, on the other hand, refers to legal strategies to minimize tax liability within the boundaries of the law.

Can tax evasion charges be dropped or reduced through negotiation?

+In some cases, tax evasion charges can be mitigated through negotiation with tax authorities or the prosecution. This often involves cooperating fully, paying back taxes, and providing information on other potential tax evaders.

Are there any specific industries or professions more prone to tax evasion?

+While tax evasion can occur in any industry, certain sectors with complex financial transactions or a high level of cash flow, such as construction, hospitality, and entertainment, may face increased scrutiny from tax authorities.

Can tax evasion charges be appealed?

+Yes, individuals and businesses have the right to appeal tax evasion charges. The appeals process varies by jurisdiction and typically involves presenting new evidence or arguing that the initial decision was based on incorrect facts or misinterpretation of the law.

What is the statute of limitations for tax evasion charges?

+The statute of limitations for tax evasion charges varies by jurisdiction. In some countries, there is no time limit for prosecuting tax evasion cases, while others have specific timeframes, often ranging from 3 to 10 years from the date of the offense.