County Of Santa Clara Tax

Welcome to a comprehensive guide on the County of Santa Clara Tax system. In this article, we will delve into the intricacies of the tax landscape within this vibrant region, offering an expert analysis and insights to help navigate the tax obligations and opportunities it presents.

Understanding the County of Santa Clara Tax System

The County of Santa Clara, nestled in the heart of Silicon Valley, California, boasts a unique tax environment influenced by its diverse economy, vibrant tech industry, and thriving local businesses. With a population of over 1.9 million people, the county’s tax system plays a crucial role in funding essential services and driving economic growth.

The tax landscape in Santa Clara County is characterized by a range of taxes, including property taxes, sales and use taxes, business taxes, and various fees. These taxes contribute to the county's revenue stream, supporting critical services such as public safety, education, infrastructure development, and social services.

One of the key aspects of the county's tax system is its property tax structure. Santa Clara County utilizes the California Proposition 13, a landmark legislation that limits property tax increases to a maximum of 2% annually unless the property changes ownership. This measure provides stability for homeowners but also presents unique challenges for the county's budget planning.

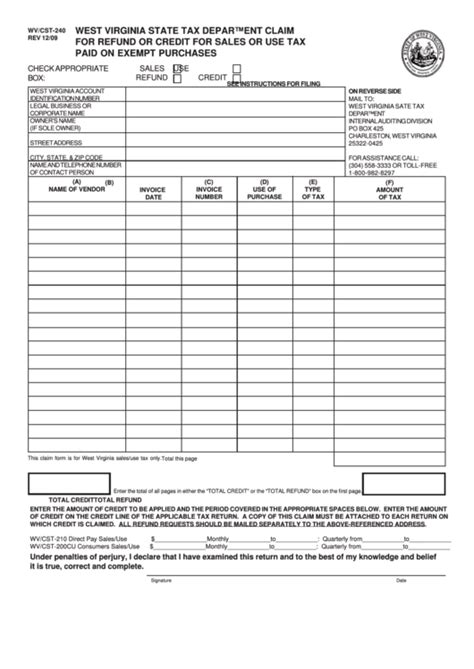

Sales and Use Taxes

Sales and use taxes are a significant source of revenue for the county. The current sales tax rate in Santa Clara County is 8.25%, which includes both state and local taxes. This rate can vary slightly within the county due to the addition of district-specific taxes. Sales taxes are levied on retail sales of tangible personal property and certain services, contributing to the county’s general fund.

Additionally, the county imposes a use tax on the storage, use, or consumption of tangible personal property purchased from out-of-state vendors. This tax ensures that businesses and individuals pay their fair share, even if they make purchases online or from remote sellers.

| Tax Type | Rate |

|---|---|

| Sales Tax | 8.25% |

| Use Tax | Equivalent to Sales Tax Rate |

Business Taxes and Fees

Santa Clara County requires businesses to obtain various permits and licenses to operate legally. These include business licenses, tax registration certificates, and special permits for specific industries. The county also imposes business taxes, which vary depending on the nature of the business and its location within the county.

For example, the Business Tax Certificate is a mandatory registration for most businesses, with fees ranging from $40 to $450, depending on the type of business and its annual gross receipts. Additionally, certain businesses, such as hotels and restaurants, may be subject to transient occupancy taxes or meals taxes, respectively.

Tax Incentives and Programs

The County of Santa Clara recognizes the importance of fostering economic growth and supporting local businesses. As such, it offers a range of tax incentives and programs to attract and retain businesses, promote job creation, and stimulate economic development.

Enterprise Zones

Santa Clara County is home to several enterprise zones, designated areas where businesses can benefit from tax incentives and reduced tax burdens. These zones aim to encourage investment, job creation, and economic development in targeted areas. Businesses located within these zones may be eligible for sales tax exemptions, property tax abatements, and hiring credits, among other benefits.

For instance, the San Jose Enterprise Zone, established in 2009, offers businesses a range of incentives, including a 50% reduction in state sales and use tax for the first $100,000 of purchases, a 50% reduction in property taxes for new construction or rehabilitation, and job creation tax credits.

