Wayne County Tax Records

Wayne County, located in the heart of Michigan, is a bustling metropolitan region known for its rich history, vibrant culture, and diverse communities. With a population of over two million people, it is the most populous county in the state and serves as a vital economic hub. As a homeowner or business owner in Wayne County, understanding the tax records and processes is crucial for effective financial planning and compliance with local regulations.

In this comprehensive guide, we delve into the intricacies of Wayne County tax records, exploring the various types of taxes, assessment processes, and payment options. Whether you are a resident seeking clarity on property taxes or a business owner navigating the complex world of commercial taxes, this article aims to provide you with the knowledge and tools to navigate the tax landscape effectively.

Understanding Wayne County Tax Landscape

Wayne County’s tax system encompasses a range of taxes, each serving a specific purpose and contributing to the overall fiscal health of the region. Let’s explore the key types of taxes you may encounter as a resident or business owner.

Property Taxes: A Cornerstone of Local Revenue

Property taxes form the backbone of Wayne County’s tax revenue. These taxes are levied on real estate properties, including residential homes, commercial buildings, and vacant land. The revenue generated from property taxes plays a vital role in funding essential services such as education, public safety, infrastructure development, and more.

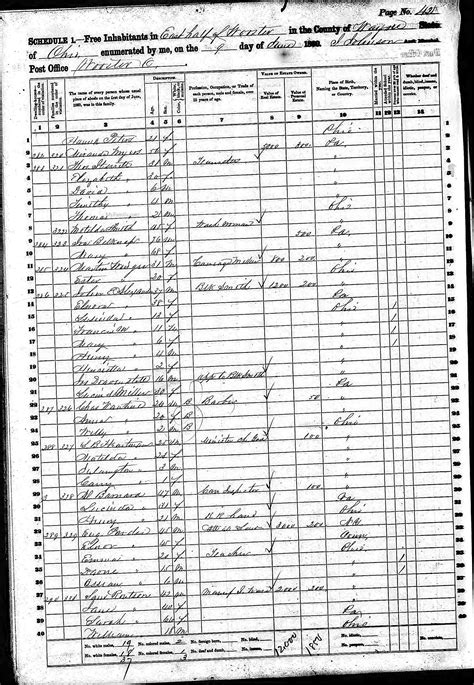

The assessment of property taxes involves a meticulous process. The Wayne County Equalization Department is responsible for ensuring equitable assessments across the county. This department employs professional assessors who analyze various factors, including property characteristics, recent sales data, and market trends, to determine the fair market value of each property. This value then forms the basis for calculating the property tax liability.

It's important for property owners to understand their assessment notices. These notices provide detailed information about the assessed value, any changes from the previous year, and the estimated tax amount. Property owners have the right to appeal their assessments if they believe the valuation is inaccurate. The appeal process involves submitting evidence and attending a hearing before the Board of Review.

To facilitate timely payments, Wayne County offers a convenient online payment system. Property owners can access their tax bills and make payments through the county's official website. This system provides a secure and efficient way to manage tax obligations, offering options for partial payments and setting up automatic payment plans.

Commercial Taxes: Supporting Economic Growth

In addition to property taxes, Wayne County imposes various commercial taxes to support the vibrant business landscape. These taxes contribute to the county’s economic development and help maintain a competitive business environment.

One of the key commercial taxes is the Business Tax. This tax is levied on businesses operating within the county, with rates varying based on the nature and size of the business. The revenue generated from business taxes supports essential services and infrastructure projects, creating a favorable environment for economic growth.

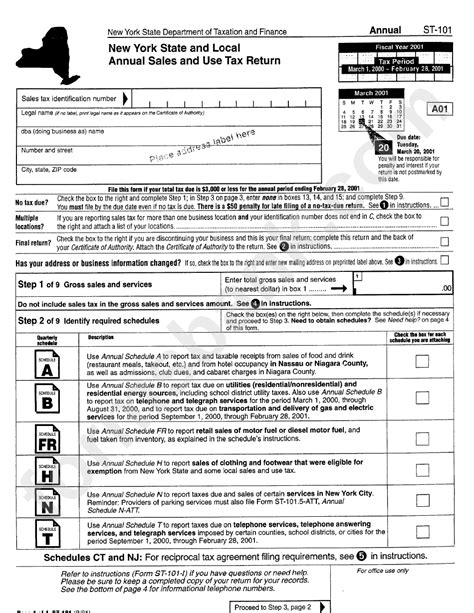

Wayne County also collects sales and use taxes, which are applied to the purchase of goods and services within the county. These taxes contribute to the overall revenue stream, allowing the county to invest in public services and initiatives. Businesses are responsible for collecting and remitting these taxes to the county.

