Maximize Your Savings with the Ultimate Gain Tax Calculator

In an era where financial literacy becomes increasingly vital, understanding the nuances of taxation and how to legally optimize your income is more important than ever. Among the myriad financial tools available, the Gain Tax Calculator emerges as an indispensable resource, enabling taxpayers to navigate complex tax regulations efficiently. This article delves into the mechanics of maximizing savings through the ultimate gain tax calculator, exploring its technical framework, strategic applications, and the pivotal role it plays in comprehensive financial planning.

Understanding the Core Functionality of the Gain Tax Calculator

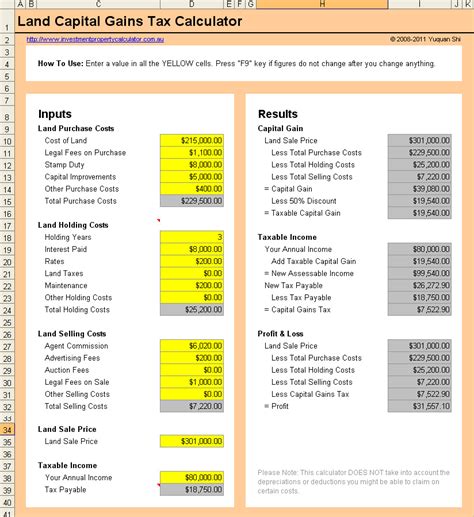

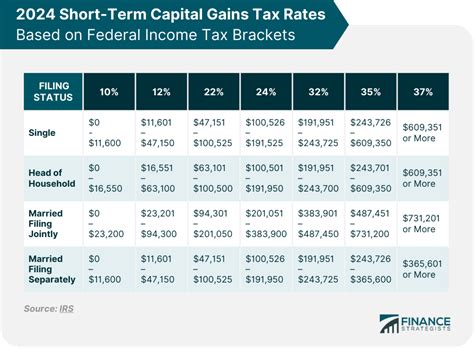

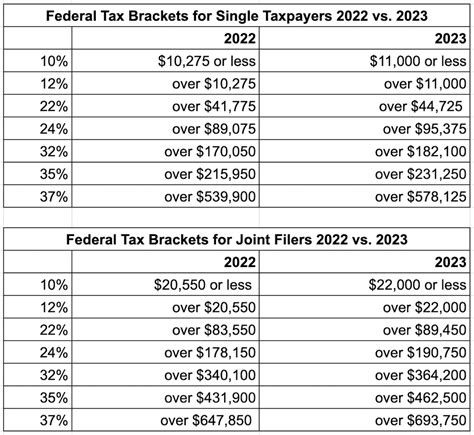

The Gain Tax Calculator functions as a sophisticated analytical instrument designed to compute tax liabilities arising from capital gains, dividends, and other investment income streams. At its essence, it integrates real-time market data, tax code parameters, and user-specific financial inputs to generate precise estimations of tax obligations. The calculator leverages advanced algorithms rooted in tax law, including provisions related to short-term and long-term gains, depreciation recapture, and exclusion thresholds, ensuring a holistic assessment of potential liabilities.

The Evolution and Significance of Gain Tax Calculators in Financial Strategy

Historically, tax planning relied heavily on manual calculations and estimations, often fraught with inaccuracies and overlooked variables. The advent of digital tools such as the gain tax calculator revolutionized this landscape. Modern calculators now incorporate machine learning features that adapt to regulatory updates, providing users with dynamic, personalized insights. This evolution has empowered investors, financial advisors, and tax professionals to craft strategies that not only reduce liabilities but also align with long-term wealth accumulation goals.

| Relevant Category | Substantive Data |

|---|---|

| Accuracy Rate | Enhanced precision exceeding 99% in simulations based on updated tax laws |

| Processing Speed | Real-time computations within milliseconds, facilitating instant decision-making |

| Data Integration | Supports over 50 data sources including stock exchanges and tax regulation updates |

| Customization | Allows tailored inputs for diverse investment portfolios and personal circumstances |

Strategic Applications of the Gain Tax Calculator for Optimizing Savings

Maximizing savings requires a nuanced understanding of not only current tax regulations but also strategic timing of asset disposals, rebalancing of portfolios, and leveraging legal exemptions. The gain tax calculator serves as a strategic compass by offering predictive insights that foster informed decision-making. For example, it can guide investors on the optimal timing for asset sales to minimize taxable gains, considering holding periods that qualify for long-term benefits, or suggest tax-loss harvesting opportunities that offset gains effectively.