Small Business Assistance

The county understands the challenges faced by small businesses and provides various resources and support to help them succeed. The Santa Clara County Office of Small Business Development offers guidance on business registration, permits, and licenses, as well as access to financing options and business resources.

Additionally, the Small Business Assistance Program provides one-on-one counseling and workshops to assist small business owners in navigating the complex world of taxes, regulations, and business planning. This program aims to empower small businesses and ensure their long-term viability.

Tax Compliance and Enforcement

Ensuring tax compliance is a critical aspect of the county’s tax system. The Santa Clara County Tax Collector’s Office is responsible for administering and enforcing the collection of taxes and fees. It works closely with businesses and individuals to ensure they meet their tax obligations.

Audit and Investigation

The Tax Collector’s Office conducts audits and investigations to verify compliance with tax laws and regulations. These audits can range from routine reviews to comprehensive examinations of a business’s or individual’s tax records. The office has the authority to assess penalties and interest for non-compliance, ensuring a fair and equitable tax system.

Appeal Process

Taxpayers who receive a notice of assessment or penalty have the right to appeal the decision. The Santa Clara County Assessment Appeals Board provides a forum for taxpayers to challenge assessments, penalties, or other tax-related issues. This process ensures transparency and allows taxpayers to present their case before an independent board.

Impact on Local Economy

The County of Santa Clara’s tax system plays a vital role in shaping the local economy. Tax revenues fund essential services and infrastructure projects, contributing to the overall prosperity and well-being of the community.

Infrastructure Development

Tax revenues are invested in infrastructure projects, including road improvements, public transportation, and utility upgrades. These investments not only enhance the quality of life for residents but also attract businesses and stimulate economic growth. Well-maintained infrastructure improves connectivity and accessibility, making the county an attractive location for businesses and investors.

Social Services and Education

A significant portion of tax revenue is allocated to social services and education. These funds support programs that address the needs of vulnerable populations, promote healthcare access, and enhance educational opportunities. By investing in social services, the county aims to create a resilient and inclusive community, ensuring that all residents have the opportunity to thrive.

Future Outlook and Innovations

As the County of Santa Clara continues to evolve, its tax system must adapt to changing economic conditions and technological advancements. The county is exploring innovative approaches to enhance tax compliance, streamline processes, and leverage data-driven insights to make informed decisions.

Digital Transformation

The Tax Collector’s Office is embracing digital transformation by implementing online platforms and mobile apps to facilitate tax payments, filings, and interactions with taxpayers. These digital tools enhance efficiency, convenience, and transparency, making it easier for taxpayers to comply with their obligations.

Data Analytics

Data analytics plays a crucial role in identifying trends, detecting anomalies, and improving tax administration. The county is leveraging advanced analytics to enhance tax compliance, identify potential fraud, and optimize resource allocation. By analyzing large datasets, the tax office can make data-driven decisions and ensure a fair and efficient tax system.

Conclusion

The County of Santa Clara’s tax system is a complex yet vital component of its vibrant economy. From property taxes to sales and use taxes, the county’s revenue stream supports essential services, infrastructure development, and social programs. By offering tax incentives and support to businesses, the county fosters economic growth and creates a thriving business environment.

As the county continues to innovate and adapt, its tax system will remain a key driver of economic prosperity and community well-being. By staying informed about tax obligations and taking advantage of available resources, taxpayers can navigate the system effectively and contribute to the continued success of the County of Santa Clara.

What is the average property tax rate in Santa Clara County?

+The average property tax rate in Santa Clara County is approximately 1.10% of the assessed value of the property. However, it’s important to note that the actual rate can vary depending on the specific location within the county.

Are there any tax incentives for green initiatives in Santa Clara County?

+Yes, Santa Clara County offers tax incentives for green initiatives through its Green Business Program. Businesses that implement environmentally friendly practices and meet certain criteria may be eligible for reduced tax burdens and other benefits.

How often are property tax assessments conducted in the county?

+Property tax assessments in Santa Clara County are conducted annually. The Assessor’s Office determines the assessed value of properties based on various factors, including market conditions and improvements made to the property.