To ensure compliance, the Wayne County Treasurer's Office provides resources and guidance for businesses. This includes information on tax registration, filing requirements, and payment deadlines. The office also offers assistance with tax exemptions and credits, helping businesses navigate the complex world of commercial taxes effectively.

Tax Assessment and Appeal Process

Understanding the assessment and appeal process is crucial for property owners in Wayne County. The assessment process begins with the collection of data by assessors, who visit properties and gather information about their characteristics and recent sales. This data is then analyzed to determine the fair market value, which forms the basis for tax assessments.

Property owners receive assessment notices, which detail the assessed value and any changes from the previous year. If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process involves submitting a written request to the Board of Review, providing evidence and arguments to support their case.

The Board of Review conducts hearings to review assessment appeals. During these hearings, property owners have the opportunity to present their case, providing evidence and expert testimony if necessary. The Board carefully considers each appeal, taking into account the presented information and market trends, to make a fair and equitable decision.

It's important for property owners to prepare thoroughly for their appeal. This includes gathering relevant documentation, such as recent sales data, appraisals, and any supporting evidence. Understanding the assessment process and being able to articulate why the assessed value is inaccurate can strengthen the appeal case.

Tax Payment Options and Deadlines

Wayne County offers a range of convenient payment options to accommodate the diverse needs of taxpayers. Property owners can choose from various methods to pay their taxes, ensuring a seamless and secure experience.

Online Payment Portal

The county’s official website provides a user-friendly online payment portal. Property owners can access their tax bills, view payment history, and make secure payments using their credit or debit cards. This portal offers a quick and convenient way to manage tax obligations, especially for those who prefer digital transactions.

To utilize the online payment portal, property owners need to register an account. This process is straightforward and requires basic information such as the property address, tax ID, and contact details. Once registered, users can log in to their accounts and access a range of features, including viewing tax statements, setting up payment plans, and receiving email notifications for upcoming deadlines.

Mail-in Payments

For those who prefer traditional methods, Wayne County accepts mail-in payments. Property owners can mail their tax payments to the designated address, ensuring they meet the specified deadlines. It’s important to include the correct tax bill or statement with the payment to ensure accurate processing.

When mailing payments, property owners should allow sufficient time for the payment to reach the county office. It's advisable to use a traceable method, such as certified mail, to track the payment's journey and ensure its timely receipt. This helps avoid any late payment penalties or interest charges.

Payment Plans and Installment Options

Wayne County understands that paying taxes in full can be challenging for some property owners. To provide flexibility, the county offers payment plans and installment options. Property owners can arrange to pay their taxes in multiple installments, spreading out the burden over a specified period.

To set up a payment plan, property owners need to contact the Wayne County Treasurer's Office. The office will guide them through the process, explaining the available options and the requirements for setting up a plan. This often involves completing an application and providing relevant financial information to assess eligibility.

Payment plans can be tailored to the property owner's financial situation, allowing for manageable monthly or quarterly payments. This option provides relief for those facing financial constraints while ensuring compliance with tax obligations.

Resources and Support for Taxpayers

Wayne County recognizes the importance of providing comprehensive resources and support to taxpayers. The county’s website serves as a central hub, offering a wealth of information and tools to assist residents and businesses in navigating the tax landscape.

Online Tax Lookup Tool

The Wayne County Treasurer’s Office provides an online tax lookup tool, enabling taxpayers to access their tax information quickly and easily. This tool allows users to search for tax records based on various criteria, such as property address, tax ID, or owner’s name. It provides a convenient way to obtain current and historical tax data, including assessed values, tax rates, and payment history.

The tax lookup tool is particularly useful for property owners who need to retrieve specific tax information for financial planning or tax preparation purposes. It eliminates the need for manual searches and provides an efficient way to obtain accurate and up-to-date data.

Taxpayer Assistance Programs

Wayne County is committed to assisting taxpayers who may face financial hardships or have complex tax situations. The county offers a range of taxpayer assistance programs to provide support and guidance.