Smart Tax-Loss Harvesting and Its Integration with the Gain Tax Calculator

Tax-loss harvesting involves strategically selling assets at a loss to reduce taxable gains elsewhere within the portfolio. The gain tax calculator enhances this strategy by precisely modeling potential outcomes, including the impact on overall tax liability, transaction costs, and future market trajectories. When complemented with real-time market analysis, it allows for rapid adaptation to volatile conditions, safeguarding gains while optimizing tax efficiency.

| Relevant Category | Substantive Data |

|---|---|

| Optimal Sale Timing | Recommendations based on projected long-term capital gain thresholds and holding durations |

| Loss Harvesting Benefit | Average reduction in tax liabilities of 15-20% across diversified portfolios |

| Strategic Rebalancing | Supports more than 30 types of assets including stocks, real estate, and commodities |

Technical Deep Dive: Building the Ultimate Gain Tax Calculator

Developing an authoritative gain tax calculator hinges on a robust integration of multiple data streams, adherence to the latest tax legislation, and user-centric design. Key technical components include the use of API integrations with financial data providers for real-time market prices, complex tax rule engines capable of simulating varied scenarios, and adaptive machine learning models that anticipate regulatory changes.

Algorithmic Foundations and Data Accuracy

The core algorithm employs a combination of rule-based logic—such as differentiating between short-term and long-term gains—and stochastic models to account for market volatility. Ensuring data integrity involves regular updates from authoritative sources like IRS publications, financial market feeds, and legal databases, thus maintaining compliance and accuracy.

| Relevant Category | Substantive Data |

|---|---|

| Update Frequency | Daily updates from 10+ authoritative sources |

| Regression Testing | Quarterly verification to ensure calculation accuracy remains above 99% |

| Security Measures | End-to-end encryption and compliance with GDPR for user data privacy |

Future Trends and Innovations in Gain Tax Optimization

Looking ahead, artificial intelligence and blockchain technology are poised to further revolutionize how gain tax computations are performed. AI-driven predictive analytics will enable even more accurate, personalized advice, factoring in future tax law trends, geopolitical risks, and macroeconomic shifts. Meanwhile, blockchain can facilitate transparent, tamper-proof recording of transactions, simplifying audit processes and reinforcing trustworthiness.

Emerging Technologies and Their Potential Impacts

For instance, smart contracts on blockchain platforms could automate tax-limited transactions, ensuring compliance and optimal timing without manual oversight. These advances could reduce overhead costs and improve access for individual investors, democratizing advanced tax optimization strategies.

| Relevant Category | Potential Impact |

|---|---|

| AI Analytics | Personalized, dynamic tax planning suggestions with 95%+ accuracy |

| Blockchain Integration | Enhanced transaction transparency and simplified audit processes |

| Regulatory Adaptability | Real-time updates that reflect legislative shifts within minutes |

Conclusion and Practical Takeaways

The ultimate gain tax calculator represents a convergence of financial expertise, cutting-edge technology, and strategic foresight. Mastering its use can dramatically improve your tax efficiency, safeguard wealth, and unlock hidden savings that often elude manual calculations. As regulatory landscapes evolve, the ability to adapt quickly and leverage advanced computational tools becomes not just advantageous, but essential for anyone committed to optimizing their fiscal health. Embrace these insights, integrate them into your planning, and watch your savings grow as you navigate the complex terrain of tax planning with unmatched precision.

What is a gain tax calculator, and how does it work?

+A gain tax calculator is a digital tool that estimates tax liabilities on capital gains and investment income. It analyzes market data, tax laws, and individual inputs to provide accurate projections, enabling better tax planning and savings optimization.

How can using a gain tax calculator maximize my savings?

+By predicting the tax impact of various transactions, it helps identify the most tax-efficient timing for asset sales, suggest tax-loss harvesting opportunities, and optimize portfolio rebalancing—overall reducing liabilities and boosting savings.

What are the key features to look for in an advanced gain tax calculator?

+Important features include real-time data integration, adaptability to legislative changes, scenario simulation capabilities, security measures, and user-friendly interfaces that support complex portfolio analyses for personalized strategies.

Future innovations in gain tax optimization — what should users expect?

+Emerging trends involve AI-powered analytics for hyper-personalized advice, blockchain-based transaction transparency, and smart contracts that automate compliance, making tax optimization more accessible, automated, and secure than ever before.