One such program is the Taxpayer Advocate Office. This office serves as a dedicated resource for taxpayers who encounter difficulties with their tax obligations. The Advocate Office provides personalized assistance, offering guidance on tax payments, resolving disputes, and exploring options for tax relief or exemptions.

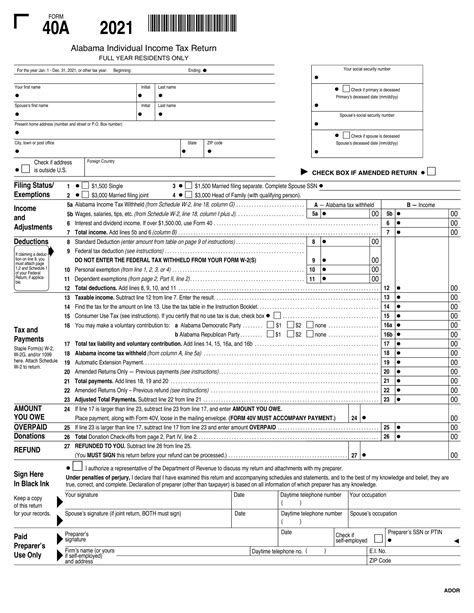

Additionally, Wayne County collaborates with community organizations and non-profits to offer free tax preparation services for eligible individuals and families. These programs aim to assist low-income residents and those who may struggle with the complexities of tax filing. Volunteers with expertise in tax preparation provide guidance and support, ensuring accurate and compliant tax returns.

Future Outlook and Potential Changes

As Wayne County continues to evolve and adapt to changing economic and demographic trends, the tax landscape may undergo transformations to meet the evolving needs of the community. Here are some potential areas of focus for future tax reforms and initiatives.

Promoting Economic Development

Wayne County recognizes the importance of fostering economic growth and attracting new businesses. As such, the county may explore tax incentives and initiatives to encourage investment and job creation. This could include tax abatements, tax credits, or targeted tax relief programs for specific industries or developments.

By offering attractive tax packages, Wayne County can position itself as a competitive business destination, attracting new businesses and generating additional tax revenue. These initiatives can contribute to the county's economic vitality and create opportunities for residents.

Enhancing Tax Collection Efficiency

To streamline tax collection processes and improve efficiency, Wayne County may invest in technological advancements. This could involve implementing modern tax assessment systems, digital payment platforms, and enhanced data analytics. These upgrades can reduce administrative burdens, improve accuracy, and provide a more seamless experience for taxpayers.

Additionally, the county may explore partnerships with fintech companies to offer innovative payment options, such as mobile payment solutions or digital wallets. These initiatives can cater to the evolving preferences of taxpayers and enhance the overall tax collection process.

Addressing Equity and Fairness

Wayne County strives to ensure that its tax system is fair and equitable for all residents. As such, the county may conduct periodic reviews and assessments to identify any disparities or areas where the tax burden may be disproportionately distributed.

By analyzing tax data and consulting with stakeholders, the county can identify potential adjustments or reforms to promote a more equitable tax system. This may involve adjusting tax rates, exploring alternative assessment methods, or implementing targeted tax relief programs for vulnerable populations.

Conclusion

Navigating the tax landscape of Wayne County requires a comprehensive understanding of the various taxes, assessment processes, and payment options. This guide has provided an in-depth look at the key aspects of Wayne County tax records, empowering residents and businesses to make informed decisions and comply with local tax regulations.

From property taxes to commercial taxes, the county's tax system plays a vital role in funding essential services and supporting economic growth. By staying informed and utilizing the resources provided by the county, taxpayers can effectively manage their tax obligations and contribute to the prosperity of Wayne County.

How often are property assessments conducted in Wayne County?

+

Property assessments in Wayne County are typically conducted every year. The assessment process involves evaluating properties based on their current market value, ensuring that tax obligations are fair and accurate.

Are there any tax relief programs available for senior citizens or veterans in Wayne County?

+

Yes, Wayne County offers various tax relief programs to support senior citizens and veterans. These programs include property tax exemptions, credits, and deferment options, providing financial relief to eligible individuals.

How can businesses stay updated on tax registration and compliance requirements in Wayne County?

+

Businesses can access the Wayne County Treasurer’s Office website, which provides comprehensive information on tax registration, filing requirements, and deadlines. The office also offers guidance and resources to ensure compliance with local tax regulations.